As the overall crypto market declines, the prices of some tokens have fallen by 80%-90% from their peak. Based on the different weights of 16 specific indicators, bitsCrunch has established an evaluation system for 2 million tokens in the market through AI algorithms, which serves as an important tool for measuring project credibility and market health.

Through the analysis of the latest data, we found that the reputation score of tokens presents a significant pyramid structure. The vast majority of tokens are concentrated in the "Average" and "Fair" ranges, while high-scoring tokens are extremely scarce. This phenomenon not only reflects the high degree of market differentiation, but also reveals the deep differences in the quality of tokens on different blockchain platforms. This article will combine the influencing factors of reputation scores to explore the driving factors behind it and the future market development.

Token Reputation Index: Only 14 tokens have excellent ratings

Data source: bitsCrunch.com

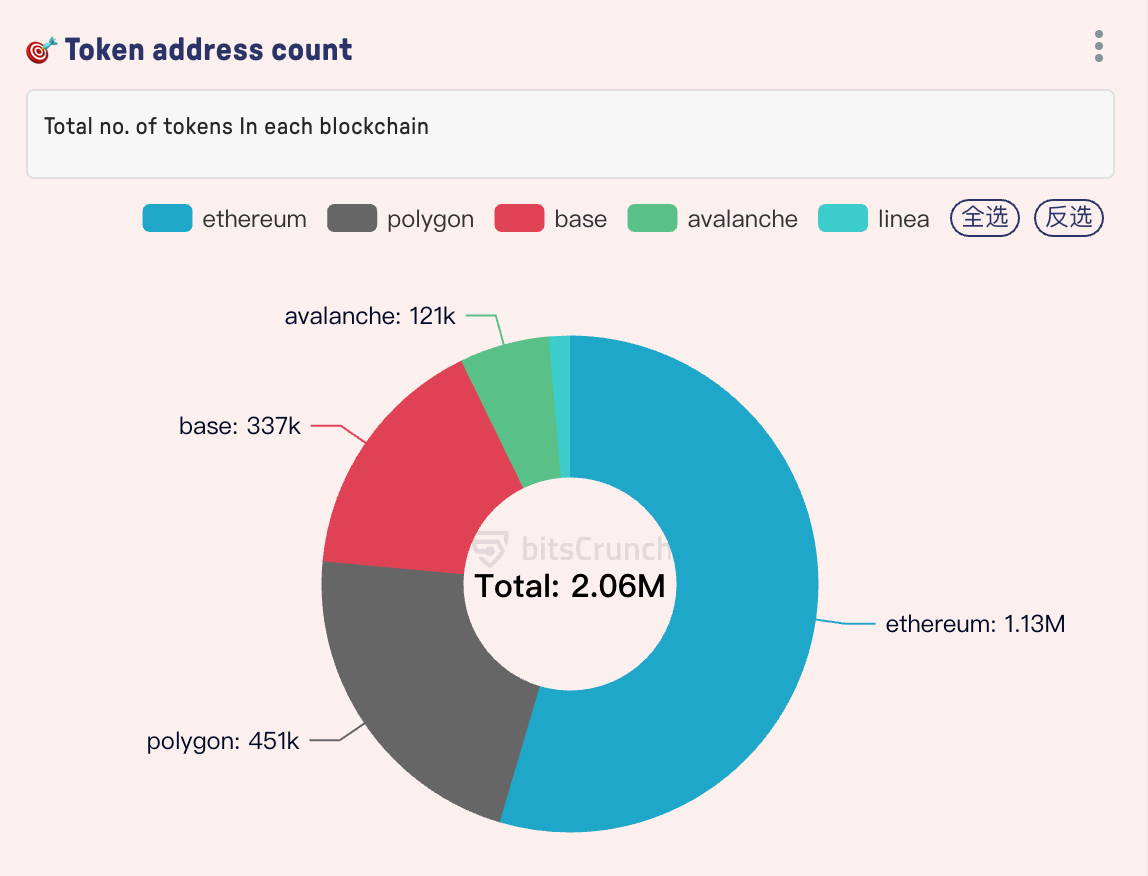

From the overall data, most tokens are still issued on Ethereum. According to bitsCrunch data, the number of token addresses issued on Ethereum accounts for 54.56% of the total number of statistics, far exceeding Polygon (451,349, accounting for 21.88%) and the third-place Base (336,616, accounting for 16.32%). Avalanche (120,587, 5.85%) and Linea (28,264, 1.37%) are relatively behind.

Data source: bitsCrunch.com

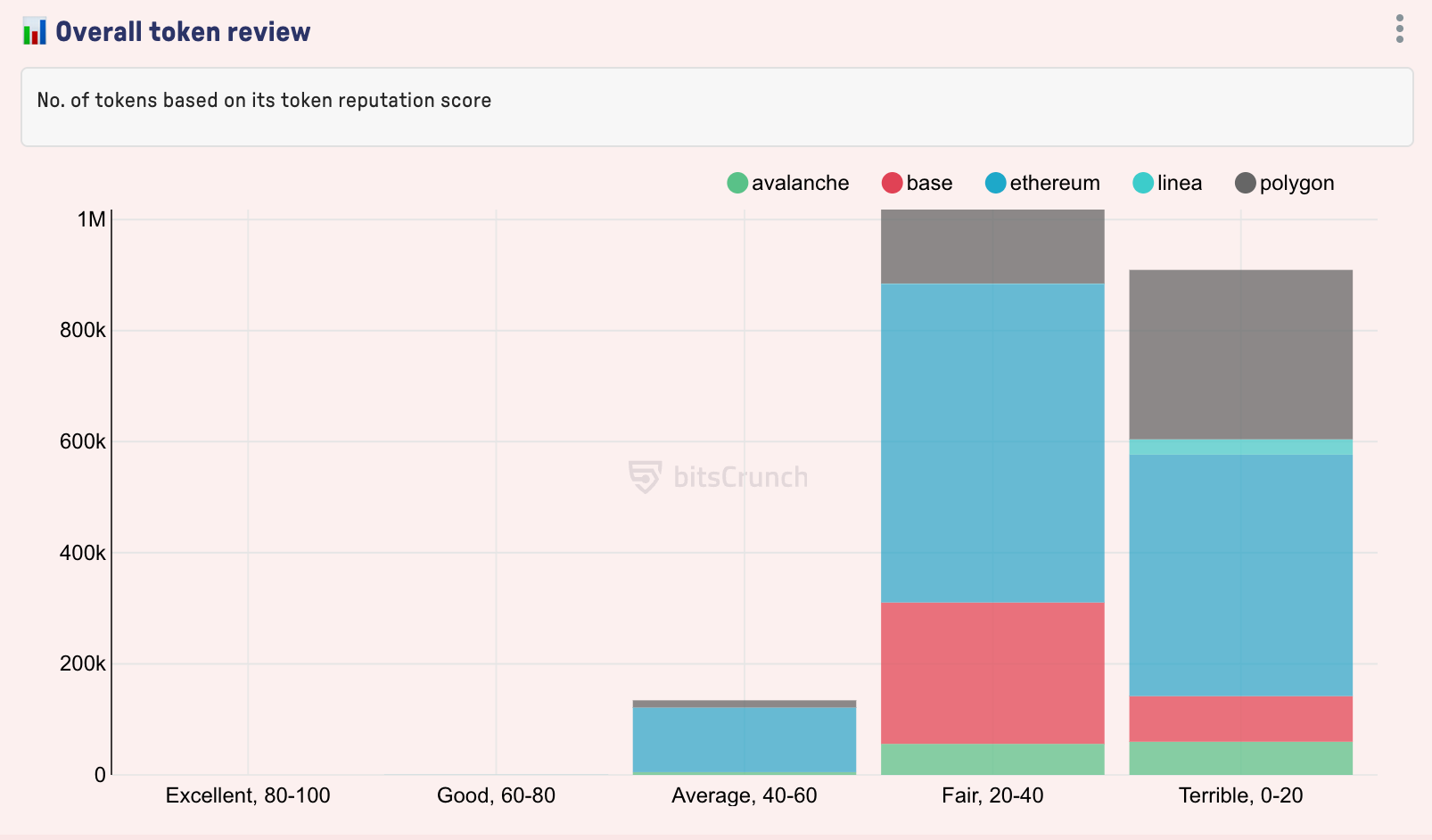

From the token reputation score table, we can see that the overall data trend presents a pyramid shape. From the perspective of reputation score, the vast majority of tokens hover in the two middle and low-level score segments of "Average" and "Fair". Among all the tokens released on Ethereum, about 116,347 tokens are at an average level and 573,739 tokens are at a poor level. In the excellent and good ratings, the number of tokens of each blockchain platform is extremely limited. Ethereum has 7 tokens that have achieved excellent ratings and 310 tokens that have achieved good ratings.

Polygon and Base ranked second and third in terms of total tokens, respectively. Taking Polygon as an example, 5 of its 450,000 tokens were rated as "Excellent", while tokens in the "Fair" and "Terrible" ranges accounted for as much as 96.7%. Among the 336,000 tokens of the Base chain, the "Fair" range accounted for 75.6% (254,482), and there were 67 tokens in the "Average" range.

It is worth noting that although the total amount of Avalanche tokens is only 10.7% of Ethereum (120,587), its tokens in the "Average" range (4,865) account for 4.03%, significantly higher than Ethereum's 0.34% (116,347).

The Ethereum ecosystem has attracted a large number of projects, but it has also led to a serious "long tail effect" - a few high-quality projects coexist with a large number of low-quality tokens. In contrast, emerging chains such as Polygon and Avalanche performed well in the "Average" range.

Reputation score influencing factors: Common flaws of low-scoring tokens

The token reputation index is composed of multiple dimensions, including 16 influencing factors such as token issuance time, liquidity pool size, and token holder distribution. By comparing the characteristics of tokens in high and low scoring ranges, it can be found that low-scoring tokens generally have the following problems:

1. Insufficient liquidity and low market participation

The liquidity pool size and liquidity participant scores of low-scoring tokens are generally low. For example, the median liquidity pool size of tokens in the "Fair" range on the Ethereum chain is only 1/5 of that of high-scoring tokens, and the number of participants is relatively low. Insufficient liquidity directly leads to sharp fluctuations in token prices, further weakening market confidence.

2. Too high a concentration of coin holders

The distribution of token holders is a core indicator for measuring the degree of decentralization of tokens. Data shows that the average share of the top 10 token holders of Ethereum's "Terrible" range tokens far exceeds that of tokens rated "Excellent". A highly concentrated token holding structure is prone to market manipulation risks, which is one of the main reasons why low-scoring tokens are avoided by investors.

3. Insufficient trading activity and profitability

In terms of trading, low-scoring tokens lag significantly behind in terms of trading volume and profitable trader scores. High-scoring tokens attract more long-term investors through stable trading volume and positive profit expectations.

Market share and ecological strategy

The correlation between the number of tokens and reputation scores reveals the differences in the ecological strategies of different blockchain platforms. As one of the most mature blockchains, Ethereum has both ecological advantages and disadvantages. On the one hand, Ethereum has become the preferred platform for token issuance with its complete development tools, large user base and rich DeFi infrastructure; but on the other hand, its high gas fees and network congestion problems have forced many projects to turn to low-cost chains (such as Polygon and Base), but these chains still need to strengthen their liquidity depth and user stickiness.

In contrast, the Polygon and Base ecosystems are also expanding rapidly. Taking the Base chain as an example, its total token volume is nearly three times that of Avalanche, but many projects in the ecosystem are still in the early stages. Avalanche and Linea are also attracting specific projects through technological differentiation, but they are still limited by the user base.

in conclusion

Since the last bull market, the number of tokens has increased exponentially. However, the current token market is clearly polarized. In the future, as regulation becomes stricter and investors become more professional, the token reputation index may also be a core tool for screening high-quality assets. Only projects that have balanced development in terms of liquidity, holder distribution, and transaction sustainability can become the "MAG-7" in the crypto field and take the lead in the next stage of market reshuffle.