Author: 0xBrooker

Over the weekend, the U.S.-China trade negotiation delegations held their fifth round of negotiations this year in Malaysia, making final preparations for the upcoming talks between the two heads of state at the end of the month.

Previously, with both sides, especially the US, continuously signaling their desire for negotiations, and with improved short-term liquidity in US financial markets, the Nasdaq has gradually stabilized and rebounded from two weeks of decline and volatility, reaching a record high after the release of US September CPI data on Friday. On Sunday, both sides announced a consensus on the "agreement framework," stimulating a collective rally in the BTC and crypto markets.

The US-China trade conflict, short-term financial liquidity, and inflation data—three major market factors that had previously weighed on bullish sentiment—all improved, contributing to the US stock market reaching new record highs this week. Meanwhile, BTC and the crypto market remained weak due to suppressed overall risk appetite and the constraints of historical cyclical trends. Although they rebounded weakly after finding support from the 200-day moving average and re-established themselves at the "Trump bottom," they have yet to return to a bull market. The crypto market remains lacking in hot spots, and altcoins remain weaker than BTC.

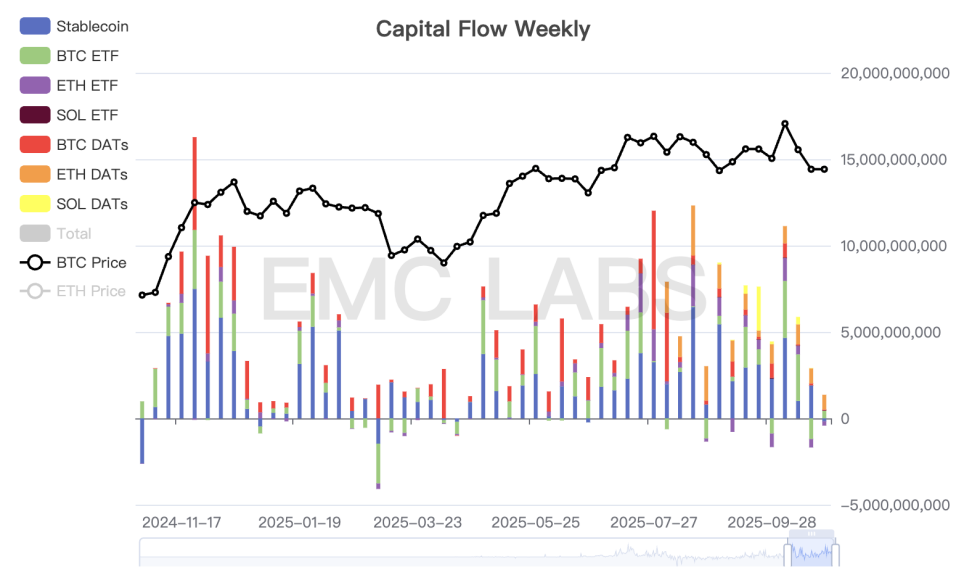

Capital inflows remain weak, making it difficult to offset the market pressure of long-term selling. We need to continue to observe whether, with interest rate cuts and the easing of the US-China trade conflict, capital can return to a state of abundant inflows, reverse the downward trend, or even rewrite the old cycle pattern.

Policy, macro-financial and economic data

Two weeks ago, the US-China tariff war suddenly escalated, triggering renewed volatility in global financial markets. Since then, both sides, especially the US, have continued to send signals of goodwill and a desire for a deal. The market gradually interpreted this as a move to "use force to promote negotiations," and the situation has since stabilized.

Over the weekend, delegations from both sides held their fifth round of talks in Malaysia. According to announcements from both sides on Sunday, over the two days, they "conducted constructive discussions" on topics such as export controls, reciprocal tariff extensions, fentanyl and drug control cooperation, further trade expansion, and Section 301 vessel charges, reaching a "preliminary consensus." The two sides will then proceed with internal approval procedures. The summit between the two leaders at the end of the month is likely to take place as scheduled.

Since the US government shutdown, the market has been struggling with a lack of economic and employment data. Finally, on October 24th, the first key data release—the Consumer Price Index—was released. The data showed a 3% year-on-year increase in the US CPI for September, below the 3.1% estimate and up from the previous reading of 2.9%. This means the Federal Reserve's October rate cut is nearly 100% certain, and expectations for a December rate cut on FedWatch have reached 91.1%. The continuation of the rate-cutting cycle has alleviated previous market concerns, and all three major stock indices hit record highs following the data release. Bitcoin also continued its weak rebound, but remains a significant distance from its all-time high.

The US government shutdown has caused short-term liquidity problems. With Powell's statement that "the Fed will soon stop QT", the pressure on the market has begun to ease.

U.S. AI and technology stocks have begun to disclose their Q3 financial reports. Tesla's financial report was lower than expected but still closed higher, indicating that the market is still optimistic about AI spending. Next week, many leading companies will continue to disclose their financial reports, which require close attention.

The US dollar index rebounded 0.39% this week, closing at 98.547, which is in a moderate state. After several weeks of short squeeze and rise, gold began to fall violently on Tuesday and has been in a weak state since then.

Crypto Market

In addition to the impact of the macro-financial market, BTC and the crypto market are still subject to the influence of historical "cyclical laws".

This week, exchanges still recorded an inflow of over 130,000 BTC, a slight decrease from last week, but net outflows shrank to 2,775, a recent low. This demonstrates that the cyclical law has a significant impact on the market as the old cycle transitions from one to the next.

Long-term investors reduced their holdings by over 39,000 coins. This kind of sustained selling during a decline often occurs during the bull-to-bear transition phase, when the buying power of short-term investors is no longer sufficient to absorb the selling pressure.

In the new market structure, the main forces bearing the selling pressure, DATs companies and BTC Spot ETF channel funds, also performed weakly this week. According to eMerge Engine statistics, the total capital inflow into the crypto market this week was only 943 million, the lowest in several months.

Weekly statistics of capital inflows into the crypto market

The underlying reason for the weak trading performance is the "cyclical law" that we have recently emphasized, which is suppressing market sentiment. A change in this situation will either require bullish forces within the new structure to actively absorb selling pressure amid rising global risk appetite, or a relentless sell-off by long and short positions to confirm a bear market.

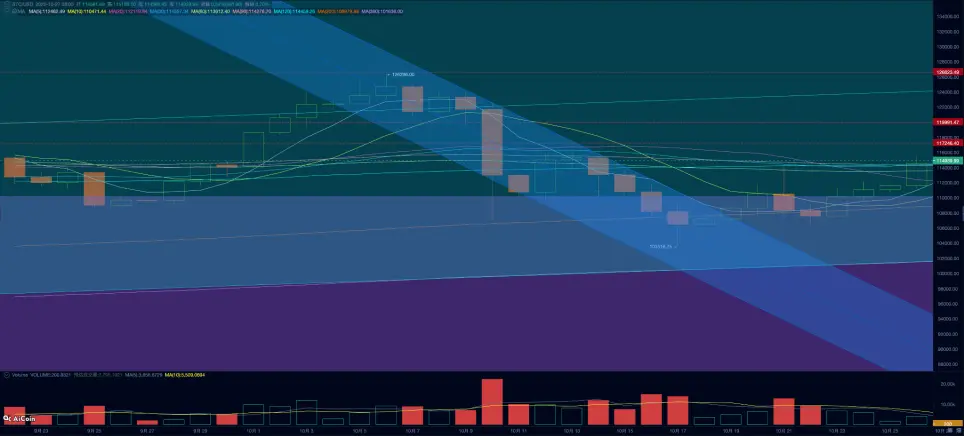

Technically, BTC stabilized above its 200-day moving average and the "Trump bottom" (between $90,000 and $110,000) this week and continued its weak rebound, achieving a 5.4% weekly gain. ETH, on the other hand, stabilized above its 120-day moving average.

BTC price trend daily

The continued liquidation of the contract market following the resurgence of the US-China conflict has resulted in a loss of over $20 billion in notional value. Recently, BTC has rebounded alongside the US stock market, but the total open interest remains low, indicating that leveraged funds are unlikely to become a key driver of the rebound in the short term.

Based on multi-dimensional judgment, we believe that the behavior of DATs and BTC Spot ETF channel funds in the future market will still be the only two forces to maintain BTC's rebound and even return to a bull market.

Cycle indicators

According to eMerge Engine, the EMC BTC Cycle Metrics indicator is 0, indicating that it is in the transition period.