Since the beginning of this year, the biggest feature of the cryptocurrency circle is the poor sustainability of its growth, which is not only reflected in the altcoins on the exchanges, but even the on-chain currencies that performed well in Q4 2024 are facing the dilemma of a sharp decline.

The following are the rise and fall of major AI Agent currencies in 2025:

- Virtual: -79.2%

- Ai16z: -85.5%

- AIXBT: -68%

- Griffain: -80.3%

- Buzz: -72.4%

- Fartcoin: -67.5%

- ARC: -62%

- Swarms: -45%

It can be found that in less than three months, the top projects of the popular narrative have fallen by 80%. Although we cannot directly judge that the track is fake at present, the loss of attention is an objective fact and it will not be recovered in a short time.

Let’s take a look at the celebrity currency narrative. Trump fired the first shot, followed by other celebrities and even countries.

The following are the main currencies of celebrity coins and their decline from their highs:

- Trump: -77.1%

- Melania: -91%

- Vine: -92.7%

- jailstool: -93.5%

- Jellyjelly: -98%

- CAR: -98.5%

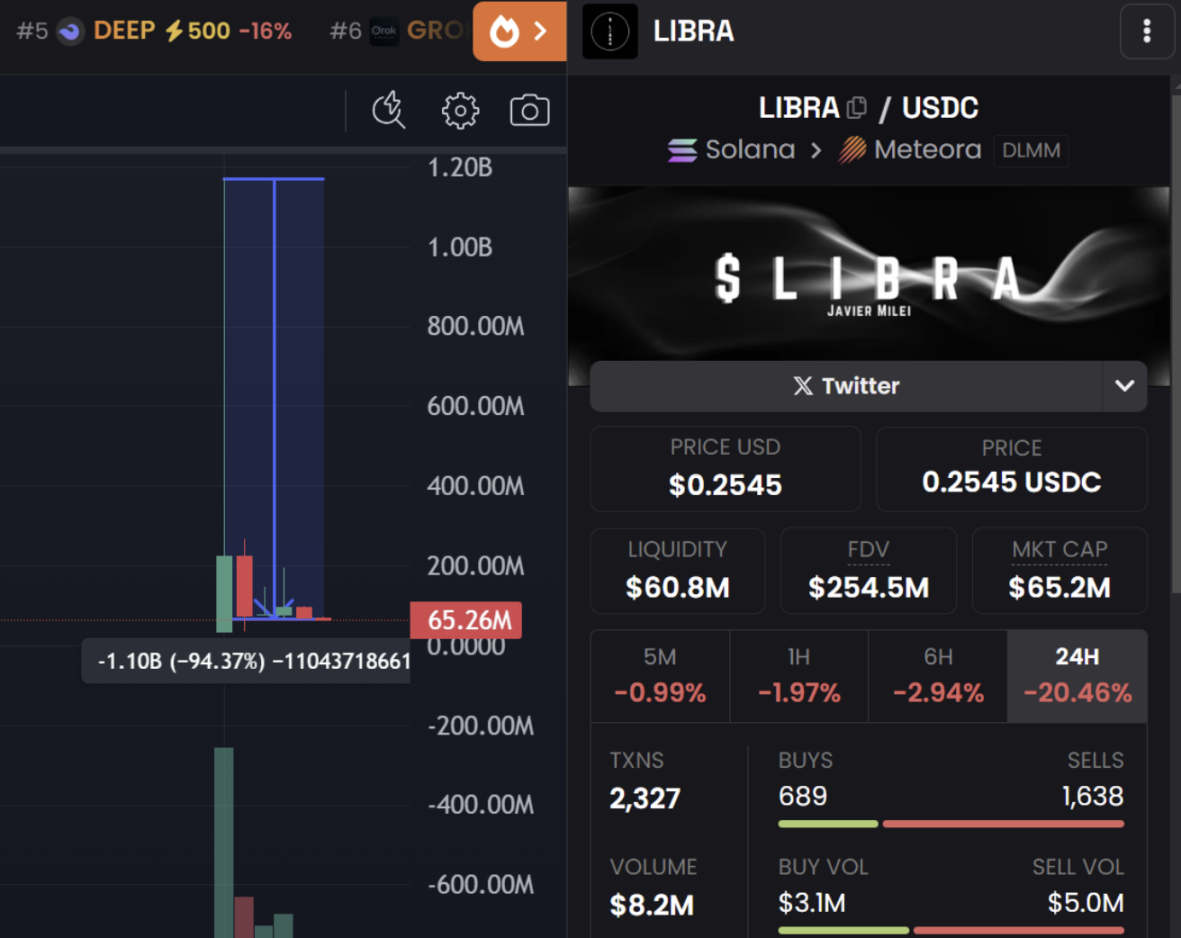

- Libra: -94.3%

There is a saying in the cryptocurrency circle that investors are more willing to speculate on new stories than old ones, which means that investors are willing to speculate on newer stories. However, compared with AI Agent, the celebrity coin track is obviously more bloodthirsty and brutal. What are the current problems of these two tracks? In the current situation where there is a lack of new narratives in the cryptocurrency circle, is there any way to break through?

Reference: dexscreener

Current narrative dilemma: pure concept speculation prevails

In the AI Agent track, many projects are still at the stage of "concept display" and "future blueprint", lacking practical products that can be widely promoted. Even if there are some operational services launched on the market, there are still problems such as complex interfaces and poor user experience, which make it difficult for ordinary investors to really stick to them. What's worse is that in order to cater to investors' expectations of "AI + blockchain", project parties often use exaggerated narratives to raise prices, but the actual landing applications are repeatedly delayed. Over time, funds lose patience and attention begins to shift, causing the prices of related tokens to fall sharply.

In the case of celebrity coins, although Trump was a hot topic at the beginning, when the token circle encountered the "celebrity ending effect", the problem was also quite obvious: there is probably no other public figure in the world who can surpass Trump in terms of topics and influence. Although politicians, Internet celebrities and stars from various countries tried to follow up, they were unable to replicate the initial capital enthusiasm and market sentiment. As the market following became weaker and weaker, the celebrity coin track also showed a "flash in the pan" phenomenon of coming and going quickly, and investors' confidence quickly lost, and the price naturally followed suit.

However, the deeper problem behind the large fluctuations in these tracks is that many projects remain at the level of "speculating on concepts" and lack a real and sustainable profit model. Whether it is AI Agent or Celebrity Coin, their core narratives rely on capital and popularity to enter the market quickly, but lack incentives for users to participate in the long term. When the heat fades, the price will be difficult to support, and it will be impossible to attract new funds to enter again.

Finding real income projects

The key to standing out in the current narrative-lacking market is to find products with "real benefits" and be "willing to share with users". The so-called "real benefits" are not just about earning the rising bubble when the exchange is listed, but about being able to continuously generate feedback through actual business models and trading behaviors, and feedback to token holders or ecosystem participants.

Among them, Hyperliquid meets the scale type. Its business is similar to that of centralized exchanges, and its revenue mainly comes from contract transaction fees. However, Hyperliquid uses 100% of the fees to repurchase Hyper tokens, and the transaction fees are determined by the transaction volume. Therefore, Hyperliquid firmly ties the currency price to the product.

According to DefiLlama data, Hyperliquid handles approximately 45% of the total 24-hour trading volume of all Perps DEXs, currently $3.78B per day, with daily revenue of approximately $1 million. It remains extremely active despite the current market downturn. Therefore, during the nearly one-month altcoin winter, the price of Hyperliquid has remained strong.

No matter how hot the narrative is, it will pass. Only projects with PMF, high user stickiness and real returns can remain in the crypto market for a long time.