The Genesis Story: How Crypto Found Me

Original author: @hmalviya9

Original translation: zhouzhou, BlockBeats

Editor's note: Although the usage of current RWA perpetual products (such as Ostium) has surged, the GLP-style liquidity model is unsustainable due to high funding rates, zero-sum games between traders and LPs, and lack of hedging mechanisms, which limit the expansion of the platform. In contrast, HyperLiquid uses a more flexible HLP model and performs better. In the future, if Ostium switches to an order book model, reduces fees and improves market efficiency, it will be possible to achieve long-term healthy development.

The following is the original content (for easier reading and understanding, the original content has been reorganized):

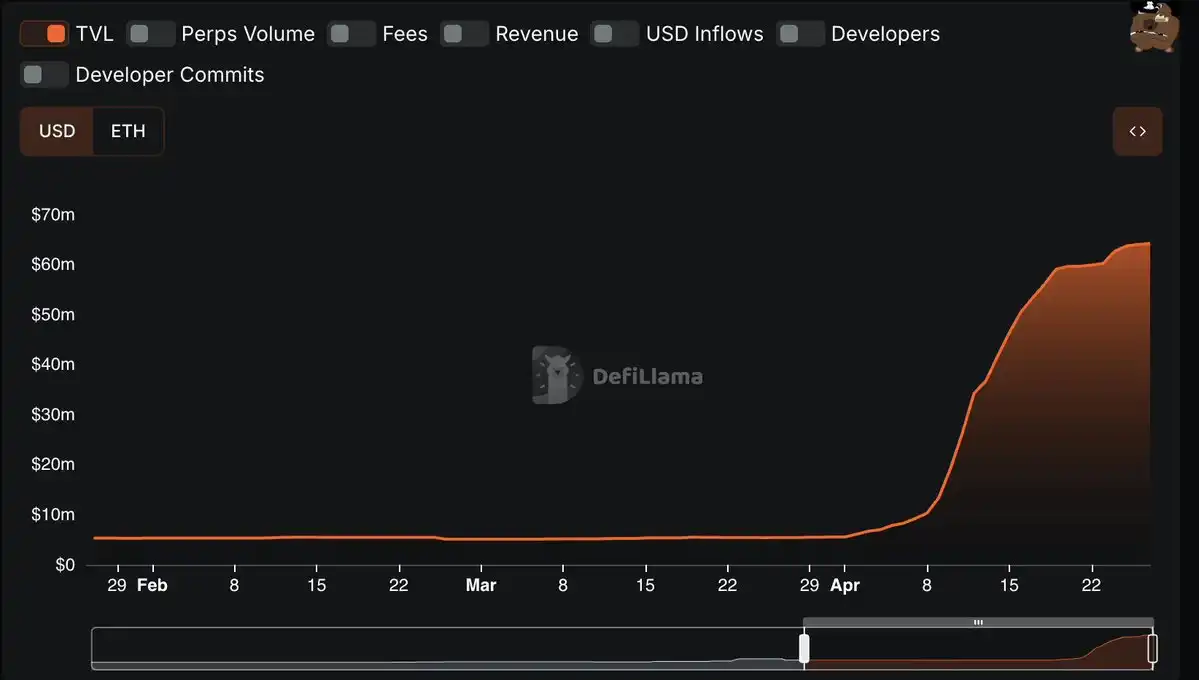

Over the past month, as tariffs loom, currency markets oscillate, and stocks fluctuate like an EKG, RWA perpetuals have seen incredible growth in usage. @OstiumLabs’ total deposits have soared from a steady less than $6 million to over $60 million in just one month. Trading volumes have also surged. HyperLiquid has also launched @Paxos’ PAXG perpetual market.

The need to go long or short RWA with crypto derivatives is already clear. The question is, are current solutions good enough? If not, how can they be improved?

Why might these solutions be bad?

At the beginning, I mentioned two seemingly contradictory points of view: on the one hand, traders are indeed using RWA products; on the other hand, I questioned whether the existing solutions are good enough.

Some people may think that since users are choosing these platforms, doesn’t it mean that the current RWA perpetual contract is good enough? But this is not the case. Let me explain it through some data.

If we look at the funding rates on Ostium, we can see that the funding rate for the gold trading pair (XAU/USD) was as high as 30% and is still 13% now.

In comparison, the current funding rate of BTC on Bybit is about half of that of Ostium, while the funding rate of BTC on Binance and OKX is only about a quarter of that of Ostium. Some people may think that this is because gold performs better, but it is not necessarily the case.

Gold is up about 50% so far this year, while Bitcoin is up a similar amount.

Moreover, when we compare the crypto market with traditional financial markets (such as CME), the gap is even more obvious. If you are long gold on CME and roll your position, the annualized cost is about 6%, which is only half of Ostium's minimum funding rate, a difference of 600 basis points.

Seeing such a large spread, readers who do delta neutral (no directional risk) trading may think there is a huge arbitrage space: for example, shorting Ostium and charging a 13% funding rate, while going long on CME and paying an annualized cost of 6%. But this is not actually the case.

Because Ostium adopts a model similar to GLP (GMX's liquidity pool), if you short Ostium, you currently have to pay a 13% funding rate.

This results in neither delta neutral traders nor market makers having an incentive to provide liquidity. This is not accidental, but a fundamental problem in Ostium’s design.

The GLP model is unsustainable

The GLP model used by Ostium and @GainsNetwork_io, in short, cannot be scaled.

The GLP model is essentially a bet between all traders and the protocol’s capital pool. It was first launched by GMX, and their capital pool was called GLP. In Ostium, it was called OLP; on Gains, it was various g (asset) vaults.

It is important to note that the GLP/OLP model is very different from @HyperliquidX's HLP model. The HLP pricing model is hidden and dynamically changing, while the GLP pricing is fixed and static.

This means that although HyperLiquid also has basic liquidity providers, basic LPs are not the only counterparties, and the funding rate mechanism can continue to motivate the market to be more efficient. In Ostium's OLP model, traders must lose money in order for OLP liquidity providers to make money. This is a zero-sum game from beginning to end.

Moreover, unlike the HLP model, which can partially hedge exposure on the chain, there is no stable mechanism to hedge the risk exposure of RWA under the OLP model.

Although the OLP model helped Ostium quickly increase liquidity in the early days, it has now become an obstacle to their continued growth. Just as HyperLiquid finally had to release HLP's absolute counterparty control over user transactions, Ostium will also need to loosen OLP's dominance over pricing in the future in order to achieve greater expansion.

A warning example has already emerged: in terms of relative share of the gold market, Ostium currently holds only $4 million in the gold market, while HyperLiquid's newly opened PAXG market has a holding of $15 million (and the funding rate and opening cost are also lower).

In addition, Ostium’s current total locked-in amount is $65 million, of which $57 million, or 86%, is concentrated in OLP. Although HyperLiquid’s is also high, it accounts for about 60%, which is healthier in comparison.

In short, this model is unsustainable.

Possible future directions

While the above problems can be serious if left unchecked, they can theoretically be solved by changing the paradigm.

If Ostium can switch to an order book model, it can reduce transaction fees, and the funding rate will also decrease due to improved market efficiency. At the same time, the platform can still make a profit by charging transaction fees.

OLP can also continue to exist, but should operate in a more dynamic and flexible form.

In my personal opinion, as someone who loves the concept of RWA sustainability, this is the only sustainable long-term model for RWA sustainability products, not only for Ostium, but also for Gains, and all related projects.

It has been proven many times that the GLP/"casino-style" model can only be used in the cold start phase and is unrealistic for long-term development.