01

The financial market in 2025 seems to no longer belong to analysts or researchers.

It belongs in a mouth.

That’s right, it’s Trump’s mouth.

Look at what happened in the past three months:

On January 23, Trump signed an executive order to establish a digital asset task force and threatened to impose a 25% tariff on Colombian goods exported to the United States. Bitcoin fell below the psychological barrier of $100,000, with a daily fluctuation of up to 12%.

On February 27, Trump threatened to impose tariffs on Mexico and Canada, and Bitcoin further slipped to around $84,000.

In March, Trump began to criticize Federal Reserve Chairman Powell for cutting interest rates "too slowly", and Bitcoin suddenly started to rebound, with the price rising above $88,500 per coin on April 3.

On April 2, Trump imposed "reciprocal tariffs", and Bitcoin experienced a "roller coaster" ride in just one week: it rose above $88,500 on April 3, fell to $74,428 on April 7, and broke through $82,000 on April 9.

On April 17, Trump's trade war remarks triggered a swift countermeasure from China, and Bitcoin traded sideways around $84,000.

Today (April 23), the Trump administration suddenly made remarks to ease its stance, and Bitcoin soared, breaking through the $94,000 mark.

Below I have compiled a table that corresponds to the big mouth and its influence. If you are not interested, you can just scroll down.

time (scope) | event | Bitcoin | gold | US stocks |

2025-01-23 | Trump signs executive order to establish digital asset task force, threatens to impose 25% tariff on Colombian goods exported to the US | The price fell below the psychological barrier of $100,000, with a daily fluctuation of 12% | As risk aversion heats up, the London gold price rises by 0.46% to $2,702 per ounce, and the Shanghai gold price rises by 0.63% to 638.72 yuan per gram | S&P 500, Dow Jones Industrial Average fall as tech stocks sell off |

2025-02-27 | Trump's comments on tariffs on Mexico, Canada | Slipped to around $84,000 | Spot gold rose by about $8 in the short term, reaching the 2890 mark | The US dollar index broke through the 107.00 mark, reaching a high of 107.1099, an increase of 0.57% |

2025-03 | Trump criticizes Fed Chairman Powell for being too slow in cutting rates | The rebound started, and the price rose to a high of $88,500 per coin on April 3 | Affected by risk aversion and expectations of interest rate cuts, the spot gold price broke through $3,350/ounce, approaching a record high | The Dow Jones Industrial Average closed down 2.48%, one of its biggest one-day declines in recent memory. |

2025-04-02 | Trump signs so-called "reciprocal tariff" policy | On April 3, it reached a high of $88,500 per coin, on April 7 it reached a low of $74,428 per coin, and on April 9 it broke through the $82,000 mark. | - | From April 3 to 4, the three major U.S. stock indexes all hit the largest single-day decline in nearly five years. In just two trading days, the total market value of U.S. stocks evaporated by about $6.6 trillion. |

2025-04-17 | Trump's trade war rhetoric triggers swift Chinese counterattack | Trading sideways around $84,000 | Spot gold prices hit a new high, breaking through $3,500/ounce during the session, and the year-to-date increase reached an astonishing 33%. | U.S. stocks fell slightly following the news |

2025-04-23 (today) | Trump administration softens stance | Breaking through the $94,000 mark | Falling back to $3325/oz | The S&P 500 rose 2.51% to 5,287.76 points; the Nasdaq Composite rose 2.71% to 16,300.42 points; and the Dow Jones Industrial Average rose 2.66% to 39,186.98 points |

——What bull market or bear market? Now it’s a mouth market.

After seeing this, what technical analysis do you still believe in? What K-line patterns do you still believe in? What MACD, KDJ, and RSI do you still believe in?

They are all scum.

Two days ago, when I opened a position in Bitcoin around 86,000 or 7,000, I followed a simple logic: Trump wanted to "fight" Fed Powell, the dollar would weaken, and safe-haven assets would rise. The purchase volume was not large, purely to maintain market sensitivity.

Today, Bitcoin has broken through 94,000. Although I made money and made the right operations, I suddenly realized that the logic of the market has changed.

This makes me sigh: What is more terrifying than not knowing why you are wrong is not knowing why you are right.

02

The so-called "mouth market" is a market dominated by one person's speech.

Over the past three months, the global financial market has become a stage for Trump's personal show. A tweet, a speech, or a casual statement can turn the entire market upside down.

Just look at the stats to see how crazy it is:

From April 3 to 4, the three major U.S. stock indices all recorded their largest single-day declines in nearly five years. In just two trading days, the total market value of U.S. stocks evaporated by approximately US$6.6 trillion.

Gold prices soared from around $2,700 per ounce at the beginning of this year to over $3,500 per ounce during intraday trading on April 17.

Bitcoin's price has fluctuated by 34% from above $100,000 in January to a low of $74,428 on April 7 and then to $94,000 today.

And what drove all this was just the words of one person.

Perhaps we have been trying to use rational tools to navigate an irrational market.

03

Back to the sentiment I mentioned earlier: What is more terrifying than not knowing why you are wrong is not knowing why you are right.

This statement may seem counterintuitive at first. After all, most people only care about the results—making money is right, and losing money is wrong.

But in the zero-sum or even negative-sum game of investment, being right without knowing why it is right is often more dangerous than knowing why it is wrong.

Because mistakes at least allow you to reflect, adjust, and evolve. However, unclear "correctness" will reinforce the wrong thinking pattern, making you more confident to make mistakes in the next decision.

Most investment veterans die because of their blind self-confidence.

The story of John Paulson, the "God of Short Selling on Wall Street", is a textbook case. In 2007, he made $15 billion by shorting the subprime mortgage market, which was hailed as "the greatest trade in history". But in the following years, he bet his huge fortune on gold, believing that inflation would explode. As a result, inflation did not come as expected, and his fund lost more than 85% from 2011 to 2016. He had clear analysis and logic when shorting subprime mortgages, but when betting on gold, he relied more on confidence and past successful experiences. A person can go from "knowing why it is right" to "not knowing why it is right" with just one huge success.

If we don't ask "why it is right", we may fall into a dangerous cycle: continue to use past logic to guide future decisions until one day we lose everything.

04

The "mouth market" phenomenon is just a superficial phenomenon. What is the essence behind it?

It is the collapse of certainty.

When the world is full of uncertainty, the market will instinctively look for an anchor of certainty. At present, Trump's remarks happen to be this anchor - although this anchor itself is constantly drifting.

On a deeper level, this reflects a paradox: the more uncertain the world is, the more people desire certainty; and this desire for certainty will, in turn, be amplified.

This is why a single word from Trump can cause the market to fluctuate wildly. In an environment full of uncertainty, any seemingly certain voice will be given too much weight.

This phenomenon is called the "anchoring effect" in psychology - when there is insufficient information, people tend to rely too much on the first information they obtain (anchor point) to make judgments.

And Trump, as the world's most influential "big mouth", provides just such an anchor.

But the question is, how reliable is this anchor?

Almost unreliable.

Because his remarks are full of uncertainty and even self-contradictory. A week ago, he was still threatening to impose tariffs on Chinese goods exported to the United States, but today he suddenly released a signal of easing.

This is also the dilemma faced by contemporary people: looking for certainty in an uncertain world, but can only rely on equally uncertain anchor points.

05

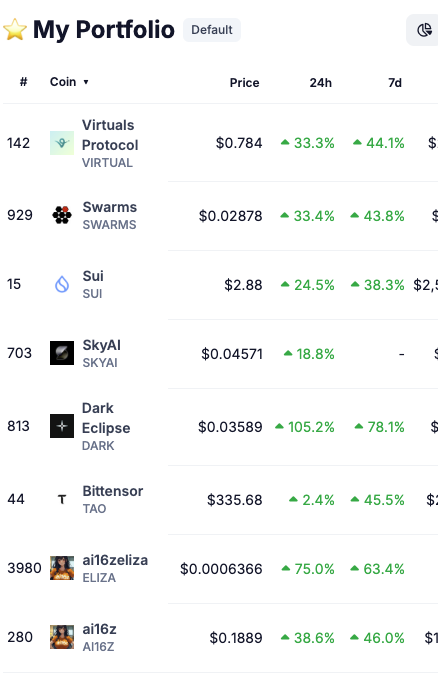

There is a sub-track that performed even better today against the backdrop of Bitcoin breaking through 94,000.

Why do AI concept coins have such a strong performance? Because the development of AI technology is irreversible and the wheel of history cannot be rolled back. No matter what Trump says or how the Federal Reserve adjusts interest rates, it will not change the trend of continued development of AI technology. Compared with traditional AI companies, the valuation of AI concept coins is still relatively low and has greater room for growth.

06

The "mouth market" cannot rely on just one mouth, but rather on finding the certainty that has been established without anyone speaking, and then firing that shot.