In the third quarter of 2025, decentralized exchange (DEX) spot trading volume reached $1.43 trillion, the strongest quarterly performance in history, marking a structural shift in the way cryptocurrency markets are priced.

The figure increased by 43.6% from $1 trillion in the second quarter and surpassed the historical record of nearly $1.2 trillion set in January-March 2025.

August and September ranked second and third highest in history with trading volumes of US$510.5 billion and US$499.1 billion, respectively, second only to US$560.3 billion in January 2025.

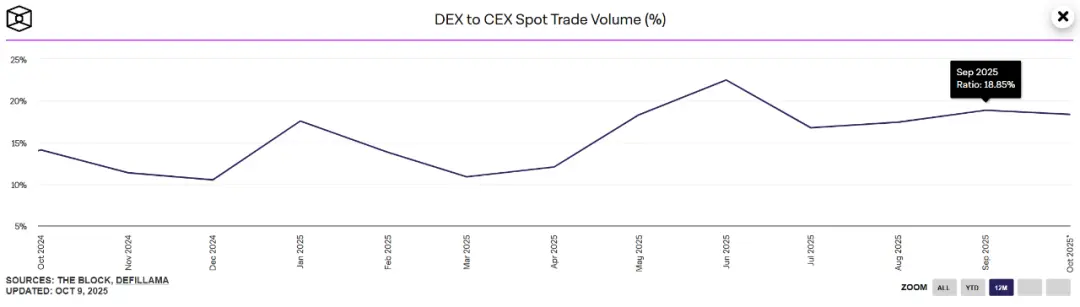

According to data from The Block, DEX trading volume accounts for 17.7% of the total spot volume of centralized exchanges, an increase of 0.1 percentage point from the second quarter and the previous historical high.

This milestone demonstrates that decentralized platforms are now on par with centralized exchanges during periods of active trading, reflecting increased infrastructure maturity and liquidity depth.

The surge in trading volume is accompanied by fundamental changes in market mechanisms. Analyst Ignas noted that the recent underperformance of cryptocurrencies listed on Binance has generally underperformed the broader market, indicating that price discovery has shifted to decentralized exchanges, while centralized platforms have become mere exit channels for liquidity.

Simon's Cat (CAT) and Magic Eden's ME both fell by 70% after listing, and Velodrome (VELO) plummeted nearly 70% to $0.1154 after listing on Binance, confirming the trend of centralized exchanges increasingly becoming exit liquidity tools rather than pricing venues.

Ignas concluded: "Previously, price discovery occurred in the VC private market, with CEXs serving as exit channels. Now, DEXs are taking on the price discovery function, while CEXs focus on exit liquidity."

This shift is being led by professional traders known as “smart money” on decentralized platforms.

Platforms such as Uniswap have achieved monthly trading volumes exceeding US$100 billion for consecutive months, which means that more prices are formed by AMM curves and RFQ auction mechanisms rather than custodial order books.

Despite Ignas’s observations earlier this year, decentralized exchanges continue to attract investors. This growth is reshaping how markets function, altering who owns pricing power, risk-taking, and liquidity.

When DEX continues to achieve monthly trading volumes exceeding US$100 billion, index construction, market-making models, and oracle design will all lean towards DEX liquidity sources, ultimately forming a transparent programmable market with a unified custody and execution wallet.

Liquidity, pricing, and risk management are migrating to smart contracts and solver networks, and regulators, index compilers, and market makers are viewing on-chain venues as core information sources rather than supplementary channels.

Maintaining exit liquidity channels through centralized exchanges remains critical to the healthy development of the market, providing an outlet for position liquidation and capital rotation.

This two-tier structure allows prices to be formed on a decentralized track while retaining deep exit channels for those who demand large-scale instant liquidity.