Written by Lauris

Compiled by Saoirse, Foresight News

For most of human history, infants were productive economic assets. They weren't just objects to be cared for; they were also laborers—herding sheep at five, joining the farm or becoming apprentices by ten. More children meant higher output, greater resilience to risk, and greater family wealth. This model worked well, with fertility rates showing positive growth and fertility being a significant driver of GDP.

Later, everything changed.

At some point in the 20th century, children ceased participating in productive labor and became consumers. Schooling replaced the practice of labor, laws restricted child labor, and the emphasis of social education shifted from fostering initiative to emphasizing obedience. Parents continued to have children, but now each child became a net liability for the family for 18 years, and the marginal utility of having a child dropped below zero.

This has led to the situation we face today: a sharp decline in birth rates, an inverted population structure, and an aging economy.

Relying on child labor on farms is a thing of the past, but incorporating infants into the “bonding curve” mechanism (a mathematical model used for the issuance and pricing of crypto assets) can achieve the following goals:

a) Develop a new financial infrastructure tool to help families accelerate their financial freedom; and

b) Re-emerging children as economically productive assets, thereby unleashing a socially beneficial effect in terms of increasing birth rates.

Opportunity: Babies as on-chain financial primitives

Cryptography gives us the tools to solve this problem. Using composable smart contracts, identity metadata, and financial instruments, we can now integrate babies back into the economy.

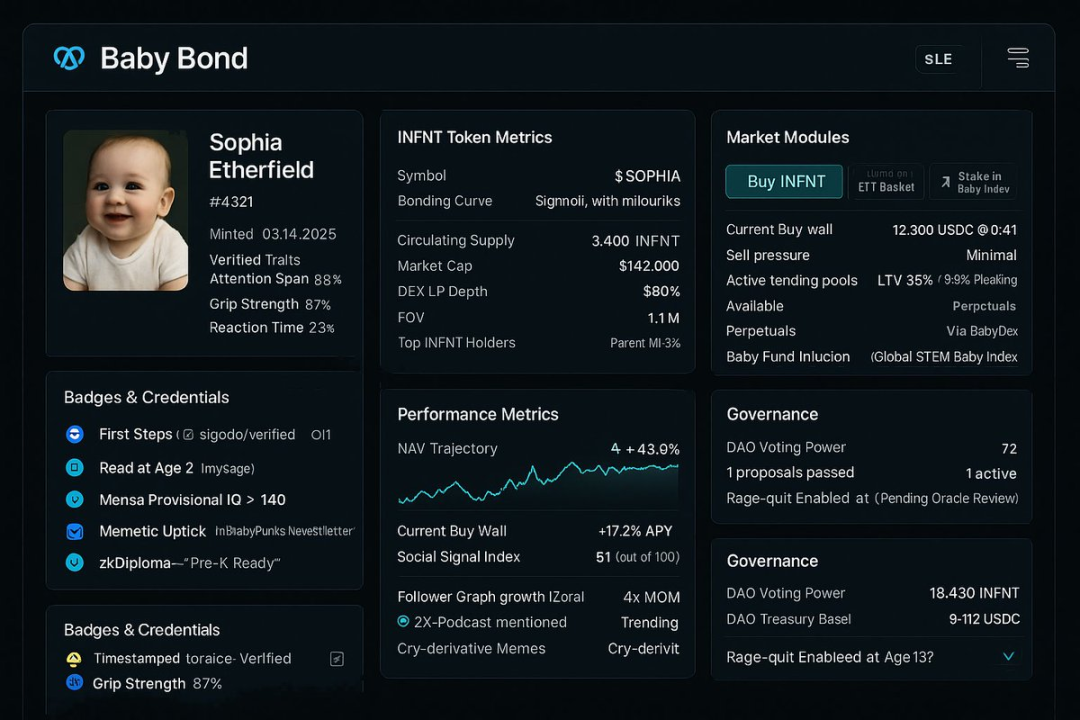

When a baby is born, a "baby bond" is minted. This is a hybrid ERC-404 token: part NFT (for identification) and part fungible token (for liquidity). This token represents the potential economic value of the baby over time, encompassing multiple dimensions such as memetic, social, and intellectual. The second derivative of value, growth acceleration, is also factored back into the birth rate.

Contract Standard: ERC-404 and INFNT Token

Traditional NFTs are not suitable for this scenario due to their lack of liquidity. Therefore, Baby Bonds adopt the ERC-404 standard. This is a hybrid standard that allows each baby-related token to:

- Fragmentation trading via INFNT tokens

- Individual identity recognition through parent NFT

- Combining badges with bonding curves to achieve dynamic valuation

This design allows us to combine the advantages of both: permanence of identity and composability of mobility.

From a mathematical point of view: let B(t) be the baby bond at time t, then the formula for its value change is: dB/dt = ∂INFNT/∂milestone + ∂INFNT/∂meme speed, where both variables are convex with respect to public interest and institutional verification.

Traits, AI, and Badges

Baby bonds are not just a token, but also a vital modular carrier that carries value accumulation and reputation transfer.

- AI-verified feature metadata: From the moment the token is minted, an AI agent monitors and records the infant's early developmental characteristics, such as movement speed, social behavior, and audio signal complexity. These characteristics are attached to the NFT via semi-immutable metadata (modifiable only through a trusted update oracle), ultimately forming a longitudinal, verifiable, and privacy-protected "baby feature profile."

- Educational Badges: Schools, universities, digital academies, and other institutions can issue cryptographic badges directly attached to NFTs. These badges, used to mark milestones (e.g., "Learned to read at age 3," "Admitted to MIT," "Top 1% in spatial IQ"), provide both public resources and exclusive advantages to token holders.

- Dynamic feature accumulation and modular governance: Before the age of 18, baby bonds are managed by parents, smart contracts, or decentralized autonomous organization (DAO) trustees. After turning 18, governance rights transfer to the baby. Furthermore, starting at age 13, babies can be granted an "exit right." Early voting decisions can be weighted quadratically to prevent aggressive large investors from manipulating governance.

- Fully auditable on the chain: All data and operations are recorded on the chain and can be audited at any time.

Example: Trait Score Formula: TraitScore (t) = ∑ (Badgeᵢ * wᵢ) where Badgeᵢ represents a verified achievement signal and wᵢ represents a weight coefficient determined by the market.

Convexity and Mechanism Design

The value of baby tokenization does not come from linear cash flow, but from "unlocking convexity" - based on the baby's developmental results, the popularity of memes and external certification, it can generate significant nonlinear revenue growth.

- Bonding Curve-Based Issuance: INFNT tokens (the native token of non-fungible baby bonds) are issued through a bonding curve to reward early backers. As babies achieve more milestones or increase their social impact, the token's value will grow exponentially, making "baby investing" a new type of "seed investment."

- Third-party feature injection: Verification badges issued by authoritative organizations can drive token value growth along a nonlinear trajectory. For example, adding an “Olympic Gold Medal” badge can cause NFTs to experience discontinuous upward adjustments in value due to a meme-based “supply shock.”

- Protocol-based fertility incentives: Decentralized autonomous organizations (DAOs), Layer 2 networks, and even countries can implement composable incentive mechanisms. Examples include providing gas subsidies for families with children, quadratic matching of baby bonds held by low-income parents, and launching "fertility farming" programs for rural users. The design space is completely open.

Downstream application scenarios

After the baby is tokenized, it will become a programmable financial infrastructure. The following are some of the downstream applications:

1. Baby Mortgage Loans

Families holding high-potential baby bonds can use their baby's expected income or meme stake as collateral to obtain long-term, low-interest mortgages. Loan approval is no longer based on parental income, but rather on the child's expected economic utility. For example, "We pay a 30% down payment, 10% in ETH and 20% in the baby's bond share."

2. Baby Index ETF

Build curated portfolios of baby bonds by geographic region, talent area, or profile. For example, "Nigeria's Top 50 STEM Potential Babies," "Genius Portfolio - Level 1 IQ Scores," and "Elite Violin DAO." These portfolios can be issued as ERC-4626 standard vaults or tradable basket tokens.

3. Baby Perpetual Futures

A comprehensive derivatives market will be built, allowing users to "go long" or "short" on the future socioeconomic benefits of specific groups. Contracts will be settled based on the on-chain composite key performance indicators (KPIs) of the infant at age 21, and oracle disputes will be resolved through multi-sig arbitration or memetic resolution mechanisms.

4. Baby Influence DAO

Tokenized philanthropy is achieved from birth. Donors can contribute to baby bonds in impoverished areas, earning impact returns and receiving governance tokens in the "Baby Enhancement DAO." This "proof of impact" mechanism will replace traditional philanthropy models and establish a regenerative fertility finance system.

5. Narrative derivatives

Bets are placed on speculative developmental trajectories of infants, such as: “Will Child X become a billionaire?” or “Will Child Y be embroiled in public controversy before the age of 12?” The on-chain prediction market will become a “narrative vehicle,” with token value increasing as the trajectory outcomes materialize.

Ethical considerations

Some may consider this proposal dystopian, arguing that it commodifies life. However, in reality, life has already become financialized in today's society, and children themselves are a cost center for families. We've simply been using a model with low transparency and poorly designed incentives. Tokenization isn't exploitation, but rather a readjustment of the existing system, allowing the coexistence of "life meaning" and "capital."

The object of the transaction is never the baby itself, but the predicted value of its growth trajectory.

in conclusion

We can’t go back to a time when we relied on child farmers; that model is obsolete. The labor of infants on farms is a thing of the past, but by tokenizing babies—a combination of real-world assets (RWAs) and decentralized physical infrastructure (DePINs)—we can leverage token incentives and cryptography to solve one of modern society’s most pressing problems.

Childbearing becomes a source of income.

Parenting becomes a protocol to follow.

Human society will also regain "mobility".