Author: Lyv

introduction

Gold has been unrivaled this year. Amidst multiple headwinds, including trade frictions, US debt volatility, and geopolitical tensions, it has outperformed Bitcoin, the Nasdaq, and all major asset classes, rekindling calls for its "return of the king." Its year-to-date gains have exceeded 50%. In contrast, Bitcoin, known as "on-chain gold," which has gradually acquired safe-haven properties in recent years, has only risen by approximately 15%. This stark divergence in strength has sparked heated market debate, with questions ranging from "Why is gold strong while Bitcoin weak?" to "Is Bitcoin still a worthwhile investment?"

After carefully analyzing gold's historical pricing patterns and buying logic, we continue to believe that Bitcoin, as an emerging safe-haven asset in the digital age, is currently experiencing a historical phase characterized by both safe-haven and risk. In the long run, Bitcoin's uniqueness and rarity mean it holds significant long-term investment value, just like gold. The current low allocation of Bitcoin in global investment portfolios suggests greater leverage and potential for returns.

This article, in the form of a Q&A, systematically sorts out our allocation framework from the perspectives of the evolution of risk aversion logic, the hedging mechanism of gold and Bitcoin, long-term allocation ratios, and tail risk pricing. It also introduces the views of mainstream global institutions and investors to further demonstrate why Bitcoin deserves a higher weight of strategic attention in current and future global asset portfolios.

Q1. In theory, both gold and Bitcoin have safe-haven properties, but what are the differences between the two in their safe-haven roles?

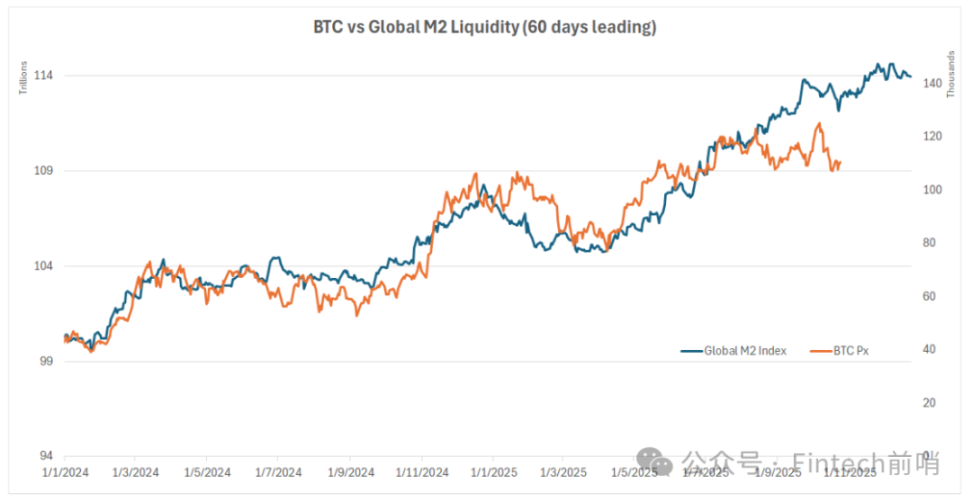

Answer: The market generally believes that gold is a mature safe-haven asset in the traditional "carbon-based world." Bitcoin, on the other hand, can be considered a rising star in the "silicon-based world" as a store of value, rather than a mature safe-haven instrument, and currently still possesses strong risk-on asset attributes. We have observed that before the Bitcoin ETF was approved in early 2024, the correlation between Bitcoin's price and the Nasdaq index was as high as 0.9. After the ETF was approved, the correlation between Bitcoin's price and the Nasdaq index dropped to 0.6, and Bitcoin has clearly begun to track global M2 liquidity, demonstrating similar "inflation-resistant" properties to gold.

Goldman Sachs analysts point out that while Bitcoin offers higher returns than gold, it also carries significant volatility. When risk appetite is high, Bitcoin often behaves similarly to stocks. However, when the stock market declines, Bitcoin's hedging effectiveness is less effective than gold. Therefore, gold is currently a more reliable hedge, while Bitcoin is still in the transition phase from a risky asset to a safe haven.

Ray Dalio, founder of Bridgewater Associates, also emphasized that if investors need to maintain neutrality and diversify their asset allocation, they can consider gold or Bitcoin, but he personally prefers gold, a historically proven hedging tool. He pointed out that although Bitcoin has a limited supply and certain store of value potential, its safe-haven status is far inferior to gold, which has a long history of support.

Q2. What have been the main drivers of gold prices since 2007? Why did central banks become the main buyers of gold after the Russia-Ukraine war in 2022?

Answer: Since the global financial crisis of 2007, US real interest rates have become a key driver of gold prices. Because gold itself does not generate interest (it's a "zero-coupon asset"), its price is inversely correlated with real interest rates. When real interest rates rise, the opportunity cost of holding gold increases, and gold prices tend to fall. Conversely, when real interest rates fall (or even turn negative), gold's relative attractiveness increases, and its price strengthens. We've observed a significant correlation over the past fifteen years. For example, after 2008, the Federal Reserve's rate cuts led to lower real yields, triggering a sharp rise in gold prices. However, the rise in real interest rates since 2013 has put pressure on gold prices. During the period when the Federal Reserve entered negative interest rates in 2016, we saw significant inflows into North American ETFs.

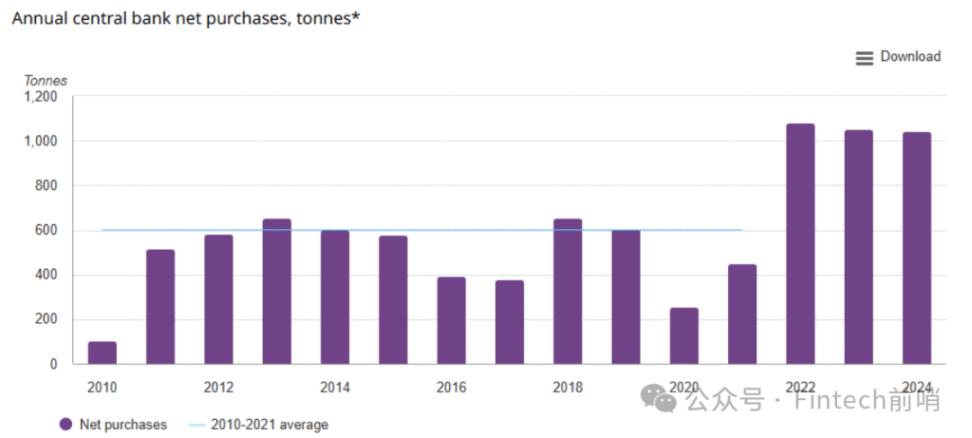

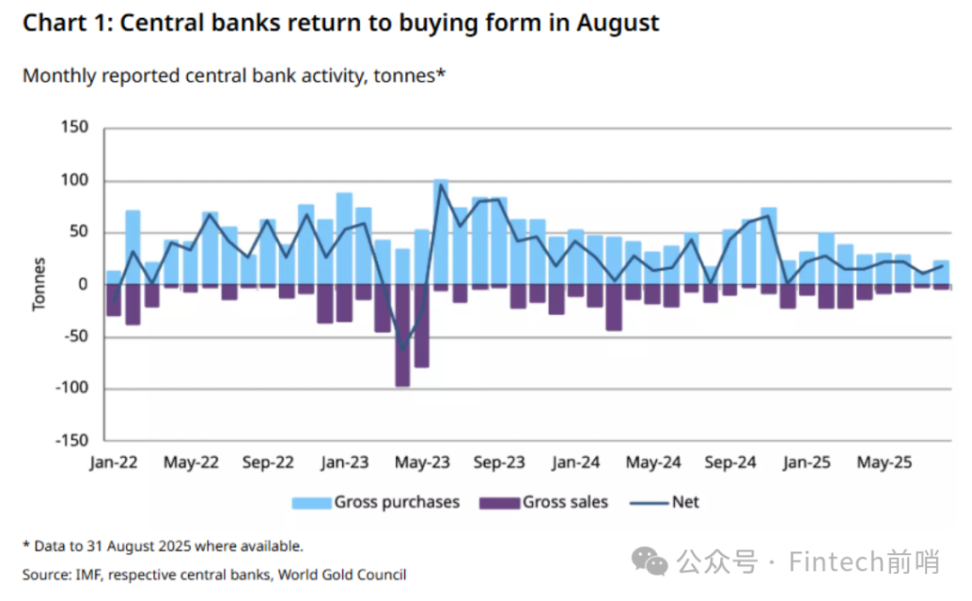

Following the outbreak of the Russo-Ukrainian war in 2022, global central banks significantly increased their gold holdings, becoming the new dominant factor driving gold prices. Net gold purchases by central banks set a record that year, and have since exceeded 1,000 tons annually. Data from Metals Focus shows that annual central bank gold purchases since 2022 have far exceeded the previous multi-year average (457 tons from 2016 to 2021), and are expected to reach approximately 900 tons in 2025. These official purchases contributed 23% of global annual gold demand (over 40% of investment demand) from 2022 to 2025, double the share in the 2010s. Currently, global central banks hold nearly 38,000 tons of gold, representing over 17% of all surface gold and 44% of all gold used for investment purposes outside of jewelry and technology, indicating continued room for growth.

The World Gold Council's latest survey shows that central banks continue to hold optimistic outlooks on gold. The vast majority of respondents (95%) believe that global central bank gold reserves will increase over the next 12 months. A record 43% of respondents believe their own country's gold reserves will also increase over the same period, and no one expects their gold reserves to decline.

The driving force behind central banks' aggressive gold purchases stems from 1) geopolitical hedging and 2) reserve asset diversification. Western sanctions stemming from the Russia-Ukraine conflict have frozen half of Russia's foreign exchange reserves, prompting many emerging economies to consider replacing some of their dollar assets with gold. With the surge in US debt and a bleak credit outlook, the relative appeal of dollar-denominated assets like US Treasuries has declined, further increasing gold's appeal as a reserve asset and safe haven.

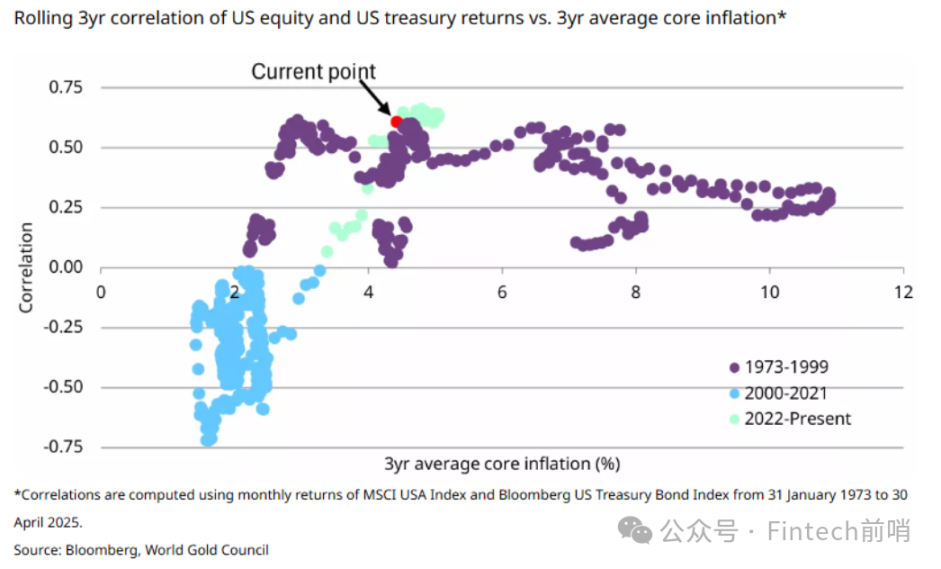

The allocation needs of some large long-term investment institutions also come from the increasing failure of the "stock-bond seesaw": starting from 2022, stocks and bonds have shown more positive correlation, which is contrary to the "6:4 stock-bond allocation" narrative we have been familiar with in the past 20 years:

Q3. What major tail risks does gold’s safe-haven function mainly hedge against?

Answer: From the above analysis, it is not difficult to see that the future safe-haven value of gold should be mainly reflected in hedging two relatively independent extreme tail risks:

- US debt or inflation crisis (i.e., US dollar credit/sovereign debt risk)

- Major geopolitical and economic conflicts

First, in scenarios of uncontrolled debt or high inflation, fiat currencies could depreciate significantly, even leading to a credit crisis. This highlights the role of gold as a long-term store of value and inflation hedge. A World Gold Council survey of nearly 60 central banks revealed that the primary motivation for central banks to hold gold is its perceived value as a long-term store of value and inflation hedge, as well as an asset that performs well in times of crisis. Central bankers also view gold as an effective portfolio diversifier, a hedge against economic risks (such as stagflation, recession, or debt default) and geopolitical risks.

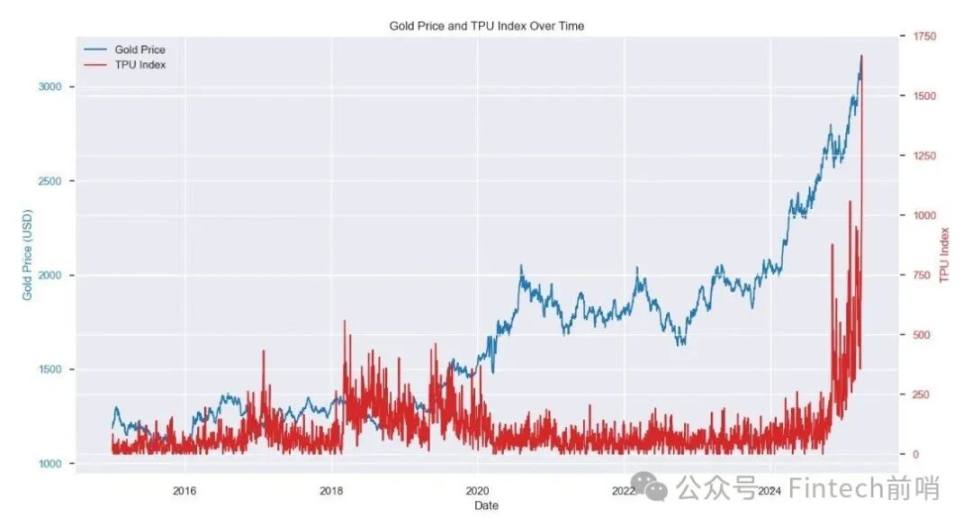

For example, the rapid rise in US debt has raised concerns about the long-term value of the US dollar. Gold can serve as a "shield" in such extreme situations. Secondly, with regard to geopolitical conflicts, gold is seen as a safe haven in times of turmoil. Whenever war or international tensions occur, such as the 2018 US-China trade war, the 2022 Russia-Ukraine war, and the 2025 US tariff shock, safe-haven funds tend to flow into gold, driving up its price. Economic historical backtesting studies have also demonstrated a positive "power law" relationship between gold prices and the Trade Policy Uncertainty Index over the past decade:

This also explains why gold has outperformed Bitcoin recently: in the process of a new round of escalation in the Sino-US trade confrontation, central banks and long-term investment institutions, as the main allocators, combined with the increasing uncertainty about the long-term bull market in US Treasuries, should prefer assets they are more familiar with: gold.

Q4. In an ideal asset portfolio, how should the gold allocation ratio reflect the expectation of tail risk?

Answer: Gold is often likened to a portfolio's "insurance"—it can drag down returns in normal times but provide protection during crises. Therefore, when managers perceive a heightened risk of extreme events in the future, they often increase their gold holdings as a safe haven. Gold can significantly mitigate potential portfolio losses during periods of financial stress and provide stable, diversified returns during severe market downturns ("left-tail events"). Because gold demand comes in part from central banks, the tech sector, and consumers, its price movements do not fully align with those of financial assets. Some asset allocation frameworks specifically use gold for tail risk hedging: for example, some insurance funds and pension funds position gold as a highly liquid asset that can be liquidated in times of emergency to offset losses in other assets when tail risks strike.

Simply put, the weighting of gold in a portfolio can be viewed as a reflection of the fund manager's assessment of the probability of extreme tail risks. If the fund manager believes the probability of the two aforementioned tail events is increasing over the next five to ten years, then increasing the weighting of gold in the portfolio is reasonable. This allocation is like buying insurance for the portfolio; the weighting reflects the manager's subjective assessment of the probability of catastrophic events.

Now let's do a simple and interesting thought experiment: If we assume that the probability of the two major risks mentioned above materializing over the next five years is 10% (e.g., 5% + 5%), then our allocation to these two risky assets should also be increased to 10%. If, looking out ten years from now, the probability of realization rises to 15%-20%, our allocation would also seem to need to be increased to 15-20%. As time goes by, we believe that the probability of these two tail risks materializing will inevitably increase.

Q5. What is the current proportion of gold and Bitcoin in global asset allocation? What suggestions do market participants have for increasing their weighting?

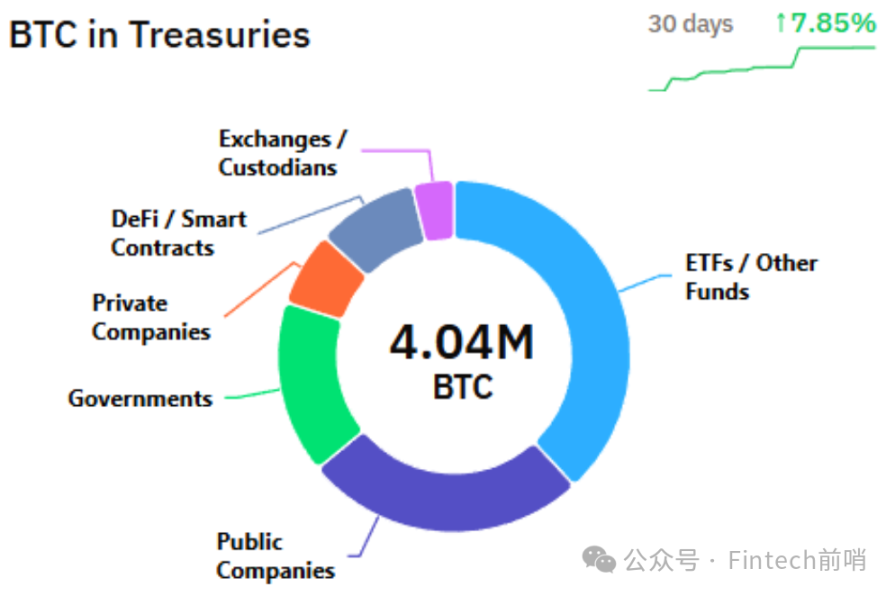

Answer: According to the latest research report from Goldman Sachs, gold currently accounts for about 6% of global investment portfolios, while Bitcoin accounts for only about 0.6%. The latter is equivalent to about one-tenth of the former (the total market value is smaller in comparison), indicating that Bitcoin as an asset allocation is still in its early stages (in comparison, gold is already a mainstream asset).

Given the recent volatility in the global macroeconomic environment, many prominent institutions and investment gurus have called for increasing allocations to gold (and, to a lesser extent, Bitcoin). Ray Dalio of Bridgewater Associates recently stated that, from a strategic asset allocation perspective, the proportion of gold in a portfolio should be increased to around 10%-15%, significantly higher than the gold weighting generally recommended by traditional investment advisors (typically around 5%). Notably, Dalio previously recommended only a 1-2% allocation to Bitcoin/gold in 2022, but has now increased this ratio several-fold to 15% due to rising risks, reflecting his reassessment of the importance of safe-haven assets.

Other prominent investors have echoed similar sentiments: DoubleLine Capital founder Jeffrey Gundlach, for example, recently suggested that allocating nearly a quarter (25%) of a portfolio to gold is reasonable. Some research and historical backtesting also support a higher gold allocation: a long-term simulation analysis by an asset management firm showed that a portfolio with a gold allocation of approximately 17% achieves the highest risk-adjusted return.

As institutional investors shift their stance on Bitcoin, some are suggesting a moderate increase in allocations. For example, Grayscale Fund recommends considering Bitcoin as a "core asset," with a 5%-10% allocation. Overall, global gold allocations currently far outweigh Bitcoin, but there's widespread consensus that increasing both in traditional portfolios is necessary to strengthen resilience to extreme risks.

Q6. Back to our thought experiment: If we believe that there is a 10% tail risk in the next 5 years and a 20% tail risk in the next 10 years, how should we synchronously increase the allocation of hedging assets such as gold and Bitcoin?

Answer: Under the assumption that the probability of tail risk cannot be ignored, investors should significantly increase their safe-haven asset allocation compared to normal circumstances. Experience shows that when anticipating the possibility of extreme events, pre-positioning hedge assets such as gold and Bitcoin can help protect the portfolio from shocks. This approach is similar to the "black swan" hedging strategy: using a small amount of cost to hedge against a small probability of a significant risk.

Based on probability mapping, to hedge 20% of tail risk, an equal amount of safe-haven assets should be allocated to the portfolio, meaning that the total allocation of gold and Bitcoin should reach 20%. Assuming we increase the weight of gold to 15% and Bitcoin to 5%, the proportion of gold in global holdings would increase from the current approximately 6% to 15%, a 2.5-fold increase; while increasing Bitcoin from approximately 0.6% to 5% would be an increase of more than 8-fold.

This suggests that within an idealized safe-haven portfolio, Bitcoin's potential for increased allocation (relative to the current benchmark) is far greater than that of gold. This is because gold, as a mature asset, already boasts significant global holdings and allocations, and doubling it would require a significant amount of capital. Bitcoin, on the other hand, has a very low base; even if it were to increase several-fold, its share of global assets would remain small. This disparity in the potential for increased allocations also means that Bitcoin's price is more sensitive to incremental allocations—even a small inflow of funds can significantly drive its price up.

Institutional investors have begun to reflect this concept in actual market operations. In recent years, some major investment banks have proactively incorporated crypto asset allocation caps to mitigate systemic risks. Morgan Stanley's Global Investment Committee, in its latest recommendations, included Bitcoin in its asset allocation model for the first time. For high-risk clients, aggressive growth portfolios are recommended to allocate up to 4% to crypto assets (balanced portfolios are capped at 2%, and conservative portfolios are currently not allocated).

Analysts have also pointed out that if Bitcoin gradually achieves a reserve status similar to gold, its market capitalization could approach that of gold. While this requires numerous prerequisites, considering the potential for increased allocation ratios, Bitcoin offers greater leverage in global asset allocations compared to gold (2.5x vs. 8.0x). This is why, while emphasizing increasing gold holdings, many institutional investors are also beginning to consider allocating a certain amount of Bitcoin: a combination of the two can both hedge against traditional financial risks and capture excess returns from the rise of emerging safe-haven assets.

Q7. Compared with gold, what are the main advantages or unique features of Bitcoin as an asset in a portfolio?

Answer: We believe that from a purely economic design perspective, Bitcoin may be a more suitable safe-haven asset than gold in the ultra-long term, and it has the opportunity to demonstrate more rigid hedging capabilities in the face of the two tail risks mentioned above.

First, supply rigidity. Bitcoin's issuance is permanently capped at 21 million coins, unlike fiat currencies, which can be issued indefinitely or as new reserves are discovered or recycling efficiency increases. This "silicon-based digital scarcity" makes it a scarce asset, similar to gold, offering long-term inflation-resistant store of value. More importantly, Bitcoin's annual inflation rate has fallen below 1% after the 2024 halving, far lower than the 2.3% annual increase in gold supply.

Second, "buy and hold" holdings remain low. Our analysis shows that mainstream institutional investors currently have a very small allocation to Bitcoin, with "buy and hold" participants holding no more than 10%, and only 17% including all ETF holders (ETFs include a large number of hedge funds and retail investors, who cannot all be counted as "buy and hold"). In contrast, gold "buy and hold" holders will account for 65% of investment gold by the end of 2024, of which central banks account for 44%, while ETF holdings account for only 4%.

This means that as recognition increases, there is huge potential for increased allocations in the future. BlackRock CEO Larry Fink recently publicly called Bitcoin "the new generation of gold" and supported its inclusion in long-term fund allocations such as pension funds.

Third, on-chain transparency. All Bitcoin transactions are recorded on the public blockchain, accessible and verifiable to anyone. This unprecedented transparency enhances market trust, allowing investors to monitor the Bitcoin network's circulation and reserves in real time, eliminating the need for a "black box" asset. In contrast, central bank gold reserves and over-the-counter (OTC) transactions often lack real-time transparency.

Fourth, decentralization makes it censorship-resistant. The Bitcoin network is maintained by countless nodes around the world, with no central authority able to unilaterally control or invalidate transactions. This decentralization provides strong censorship resistance—it is difficult for any country or organization to freeze or confiscate Bitcoin accounts, nor can it dilute its value through issuance. In extreme cases, non-physical gold also carries counterparty risk; during wartime, gold faces embargoes, confiscation, and other risks. Bitcoin, on the other hand, requires only electricity, a network, and a private key to store value and transfer payments.

In summary, Bitcoin's fixed supply and technical architecture endow it with inherent anti-inflation, low correlation, and censorship resistance. This makes it poised to play a new role in long-term asset allocation as a store of value and risk hedge in the digital age, serving as a valuable complement to gold and other safe-haven assets.