Written by: J1N, Techub News

Unexpectedly, by 2025, the problems with stablecoins are still continuing.

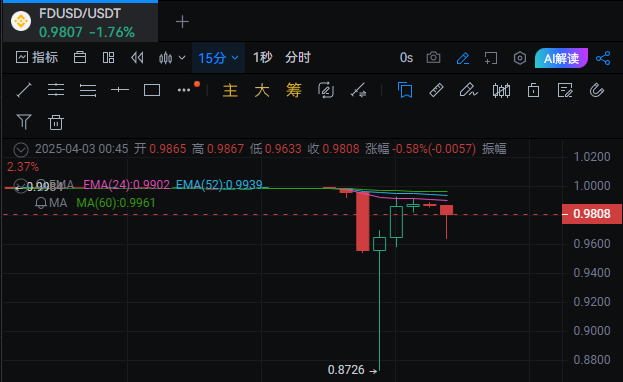

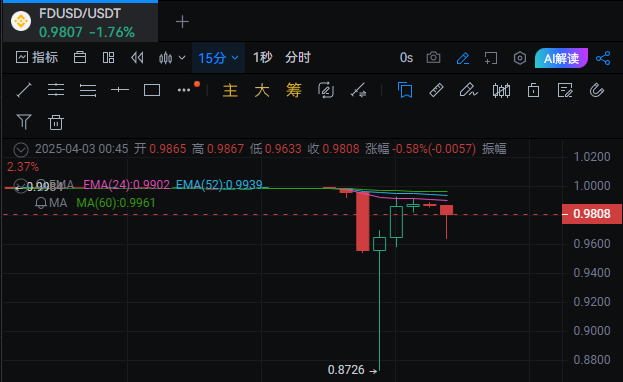

In the evening, CoinDesk published a report about TUSD's loss of nearly $500 million due to the misappropriation of its custodian assets by First Digital Trust, the issuer of FDUSD. After the report was issued, due to concerns that FDUSD's reserve assets were also misappropriated, FDUSD once decoupled to around 0.88 USDT. Later, after He Yi and First Digital Trust both refuted the rumor, FDUSD has gotten rid of the situation of a significant decoupling.

Cause of the incident: TUSD suffered a huge deficit, and Justin Sun paid out of his own pocket to make up for it

Techteryx filing in Hong Kong court

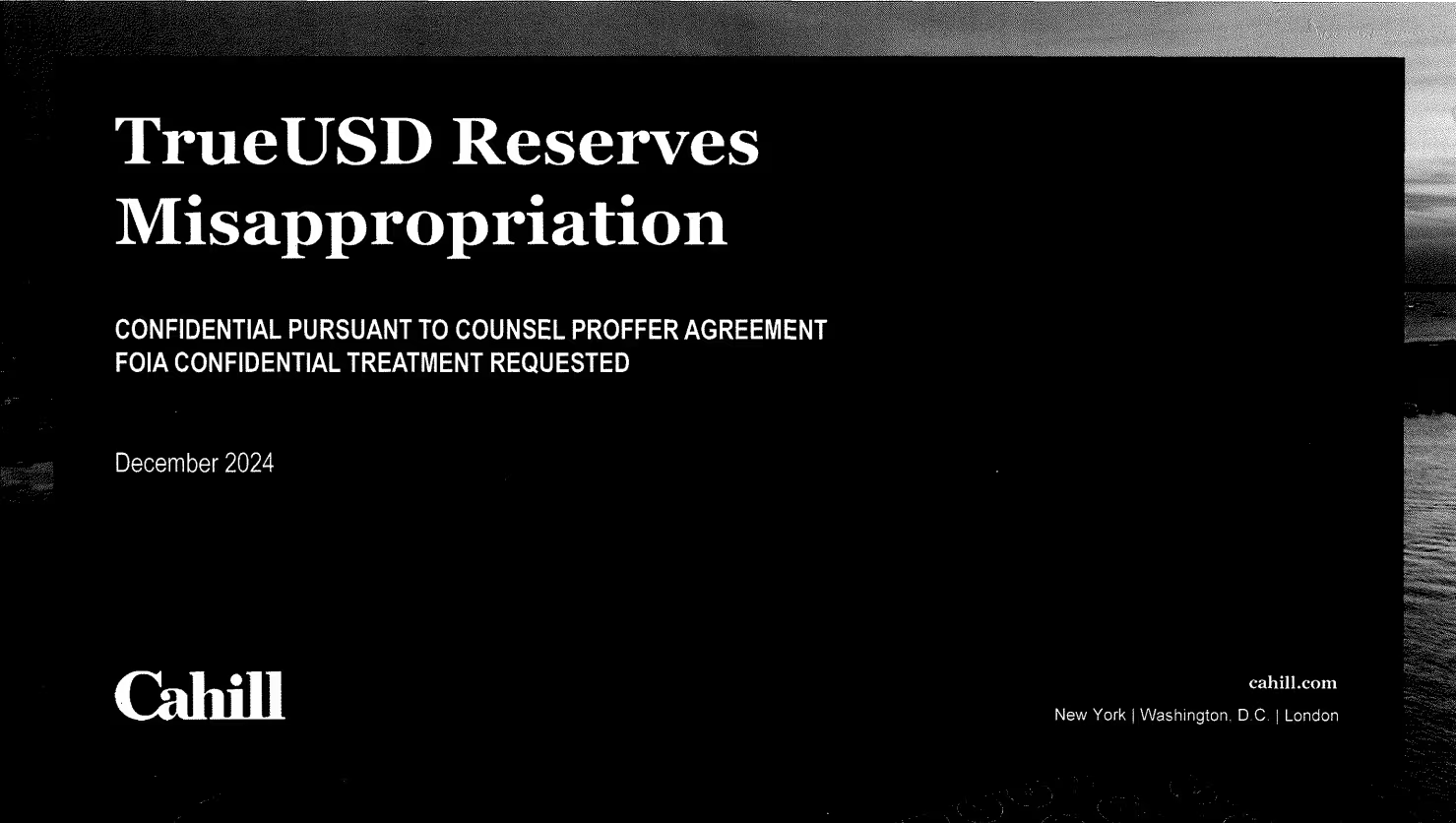

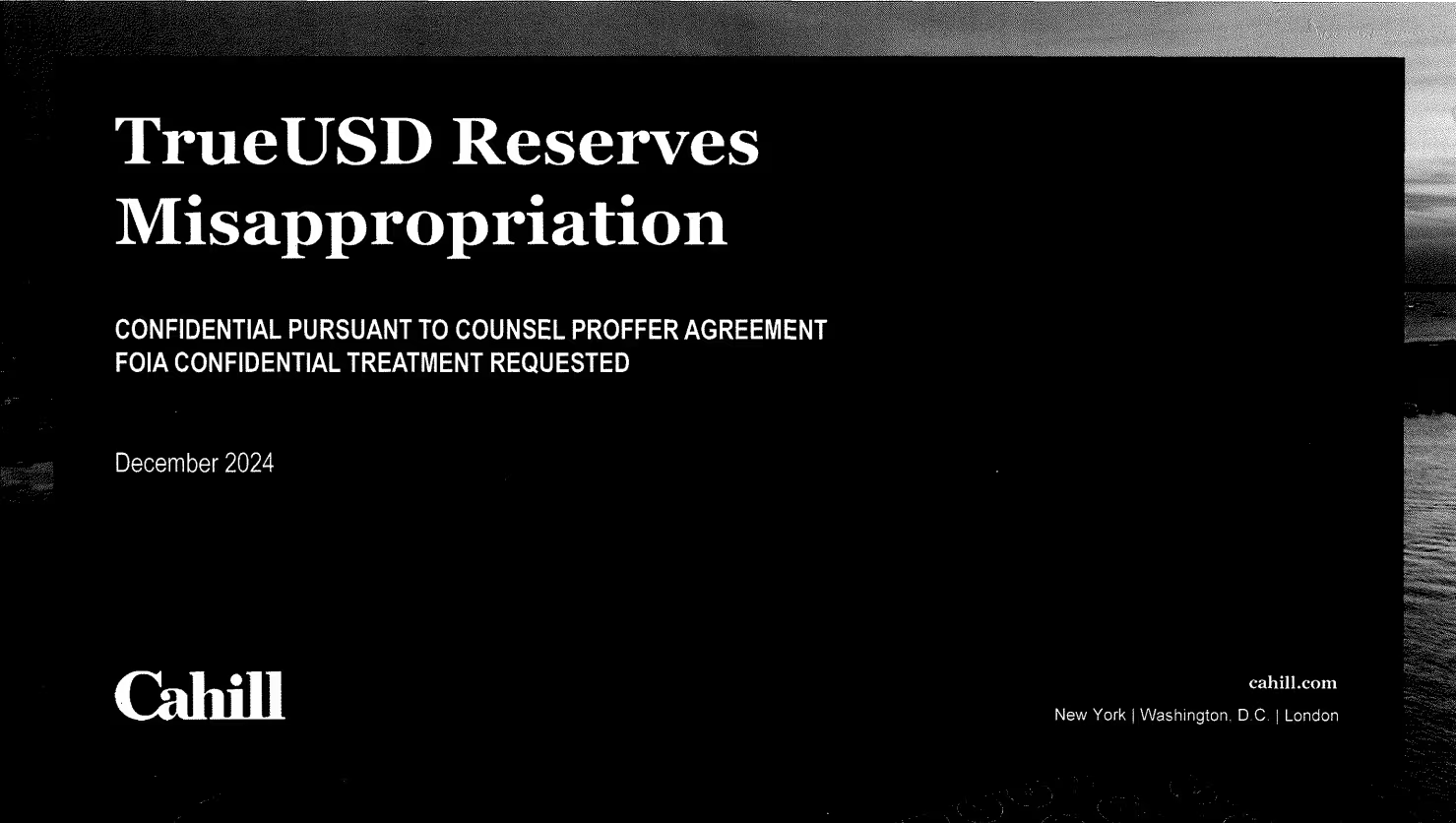

Documents from the U.S. law firm Cahill Gordon & Reindel show that FDT was instructed to invest TUSD's reserves in the Cayman Islands-registered Aria Commodity Finance Fund (Aria CFF). However, court documents allege that approximately $456 million was improperly transferred to Aria Commodities DMCC, an independent, unauthorized entity based in Dubai.

Cahill's filing with the Justice Department

Back to the point, CoinDesk also mentioned in the report that court documents show that Matthew Brittain, CEO of Aria Capital Management Ltd, controls Aria Commodity Finance Fund (Aria CFF), while Matthew Brittain's wife Cecilia Brittain is the sole shareholder of Aria Commodities DMCC, an independent holding entity headquartered in Dubai. Aria DMCC is engaged in trade financing, asset development and commodity trading, while CFF provides financing for commodity traders including DMCC and third parties.

Hong Kong court documents show that FDT CEO Vincent Chok allegedly paid an undisclosed commission of approximately $15.5 million to an entity called "Glass Door" and separately constructed an unauthorized trade finance loan of approximately $15 million from FDT to Aria DMCC, which was invested by Aria DMCC in global projects such as manufacturing plants, mining operations, shipping vessels, port infrastructure and renewable energy companies. FDT later defined the use of the funds as legitimate fund investments.

The plaintiffs allege that “FDT’s transfers of funds to Aria DMCC were blatant acts of embezzlement and money laundering. These transfers were made without the plaintiffs’ knowledge, authorization or approval.”

Techteryx unsuccessfully attempted to redeem its investment funds from Aria CFF in mid-2022 to early 2023, allegedly because the Aria entity defaulted on payments and failed to meet redemption requests. Although Techteryx lost $400 million in TUSD reserves at the time, its team isolated these assets to ensure that stablecoin redemption operations were normal and token holders would not be affected. Sun Yuchen stepped in at this time to provide emergency liquidity support for TUSD in the form of a loan.

Vincent Chok clarified that First Digital Trust acts as a custodian and executes transactions strictly in accordance with Techteryx's instructions. He claimed that FDT does not participate in the evaluation and investment decisions of the project. Vincent Chok said, "As far as we know, one of the main reasons why ARIA refused Techteryx to redeem the investment funds was their AML/KYC concerns about the transactions between TrueCoin and Techteryx, as well as concerns about the true identity of Techteryx's ultimate beneficial owner." At the same time, no one in the case would think that Aria lacks liquidity.

Aria Group CEO Matthew Brittain denied all "Techteryx's allegations against ARIA DMCC and any of its related entities," adding that "many false allegations have been made in the court proceedings." Techteryx was fully aware of the commitments for the investment period, which were outlined in the contract agreed to by subscribers when investing in ARIA CFF and clearly listed in the offering memorandum. Matthew Brittain also echoed Vincent Chok's concerns about Techteryx's actual ownership, pointing to

the Wall Street Journal's previous reporting on the alleged embezzlement of TrueCoin and TrustToken:

“In September 2024, TrueCoin and TrustToken (the former operator of TUSD) settled with the U.S. Securities and Exchange Commission (SEC) over allegations that they falsely advertised that TrueUSD was fully backed by U.S. dollars while misappropriating reserves to invest in high-risk offshore funds. Without admitting wrongdoing or detailing the nature of the offshore investments made with Aria, TrueCoin and TrustToken agreed to pay civil penalties and disgorge profits in excess of $500,000 to resolve charges of fraud and unregistered securities offerings.”

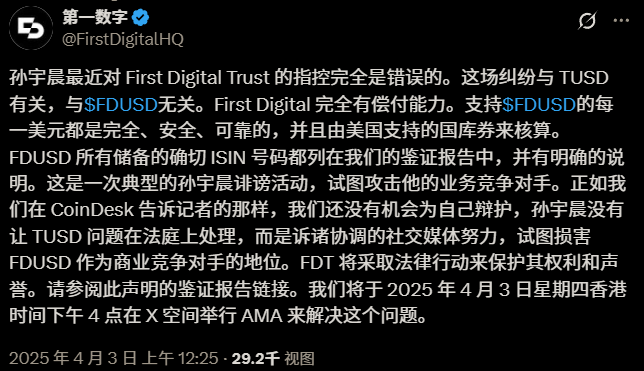

First Digital Trust has gone bankrupt? Both the official and Binance deny it

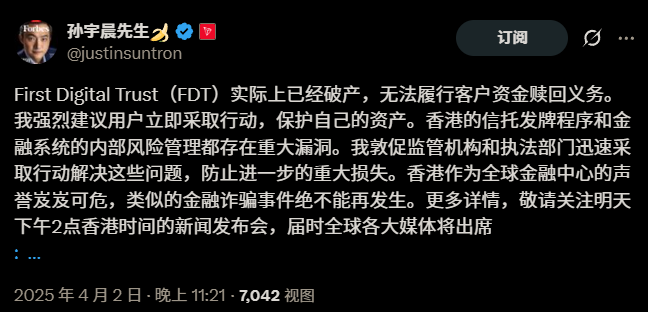

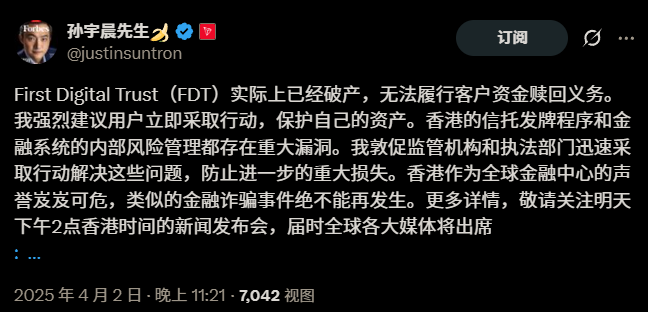

Shortly after the report was issued, Justin Sun tweeted that First Digital Trust (FDT) was actually bankrupt and unable to fulfill its obligations to redeem customer funds. It strongly recommended that users take immediate action to protect their assets and urged regulators and law enforcement agencies to take prompt action to resolve these issues and prevent further significant losses. A press conference will be held in Hong Kong at 14:00 on April 3.

This statement also caused FDUSD to temporarily de-anchor to around 0.88 USDT, and the price of the BTC/FDUSD trading pair once soared to nearly 100,000. FDUSD holders fled frantically, which was exactly the same as the situation when USDC was de-anchored due to the collapse of Silicon Valley Bank in 2022. After

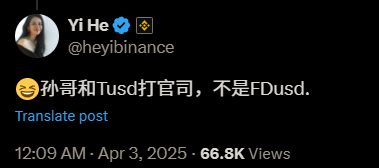

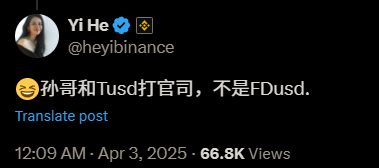

He Yi tweeted to clarify that Sun Yuchen initiated the lawsuit around TUSD rather than FDUSD, the price of FDUSD quickly returned to around 0.99 USDT.

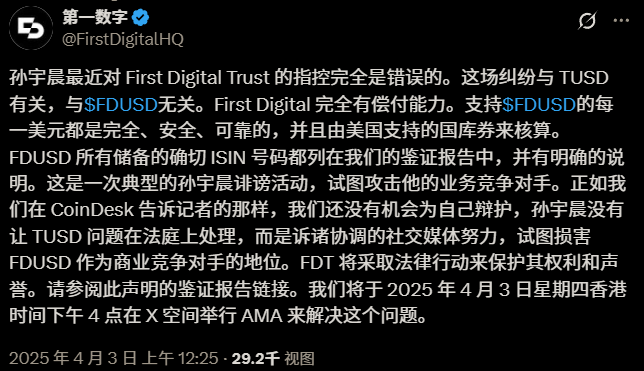

At the same time, First Digital Trust tweeted to deny Sun Yuchen's false accusations, saying that he was trying to damage FDUSD's position as a business competitor and would take legal action to protect its power and reputation. At the same time, a live AMA will be held on X at 16:00 Hong Kong time on April 3 to respond to this matter.

In addition,

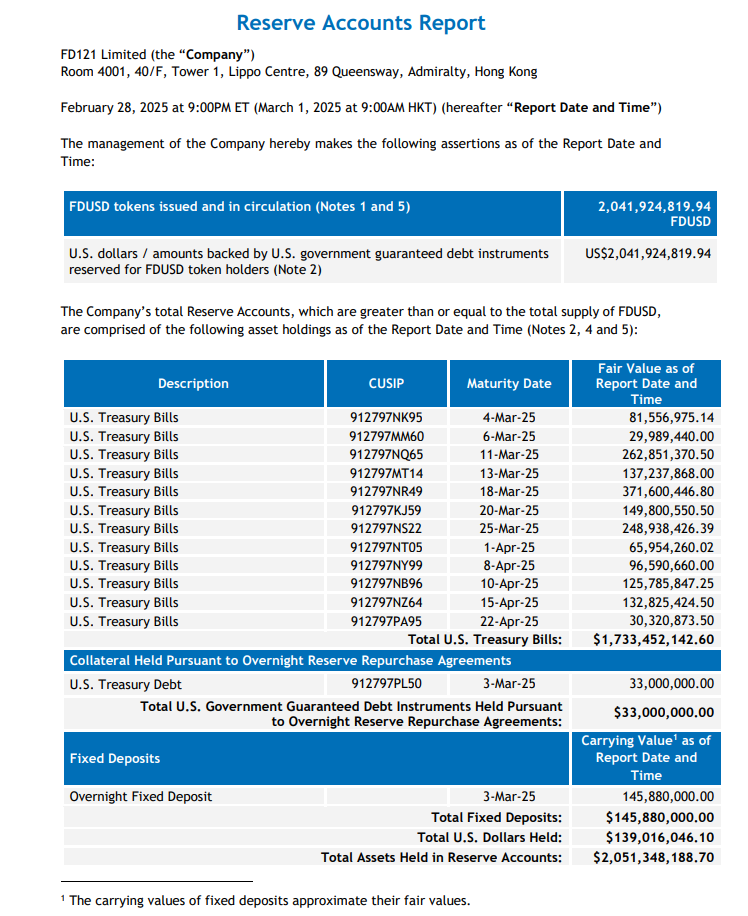

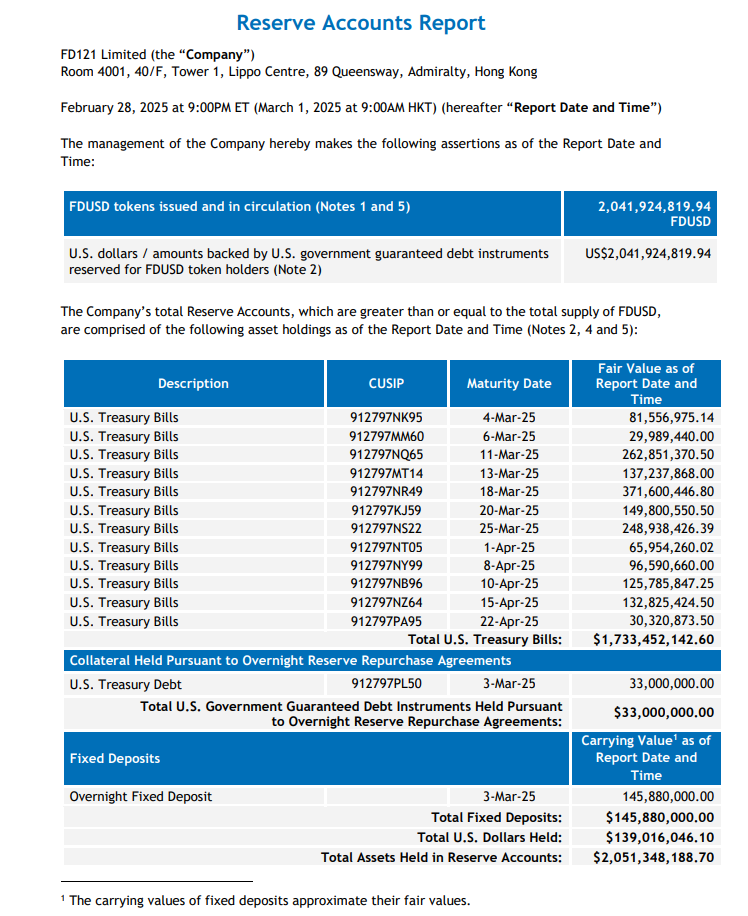

the certificate provided by Hong Kong accounting firm Moore CPA Limited shows that as of November 2024, FDT manages $501 million in TrueUSD reserves. At the same time, First Digital released

a February reserve report showing that First Digital's total reserve assets are $2,051,348,188.70, the FDUSD issuance is 2,041,924,819.94 pieces, and the reserve assets cover more than 100% of the issued FDUSD, meeting the 1:1 reserve requirement.