Are there more and more people around you discussing "gold" recently?

Yes, I'm talking about physical gold. As geopolitical risks and global macroeconomic uncertainty increase, gold's total market capitalization has (at one point) surpassed $30 trillion, firmly securing its position as the world's leading asset.

At the same time, an interesting thing is happening in the Crypto world. In addition to Bitcoin, which is widely regarded as "digital gold", physical gold is accelerating its on-chainization: tokenized gold represented by Tether Gold (XAUT) has acquired new capabilities such as divisibility, programmability, and even interest-bearing through the RWA wave.

It is challenging a narrative that has long been almost monopolized by Bitcoin: "Who is the real digital gold?"

01. BTC: Narrative Changes Across a Decade

Is Bitcoin a currency or an asset? Is its core function payment or a store of value? Or is it a risky asset similar to a tech stock?

This problem has existed throughout almost the entire history of Bitcoin since its birth in 2009.

Although Satoshi Nakamoto clearly stated the "Electronic Cash" attribute of BTC in the white paper as early as then, with the evolution of its size, this has been a topic of narrative reversal and constant community debate at different times in the past 10 years - from an early means of payment to a "store of value" and "alternative asset."

In particular, the official approval of the spot ETF in 2024 has become a turning point in the narrative. More people are no longer optimistic about Bitcoin becoming a "global currency" for transactions and payments. Instead, more and more people are beginning to view Bitcoin as a value storage target with a consensus basis, that is, "digital gold":

Like gold, it is scarce, with predictable and stable production, but it also has advantages that gold cannot match: better divisibility (1 satoshi = 0.00000001 BTC), portability (cross-border transfers in seconds) and liquidity (7×24 hour market).

Because of this, Bitcoin has gradually become the third global storage logic after the US dollar and gold in the macro-monetary system.

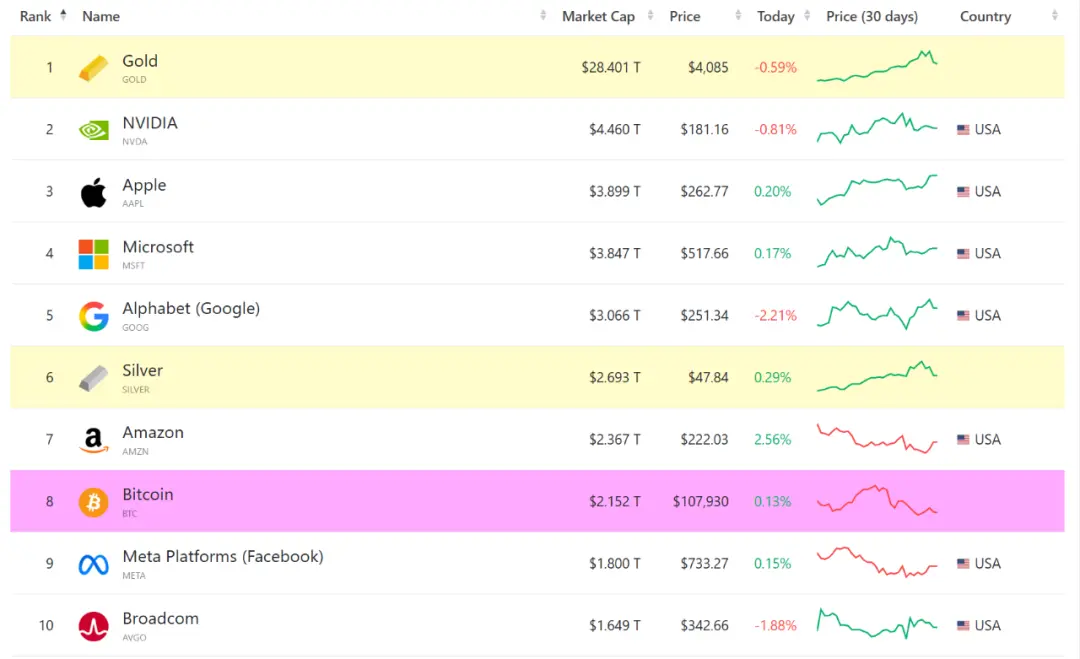

Source: companiesmarketcap.com

According to statistics from companiesmarketcap, gold currently holds an absolute leading position among the world's top 10 assets, with its total market value (28.4 trillion) far exceeding the sum of the next 9 assets (26 trillion).

You should know that even when BTC broke through $100,000, its total market value was only $2 trillion, which is only about 1/15 of the total market value of gold. This is actually the underlying driving force behind the BTC community's continuous emphasis on the "digital gold" narrative, that is, targeting the largest and oldest value storage target in the traditional financial world.

However, what is interesting is that while BTC strives to move closer to the “digital gold” narrative, gold itself is also being “digitalized”.

The most direct incentive is that with the record highs of real-world gold and the RWA wave this year, tokenized gold represented by Tether Gold (XAUT) and PAX Gold (PAXG) has risen rapidly.

Since they are anchored to physical gold, each token issued is backed by an equal amount of physical gold reserves. Therefore, this batch of "digital gold" products is undoubtedly a new financial species for the Crypto and TradFi fields.

02. The Rise of the Gold RWA Wave

In fact, the word "emergence" may not be very accurate for tokenized gold.

Strictly speaking, neither XAUT, the currently largest, nor PAXG, which follows closely behind, are newly launched internet-famous products. On the contrary, it is the current RWA wave and macro market conditions that have helped them gain new strategic significance and market attention.

Take XAUT as an example. Its early germination can be traced back to the end of 2019. At that time, Paolo Ardoino, the chief technology officer of Bitfinex and Tether, revealed that Tether was planning to launch a gold-backed stablecoin product, Tether Gold, and the XAUT white paper was also released to the public on January 28, 2022.

The white paper clearly states that each XAUT token represents ownership of one ounce of physical gold. Tether guarantees that it has prepared physical reserve gold corresponding to the amount issued, and all gold is stored in "first-class Swiss vaults with first-class security."

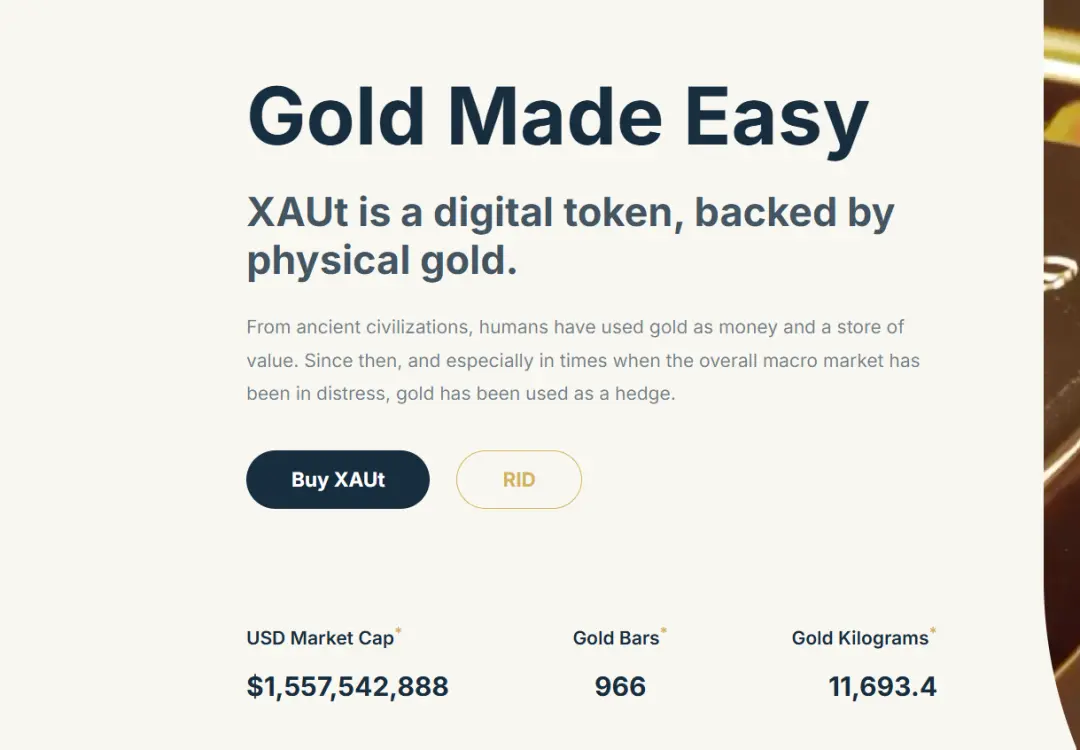

As of the time of writing, the total issuance of XAUT has exceeded US$1.55 billion, representing a physical reserve of approximately 966 gold bars (totaling 11,693.4 kg).

Source: Tether

In fact, in Tether Gold’s white paper, we can see its clear positioning of its own advantages:

- Compared to physical gold, “gold stablecoins” can divide precious metals that are difficult to divide into smaller denominations, making them easier to carry and transport, and greatly lowering the threshold for individual investment;

- Compared with gold ETFs, it enables 24/7 asset trading with no custody fees, significantly improving the speed and efficiency of asset transfers.

- That is, Tether Gold believes that it can help users obtain extremely high liquidity and divisibility while owning the gold behind it.

In other words, tokenization imbues real gold with the unique "digital attributes" of Bitcoin, allowing it to be fully absorbed into the digital world for the first time, becoming an asset unit that can be freely circulated, combined, and calculated. It is this step that makes tokenized gold products like XAUT more than just "on-chain gold certificates" and opens up a vast new space on-chain.

Of course, this trend also makes the market rethink: when both gold and BTC become on-chain assets, is the relationship between them competitive or symbiotic?

03. Thinking about tokenized gold and digital gold

In general, if the core narrative of BTC is "scarcity consensus in the digital world", then the biggest difference of tokenized gold (XAUT/PAXG) lies in "introducing scarcity consensus into the digital world".

This is a subtle but essential difference, where BTC creates trust from scratch, while tokenized gold digitizes the traditional trust structure, as CZ recently stated in his tweet:

“Tokenized gold is not real gold on the chain, but is based on trust in the issuer’s ability to fulfill its obligations. Even in extreme circumstances, such as management changes or war, users still need to rely on the continuation of this trust system.”

This sentence points out the fundamental difference between tokenized gold and Bitcoin, that is, the trust in Bitcoin is algorithmic consensus, without any issuer or custodian, but the trust in tokenized gold is institutional credit - you need to believe that Tether or Paxos will strictly execute the reserve commitment.

This also means that Bitcoin is a product of "trustlessness", while tokenized gold is an extension of "re-trust".

Of course, if we only look at the asset value dimension, in the traditional financial system, the core value of gold lies in risk aversion and preservation of value. However, in the context of blockchain, tokenized gold has programmability for the first time:

- It can be used as collateral in DeFi protocols to lend stablecoins on platforms such as Aave and Compound for leverage or yield management;

- It can be integrated into smart contract logic to become yield-bearing gold, potentially enabling yield-bearing gold.

- It can also circulate freely between different networks through cross-chain bridges, becoming a stable liquid asset in the multi-chain ecosystem;

The essence of this change is that gold has transformed from a static store of value into a dynamic financial unit. Through tokenization technology, gold has been given Bitcoin-like digital attributes - verifiable, liquid, composable, and computable. This means that gold is finally no longer just a symbol of value lying in the vault, but has become a "living asset" in the on-chain world that can participate in profits and generate credit.

Objectively speaking, at a time when liquidity is tightening and Alt assets are weak, the rise of the RWA wave has brought traditional assets such as gold, bonds, and stocks back into the crypto vision. The popularity of tokenized gold just shows that the market is seeking a more stable and certain on-chain value fulcrum.

From this perspective, tokenized gold, which is accelerating its development under the RWA wave, is not intended to (and cannot) replace BTC, but rather serves as a perfect complement to BTC's "digital gold" narrative, becoming a new financial species that combines the efficient liquidity of digital assets with the safe-haven certainty of traditional gold.