By Lacie Zhang, Researcher at Bitget Wallet

On September 3, 2025, Ondo Finance officially launched its stock tokenization platform, "Ondo Global Markets," initially listing over 100 tokenized stocks, with plans to expand to 1,000 by the end of the year. This move is not only a solid step forward in Ondo's strategic development, but is also widely recognized by the industry as a key validation of the transition of stock tokenization from theory to large-scale practice.

As Wall Street's century-old trading rules collide head-on with blockchain's trustless technology, a profound shift in efficiency, liquidity, and compliance is brewing. In this article, Bitget Wallet Research Institute returns to fundamentals, systematically analyzing and presenting the current stock tokenization market from three core perspectives: value logic, implementation path, and compliance framework.

The Imagination of a Trillion-Dollar Market: Analyzing the Value Logic Behind Stock Tokenization

Stock tokenization is not a new concept, but its potential is significant enough to reshape the existing financial landscape. The current market capitalization of all tokenized stocks is less than $400 million, a drop in the ocean compared to NVIDIA's single stock market capitalization of over $4 trillion. This stark contrast reveals both the early difficulties of the sector and its unparalleled growth potential. Its core value lies in the following three aspects.

First, it aims to revolutionize the traditional trading and settlement system. The current mainstream "T+N" delayed settlement mechanism is a major bottleneck in capital market efficiency. It means that investors' funds are still locked up for one to two days after the transaction is completed. This inefficient use not only limits the ability to reinvest capital but also creates counterparty risk during the settlement process. Equity tokenization, through "atomic settlement," allows the transfer of asset ownership and the payment of funds to be completed simultaneously. This model not only supports a 24/7 global trading market but also frees up a large amount of capital stuck in the clearing process, bringing a qualitative leap in the overall market's circulation efficiency.

Secondly, stock tokenization helps break down the complex barriers of traditional cross-border investment. Under the traditional model, a cross-border securities investment must navigate a multi-layered intermediary network consisting of custodian banks, clearing houses, and brokers, each of which carries both time and financial costs. Tokenization technology offers a new approach, allowing compliance logic, such as investor identity verification (KYC) and anti-money laundering (AML), to be directly programmed into the asset protocol layer. This effectively empowers the asset itself with the ability to self-check compliance, significantly reducing the number of trusted intermediaries and manual review steps in the transaction process, paving the way for a flatter, more efficient, and lower-cost global capital market.

Finally, from a more macro perspective, its ultimate value lies in its role as a crucial bridge between the two parallel worlds of traditional finance (TradFi) and decentralized finance (DeFi). On the one hand, it provides a low-barrier-to-entry "on-chain" channel for the vast traditional capital pool accustomed to established investment targets, allowing them to first reap the efficiency dividends of blockchain technology without having to commit to completely unfamiliar DeFi protocols. On the other hand, it also injects much-needed stability and value support into the crypto ecosystem, which is native to the digital world. These blue-chip assets, with real profitability and strong fundamentals, can effectively hedge against the inherent high volatility of the crypto market while also providing a new source of robust collateral for on-chain DeFi. This two-way value empowerment makes it a promising core pillar of the future new financial system.

Three distinct paths, one common destination: Decoding the path to stock tokenization

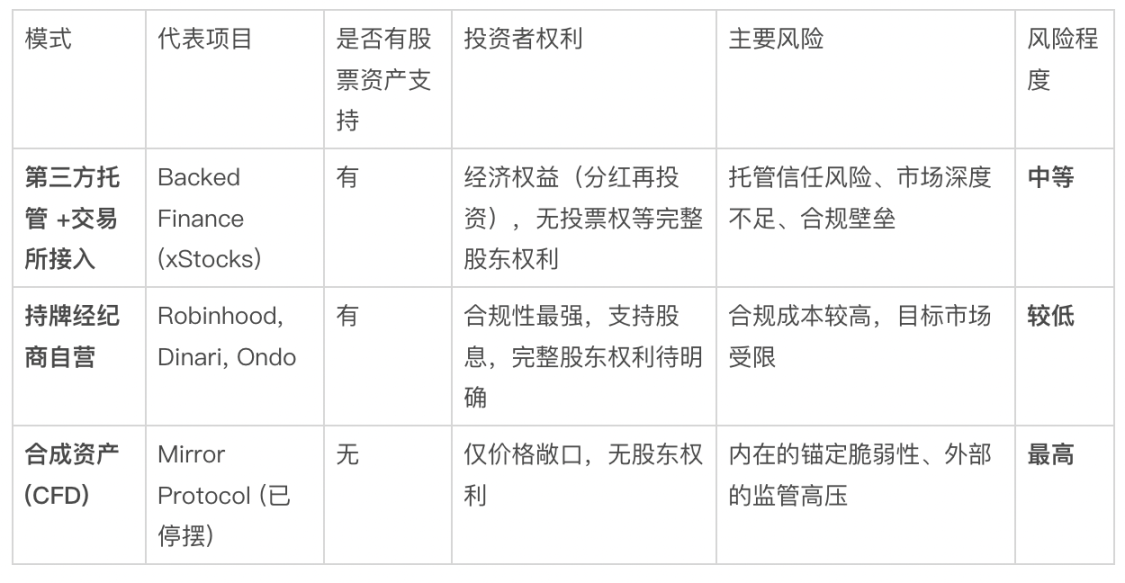

Despite the promising prospects, the key challenge for the industry is how to safely and legally map real-world equity interests to the blockchain. Currently, the mainstream issuance models in the market can be roughly categorized into three types, which differ significantly in terms of asset backing, investor rights, and risk levels.

Table of three issuance models

The first is the "third-party custody and external channel" model. Backed Finance's xStocks series is a typical example. Its operating logic involves establishing an independent legal entity (SPV) to hold actual stocks, with off-chain assets then managed and audited by a third-party institution, ultimately reaching users through mainstream exchanges. This model's foundation of trust lies in the custodian's credibility and the transparency of the assets, but investors typically receive economic rights tied to the underlying assets rather than full legal shareholder status.

The second approach is the "licensed institution proprietary trading" model, considered the most rigorous in terms of compliance. Its essence lies in the fact that an entity holding the appropriate securities license personally builds a vertically integrated system covering the entire process from asset issuance and trade matching to clearing and settlement. Institutions such as Robinhood, Ondo Finance, and Dinari have all adopted this approach. This model has the highest legal and technical barriers to entry, but in return, it also provides investors with the highest level of legal protection.

The third model involves the "synthetic derivatives" model, which carries the greatest risk exposure. For example, the once-active but now-dormant Mirror Protocol doesn't issue tokenized shares. Instead, it issues financial derivatives that simulate stock price performance, without any real stock backing them. Users only receive the risk and reward of price fluctuations, without any shareholder status. Lacking a physical asset as a backing, these platforms face the dual pressures of asset decoupling and regulatory compliance.

It's worth noting that these models aren't clearly defined in practice, but rather exhibit a dynamic evolution. Licensed issuers often combine third-party custody and exchange access strategies to enhance liquidity, while unlicensed projects actively seek licenses and move toward compliant, self-operated models. This reflects a clear industry consensus: compliance is the only way to the future.

Ondo Holding the "Trump Card": Why is Compliance the Ultimate Moat?

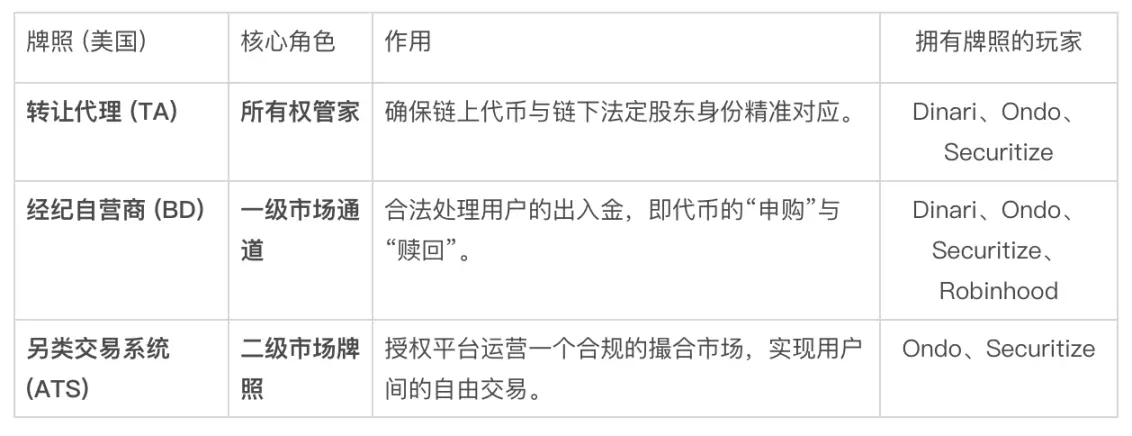

Of the several paths explored above, Ondo Finance's choice stands out. As a leading player in the tokenization market, its core strategy directly targets the industry's highest barrier: building a fully compliant tokenized stock system within the stringent US regulatory framework. Achieving this goal requires holding three key financial licenses, and Ondo is one of the few institutions in the market that has crossed this threshold.

A summary of the three major compliance licenses in the United States

The first license is for a transfer agent (TA). Its core function is to serve as the issuer's official shareholder register, accurately recording the ownership of securities. In the tokenization business, TAs are the cornerstone of ensuring the precise mapping of on-chain digital certificates to off-chain legal rights and interests, and are the foundation of trust for the entire compliance system.

The second license is a broker-dealer (BD). This is the gateway to engaging in all securities business. In a tokenized scenario, whether users purchase tokens with fiat currency (minting) or sell tokens for cash (redemption), transactions in the underlying stock must be executed by an entity holding a BD license. It serves as the core compliance hub connecting investors with the primary market.

The third license, and the most difficult to obtain, is the Alternative Trading System (ATS) license. This authorizes an entity to operate a regulated secondary market trading platform. Without an ATS license, the platform can only handle issuance and redemption, and users cannot engage in legal peer-to-peer transactions. Therefore, the ATS is the key to unlocking true liquidity for tokenized stocks and the ultimate solution to the industry's long-standing liquidity dilemma.

Through forward-thinking planning, Ondo secured all three licenses, creating a robust business model. This not only distinguishes it from competitors that rely on European regulatory frameworks or hold only a single license, but also means it has the potential to provide investors in the United States with a comprehensive, compliant service from primary market subscriptions to secondary market transactions. This "moat" built by these licenses is Ondo's core competitive advantage.

Conclusion: Innovation, or “old wine in new bottles”?

Stock tokenization paints a picture of a future where traditional finance and the digital world merge deeply—a global value network that transcends time zones, offers instant settlement, and offers limitless possibilities. It could potentially trigger the digital migration of trillions of dollars in traditional assets and a fundamental reshaping of the global capital landscape. However, the collision of these two ecosystems has sparked both an efficiency revolution and significant friction between regulatory rules and investment culture.

Ondo Finance's compliance-first approach to market entry is more like a directional exploration at this fraught intersection. Can it leverage its strong licensing advantages to carve out a path within the stringent regulatory framework and truly attract incremental capital from both global players? Will this grand financial innovation ultimately foster a new and efficient market, or will it become just another example of "old wine in new bottles" due to incompatibility? The answer lies in the ongoing struggles of market pioneers and the ultimate judgment of time.