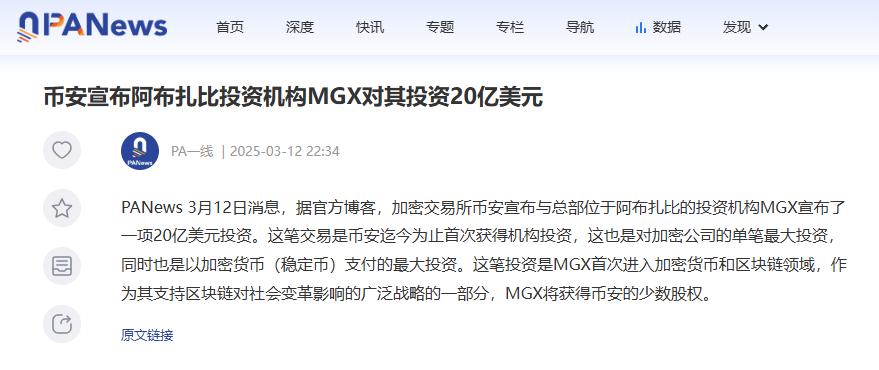

The biggest news this week is that Abu Dhabi investment company MGX invested $2 billion in Binance, setting a record for the largest single investment in the crypto industry, which is a milestone event.

There are already a lot of interpretations on Twitter, so we will not repeat them and just get to the point: MGX represents a sovereign fund. Binance, which is not short of money, accepted the investment from MGX because it values the strategic significance behind it.

For Binance, the process of globalization and compliance has made important breakthroughs; for the industry, mainstream funds have accelerated their entry and market confidence has been boosted.

So the question is: Does this have anything to do with us?

The answer is yes. I personally think there are two most direct benefits:

①Good for BNB

Thanks to the funds and resources provided by MGX, Binance will accelerate its global expansion and ecosystem construction, which will not only effectively boost the confidence of BNB holders, but also provide actual support for the value of BNB, forming a positive cycle.

It is no exaggeration to say that after the trials and tribulations of the past year, Binance is now safer than ever, and $BNB is now more valuable than ever.

If you are a big ETH user, I sincerely recommend switching to BNB. ETH was once regarded as the source of innovation and had the most awesome developer community, but how many years have you not seen a new narrative? BNB can provide everything that ETH can provide you, but ETH may not be able to provide what BNB can provide you.

From the perspective of the exchange, BNB's golden shovel attributes will only become stronger and stronger; from the perspective of the public chain, reviving BSC is Binance's strategic focus, and we look forward to further empowering BNB in the future.

②Good for RWA

MGX represents sovereign funds and traditional finance, while Binance represents the king of encryption and core infrastructure. The combination of the two opens up exposure for mainstream funds to enter Web3, which has huge room for imagination and is a huge positive for the RWA track.

First of all, capital investment is only the first step. In the future, the two parties will take a series of actions around the integration of the crypto market and traditional finance. MGX emphasizes "the intersection of AI, blockchain and finance" and does not rule out the possibility of launching a more efficient RWA tokenization platform or zone in conjunction with Binance in the future.

Secondly, the $2 billion investment was paid in stablecoins, setting a record in the crypto industry. Stablecoins are an important medium for RWA tokenization, and their large-scale application is expected to encourage more RWA projects to adopt stablecoin mechanisms and enhance asset liquidity.

For us, what we can consider now is to ambush RWA concept coins. At present, Binance has launched several head tokens, but FDV is not cost-effective. We can pay more attention to those assets with potential but not listed on Binance.

My main ambush is $PLUME. It has been fluctuating in a narrow range since TGE and is not affected by the broader market at all. There will be many positive factors to be realized in the future, and I look forward to it taking off soon.