Compiled by: Felix, PANews

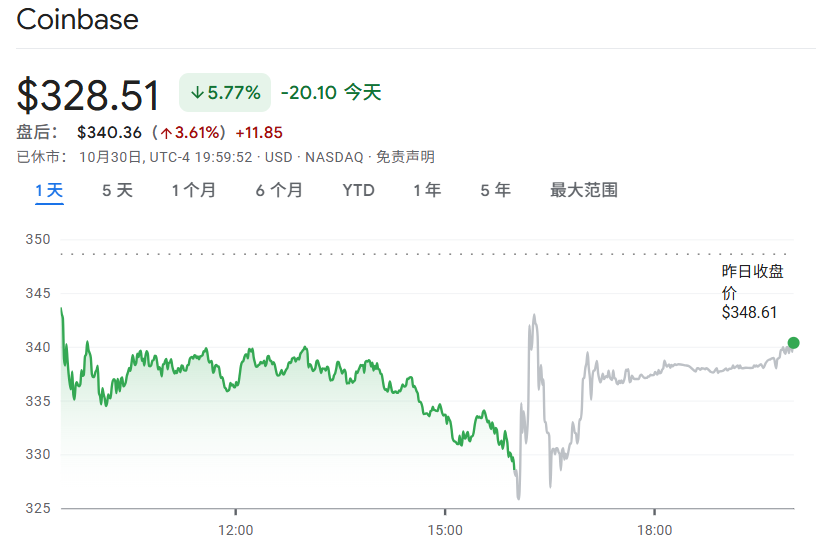

US cryptocurrency exchange Coinbase released its third-quarter (Q3) financial report on October 30th, local time. Total revenue was $1.869 billion, a 25% increase quarter-over-quarter and a 58% increase year-over-year, exceeding FactSet analysts' expectations of $1.8 billion; net profit was $433 million. Trading revenue reached $1 billion, a 37% increase quarter-over-quarter; trading volume also increased from $185 billion in the same period last year to $295 billion, a quarter-over-quarter increase.

Coinbase's revenue growth was primarily driven by a surge in trading activity, a rebound in asset prices, and continued growth in its subscription and services businesses. Following this news, Coinbase (COIN) shares rose 3.61% in after-hours trading.

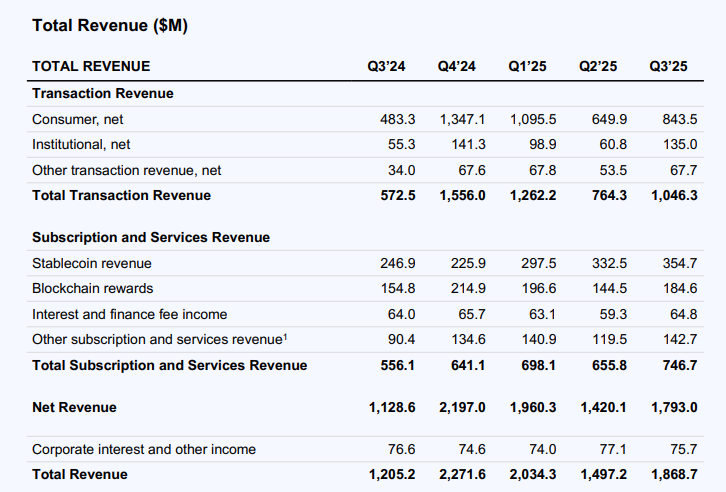

Transactions remain the primary source of revenue, but have declined significantly since the beginning of the year.

As of September 30, Coinbase's revenue increased to $1.869 billion from $1.21 billion in the same period last year. Net income rose to $432.6 million ($1.50 per share) from $75.5 million ($0.28 per share) in the same period last year. This earnings exceeded the consensus estimate of $1.10 per share previously announced by the London Stock Exchange Group (LSEG).

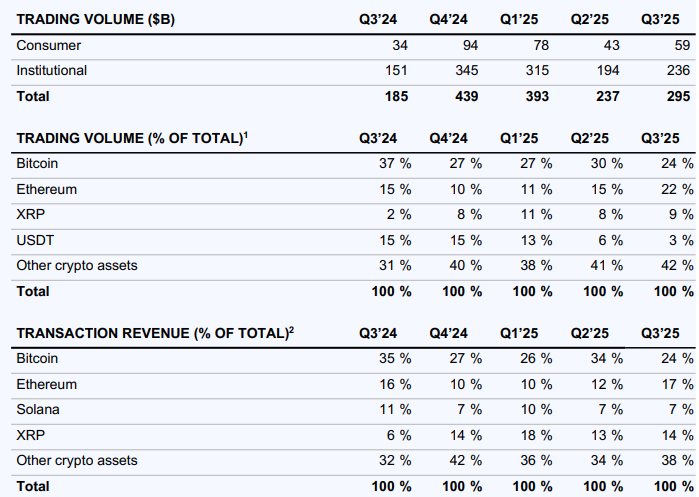

Coinbase's financial report shows that trading remains its primary source of revenue. Coinbase's total trading revenue in Q3 was $1 billion, a 37% increase quarter-over-quarter. Total trading volume was $295 billion, a 24% increase quarter-over-quarter.

It's worth noting that $1 billion in transaction revenue is still far below the peak at the beginning of the year. Transaction revenue in Q4 2024 was $1.6 billion, while Q1 2025 was $1.3 billion. This trend indicates that despite rising Bitcoin prices and increased market activity, transaction volume is still insufficient to support significant revenue growth for Coinbase.

In retail trading, volume reached $ 59 billion, a 37% increase quarter-over-quarter , outperforming the US spot market; trading revenue was $ 844 million, a 30% increase quarter-over-quarter. Coinbase attributed this to retail investors chasing memes and other speculative assets.

In terms of institutional trading, trading volume reached $236 billion, a 22% increase quarter-over-quarter; trading revenue was $135 million, a 122% increase quarter-over-quarter. The revenue growth was driven by a variety of factors, the most significant being the acquisition of derivatives exchange Deribit completed on August 14th. During the 47 days that Coinbase held Deribit , the acquisition contributed $ 52 million in revenue .

In terms of asset trading, Ethereum trading activity saw a significant increase in Q3, with ETH accounting for 22% of total trading volume, compared to 15% in the previous quarter. Ethereum trading revenue also rose from 12% to 17%. Although BTC trading volume and revenue remained the highest, its share of overall trading volume and revenue decreased due to ETH's increased market share.

Stablecoins account for half of subscription and service revenue

Q3 subscription and service revenue was $747 million, a 14% increase quarter-over-quarter. Stablecoin revenue was $355 million, a 7% increase quarter-over-quarter, accounting for approximately half of all subscription and service revenue. The average USDC balance held in Coinbase products increased by 9% quarter-over-quarter to $15 billion. Meanwhile, the average USDC balance outside the platform increased by 12% quarter-over-quarter to $53 billion.

Other subscription and service revenue was $143 million, up 19% quarter-over-quarter, primarily driven by revenue sharing with ecosystem partners and custody fees, with assets under custody reaching a new record of $300 billion.

Q3 Other Transaction Revenue reached $68 million, a 26% increase quarter-over-quarter. The Base L2 public chain, backed by Coinbase, was the main component of "Other Transaction Revenue." This growth was primarily driven by the increase in the average price of ETH and the rise in transaction volume, but was partially offset by a decrease in average revenue per transaction due to network scaling. In its letter, Coinbase emphasized that Base remains a leading L2 network, excelling in speed, scalability, and cost efficiency.

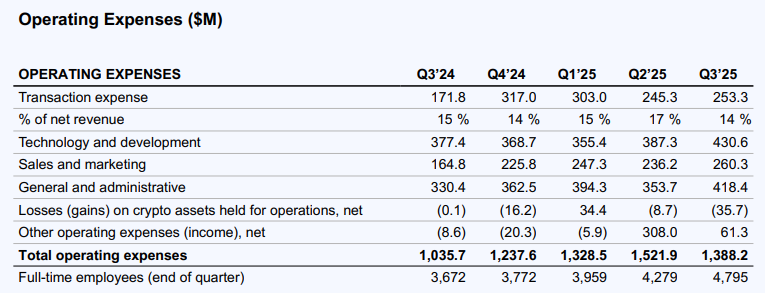

The company has 4,795 employees and spent $ 250 million on user rewards in the third quarter.

Total operating expenses in Q3 decreased by $134 million, or 9%, sequentially, to $1.388 billion. Transaction expenses, however, increased by $253 million, or 3%, sequentially, primarily driven by increased blockchain reward fees (due to the rise in token prices in Q3) and increased customer transaction activity.

Technology and development spending was $431 million, an 11% increase quarter-over-quarter, primarily driven by an increase in headcount, with full-time employees growing 12% quarter-over-quarter to 4,795 , including employees from Deribit .

General and administrative expenses were $418 million, an 18% increase quarter-over-quarter. Sales and marketing expenses were $260 million, a 10% increase quarter-over-quarter. The two main drivers of the increase were certain amortization costs related to the acquisition of Deribit, and higher USDC rewards.

Other operating expenses were $61 million, down 80% quarter-over-quarter. This included $48 million related to the theft disclosed in May. Stock-based compensation expenses were $222 million, up 13% quarter-over-quarter.

Including both revenue and expenses, Coinbase reported a net income of $433 million in Q3. Adjusted net income was $421 million, and adjusted EBITDA was $801 million. Excluding $7.2 billion in long-term debt, Coinbase has $4.7 billion in assets.

Coinbase increased its Bitcoin holdings by $ 299 million in Q3 , adding 2,772 coins. Coinbase CEO Brian Armstrong tweeted: "Coinbase will hold Bitcoin for the long term and will continue to increase its holdings in the future."

Details on prediction markets and tokenized stocks will be announced.

In addition, according to Bloomberg, Brian Armstrong stated in a conference call that Coinbase plans to hold a product showcase on December 17, at which time it will announce more details about tokenized stocks and prediction markets. The company will continue to focus on M&A opportunities, especially in the trading and payments sectors.

In a letter to shareholders, Coinbase stated its outlook for the next quarter, projecting transaction revenue of approximately $385 million for October. Q4 subscription and service revenue is expected to be between $710 million and $790 million. This Q4 forecast is driven by the growth in USDC market capitalization (which hit a record high in October) and the Coinbase One user base.

On the spending front, Coinbase expects technology and development, as well as general and administrative expenses, to be between $925 million and $975 million. The approximately 50% sequential increase is due to Coinbase's acquisitions of Deribit and Echo, and an increase in headcount, although it anticipates Q4 headcount growth to be slower than in Q3. Sales and marketing expenses are expected to be between $215 million and $315 million.

Coinbase previously outlined its vision of becoming an "exchange for everything" and increased the number of tradable spot assets and expanded its derivatives offerings in Q3. Through its DEX integration on the Base platform, Coinbase added trading functionality for over 40,000 assets. The Coinbase platform now covers approximately 90% of the total market capitalization of crypto assets. With the launch of US perpetual contracts and 24/7 futures trading, and the acquisition of Deribit, Coinbase's derivatives business achieved record market share in multiple markets, including US cryptocurrency futures and global cryptocurrency options. In Q4, Coinbase will continue to focus on launching innovative products and further building the infrastructure for its "exchange for everything."

Related reading: Coinbase's ecosystem "testing ground": Frequent moves by Based App and x402, how is it laying the groundwork for the BASE ecosystem?