Author:Kaori

Binance Alpha has formed a consensus on value among project parties, coin-collecting circles, retail investors and other circles. Projects "pay" to Alpha, and coin-collecting parties do KYC in batches to start a new round of coin-collecting journey, while retail investors make profits by manipulating point limits, lucky tail numbers and transaction wear and tear.

From the very beginning, Alpha was the best exit window for meme coins, to the first few rounds of "violent money giveaways" in Alpha2.0, to the introduction of a points system to screen users and token issuers to line up for Alpha, Binance has gradually regained the traffic and pricing power of the on-chain market. Behind all this is Binance's ambition to reorganize the ecosystem through liquidity discourse power on the asset side after being left behind by OKX on the product side.

150 days have passed, and Binance Alpha has evolved from a wallet function into the most influential structural mechanism in the entire crypto market.

What has Alpha done in these 5 months?

In 2024, the crypto market ushered in a bull market boom under the dual stimulation of the approval of Bitcoin spot ETF and the meme craze. However, under the appearance of liquidity recovery, a deeper problem is that the pricing mechanism between the primary market and the secondary market is gradually failing. VC project valuations are inflated, the project issuance cycle is repeatedly extended, the user participation threshold is constantly raised, and the final listing window often becomes the end point for the project party and early investors to collectively cash out, leaving retail investors with only a mess.

It is in this context that Binance launched Binance Alpha on December 17, 2024. At first, it was just an experimental function in the Binance Web3 wallet for discovering high-quality projects, but it quickly evolved into Binance's core tool for reconstructing pricing power in the on-chain market.

In a Space post responding to community disputes, Binance co-founder He Yi admitted that Binance's listing of coins had the problem of "peaking at the opening", and frankly stated that the traditional listing mechanism is no longer sustainable under the current volume and regulatory constraints. Binance has also used mechanisms such as voting for listing and Dutch auctions to constrain the price performance of new coins after listing, but the results have always been unsatisfactory.

Therefore, Alpha listing became a strategic alternative within the controllable range of Binance at that stage.

"Put these hot projects in the market in Binance Alpha. Projects in the observation area are not guaranteed to be listed on Binance. A project can only generate income and profits, and only then can it share the benefits with users, if it is beneficial to society." He Yi made such a promise in Space.

On December 18, Binance Alpha announced the first batch of project lists. As of February 13, Binance Alpha has launched more than 80 tokens from ecosystems such as BSC, Solana, and Base, mainly meme and AI tokens. However, the market did not reduce the criticism of VC coins that fell at the opening as Binance expected, and the launch of Alpha became the expected last stop for meme coins.

It was not until early February 2025 that the BSC ecosystem opened up the channel between Alpha and traffic, starting with the test coin TST. It was also from that period that Alpha began to launch non-meme tokens, such as ONDO, MORPHO, AERO, etc.

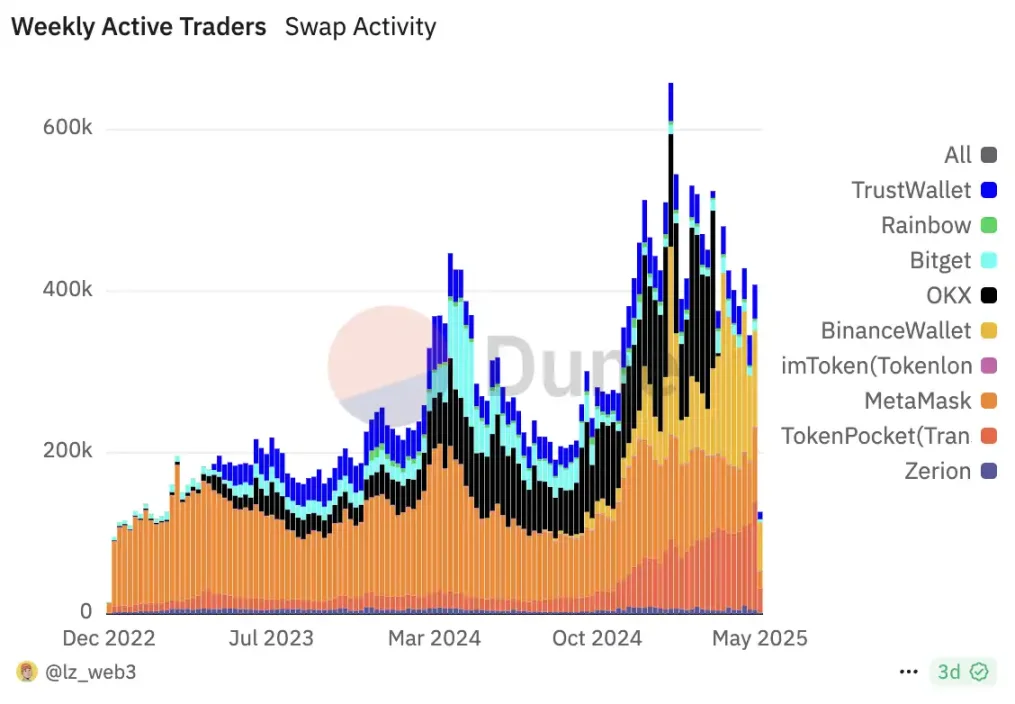

In March, due to the closure of OKX DEX, Binance Wallet launched Binance Alpha 2.0 at this time. By integrating Binance Alpha directly into CEX, users can directly use funds in the exchange to trade Alpha tokens. As a result, Binance Wallet's trading volume and active users surpassed in one fell swoop, accounting for 80% of the trading volume of crypto wallets, becoming the steepest part of the growth curve of wallet products.

At the same time, Binance's screening criteria for Alpha users are also constantly evolving. Since the initial "task-based points system" is no longer sufficient to form an effective distinction, the platform quickly introduced systems such as lucky tail numbers and points consumption to stimulate more frequent interactions. This mechanism takes into account the continuity and differentiation of user participation, and also provides project parties with a relatively accurate airdrop target group.

The project party is no longer hesitant

Since the launch of the Alpha mechanism, the choices facing project owners have changed.

Faced with the high uncertainty of the main site listing window, the cashing pressure of the on-chain community, and the inverted valuation on VC books, more and more teams are beginning to realize that if they want to gain market attention and liquidity support, it may not be enough to just tell stories, maintain the community, or wait for the traditional listing process.

Rather than continuing to waste time on a route where the results cannot be measured, it is better to actively adapt to the new paradigm brought by Alpha. In the Alpha system, token flows, airdrop amounts, and trading activity can all be directly reflected as observable data on the platform. And these data are likely to be the pre-tickets to Binance's official launch, and being on Alpha can also gain market attention with almost no negative impact.

Because of this, project developers began to quickly adjust their strategies. They were no longer hesitant about whether to launch, whether to list, and when to list. Instead, they tailored a "low-cost listing on Binance" execution model specifically for the Alpha mechanism.

Backstabbing the community has become the norm

Binance Alpha currently has two options for listing coins, either a circulating project or a new project that is not circulating, and there are different detailed indicators around these two main lines. This makes Alpha an entry point with clear systems and standards.

At the execution level, Binance Alpha’s pace of going to the main site spot is extremely restrained, and the number of spot listings in the past five months is far lower than Binance’s previous spot listing pace. This limited and scarce design has built a typical Web2-style growth flywheel - spending money to gain traffic, setting thresholds to screen users, and continuously optimizing internal rules, ultimately achieving user retention and strengthening the ecological structure.

To enter this system, project owners usually need to make significant adjustments, including but not limited to deploying or mapping tokens to BSC, redesigning incentive structures, and sacrificing part of the community's original airdrop quota. To some extent, Alpha is not just a wallet product, but more like a lightweight, centralized on-chain coin issuance protocol that meets the data selection and risk hedging needs of the Binance platform.

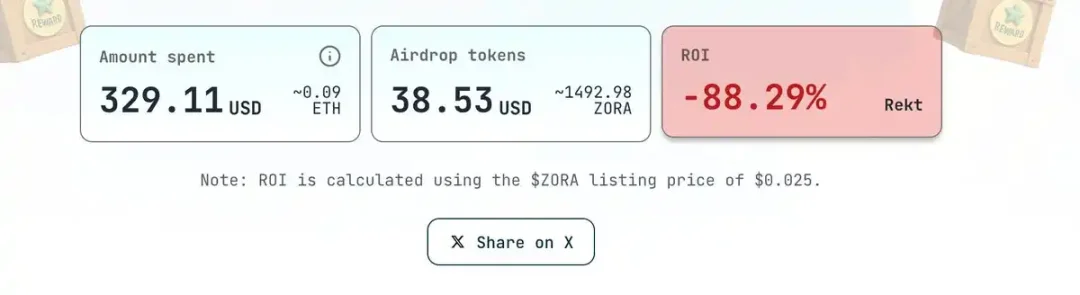

After Zora of the Base ecosystem announced its first launch on Binance Alpha, someone in the chat group said, "Don't have too high expectations. Maybe after working hard for several years, you might as well play Alpha with others." Unexpectedly, his words came true. Binance Alpha users who met the requirements received 4,276 ZORA tokens, worth nearly 90U; and many users in the community who have been paying attention to Zora and participating in ecological activities since its launch reported that they only received 30U airdrops, or even single-digit tokens.

Screenshot of the airdrop income posted by Zora ecosystem users in the community; Source: @zkgoudan

This situation of bypassing the original community and directly serving Alpha users is not uncommon in projects where Alpha has already been launched.

Take PRAI as an example. According to feedback from users who participated in its KOL round, "VC and KOL rounds are losses." On the one hand, the project adopts a lock-up policy for community users to restrict the circulation of tokens; on the other hand, Alpha users do not need to bear the cost of early participation or fund lock-up, and can get nearly $100 worth of token airdrops just by wallet points and interaction records. This obvious incentive contrast breaks the original "ecosystem internal fairness" of the project.

Depositors who have participated in Sui's ecological lending protocol Haedal told BlockBeats that Haedal's airdrop quota spans a wide range, almost ignoring the participation costs of early depositors, leaving significant returns only for Alpha users.

Before the launch of MilkyWay, the Celestia liquidity staking derivatives protocol on Osmosis, on Alpha, community users not only had to bear the decline of TIA, but also the project allocated very little shares to early users, who not only had to lock positions but also had to complete tasks to unlock. Those who only held NFTs but did not bind to the points system did not receive airdrops, and the window period was also very short, and their income was far lower than that of Alpha users.

Although this practice of deviating from the project's original support group and redirecting resources to Alpha users has sparked widespread discussion, it is a realistic choice for most project owners: given limited resources, prioritizing resources to paths that can bring secondary liquidity and platform exposure is a strategy that maximizes efficiency.

After Alpha launch

The core indicator of Binance Alpha's listing is how many chips it can provide, which is consistent with the concept of "embracing the Binance ecosystem and BNB chain."

According to crypto KOL AB Kuai.Dong, Puffer launched Alpha seven months after the token was issued. According to on-chain data, the project mapped about 3.16% of the tokens to the BNB chain, of which 1.24% was directly allocated to the Alpha user airdrop pool, and nearly 500,000 USDC liquidity was injected into PancakeSwap. According to comprehensive estimates, the total cost paid by Puffer for this Alpha airdrop is close to 3 million US dollars.

As AB said, "the cost is not small, but the benefits are also obvious." Through the Alpha function entrance, the Binance CEX trading channel was directly obtained. Before the futures or main site listing, the liquidity preheating and market awareness preparation were completed in advance.

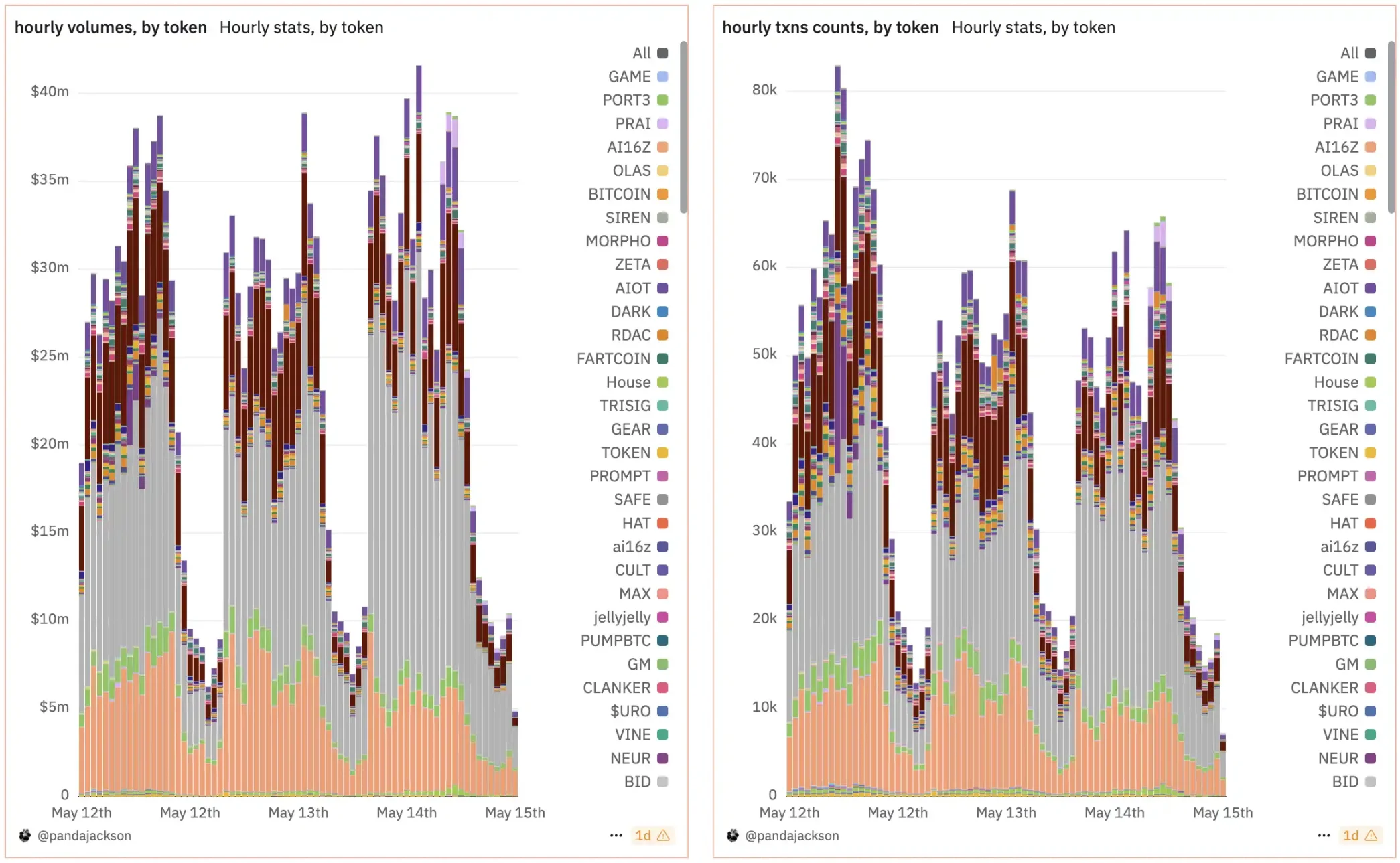

A similar path can also be seen in the star project Polyhedra in the ZK track. Its token ZKJ entered Alpha without being listed on the Binance main site, becoming the first top 100 market value token to be included in this mechanism. In order to support the price of the currency, the project party has successively launched a staking income of up to 150% and a points competition to attract users to brush transactions and accumulate wallet activity. Strategically speaking, perhaps the project party wants to use Alpha's internal indicators to accumulate influence and ultimately promote the realization of Binance's listing decision.

ZKJ has been at the top of the Alpha trading volume list recently; Source: Panda Jackson (@pandajackson42)

This closed loop of on-chain behavior - point rewards - platform inclusion has reconstructed the game structure between Binance and the project parties: in the past, "market value + community" determined whether a project could be listed, but now "on-chain data + Alpha performance" dominates the pace of listing.

The strategy of new projects is more radical. Since Stakestone was launched on Binance Alpha in mid-April, it has adopted an extremely proactive market strategy, first distributing 5% of tokens through wallet IDO, then airdropping 1.5% to Alpha users, and releasing nearly 4% incentives to old community users, with a cumulative distribution of more than 10% of the total.

At the same time, the project team invested part of the funds raised directly into the secondary market, guiding the price of the coin to remain stable in the early stage of public circulation. This series of operations eventually resulted in the launch channel of Binance’s main website. As an industry insider familiar with the process said: “After the change in Binance’s listing standards, projects no longer need to tell stories, but need to show data and control.”

Retail Investor Psychology

Compared with the project party's well-calculated and carefully laid out strategies, the role of retail investors appears complex and ambiguous.

In the traditional logic of new listings, retail investors can obtain primary arbitrage opportunities by relying on their information acumen and capital agility. However, under the points system built by Alpha, the profit path of retail investors has been institutionalized and transparent, and has also become highly involuted. Alpha does not activate the imagination of coin price growth, but the on-chain conversion mechanism of "points-airdrop-listing springboard".

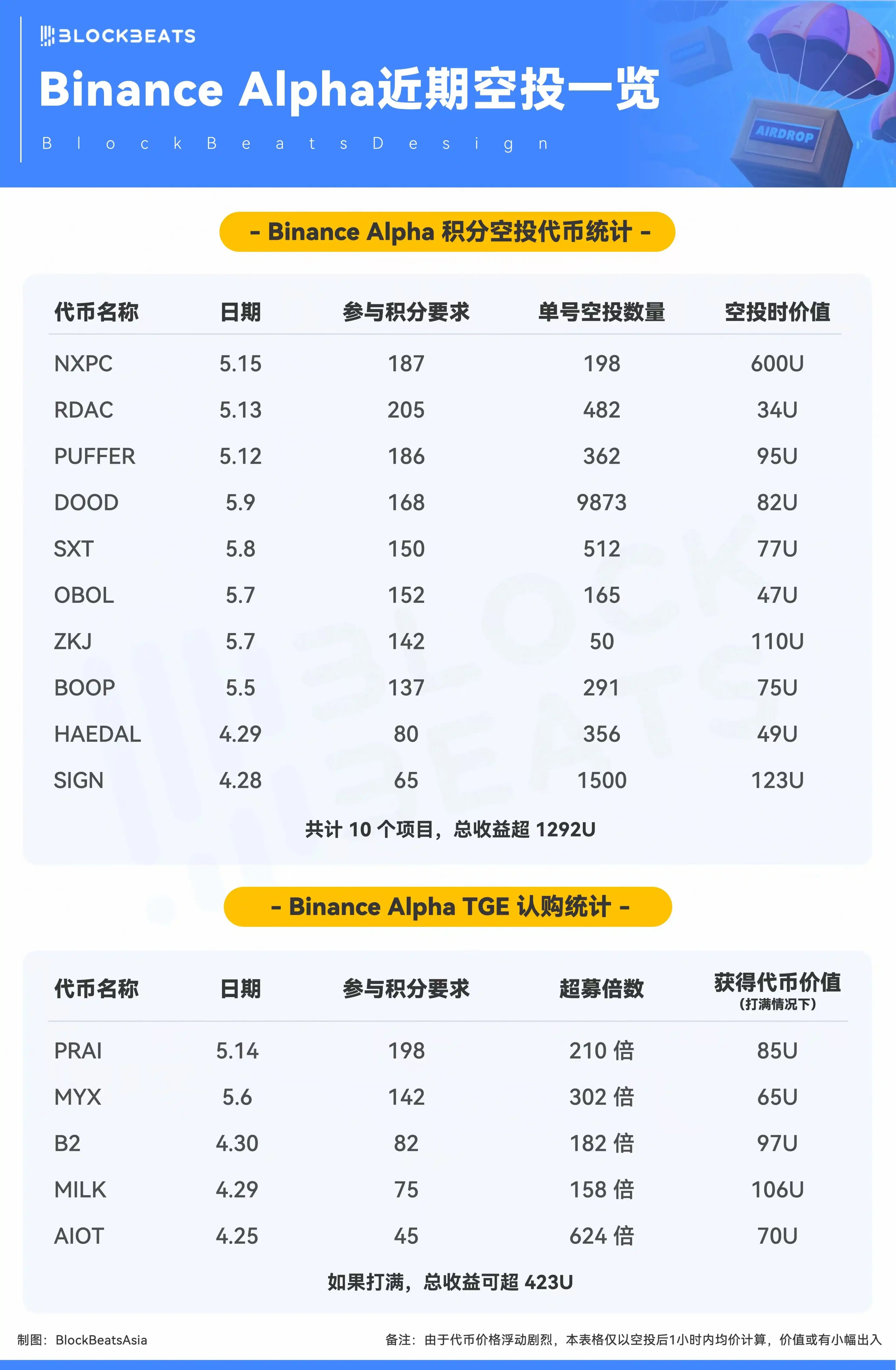

For some users, this mechanism does reconstruct the concept of fairness. Small and medium-sized users who stay in the wallet for a long time, if they can maintain their activity, still have the opportunity to get a return from Alpha that far exceeds the cost, even if the amount of funds is not large. Since Alpha started the points system, according to BlockBeats statistics, if ordinary users participate in every Alpha airdrop and wallet new activities, they will get nearly 1,700U of income.

However, the other side of high returns is a highly structured screening system. This points game, which appears to be open to everyone, actually sets hidden thresholds and places considerable demands on users' behavioral paths, transaction frequencies, and even the sustainability of their participation.

Binance itself does not directly issue airdrops, but provides infrastructure such as points distribution, data screening, and user classification. The airdrops are borne by the project party, but who they are issued to and based on what criteria are determined by the mechanism of Binance Alpha. The core of this system design is not "rewards" but "screening". Whoever can be identified as a "high-value user" can continue to receive airdrops.

Doubts also followed. Some users pointed out that there was a deviation between the transaction volume on Alpha and the actual user demand. "There would be no transactions without points and airdrops", which led to inflated data of the project party and superficial user retention. "What is the difference between this incentive method and the ghost links and pseudo-game airdrops that no one uses after TGE?"

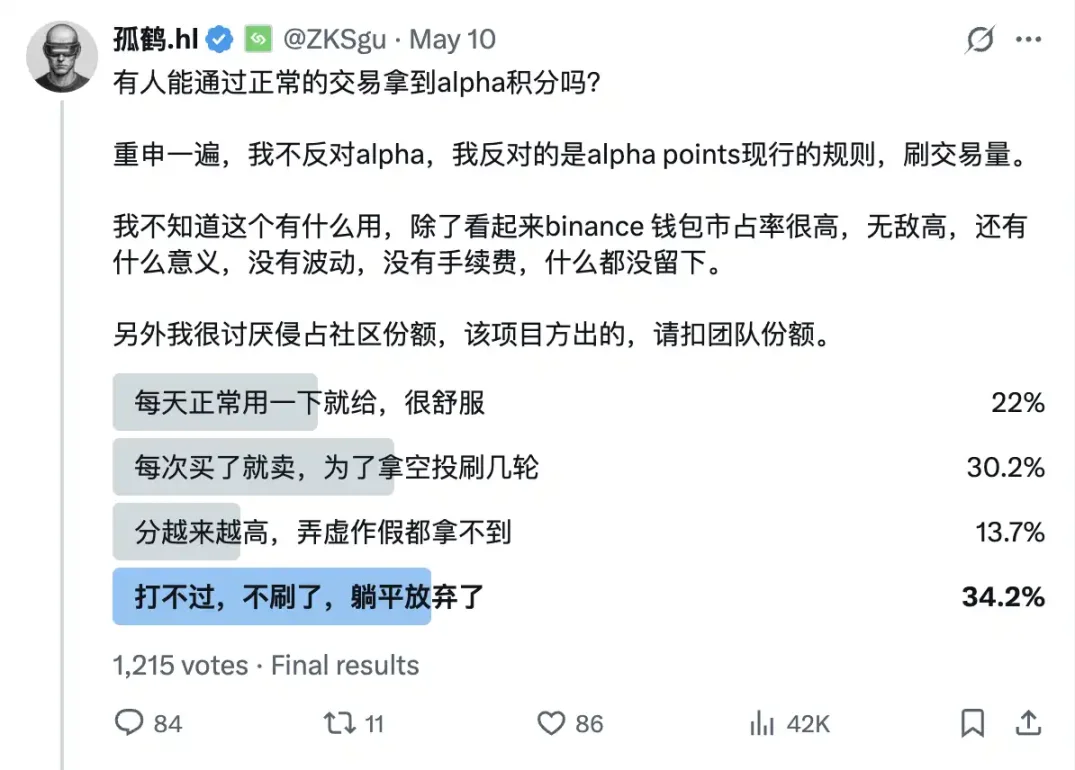

According to statistics from crypto KOL Guhe, in the statistical sample, only 22% of users can obtain enough points to get airdrops through normal daily transactions, while the rest need to repeat transactions continuously or give up participating because they cannot keep up with the points accumulation rhythm.

However, it is undeniable that in the current context of scarce overall market liquidity and lack of continuous attention mechanisms for projects, Alpha is still one of the few channels that can earn returns by doing something. Under the premise of both returns and certainty, this mechanism is still very attractive. Under this system, the logic of retail investors' participation has shifted from value judgment to mechanism game, and their returns no longer depend on their judgment of the future of the project, but on their understanding of the Alpha mechanism and their ability to execute it.

Who are the real beneficiaries of Alpha?

Although retail investors and project parties have their own games in the Alpha mechanism, returning to the overall framework, what Alpha truly reshapes is actually the underlying relationship between the trading platform and assets.

In terms of product experience and tool ecology, Binance does not have a significant advantage over platforms such as OKX, but the liquidity entry mechanism built through Alpha still allows it to maintain a strong voice in the asset startup phase.

Even if the project is not first launched on Binance, the traffic screening and points path provided by Alpha are enough to allow a large number of new coins to complete a round of market preheating and pricing anchoring before they are connected to the main site trading pairs. It changes the starting point of coin issuance and extends the influence of Binance on the asset side.

The blockchain game NXPC, which launched Alpha yesterday, is a good example. After the on-chain liquidity pool was opened, Alpha airdrops were distributed to users with points soon after the interval, while Binance contracts and spot were delayed by nearly half an hour and several hours respectively, and there was also a certain price difference on other trading platforms such as Bybit and Upbit. Trading windows at different rhythms determine the profit of funds at each stage, and also strengthen Alpha's leading role in the start of liquidity.

In the past, listing a project on Binance meant that the first-level pricing had been completed and the project had reached the final destination. Now, Alpha is the starting point for project listing and the source of pricing. It has moved the cold start field that originally belonged to other trading platforms such as OKX and Bybit back to the Binance system. Once Alpha's project rises, there will be a reason to access Binance contracts and spot. Naturally, the project is willing to "supply" shares according to the rules, take out token shares and capital injections in exchange for platform exposure and liquidity. This is the closed loop of traffic feeding back to the platform.

This also means that Binance no longer has to bear the public opinion burden of "listing a coin means the peak" in the past. CZ once expressed his hope to eliminate the premium effect brought by Binance listing a coin and let the market return to fundamentals. Alpha is actually his way to fulfill this statement. Instead of directly taking "Binance listing" as the authority, Alpha will establish a new liquidity screening mechanism to level the starting line between projects, and then decide who can continue to move forward based on the on-chain data.

At present, this path seems to be successful. Alpha is no longer just a function in the Binance wallet. Behind this mechanism is Binance's new understanding of its own role. Its success does not lie in whether the product experience is extreme, but in the fact that it has brought Binance's primary asset organization capabilities from behind the scenes to the chain, making it public and quantifiable.

Compared with OKX's product polishing route in the wallet field, Binance chose to exchange points for traffic and airdrops for attention. Winson, head of Binance's wallet business, publicly stated that Binance Wallet will not copy any competing product model, but chooses differentiated development, "The market does not need two identical wallets." He believes that it is better to reconstruct the scene than to redo the product.

Faced with industry problems such as airdrops and distorted trading data, Binance did not try to eliminate these behaviors, but instead built a mechanism to allow projects to prove their attractiveness first, and then observe whether they can form a stable user base and real trading depth. The boundary between scalping and real behavior is deferred in Alpha's scoring system and is also digitized.

But from another perspective, many people still believe that Binance Alpha has only successfully attracted the freeloaders, but has not attracted real trading volume. Users will still not choose Binance wallet as their first choice when choosing on-chain behaviors.

In the past, the cycle was to some extent "to VC", relying on storytelling to raise money, but now it is "to liquidity", and Alpha is the anchor for Binance to regain control of liquidity. In an era where VC is no longer reliable, the community has been lost, and product competition has fallen into homogeneity, Binance Alpha may not be the optimal solution for innovation, but it is the most effective way to take on the bubble.