Author: FinTax

introduction

In recent years, with the rapid development of the cryptocurrency market and digital payment technology, some exchanges, wallet service providers, etc. have launched their own U card products, and U cards have become a tool for more and more Web3 users to make cross-border payments and daily consumption. At the same time, the topic of U card on various social media platforms has also shown explosive growth, and U card has become a hot topic. Some people regard it as the key to solving the OTC problem of cryptocurrency, some people take a wait-and-see attitude, and some people are full of doubts about it. In this article, FinTax will introduce you to the basics of U cards, and especially remind you that you should not ignore the potential tax and other risks of U cards.

1. Concept of U card

1.1 U card

U Card is a tool that provides financial services to cryptocurrency investors. The usage of U Card is similar to that of a bank card. Cardholders can directly consume or withdraw cash through U Card without having to convert virtual currency into legal currency in advance.

U cards are divided into two categories: physical U cards and virtual U cards. Physical U cards, such as MasterCard U cards and UnionPay U cards, are more widely accepted and have a higher acceptance rate. Virtual U cards, such as Dupay, are mostly used for e-commerce or international payments, which are more convenient and flexible, but cannot be used to withdraw cash at ATMs.

Common U card issuance modes include the following:

- Direct issuance by banks. Banks use their own payment networks and compliance frameworks to provide users with stable cryptocurrency payment solutions.

- The bank cooperates with the cryptocurrency company to issue it. At this time, the bank provides the traditional financial infrastructure, and the third-party company is responsible for the management and conversion of the cryptocurrency.

- Independent issuance by professional crypto payment companies. Some companies specializing in cryptocurrency payments independently issue U cards by cooperating with payment networks such as Visa or MasterCard.

- SaaS model cooperative issuance. This refers to some third-party payment companies providing U card issuance platforms to channel merchants or other financial service providers through the SaaS (Software as a Service) model.

1.2 U card usage mechanism

U card is convenient to use, which is one of the important reasons why it is widely accepted. We can understand the usage mechanism of U card in two steps.

- Recharge: The user recharges USDT into the wallet, and then recharges USDT from the wallet address to the U card address. At this time, the U card operator will settle USDT into the corresponding foreign currency.

- Withdrawal or consumption: Users can use the U card to withdraw cash from ATMs around the world, or they can directly swipe the U card to pay for fees. At this time, the payment is in the converted legal currency, not USDT.

2. Reasons why U Card is popular

2.1 Protecting Personal Privacy

Web3 users tend to pay more attention to personal privacy, including transaction privacy, and hope to remain anonymous when paying or transferring money, while U Card provides users with an excellent privacy protection mechanism. On the one hand, virtual U Cards usually do not require real-name registration, allowing users to purchase or recharge anonymously; on the other hand, although physical U Cards may require a certain degree of KYC certification, compared to the large amount of personal information required when conducting transactions through traditional banks, U Cards still greatly reduce the risk of personal information exposure.

2.2 Simplify the payment process

U Cards can usually provide real-time payment and settlement, which not only avoids the time delay that may occur in traditional bank transfers, but also does not require the USDT to be converted into legal tender before use, making it highly convenient. At the same time, in addition to traditional POS payments, U Cards can also be paid through digital wallets, QR code scanning, etc., and are compatible with various mainstream payment channels, with strong flexibility.

2.3 Reduce cross-border payment costs

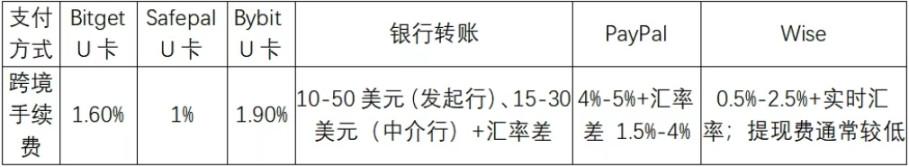

The U card transaction fee is often significantly lower than traditional payment channels, which is particularly evident in cross-border payments. The following compares the cross-border transaction fees of various payment methods:

3. Potential risks of U card

3.1 Tax risks

Due to the support of anonymity or fewer real-name requirements, some users hope to evade taxes through U cards, such as using U cards to conceal the source of income, thereby reducing the amount of tax payable. However, this behavior of evading taxes through U cards is actually not feasible. First of all, although U cards have a certain degree of anonymity, most U cards still rely on international payment networks (Visa, Mastercard, etc.). These payment networks will record the data of each transaction in detail, including transaction amount, merchant information, transaction time, etc. Therefore, the tax authorities can actually still track the flow of relevant funds through these transaction records. Secondly, for cross-border transactions, tax authorities can also track cross-border capital flows through foreign exchange monitoring systems, bank information exchanges and other means. Many countries have signed the Common Reporting Standard (CRS), and cross-border capital flows are relatively transparent. In this way, tax authorities can also obtain transaction information related to U cards. Finally, in actual use, payment platforms may also conduct strict real-name reviews for large transactions. If users are involved in frequent large-scale capital flows, the platform may require additional information such as proof of the legality of the source of funds. Therefore, tax evasion through U cards is not actually feasible and may lead to tax audits and penalties.

3.2 Legal risks

There are also some legal risks to be aware of when using U cards. For example, in some countries with strict foreign exchange management, although U cards do not set an upper limit for personal deposits and withdrawals, the outflow of funds exceeding the foreign exchange quota will also touch upon foreign exchange management regulations. If discovered by the foreign exchange management authorities, administrative fines will be imposed, and even crimes will be involved. For another example, the legal status of cryptocurrencies in some countries is still unclear, and some countries completely prohibit the use of cryptocurrencies. At this time, using cryptocurrency U cards for transactions may also be considered illegal. Therefore, before using U cards, users should understand the basic compliance requirements of the countries and regions where they are located. In addition, users should not use U cards as a tool for illegal crimes. For example, if a user uses a U card for high-frequency, large-value transactions, or helps others cash out, it will also be considered illegal operations or money laundering activities and face criminal penalties.

4. Conclusion

In short, U Card has won the favor of many people by providing an excellent off-chain payment solution for cryptocurrency investors with its strong privacy, convenient payment and low handling fee. However, U Card is not perfect. U Card users still face potential problems such as tax risks and legal risks, and must be treated with caution, otherwise the gains will outweigh the losses.