In the early morning of May 7, India launched a military strike against Pakistan, and a full-scale war broke out in the heart of Asia.

This is not friction, it is a full-scale war with fighter jets, ground troops, and strategic mobilization.

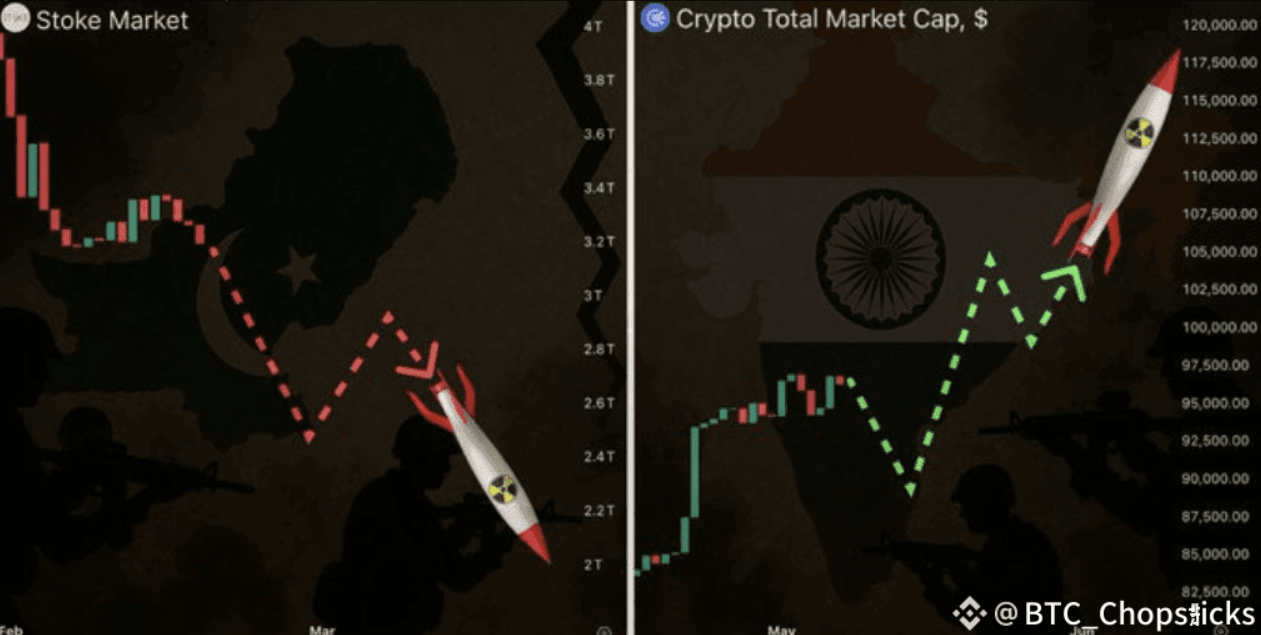

The market has reacted violently at the first opportunity, with crypto assets being the first to be hit.

📊 Five core signals behind the war

1️⃣ Why is this war unusual?

India and Pakistan are both nuclear weapons states with a total population of 2 billion.

Highly integrated into the global supply chain, conflicts will reshape Asia's logistics + capital structure

Geopolitical risk index soars, and global capital is re-pricing risk exposure

2️⃣ The market’s immediate and violent reaction:

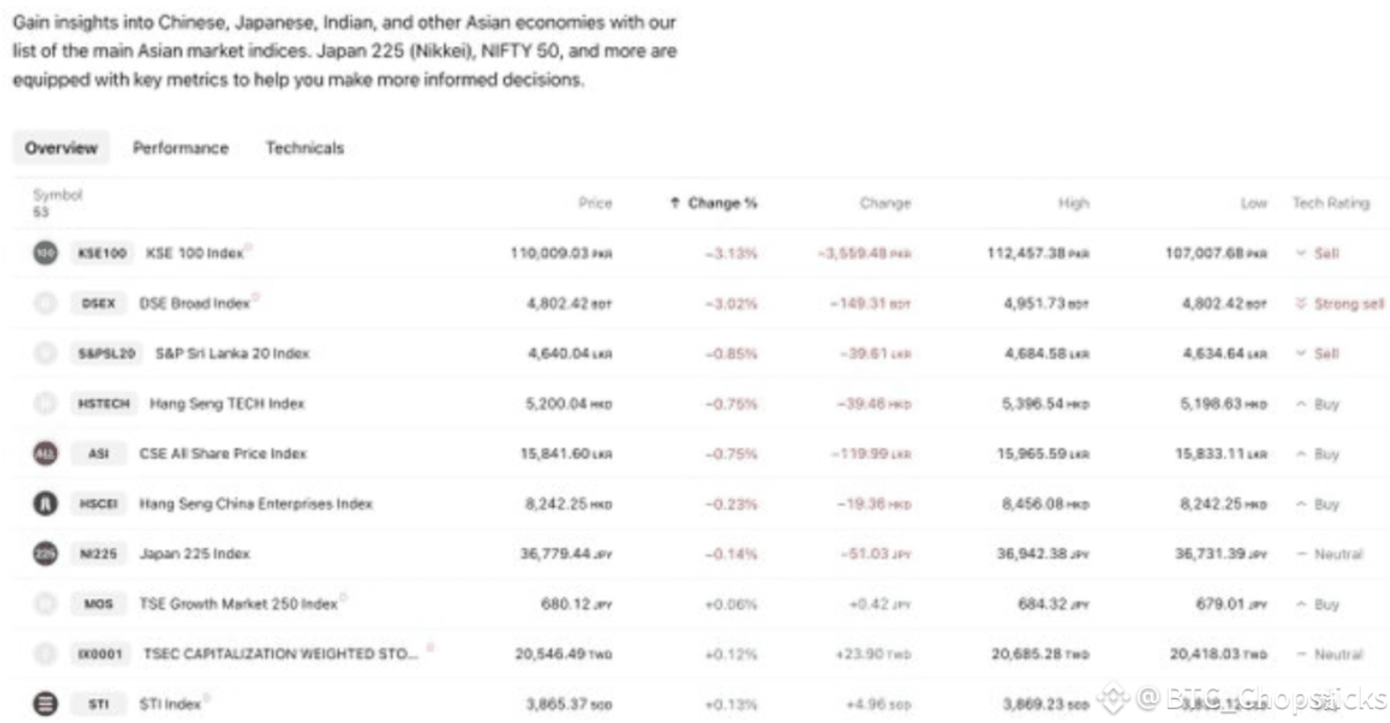

Asian stocks fell 3-6%

Gold and crude oil surged, with Brent crude breaking through $90

Demand for the US dollar surges as risk aversion dominates the world

The crypto market is also not immune:

BTC and ETH took the lead in diving

SOL, AVAX, MATIC and others fell more than 5%

Liquidity dries up on local exchanges in South Asia, causing panic selling by users

3️⃣ Why is even Bitcoin plummeting?

Many people think that BTC is a safe-haven asset, but in fact:

In the first phase of panic, institutions will liquidate all assets and cash is king

The safe-haven effect of $BTC often begins to emerge in the second stage

Therefore, short-term decline may lead to long-term rise

4️⃣ Short-term strategic opportunities during war?

If you are comfortable with high volatility trading, you may consider:

News-level reaction: The most intense reaction within 1 hour after the upgrade news is released

The first choice for shorting is BTC, $ETH ETH (high liquidity, strong directionality)

It is recommended to control the leverage between 1x and 3x to avoid the risk of rebound liquidation

Profit-taking signal: The peak of on-chain activity + social public opinion is the best exit point

5️⃣ Medium- and long-term trends: Will Bitcoin regain its “safe-haven asset” attributes?

If the war continues to escalate:

Trust in local fiat currency decreases

Demand for cold wallet P2P transactions surges

Stablecoin + BTC = asset safe-haven combination

This has been repeatedly verified in the Russia-Ukraine conflict in 2022 and the Israel-Kazakhstan conflict in 2023.

✅ Summary:

War = volatility, volatility = opportunity.

Don't use emotions to predict peace, and don't use positions to trade the market.

Those who really make money are calm, decisive and disciplined responders.

War changes not only borders, but also capital flows, financial logic and market rhythm.

This is not only a war between India and Pakistan, but also the starting point of a new round of global risk pricing.

📌 Collection + Share, the next round of volatility window may be approaching.