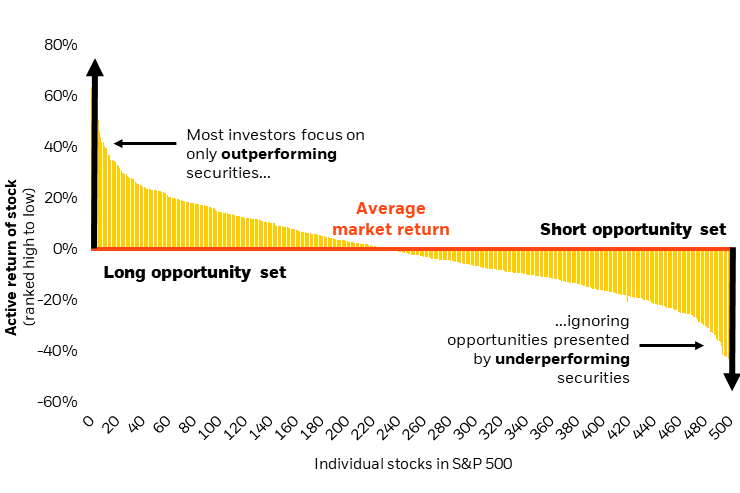

For most investors, investing always seems to be a game of "direction". When we buy stocks, cryptocurrencies or other assets, we are essentially predicting that it will rise in the future. If the market goes up as expected, we make a profit; conversely, if the market falls, we may face losses. Although this investment method that relies on the overall direction of the market (i.e. "Beta" risk) is simple and intuitive, it also means that our returns are closely linked to the "face" of the market and are full of uncertainty.

Especially in periods of volatile market or unclear market direction, predicting ups and downs becomes extremely difficult. So, is there an investment strategy that can get rid of the dependence on market direction as much as possible and seek profit opportunities regardless of bull or bear market? The answer is yes, and this is what we are going to discuss today - Market-Neutral Strategy.

What is a market neutral strategy?

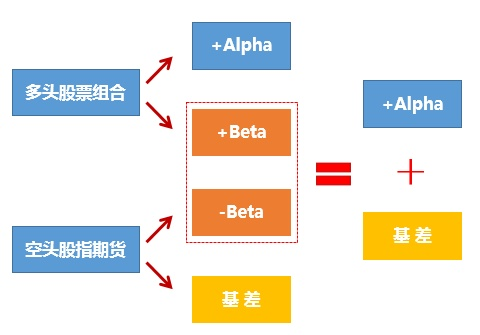

As the name suggests, the core idea of "market neutrality" is to hedge or eliminate systematic market risks (Beta risks) so that the overall performance of the investment portfolio is as poorly correlated with the rise and fall of the broader market as possible (that is, the Beta value is close to zero).

Simply put, the goal of investors adopting a market neutral strategy is not to predict whether the entire market will rise or fall, but to capture the returns brought by relative value or specific opportunities (i.e. "Alpha" returns) by simultaneously holding correlated long (buy) and short (sell/short) positions, or by taking advantage of small differences between different markets.

Imagine that instead of caring about whether the harvest from the entire orchard was good or bad, you focused on figuring out which tree in the orchard had “relatively” sweeter apples than another tree, and profiting from that “relative difference” in some way.

Common types of market neutral strategies

Market neutral strategy is not a single method, but a family of strategies that covers a variety of specific operating methods. Here are some common types:

Pairs Trading:

How it works: Find two assets with highly correlated price movements historically (like two company stocks in the same industry, or two highly correlated cryptocurrencies). When the price relationship between the two temporarily deviates from the historical norm (for example, one rises too much and the other falls too much), the strategy will buy the relatively undervalued asset and short the relatively overvalued asset. The bet is that the price difference between the two will eventually return to normal levels.

Assume that the stocks of Coca-Cola (KO) and PepsiCo (PEP) have been highly correlated over the long term. If KO is unusually strong relative to PEP (the spread widens) over a period of time, pairs traders may short KO and simultaneously buy PEP, expecting their spread to revert to its historical mean. Many hedge funds use complex models to find such opportunities across a large number of stock pairs.

Statistical Arbitrage (Stat Arb):

How it works: This is a complex and large-scale version of pairs trading. It uses complex mathematical models and computer algorithms to look for brief, statistical mispricing or correlation deviations among a large number of securities and capture these tiny profit opportunities by quickly establishing large long and short positions.

Features: This is one of the core strategies of quantitative hedge funds. For example, Renaissance Technologies is said to be an expert in this field (although its specific strategy is highly confidential). This type of strategy is highly dependent on mathematical models and computing power.

Cross-market/exchange arbitrage:

How it works: This is one of the most classic forms of arbitrage. It takes advantage of the instantaneous price difference between the same asset in different markets or exchanges to make a profit. For example, the price of a certain cryptocurrency is $100 on exchange A and $100.05 on exchange B. Arbitrageurs will quickly buy on exchange A and sell on exchange B at the same time, earning the risk-free (theoretical) price difference of $0.05.

Challenges and Participants: Such opportunities are usually fleeting and require extremely high execution speed and low transaction costs. Price differences may be due to information transmission delays, liquidity differences in different markets, etc. Such opportunities are usually captured by high-frequency trading (HFT) companies (such as Virtu Financial, Jump Trading, etc.) using advanced technology. In the cryptocurrency market, due to the large number of exchanges and global dispersion, such arbitrage opportunities are relatively more, attracting many specialized quantitative teams and individual developers to use trading robots (bots) to execute.

Market Making:

Principle: Market makers provide liquidity to the market by simultaneously quoting the bid price (Bid Price) and the ask price (Ask Price) of an asset in the market. Their profits mainly come from the bid-ask spread between the bid and ask prices. For example, a market maker is willing to buy at $99.9 and sell at $100.1 at the same time. As long as the sell orders can be continuously executed at the ask price and the buy orders can be executed at the bid price, the $0.2 spread can be earned.

Participants: Professional market makers (Specialist Firms) of traditional exchanges, trading departments of large investment banks, and a large number of professional crypto market making teams emerging in the cryptocurrency field (such as Wintermute, GSR, etc.) are all using market making strategies. They provide key liquidity for the market.

Advantages and challenges of market neutral strategies

Advantages:

Reduce directional risk: In theory, the strategy returns have a low correlation with the overall market ups and downs, which helps to maintain relative stability in turbulent markets.

Potentially stable source of returns: Focus on capturing alpha returns, potentially providing a return stream with low correlation to traditional investment strategies.

Diversified investment portfolio: Can be used as a supplement to traditional investment portfolio to reduce overall volatility.

challenge:

Risk of strategy failure: Market structure may change, causing historical correlations or pricing models to fail (such as the breakdown of the “pairing” relationship in pair trading).

Execution risk: Especially for high-frequency strategies, execution-level issues such as transaction speed, slippage, and transaction costs may seriously affect profitability.

High technical and resource barriers: Many complex market-neutral strategies require advanced algorithms, powerful IT infrastructure and professional talent.

Intense competition: As technology develops and more participants join the game, simple arbitrage opportunities become fewer and fewer, and profit margins are squeezed.

It is not completely “risk-free”: it still faces operational risk, model risk, liquidity risk, counterparty risk, etc.

Does technological progress make strategies more inclusive?

Historically, due to its complexity and high barriers to entry, market neutral strategies are often the "patent" of professional institutions such as large hedge funds and investment banks. It is difficult for ordinary investors to participate directly.

However, with the rapid development of financial technology, the situation is changing. The improvement of algorithmic trading, big data analysis and cloud computing capabilities has reduced the cost of implementing these strategies and improved their efficiency.

A noteworthy trend is that some emerging fintech platforms have begun to try to provide investment products based on such complex strategies to retail investors in a way that is easier to understand and participate in. This is reflected in both traditional finance and cryptocurrency fields:

Traditional financial sector: There are some exchange-traded funds (ETFs) or mutual funds that claim to adopt market neutral or low correlation strategies. For example, some "Alternative ETFs" or "Managed Futures ETFs" may contain market neutral elements, but investors need to read their prospectuses carefully to understand the specific strategies and risks. However, such products often have relatively high management fees.

Cryptocurrency sector: This sector is developing particularly rapidly.

The income of some centralized crypto platforms (CeFi)'s "Earn" or financial products may partly rely on market making or arbitrage activities within the platform (although transparency varies).

In the field of decentralized finance (DeFi), in many liquidity mining projects, users actually assume the role of partial market makers by providing two assets to form a trading pair (LP Token), and their income (transaction fees + token rewards) is different from the risk exposure of simply holding coins. Going further, some DeFi yield aggregators or automated vaults (such as some early strategies of Yearn Finance, or some emerging Delta-Neutral strategy protocols) will try to build more complex automated strategies to hedge against impermanent losses or market fluctuations and pursue more stable returns.

Emerging compliant crypto platforms are also exploring this. For example, the “Strategies” account launched by Neverless, a crypto platform founded by former Revolut core members, uses a market neutral strategy that combines automated high-frequency arbitrage and market making, aiming to provide users with a stable income option with low correlation with market direction.

Of course, no matter which platform provides such automated products, investors must carefully understand the specific strategy details, potential risks (including model risk, execution risk, platform risk, smart contract risk, etc.), and fee structure behind them before considering participating. They must also realize that "stable returns" are usually a goal rather than a guarantee, and that historical performance does not represent future performance. Adequate due diligence and risk assessment are indispensable.

Beyond direction, looking for value

Market neutral strategies offer investors a different perspective: no longer just betting on the unilateral direction of the market, but through more sophisticated operations, looking for relative value and certain opportunities in the complex structure and ever-changing market. Although they are not infallible "holy grails" and face their own challenges, their core concept - reducing dependence on market direction and pursuing more independent and more stable sources of income - is of great significance for building a diversified and risk-resistant investment portfolio.

As technology continues to advance, we have reason to expect that more complex investment strategies that were once "high and mighty" will be able to serve a wider range of investors in a more transparent and convenient way. Understanding the basic principles of these strategies will undoubtedly help us make more informed decisions in this increasingly complex financial world.