- VCs and market makers are the main front-end barriers of exchanges

- Airdrops and Memes Start the Reevaluation of the On-chain Value System

- More complex token economics mask weak growth

Retail investors have been a bit annoyed recently. First, RedStone had many twists and turns, and finally the retail investors failed to block it. RedStone was still listed on Binance. Then GPS pulled out the carrot and brought out the mud. Binance launched a heavy blow to the market maker, showing the absolute strength of the Universe Institute.

The story is not perfect. As VC coins gradually decline, value coins become an excuse for project parties, VCs, and market makers to sell their products. During each market shock period, they urgently complete the three steps of establishing a foundation, launching an airdrop plan, and crashing the market.

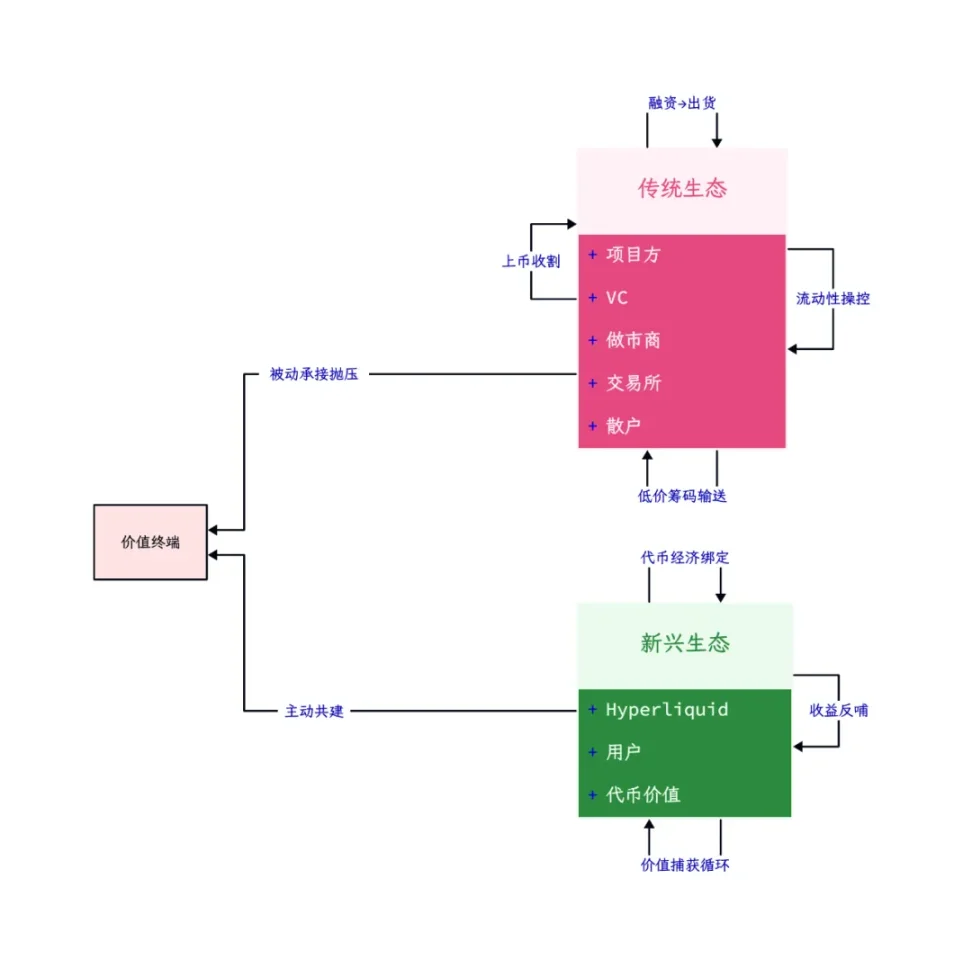

Image caption: Traditional and emerging value circulation, Image source: @zuoyeweb3

It can be predicted that Babylon, Bitlayer and other BTCFi ecosystems will repeat this process. Looking back, the strange trend after the IP listing has nothing to do with the project performance, but is positively correlated with the crazy purchasing power of Koreans, and the joint efforts of market makers, project parties and exchanges cannot be ruled out.

Because of this, Hyperliquid's route is indeed unique, with no investment, no big firms, and no separation of interests. It achieves a balance between the project party and early users. All protocol income empowers its own tokens to meet the value preservation needs of people who buy tokens later.

Judging from the performance of IP and Hyperliquid, the project parties’ own solidarity and willingness to empower can suppress the concentration of chips and market-crashing behavior of exchanges and VCs.

With one step forward and one step back, as Binance pushes market makers to the forefront, its own industry barriers are rapidly collapsing.

Self-fulfilling prophecy, the red stone

In Minecraft, RedStone is buried 16 levels underground and needs to be mined before it can be ground.

Throughout the gold-digging process, exchanges have become the final destination of tokens by virtue of their absolute flow effect and liquidity. In this process, on the surface, both exchanges and users are happy. Exchanges obtain more currencies to attract users, while users can access new assets and gain potential profits.

On this basis, the enabling value of platform coins such as BNB/BGB can be added to further consolidate its own industry position.

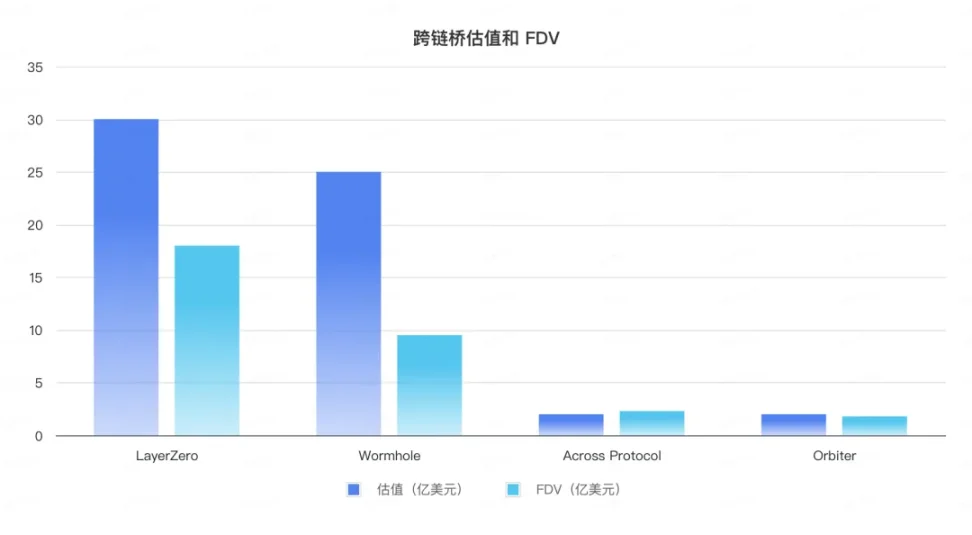

However, since 2021, with the participation of large European and American Crypto VCs, the initial valuation of the entire industry has been too high. Taking the cross-chain bridge industry as an example, based on the last disclosed valuation before the above, LayerZero is valued at US$3 billion, Wormhole is valued at US$2.5 billion, Across Protocol is valued at US$200 million in 2022, and Orbiter is valued at US$200 million. The current FDVs of the four projects are US$1.8 billion, US$950 million, US$230 million, and US$180 million, respectively.

Data source: RootData&CoinGecko, chart: @zuoyeweb3

Every Big Name endorsement effect added to a project actually comes at the expense of retail investors.

From the VC coin storm that started in mid-2024 to He Yi's "Girlfriend Coin Storm" AMA in early 2025, the relationship between exchanges and VCs has apparently become unsustainable. VCs' own endorsements and the effects of listing help seem ridiculous amid the Meme carnival. The only remaining role is to provide funds. Driven by the rate of return, token-oriented investment has in fact replaced product-oriented investment.

At this point, Crypto VCs are at a loss, Web2 VCs cannot invest in DeepSeek, and Web3 VCs cannot invest in Hyperliquid. An era has officially ended.

After the collapse of VC, exchanges only have market makers to act as a shelter for retail investors. Users rush to buy local coins on the chain, and market makers can only be responsible for the market making of a few listed tokens after the internal market of PumpFun runs out and the external market of DEX rushes out. Of course, this article will not delve into the relationship between on-chain business and market makers, and we will focus on the exchange.

At this time, Meme coins are priced as high as VC coins for market makers and exchanges. If value coins have no value, then air coins obviously cannot be fairly priced based on air, and quick absorption and quick selling becomes the common choice of all market makers.

When the entire process is swept away by the industry, Binance's one-year speed pass is not the original sin of the market maker. The fact that Binance can be speed-passed is an industry crisis. As the last link in liquidity, Binance can no longer discover truly long-term tokens, and an industry crisis is born.

Binance can promote RedStone despite its problems this time, and can also bring justice to the market makers, but after that, the industry will not change the existing model, and there will still be high-priced tokens waiting for the listing process.

Complexity and gigantism mean the end

Ethereum's L2 is increasing, and all dApps will eventually become one chain.

Token economics and airdrop schemes are becoming more and more complicated. From BTC as a Gas to ve(3,3), the links between them have long exceeded the understanding ability of ordinary users.

Since Sushiswap relied on issuing token airdrops to Uniswap users to occupy the market, airdrops have become an effective means of stimulating early users to buy volume. However, under Nansen’s anti-witch censorship, airdrops have become a reserved program for the battle of wits and courage between professional hair-pulling studios and project parties. The only ones excluded are ordinary users.

The money-grabbing parties want tokens, the project owners need trading volume, the VCs provide initial funding, the exchanges need new coins, and ultimately the retail investors bear all the consequences, leaving only the endless decline of prices and the impotent rage of the retail investors.

Turning to Meme is just the beginning. What is really serious is that retail investors across the industry are re-evaluating their own interests. What are the gains and losses if they do not trade on Binance but open contracts on Bybit and Hyperliquid?

At present, the daily trading volume of on-chain contracts has reached 15% of Binance, of which Hyperliquid can account for 10% of Binance's share. This is not the end, but the real beginning of the on-chain process. Coincidentally, DEX accounts for about 15% of CEX's trading volume, and Uniswap accounts for about 6% of Binance, highlighting Solana DeFi's latecomer position.

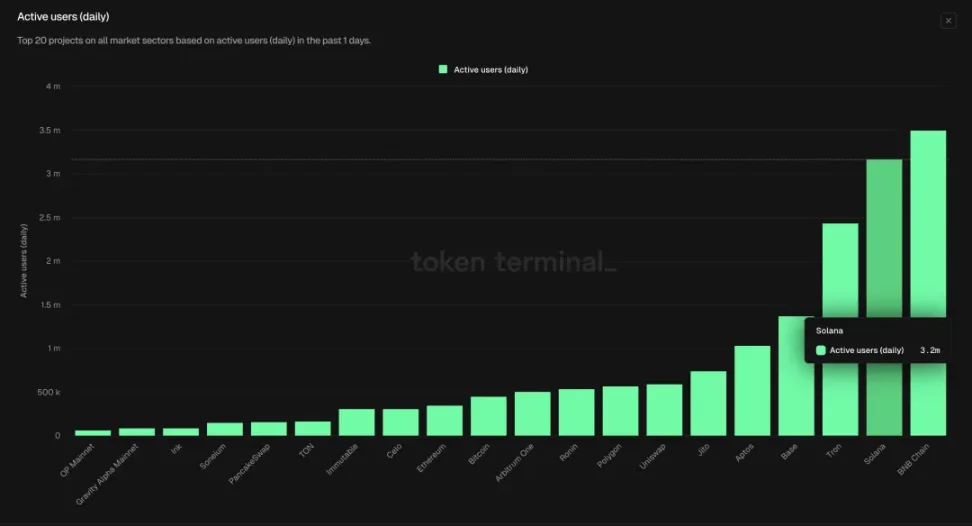

Image description: On Chain DAU, Image source: Tokenterminal

Binance has 250 million users, Hyperliquid has only 400,000, Uniswap has 600,000 active users, and Solana has 3 million daily active users. Our overall estimate is that the on-chain user base is around 1 million, and it is still in the very early stages of adoption.

However, not only are there more and more L2s, but the token economics of dApps are also becoming increasingly complex, reflecting the inability of project owners to strike a balance between their own interests and those of retail investors. Without the commitment of VCs and exchanges, the project cannot be launched. However, if the division of interests between VCs and exchanges is accepted, the interests of retail investors will inevitably be ceded.

In the evolutionary process of biology, whether it is Darwin's theory of evolution or the probability measurement of molecular biologists, they all point out a basic fact without exception: once a certain creature becomes extremely huge and has an exquisite shape, such as Quetzalcoatus, it generally means that it is entering an extinction cycle. Nowadays, it is birds that ultimately occupy the sky.

Conclusion

The exchanges are clearing out market makers, which is essentially an act of cannibalization under the existing competition pattern. Retail investors still have to face the encirclement and suppression of VCs and project parties, and the situation will not change fundamentally. The transfer to the chain is still an ongoing historical process. Even a strong company like Hyperliquid is still not prepared for the impact of hundreds of millions of users.

The fluctuations in value and price, and the game of interests and distribution will still move against each other in each cycle, constituting the blood and tears history of retail investors.