Looking ahead to 2025, we believe there are seven key areas that will have a short-term or long-term impact on the market. Here, we analyze the development trends in these areas in detail and explore which sub-sectors and regions are likely to be affected and why.

1. Bitcoin enters mainstream finance

2024 is undoubtedly a key year in the development of Bitcoin. The official launch of the US Bitcoin spot ETF is an important milestone in the integration of Bitcoin and the traditional financial system since the birth of stablecoins ten years ago. This event not only marks the rise of Bitcoin as a mature asset, but also pushes the discussion of Bitcoin as a global reserve asset from a small number of geek groups to the mainstream vision, opening a new chapter in the financial field.

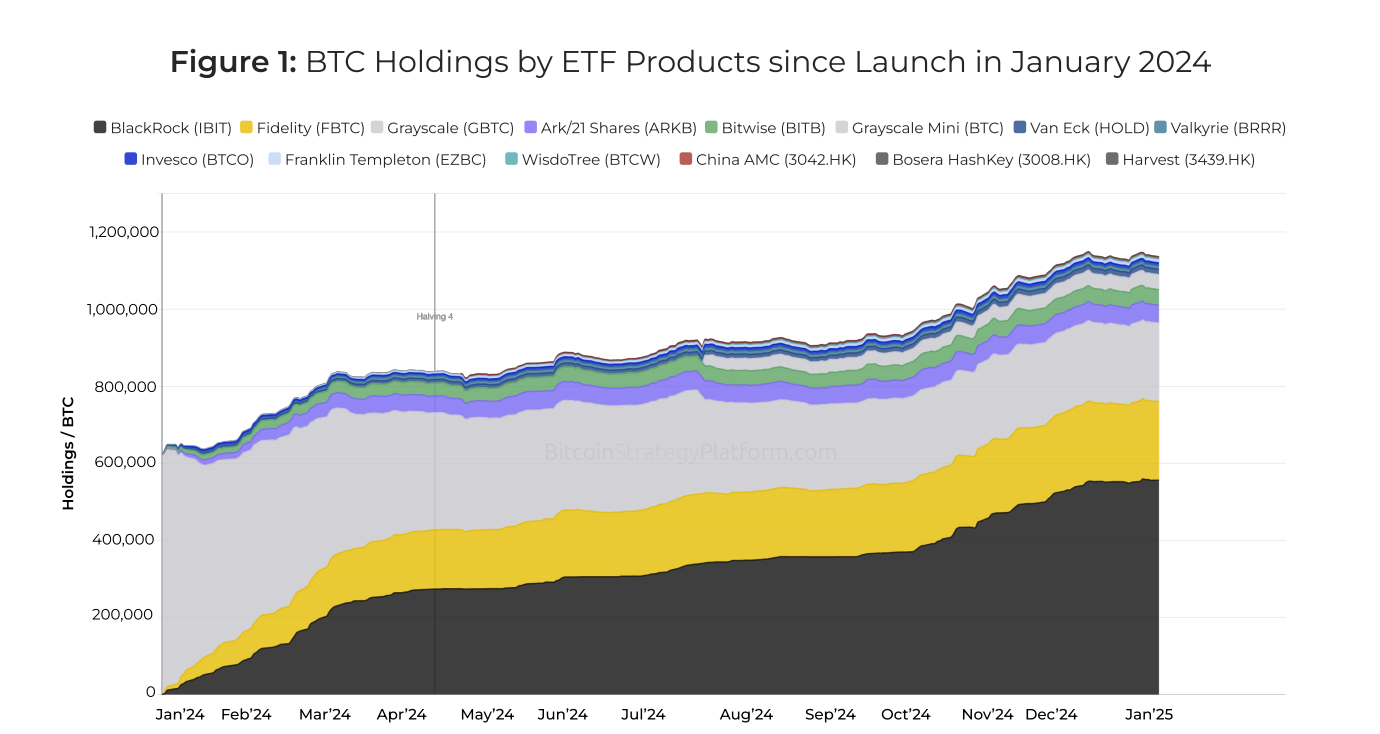

In 2024, Bitcoin broke through the $100,000 mark for the first time. This was thanks to a buying spree by listed companies such as Strategy, which reportedly accumulated 257,250 bitcoins in 2024. At the same time, the newly approved U.S. spot Bitcoin ETF accumulated more than 500,000 bitcoins in 2024. Together with the 619,000 bitcoins previously held by Grayscale Bitcoin Trust, the total amount of bitcoins currently held by ETF products has exceeded 1 million.

Additionally, discussions about national Bitcoin strategies have rapidly heated up around the world since Donald Trump’s speech at the Bitcoin Nashville Conference in July.

Bitcoin continues to strengthen amid policy stimulus. Most analysts expect the current bull run to continue until 2025 and peak in the third quarter. However, there is still uncertainty in the global economy, and if a global recession were to occur, Bitcoin may already be close to the top of its cycle. Early warning signs of such a recession could include a stronger dollar, falling bond yields, and deteriorating U.S. employment data.

analyze

For many years, Bitcoin was often seen as a relatively stagnant and unattractive asset, compared to the more dynamic altcoins that have emerged in recent years. However, in 2024, Bitcoin has returned to the spotlight, and this shift is mainly reflected in three trends that have attracted widespread attention. First, the development of the Bitcoin ecosystem has reached a new high. New sidechains have been launched and Bitcoin staking technology has been put into use. In addition, ZK-proof has been verified on the Bitcoin mainnet for the first time.

Secondly, with the launch and trading of the US Bitcoin spot ETF and its related options, Bitcoin has attracted the attention of the traditional capital market, and its asset management scale (AUM) has exceeded 1.1 million Bitcoins, equivalent to approximately US$100 billion. This fully integrates Bitcoin with the world's most liquid capital pool.

Finally, as discussions about the US strategic Bitcoin reserve heat up, the “Bitcoin First” narrative has entered the mainstream political sphere. Bitcoin is gradually being taken seriously as the base layer of a robust new monetary system.

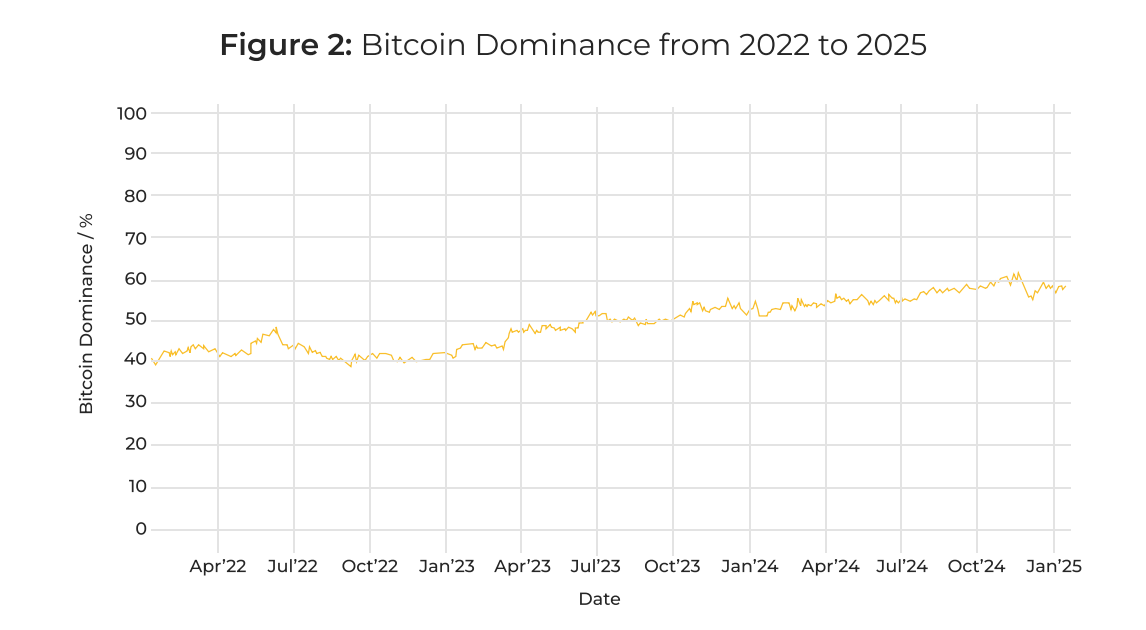

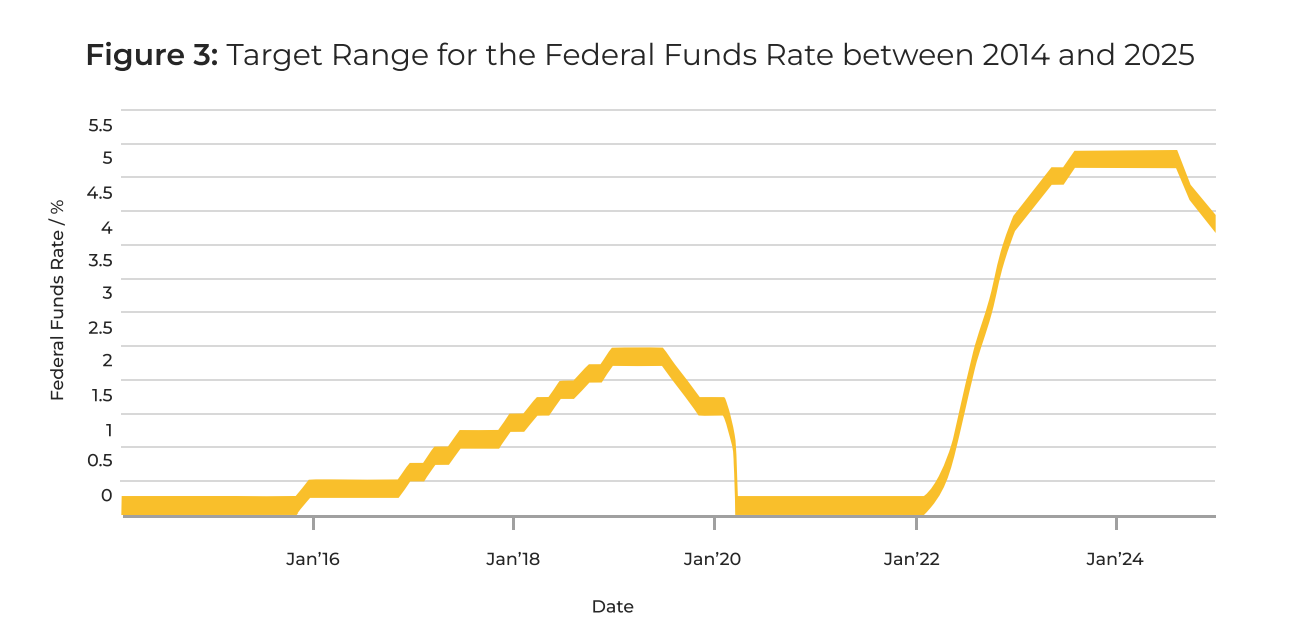

Throughout the cycle, Bitcoin’s dominance continued its long-term upward trend that began in late 2022. In addition to renewed investor interest in Bitcoin, the trend is widely attributed to the global tightening cycle that began in January 2022, which pushed the U.S. policy rate to 5.5%.

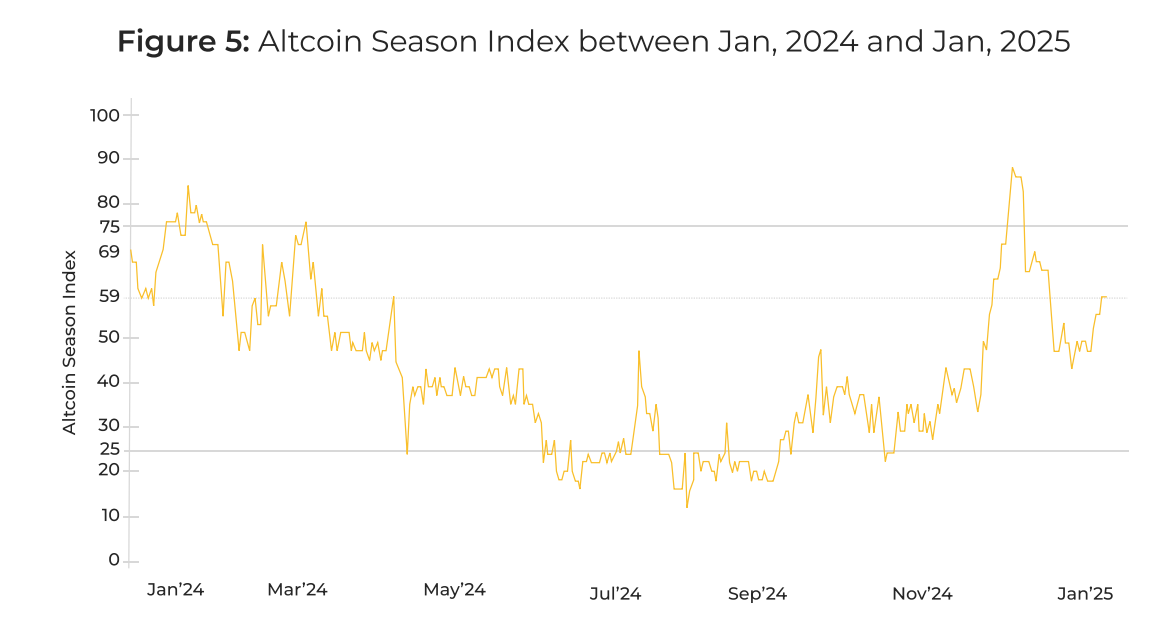

As of this writing, Bitcoin's upside appears to have reached a ceiling. Currently, stablecoins alone account for 17.5% of the total cryptocurrency market cap, while Bitcoin's market share is close to 60%. However, if interest rates remain high due to persistently high inflation, or the global economy experiences a hard landing, Bitcoin's dominance will remain high, and the long-awaited rotation into altcoins is unlikely to occur. Previously, the market had strongly expected a full-blown alt season in the first half of December, but this expectation has gradually faded as Bitcoin's market share rebounded from 55% to 58%.

2. Altcoins: It will take some time for a full-scale outbreak

The altcoin market experienced many challenges in 2024. Bitcoin absorbed most of the institutional funds during the year, while memecoins attracted the attention of retail investors. Nevertheless, after a seven-month period of Bitcoin dominance, the market briefly entered the altcoin season in early December. However, Bitcoin's market dominance rate has only slightly declined after reaching a high of 61% in mid-November. This shows that the market has not yet fully shifted to altcoin dominance.

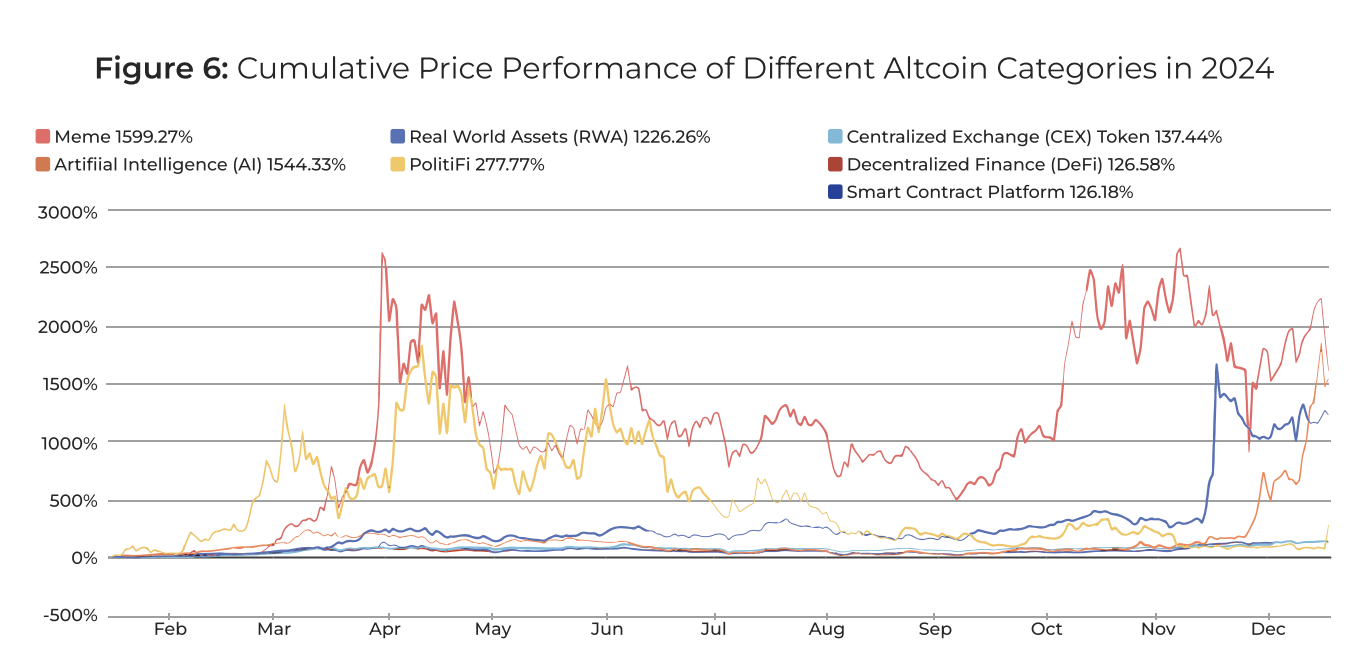

According to the data, the total market value of altcoins (excluding stablecoins) increased by 76% in 2024 and broke the all-time high in 2021. This growth was mainly driven by the strong performance of large-cap coins, and memecoins had the highest increase among all altcoin categories. According to the 900 memecoins tracked by DeFiLlama, their weighted average return rate exceeded 1,600%, showing the outstanding performance of memecoins in 2024. Although Bitcoin's dominance in the market has loosened, the overall market structure has not changed fundamentally, and it will take some time for altcoins to fully explode.

analyze

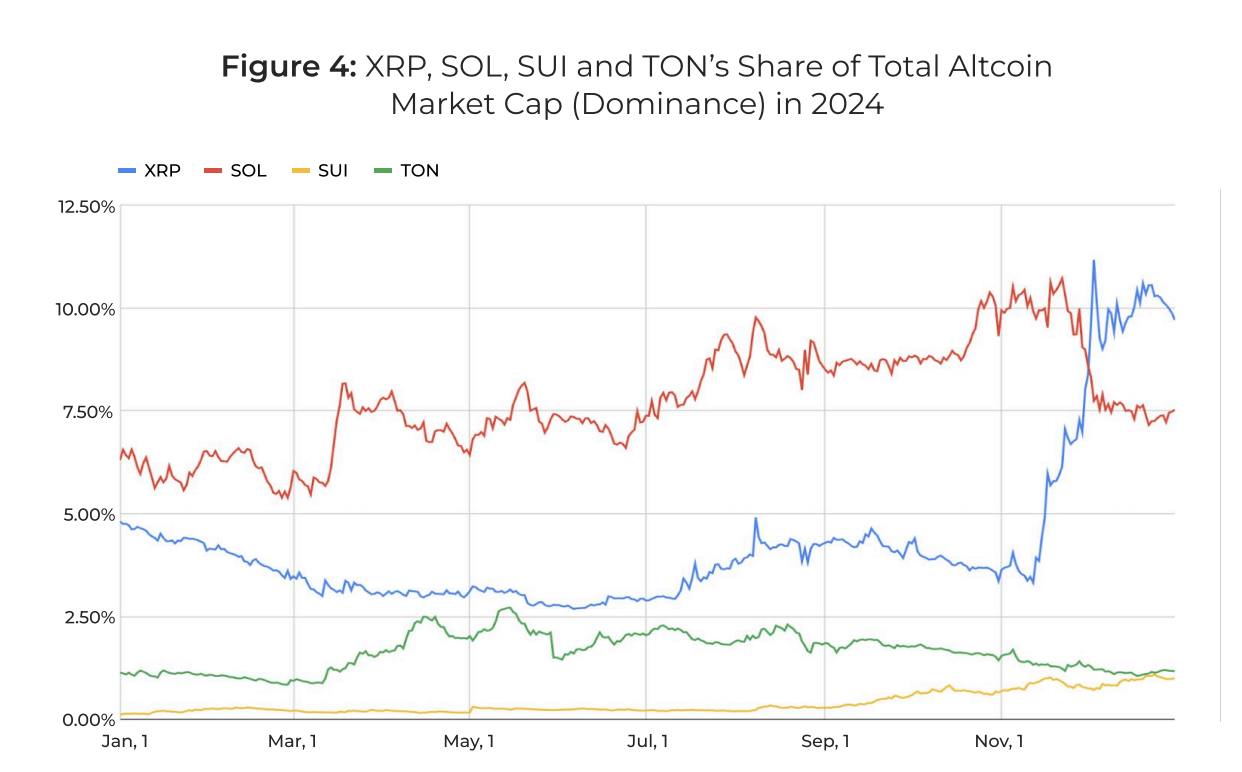

The arrival of this small-cap alt season is mainly due to the strong performance of large-cap coins, especially Solana (SOL), Ripple (XRP), Sui (SUI) and The Open Network (TON). Solana, Sui and TON attracted a large number of meme coin traders and retail investors, which led to a significant increase in on-chain activity. Meanwhile, XRP rose 300% after Trump's election.

Driven by this strong performance, these tokens have achieved significant price growth and increased their dominance relative to the broader altcoin market. Some new tokens have also emerged with multi-billion dollar valuations and caused Bitcoin's dominance rate to decline slightly by the end of 2024 (e.g. HYPE, ENA).

From a sector analysis, memecoins are the best performing altcoin category in 2024. Based on market capitalization weighted calculations, the year-to-date price performance of 900 memecoins exceeds 1,600%. However, this figure does not include the large number of failed projects on platforms such as Pump.fun or Moonshot. Of the 5.2 million tokens launched on Pump.fun, 98% failed and went to zero.

Despite this, memecoin’s share of the total cryptocurrency market capitalization has risen to nearly 3%. Although this proportion is still relatively small, memecoin has attracted a lot of attention from retail investors.

While retail investors focused on memecoins and Bitcoin absorbed most of the institutional money, technology-driven and venture-backed projects lagged significantly. Both decentralized finance (DeFi) and smart contract platforms underperformed Bitcoin overall. Ethereum (ETH), the traditional bellwether of altcoins, has significantly lagged behind Bitcoin despite the launch of a spot ETF. The reasons for these projects’ poor performance include Ethereum’s poor market performance, lack of on-chain activity, and a tightening macroeconomic environment. In addition, venture-backed projects also had poor overall dynamics due to retail investors’ disappointment with long-term lockup arrangements and large unlocks.

3. RWA tokenization will grow by 85% in 2024, becoming a bridge between traditional finance and blockchain

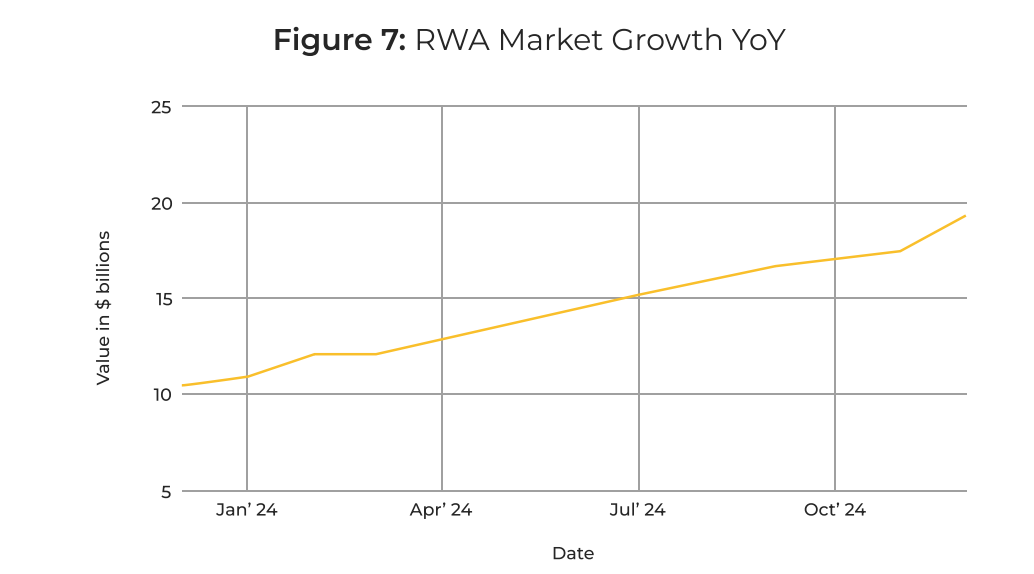

In 2024, the real-world asset (RWA) tokenization market has seen explosive growth, mainly due to the continuous advancement of blockchain infrastructure and the increasing institutional adoption rate. The total value of tokenized assets increased by 85% this year, breaking the $19 billion mark. This milestone growth marks a new stage in the deep integration of traditional finance (TradFi) and decentralized technology. In particular, in the fields of tokenized credit, real estate, and treasury tokenization, a large number of new issuance projects have emerged, becoming a key force driving market growth.

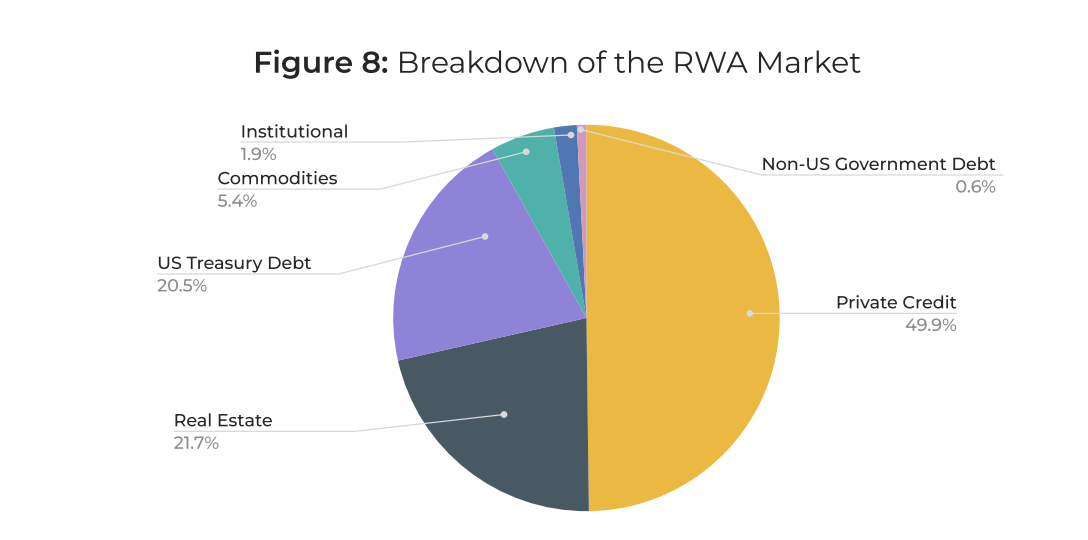

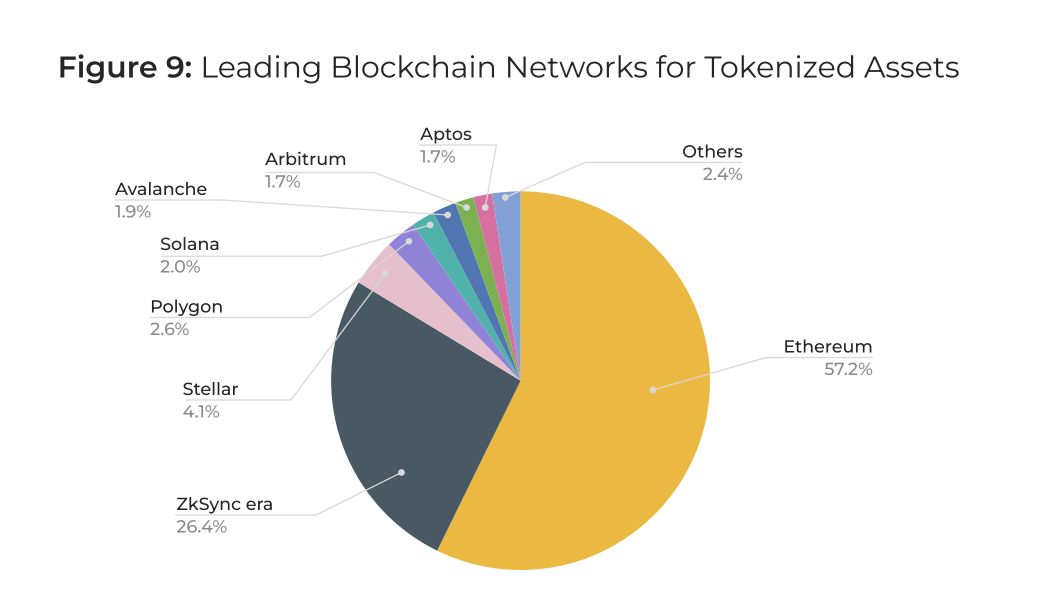

In 2024, the RWA tokenization market achieved significant growth, with a total value exceeding $19 billion (excluding stablecoins). Among them, private credit accounts for the largest proportion, followed by treasury tokenization and real estate. Ethereum and ZKsync Era together account for more than 80% of the RWA tokenization market.

In 2024, the European Investment Bank issued a tokenized digital bond worth $100 million on Ethereum. This project demonstrated the feasibility of blockchain technology in compliant high-value financial instruments.

According to the latest market forecasts, the RWA tokenization market is expected to achieve significant growth in 2025. Bitwise expects the RWA tokenization market to reach $50 billion by 2025. This growth is mainly driven by the expansion of the tokenized bond and real estate sectors.

By 2030, if the RWA tokenization market maintains its current compound annual growth rate (CAGR), its size could reach $1.3 trillion. This trend not only reflects the accelerated integration of traditional finance and the crypto market, but also shows the broad recognition of RWA tokenization by institutional investors.

analyze

In 2024, the RWA tokenization market saw strong growth, with a total value of nearly $20 billion. Among them, the market value of tokenized U.S. Treasuries exceeded $3.9 billion, an increase of nearly 400% over the same period last year, becoming the main driver of market growth. This growth was mainly driven by the high-yield environment. The Federal Reserve maintained the federal funds rate at around 4.4% for most of 2024, keeping short-term Treasury yields at a high level, attracting a large number of investors.

Therefore, tokenized Treasury bills (T-bills) are very attractive to both institutional and retail investors, especially in the context of seeking stable and risk-adjusted returns. Asset tokenization and fragmentation significantly lower the investment threshold, reducing the minimum purchase requirement of traditional Treasury bonds from $100 to $10,000 to around $10 after tokenization. This low threshold design allows more investors to participate, further promoting market activity.

In 2024, tokenized real estate received high attention in Asia and the UAE, mainly due to regulatory policy progress and increased interest from institutional investors. In Japan, Kenedix successfully completed its 12th real estate security token issuance (STO), targeting 484 rental houses in the Tokyo area. Meanwhile, Mitsui Bussan Digital Asset Management tokenized three residential properties worth 1.7 billion yen. In Dubai, UAE, real estate giant MAG partnered with Mantra to tokenize luxury properties worth $500 million. These projects have driven significant growth in the total market value of the tokenized real estate market, bringing its annual growth rate to 50% and exceeding $4 billion.

Technological advances also provide strong support for RWA tokenization. Ethereum's "Cancun" upgrade (introducing EIP-4844, or "proto-danksharding") and further optimization of the Layer-2 network have reduced on-chain transaction costs by more than 50% compared to 2023. This makes the issuance and trading of tokenized assets smoother, and the secondary market activity of RWA has increased significantly. Platforms focused on private credit, such as Securitize, reported that they generated more than $1 billion in secondary market trading volume in 2024.

4. DePin and AI are growing explosively, while DeSci is lagging behind

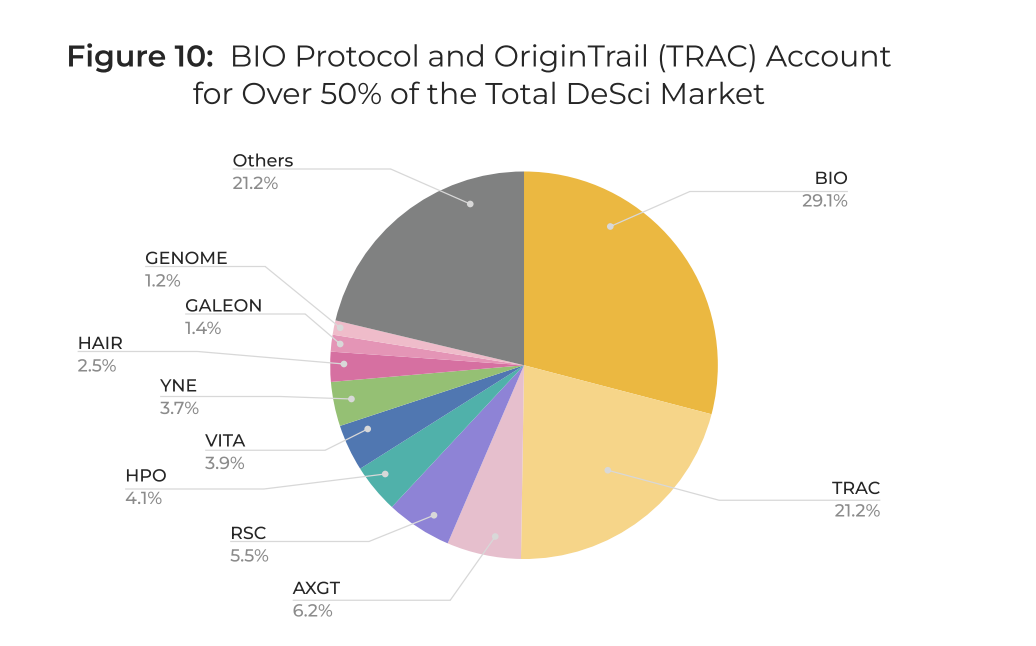

In 2024, the revenue of the DePIN (decentralized physical infrastructure network) project increased by more than 100 times to $500 million per year. The total number of DePIN devices exceeded 13 million. At the same time, the total market value of AI agents increased by 222% in the fourth quarter, from $4.8 billion in October to $15.5 billion in December. Among the three emerging technology fields, DeSci (decentralized science) grew the slowest. The top two projects currently dominating this field - BIO Protocol and OriginTrail - account for 50% of the total market value in this field.

If application scenarios become clearer, emerging technologies will achieve deeper integration with mainstream industries in 2025. Cross-domain innovations, such as the combination of AI and DePIN, may dominate as they offer the best growth opportunities. AI agents will play a key role in content creation, while DePIN networks will expand to the RWA market, but DeSci may encounter resistance from traditional academia.

analyze

In 2024, the DeSci field continued to expand its influence, with BIO Protocol and OriginTrail (TRAC) reaching market capitalizations of $440 million and $320 million, respectively. Together, they account for more than 50% of the market share in the DeSci field, which has a total market capitalization of approximately $1.43 billion. In order to promote community activity, the BIO Protocol uses a curation system where community members vote to decide which projects to support first, thereby ensuring that resources flow to the most promising and important scientific initiatives.

The model is committed to reducing dependence on centralized institutions and building a more transparent and accessible system for sharing and verifying scientific data. OriginTrail's decentralized knowledge graph has been more widely adopted in supply chain management and AI-driven applications. The rising valuations of these projects reflect the growing recognition of DeSci's potential - reshaping the future of scientific research through blockchain infrastructure.

Although DeSci shows great potential, problems with incentive mechanisms and funding structures will prevent the field from breaking out of the niche market by 2024. A typical example is ResearchHub, a decentralized science platform that aims to help researchers monetize their research results through token incentives.

Nature magazine pointed out that some reviewers earn more on ResearchHub than in academia. The platform encourages more activity through token incentives, but this model promotes participation rather than improving research quality. This raises concerns that academic standards may be ignored for financial interests.

Funding constraints have also hampered DeSci’s expansion. While projects like AminoChain have raised $5 million and LabDAO has received $3.6 million in funding, these figures pale in comparison to traditional R&D costs. Deloitte estimates that developing a new drug can cost as much as $2.3 billion, with no guarantee of market success.

Unlike biotech and pharmaceutical companies, which operate within established intellectual property frameworks and attract large-scale institutional funding, DeSci still relies on volatile token markets and decentralized community funding. This makes it less suitable for long-term, capital-intensive research, such as drug development or large-scale physics experiments.

Still, DeSci could be valuable for small, early-stage research projects, especially in areas that have difficulty obtaining institutional funding. By crowdsourcing resources and decentralizing data access, DeSci is able to support independent labs, open-source drug discovery, and underfunded research areas that are often overlooked under traditional models. While token-based financing may not replace large grants, it offers researchers an alternative to seeking new funding avenues outside of academia and corporate R&D.

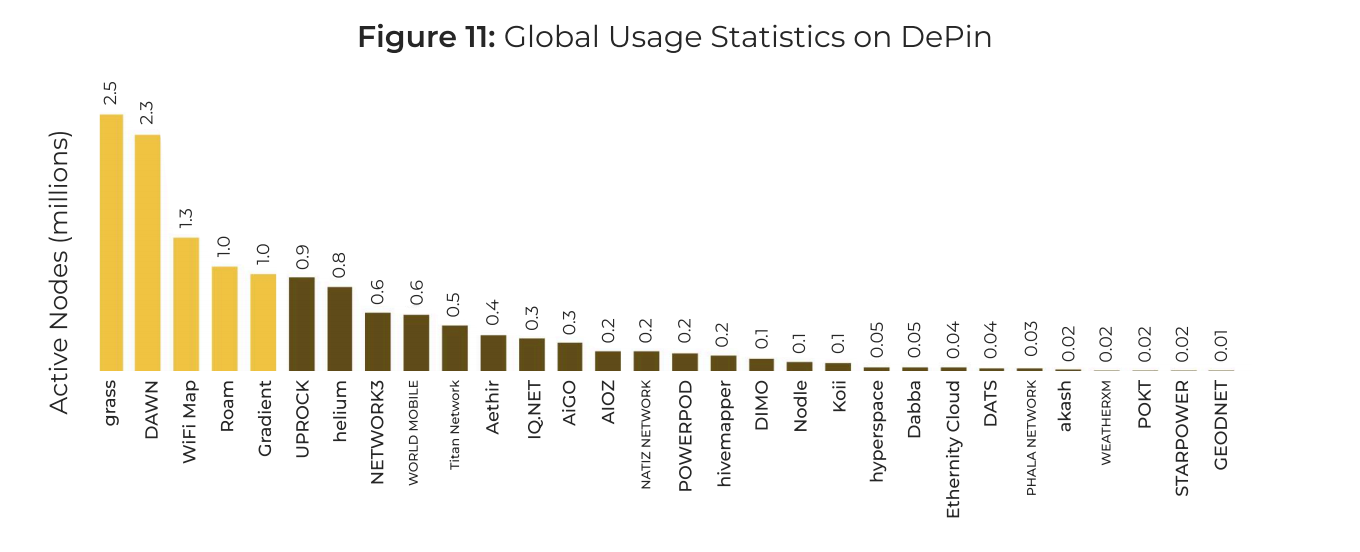

Similar decentralized financing models have driven the rapid expansion of DePIN, with the number of connected devices exceeding 13 million in 2024. More than 20 projects have 100,000 active nodes, and five of them have more than 1 million active nodes.

This growth has attracted support and venture capital from major institutions such as Pantera, Multicoin Capital, and Coinbase. Borderless Capital's $100 million DePIN fund is backed by Peaq and the Solana Foundation, further strengthening confidence in decentralized infrastructure. Render Network has become one of the leading DePIN projects, providing decentralized GPU computing services, with a market value of over $3.5 billion. At the same time, Helium Network has also achieved rapid growth, processing 88,000 GB of data from US mobile operators by the end of the third quarter, an increase of 10,202%. Its Helium Mobile service has also made significant progress, attracting 116,000 users to subscribe to unlimited calls and texts.

Another prominent project, Grass, expands decentralized internet sharing infrastructure, allowing users to monetize unused bandwidth for AI model training. By the end of 2024, Grass had more than 2.5 million user-run nodes and launched a major airdrop event, distributing 10% of its token supply to 1.5 million users, driving Grass tokens up more than 317%.

In addition to digital infrastructure, DePIN is also beginning to reshape traditional industries, especially electric vehicle charging networks. Compared with Tesla's proprietary super charging network, companies such as ChargePoint and Electrify America have adopted the DePIN model, allowing multiple investors and partners to fund and expand the charging network. This decentralized approach ensures a wider distribution of charging stations, improves accessibility for electric vehicle owners, and creates a more balanced and competitive market.

Just as DePIN began to reshape infrastructure, AI agents completely revolutionized the automation field in 2024. In just a few months, the market value of AI agents soared 222% in the fourth quarter to $15.5 billion. Solana quickly rose to take advantage of this trend and occupied 56.48% of the market, equivalent to $8.44 billion.

Among them, Virtuals.io has become one of the most successful cases in AI agent projects. The platform launched an AI agent launch platform with a built-in co-ownership model. Users can create, deploy and tokenize entertainment-focused AI agents on the platform, each of which is backed by a dedicated token. Through initial agent offerings (IAOs), the platform issued 1 billion native tokens that users can buy, trade and participate in governance.

The system incentivizes community users to develop AI by issuing VIRTUAL tokens to the best performing AI agents. As one of the best performing AI agents on the Virtuals.io platform, Luna has become a fully autonomous influencer. It has accumulated more than 500,000 TikTok followers by generating AI-driven content and constantly interacting with users.

Luna’s success provides strong proof of concept for Virtuals.io’s business model, demonstrating that AI agents can generate consistent revenue through affiliate marketing, brand sponsorships, and token buyback mechanisms.

5. Cryptocurrency stocks: Mixed performance

In 2024, the performance of cryptocurrency stocks can be described as mixed. Some companies' stock prices have outperformed Bitcoin, while others have lagged far behind. MicroStrategy has become the most prominent "dark horse" in the industry with its aggressive Bitcoin investment strategy, with its stock price soaring 400%. Marathon Digital has also achieved impressive results by imitating MicroStrategy's strategy and successfully raised $1 billion in funds by issuing convertible senior notes.

However, most mining companies have not performed well after the Bitcoin halving. Looking ahead to 2025, the outlook for the cryptocurrency industry depends largely on the macroeconomic situation and whether the Trump administration will introduce supportive policies.

If President Trump continues his friendly stance towards cryptocurrencies and actively promotes policies and legislation that reduce regulatory barriers, the stock performance of cryptocurrency miners and related companies is expected to improve. In addition, as the global transition to renewable energy accelerates, Bitcoin mining companies that adopt sustainable development strategies may attract more investment and achieve better financial performance in 2025.

analyze

MicroStrategy stood out for its aggressive Bitcoin investment strategy, which saw its stock price rise by about 400%. The company successfully attracted a lot of investor attention through strategic debt financing and Bitcoin hoarding.

In addition, hedge funds have increasingly used MicroStrategy’s convertible bonds for arbitrage, shorting the stock to take advantage of the volatility of its underlying assets. This shows that the company’s performance is closely linked to the price of Bitcoin, bringing both opportunities and risks.

Marathon Digital (MARA) was the first Bitcoin miner to follow MicroStrategy’s debt financing strategy by issuing $1 billion worth of convertible senior notes and raising $980 million in net proceeds through a Rule 144A private placement.

In terms of fund allocation, $199 million was used for refinancing, repaying $212 million of MARA's convertible notes due in 2026, and the rest was used for bitcoin acquisitions, strategic expansion, and debt repayment. These convertible notes can be converted into cash or equity, and were issued at a premium of 42.5% to MARA's share price.

Additionally, MARA has deployed 7,377 bitcoins, or 16% of its reserves, through a lending program to generate revenue and manage costs. In 2024, the program helped cover operating costs by generating $3.9 million in revenue in the third quarter and $4.8 million in the first half of the year.

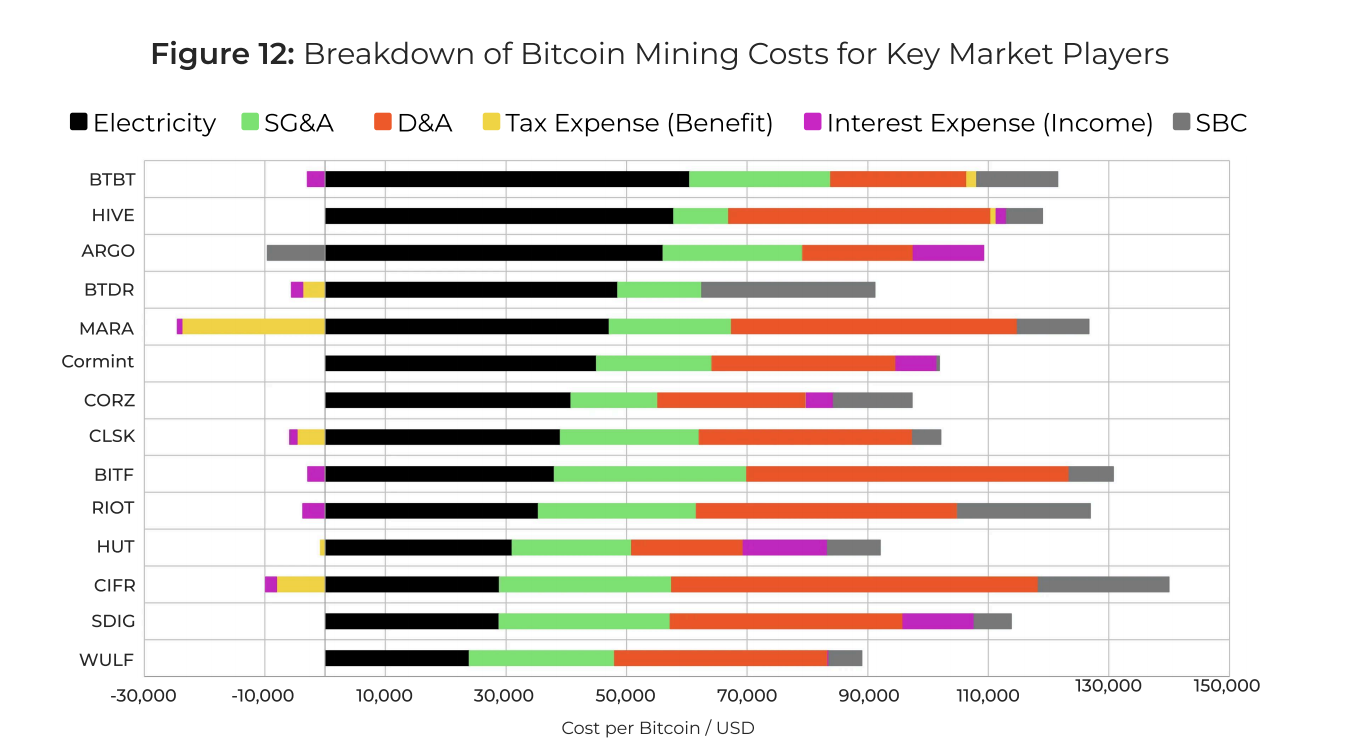

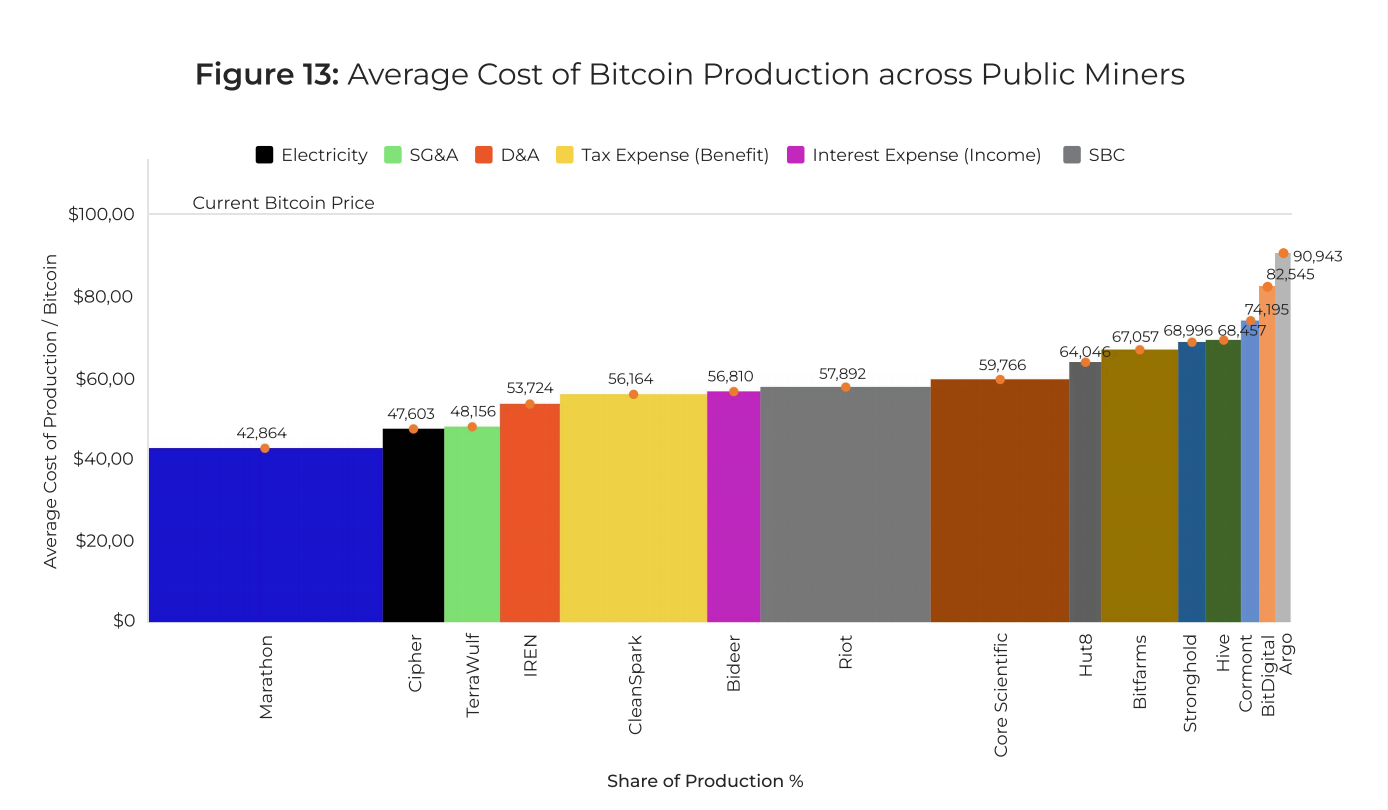

However, as competition intensifies and costs rise, Bitcoin miners are facing greater challenges in profitability. In the third quarter of 2024, the cost of Bitcoin mining increased significantly, with the weighted average cash cost reaching $55,950, up 13% from $49,500 in the second quarter. If non-cash costs (such as depreciation and stock compensation) are included, the total cost per Bitcoin soars to $106,000.

Both Bitdeer Technologies and Bitfarms face tough challenges in 2024 as rising costs and the Bitcoin halving event hit their operations and strategic goals. However, their stock price trends are very different.

Bitdeer Technologies' stock price rose more than 165% despite reporting a net loss of $50.1 million in the third quarter of 2024. The company's electricity costs rose from $32 to $41 per megawatt-hour, while R&D expenses surged to $24.8 million due to the development of the SEAL02 chip. These pressures caused its gross profit margin to drop from 24.2% to 4.5%, further exacerbating financial pressures.

Meanwhile, Bitfarms’ stock price has been hammered, down 48.4% for the year, as earnings fell due to unexpected expenses, despite a 97% increase in its operational computing power in 2024.

Despite a 30% increase in revenue, Bitfarms' gross margin fell to 38%, while operating expenses surged 230% year-over-year. This widened its net loss to $36.6 million, a significant increase from the $16.5 million loss in the third quarter of 2023. Similar to Bitdeer, Bitfarms also cited rising electricity costs and increased network mining difficulty as the main reasons for the decline in profitability.

To achieve recovery, the company plans to upgrade 18,853 mining machines to Bitmain's S21 Pro model mining machines in early 2025. In addition, Bitfarms spent $125 million to acquire Stronghold Digital Mining, which includes two power plants in Pennsylvania with a total installed capacity of 165 megawatts. Despite the challenges, Bitfarms still holds $72.6 million worth of Bitcoin and maintains $146 million in total liquidity, which provides it with a buffer against rising costs.

6. Cryptocurrency regulation: MiCA reshapes the EU landscape, and the United States opens a new business-friendly path

In the EU, the implementation of the MiCA (Markets in Crypto-Assets Act) framework introduced strict compliance standards that are consistent across member states. The new measures remove user anonymity and are more favorable to large companies that already have compliance departments, but for small companies, they bring significant additional costs. In the United States, the Securities and Exchange Commission (SEC) has softened its crackdown on cryptocurrency companies since Gary Gensler left, and the Financial Innovation and Technology Promotion Act (FIT21) may limit the SEC's powers. These changes make the United States more attractive to cryptocurrency companies in the new year.

In 2025, small cryptocurrency businesses in Europe may face many challenges and may even have to move their operations overseas. With the full implementation of the MiCA framework, the EU has stricter requirements for crypto asset service providers, including setting up offices, complying with anti-money laundering (AML) guidelines, and following rules for marketing materials. Although these requirements bring legal certainty and stability to the market, the compliance costs are too high for small businesses, which may make it difficult for them to continue operating in Europe.

At the same time, the United States' attitude towards cryptocurrency regulation has gradually turned friendly. With the departure of SEC Chairman Gary Gensler, his "enforcement-style regulation" approach has come to an end, and the new government is expected to adopt a more relaxed regulatory policy. In addition, the advancement of FIT21 may further limit the SEC's power and distribute the regulatory power of cryptocurrencies between the CFTC and the SEC. These changes make the United States more attractive to cryptocurrency companies in 2025.

analyze

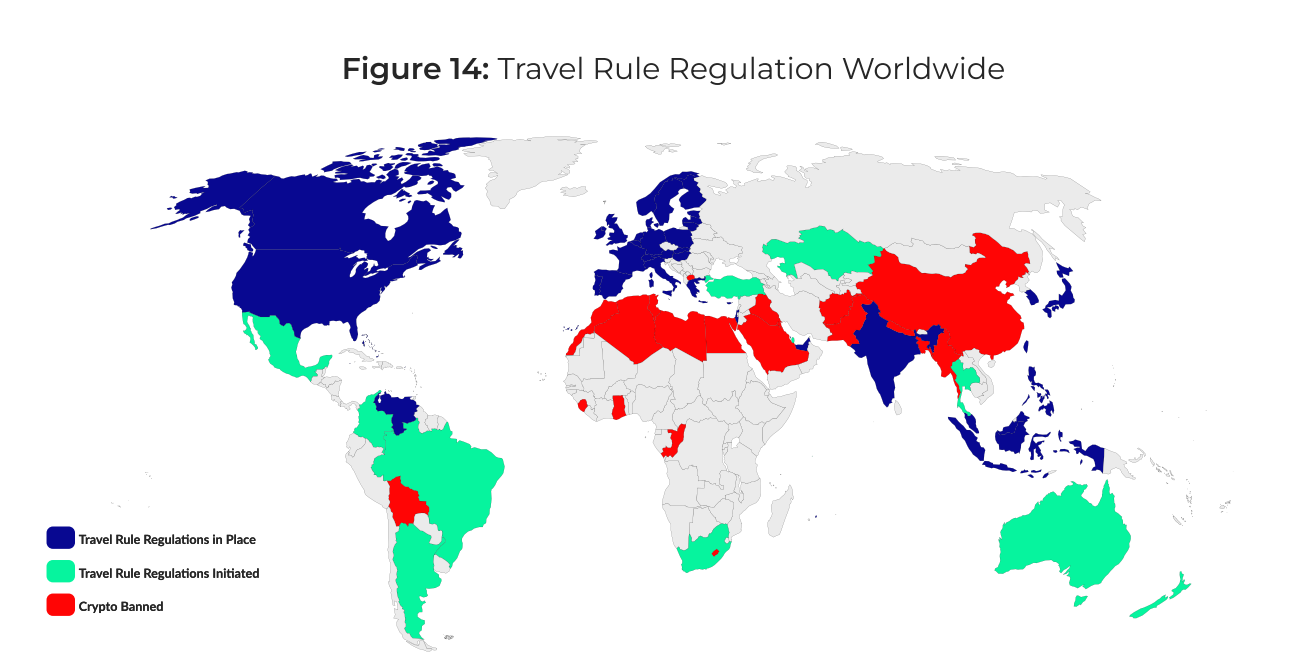

The "Travel Rule" for cryptocurrency transactions has officially come into effect in the European Union since December 30, 2024. The rule restricts crypto asset service providers (CASPs) from providing anonymous cryptocurrency transfer services within the EU. The "Travel Rule" was originally introduced by the Financial Crimes Enforcement Network (FinCEN) under the U.S. Treasury Department as a broader principle.

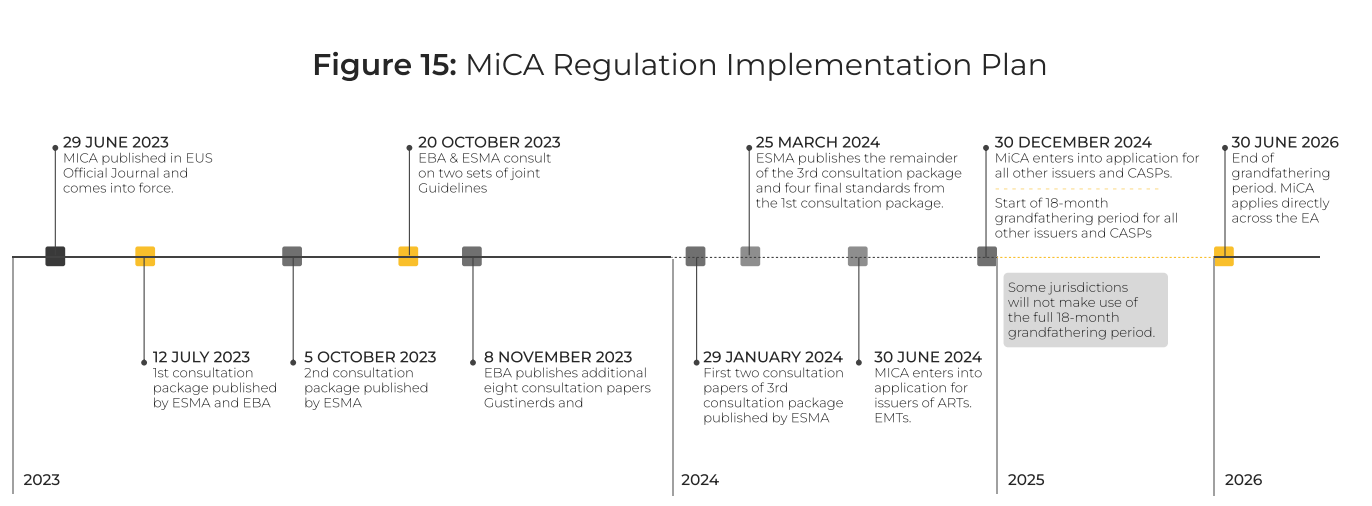

MiCA sets clear requirements for institutions providing crypto services and will enter the implementation phase in the EU in 2024. MiCA aims to unify the cryptocurrency regulatory framework across EU member states and provide a unified license for the entire region. Under MiCA, crypto asset service providers must set up offices in the EU, comply with operational communication requirements, and implement data security services. During the transition period, the regulation also requires CASPs to provide the full name and address of the storage initiator and additional identification information, and to record relevant information about the beneficiary regardless of the transaction amount.

The rule is costly to implement and puts smaller CASPs in the region at risk. In contrast, in the United States, the United Kingdom, Switzerland and Canada, the Travel Rule only applies to transactions below a certain amount. In the future, as many countries such as Australia and Mexico consider introducing the Travel Rule under pressure from the United States, the scope of application of the rule may be further expanded. During the transition phase, MiCA allows countries to choose a transition period of up to 18 months, during which companies can still operate under existing regulations. Most countries have chosen a transition period of at least 6 months.

Last year, regulatory scrutiny of stablecoins became a global trend. In Europe, algorithmic stablecoins have been banned by the MiCA framework, while fiat-backed stablecoins are required to be fully collateralized by liquid reserves. In addition, entities intending to issue stablecoins need to obtain authorization before the stablecoin is listed. This tightening of regulation has put USDT and other stablecoins in a gray area in the EU, and its future is expected to become clearer during the 18-month transition period stipulated by MiCA.

In addition to the EU, Switzerland, the UK, the UAE, Hong Kong and Brazil have also issued legislative directives on stablecoins. In the EU, stablecoin issuers are required to deposit at least 30% of their collateral in cash in a segregated account of a financial institution.

7. DeFi’s strong recovery: As the market recovers, the total locked value (TVL) surges by 118%

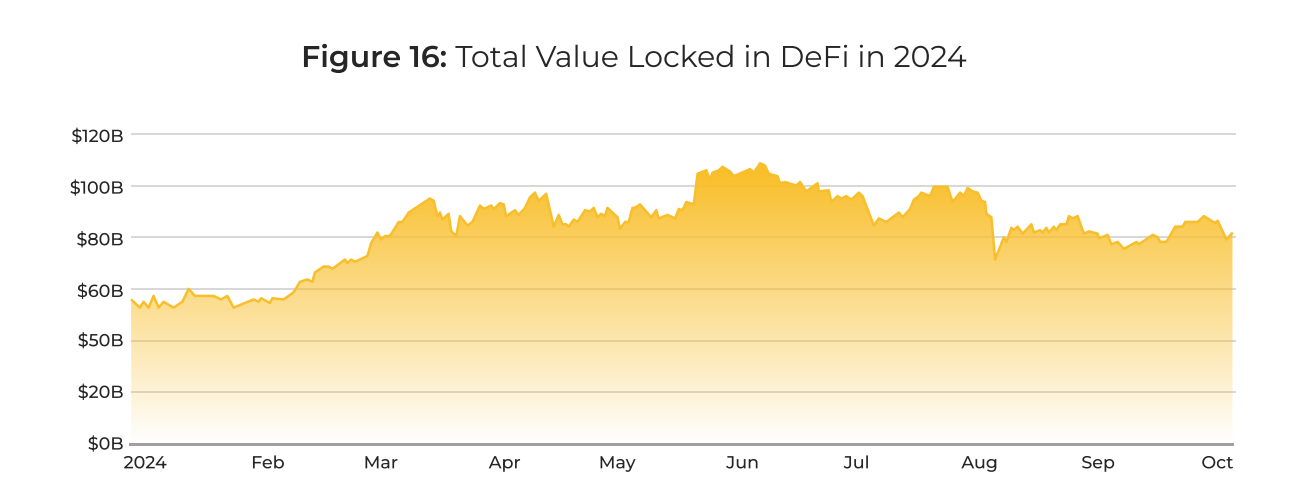

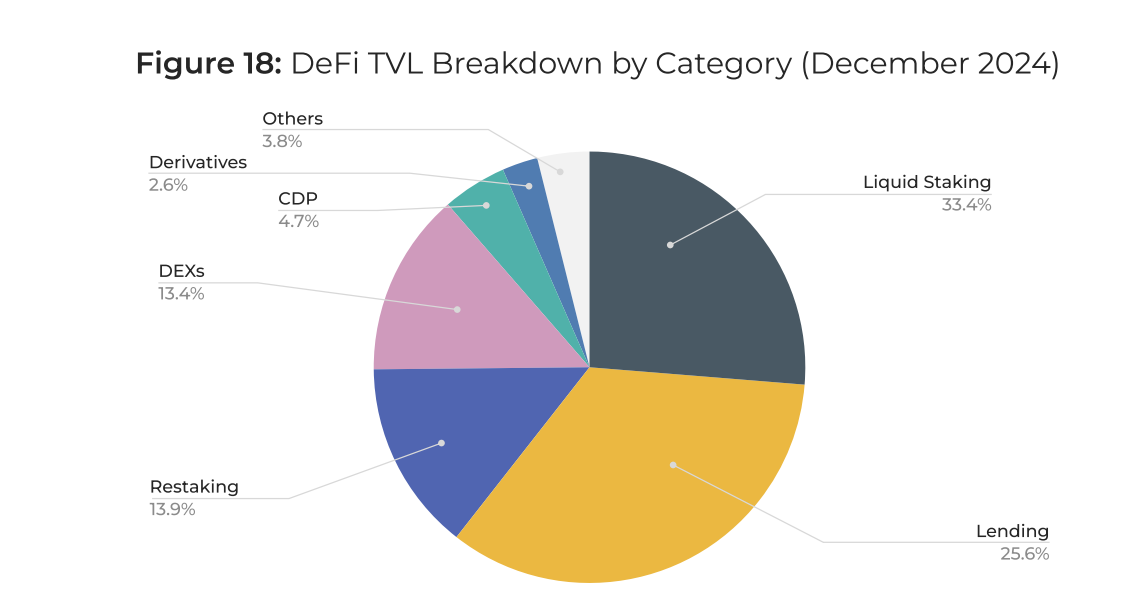

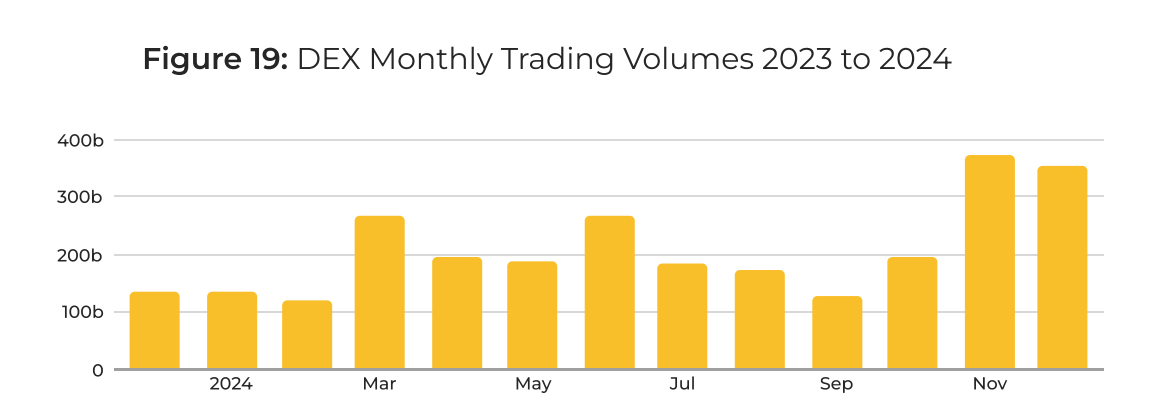

After a long period of difficult development, the decentralized finance (DeFi) sector began to recover in late 2024. Previously, DeFi faced many challenges, including regulatory uncertainty and downward market pressure. With the broader market recovery and the advancement of liquidity staking and re-staking technology, DeFi's total locked value (TVL) increased by 118% to $185 billion. Decentralized exchanges (DEXs) also reflected this recovery, with their trading volume increasing by 165%.

Derivative DEXs saw a 328% year-on-year increase in trading volume between January and November 2024. This reflects the resurgence of speculative activity amid improved market conditions. In addition, the number of transactions on leading Layer 2 networks Arbitrum, Base, and Optimism has quadrupled over the past year.

According to VanEck's latest report, the DeFi sector is expected to achieve transformative development in 2025, with the total locked value (TVL) expected to exceed US$200 billion. This growth is mainly due to the strong performance of liquidity pledge, re-pledge, and lending markets.

In addition, the trading volume of DEXs is also expected to grow significantly, expected to exceed $4 trillion and account for about 20% of the overall cryptocurrency spot trading volume. This trend reflects that the DeFi field is attracting more institutional participation and user attention as market conditions improve and technology advances.

analyze

Liquidity staking products became a highlight in the DeFi field last year. The scale of related assets doubled from US$30 billion in December 2023 to US$60 billion in December 2024, and now accounts for about 30% of the total DeFi lock-in volume (TVL). This growth is mainly due to the outstanding performance of leading platforms such as Lido and Rocket Pool, as well as the rapid growth of liquidity staking on BNB and Solana chains.

At the same time, the increasing popularity of Liquidity Staking Tokens (LSTs) and their derivatives as collateral on lending and trading platforms has further driven this trend and made an important contribution to the growth of the entire industry.

Re-staking technology - a major innovation pioneered by EigenLayer - allows users to generate additional returns by staking a second time. This technology not only improves the security of small blockchains, but also promotes the development of cross-chain transaction processing and oracles. As of this writing, re-staking accounts for about 14% of the total locked value in DeFi.

Currently, more than 5 million ETH is locked in re-staking, worth approximately $17 billion, accounting for more than 9% of Ethereum's total staked supply.

The rise of liquidity staking and re-staking is closely tied to the scalability improvements in the Ethereum ecosystem, thanks in large part to improvements in Layer-2 solutions and the introduction of EIP-4844, which aims to increase transaction throughput and reduce costs, while also bringing significant benefits to the re-staking protocol, successfully reducing its associated transaction costs by more than 90%.

DEXs also achieved significant growth in 2024. In December 2024, their monthly trading volume exceeded US$350 billion, a year-on-year increase of 165%. This growth was mainly due to the overall recovery of the market in the second half of the year and the reduction of on-chain transaction costs.

In addition, trading activities on chains such as Solana, Base, and SUI/Aptos have also increased. DEXs such as Orca, Lifinity, Aerodrome, and Cetus will account for about 15% of trading volume in 2024, up from less than 0.5% a year ago. The ratio of DEX to CEX (centralized exchanges) spot trading volume in 2024 is about 14%, up from 9.5% a year ago.

Conclusion

2024 is a key turning point for the cryptocurrency industry. With the launch of spot Bitcoin ETFs listed in the United States, Bitcoin has gradually entered the field of vision of traditional finance, marking the maturity of this asset class.

While Bitcoin attracted significant institutional inflows, the altcoin market underperformed expectations, with only memecoins posting decent returns. Crypto-related stocks had mixed performances, reflecting the complex dynamics of the broader market, but companies such as MicroStrategy and Marathon Digital demonstrated the potential for strategic integration of Bitcoin. Meanwhile, DeFi recovered strongly at the end of the year, setting the stage for significant growth and innovation in 2025.

The regulatory landscape has also changed significantly, especially the EU's Markets in Crypto-Assets (MiCA) framework, which introduced stricter compliance requirements. At the same time, the United States has shifted to a more friendly attitude towards cryptocurrency regulation, with potential restrictions on the SEC's power and the emergence of a new government that supports cryptocurrency, making the regulatory environment in the United States more favorable.

As these trends advance, the industry landscape may see a major shift. Many small European companies may shift their business focus overseas in search of a more relaxed policy environment, while the United States is expected to become a core gathering place for cryptocurrency companies with its friendly regulatory attitude and policy support.

In 2025, the cryptocurrency industry will usher in a year of vitality and change. Bitcoin is expected to continue to sit firmly on the throne of the flagship asset, and the discussion around whether it can become a global reserve asset will become more intense. As the market enters a potential "alt season", altcoins are expected to regain growth momentum, break Bitcoin's dominance, and open up new space for industry innovation. DeFi will also usher in further expansion, with its total locked volume (TVL) expected to exceed the $200 billion mark, and DEXs' share in trading activities will also increase further.

However, the future development of the industry still faces many uncertainties, and its direction will largely depend on the macroeconomic environment, the clarity of regulatory policies, and technological progress, especially breakthroughs in key technology areas such as energy-saving mining and blockchain interoperability.