The market is still full of volatility this week, and capital flows are cautious. Especially under the background of pressure on U.S. stocks, BTC may become a safe-haven asset, but the altcoin market is still facing outflow pressure, and the overall investment sentiment is relatively cautious.

This week (February 10 to February 14), the crypto market showed some volatility, mainly affected by macroeconomic indicators and market capital flows:

Macroeconomic Review:

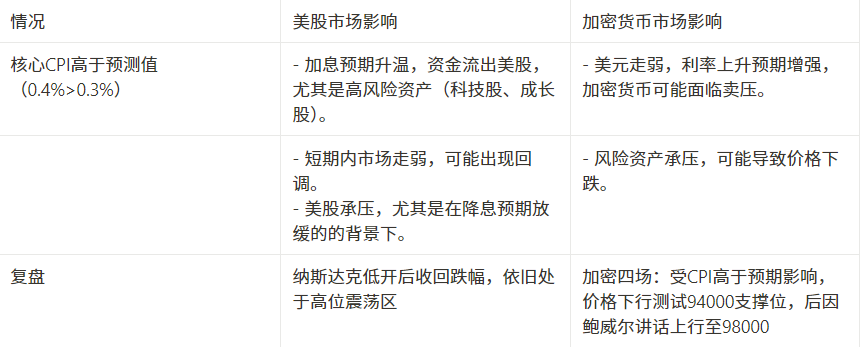

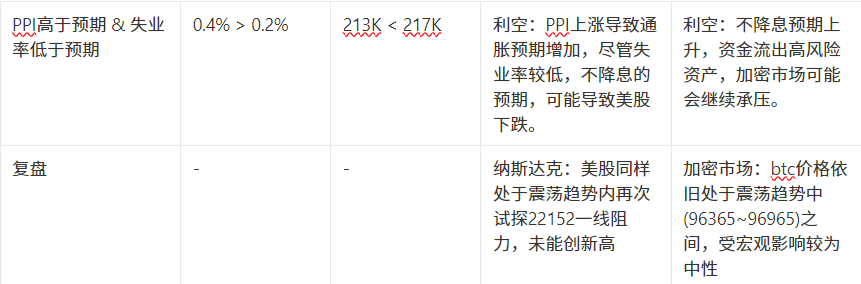

This week, the US inflation data continued to be higher than expected. Both the core CPI and PPI showed that the expectation of interest rate hikes was rising, which put pressure on the US stock market, especially the weak performance of technology stocks and growth stocks. The increase in the expectation of interest rate hikes also put pressure on the crypto market. The price of BTC fluctuated violently and was in a shock consolidation stage in the short term. The decline of the US VIX index prompted funds to start looking for safe-haven assets, and BTC may become a hedging tool.

On-chain data:

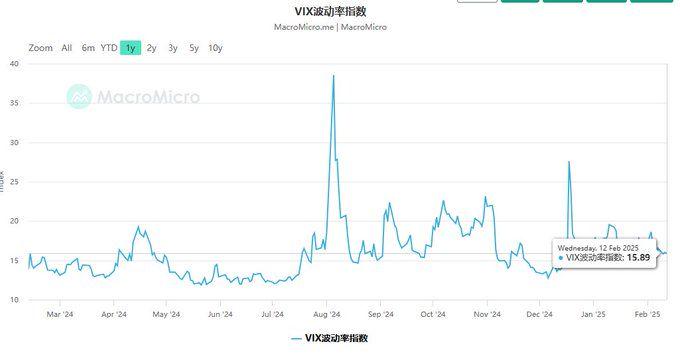

- The issuance of stablecoins has decreased : The issuance of stablecoins has slowed down significantly, indicating that the inflow of funds into the market has slowed down and the flow of funds has become more cautious, which may affect the continued rise in BTC prices.

- ETF outflows : BTC ETF inflows have dropped significantly, and the market demand for Bitcoin has gradually slowed down, which has put downward pressure on BTC prices.

- BTC trading volume and market value fluctuations : BTC's overall trading volume fluctuates greatly, but remains at a high level, indicating that the market still has certain financial support. The price remains in the range of US$96,000 to US$98,000 and may fluctuate upward in the short term.

Altcoin market analysis: Altcoin market showed some rebound this week, but due to the lack of significant relief in capital outflow pressure and the lack of macro-favorable factors, the rebound was more of an oversold correction. Due to the influence of CZ's orders, the inflow of BSC ecosystem was relatively good this week, and there was no substantial growth in other tracks.

Fund Flow and Strategy:

- BTC : BTC may face selling pressure in the short term. It is recommended to short BTC for hedging when the U.S. stock market retreats, and pay attention to buying opportunities after the market oversells.

- Altcoins : The altcoin market is still in a state of capital outflow, and it is recommended to remain cautious. Unless there is a significant improvement in fundamentals or macro-stimulus policies, it will be difficult to have sustained upward momentum in the short term.

Summary : In the absence of strong macro-economic stimulus, capital flows tend to be cautious in the current market. Investors should pay close attention to the trends of US stocks and the flow of stablecoins, and be prepared for short-term shocks and adjustments.

1. Macro

Macro data this week

2.12th

2.13th

US stocks panic, will BTC become a hedging tool?

Recently, SP500 has remained high and has not retreated significantly, but the price of BTC has been unable to stabilize at 100,000. The difference between the rise and fall of BTC and SP500, which have always been linked in the early stage, has also continued to expand.

Among the data that are being focused on, the VIX index (often referred to as Wall Street's "fear indicator"), which measures the short-term volatility of U.S. stocks, is approaching the threshold of irrational exuberance.

Therefore, it is inferred that funds in the U.S. stock market that are currently considered to be more risky are beginning to seek hedging and begin to enter the BTC market to short

Moreover, the BTC market has the characteristic of never closing, which can greatly offset the impact of events during the US stock market closure on the US stock market.

Strategy

1. The BTC market may face more selling pressure in the future, especially when the U.S. stock market faces a pullback. Therefore, when the U.S. stock market begins to show a pullback signal, open a BTC short order for hedging.

2. If the US stock market retreats and causes BTC emotional panic to intensify the market oversell, it will be a good time to buy

Macroeconomic data to watch next week

Based on the current macroeconomic dynamics, the following factors are worth paying attention to and may have a significant impact on the cryptocurrency market:

2. Industry Analysis

Interpretation of the impact of this week's on-chain data on BTC

Combined with this week’s on-chain data, the following analyzes the impact of these data on the BTC market from the aspects of capital flow , price indicators , and trading volume , and evaluates the key risks and opportunities in future trends.

Short-term trends:

- Momentum for the rise : Despite the reduction in stablecoin issuance and ETF fund outflows, BTC's market value and trading volume remain relatively strong. In particular, the recovery in BTC's overall trading volume and the rebound in market value provide support for short-term gains.

- Oscillating upward : BTC prices may oscillate upward within the current range, gradually breaking through $97,000 and approaching $100,000. However, as the market remains cautious, price corrections and fluctuations may occur, especially against the backdrop of ETF outflows and reduced issuance of stablecoins.

Key risks:

- Slowing capital inflows : The issuance of stablecoins and outflows from ETFs mean that capital inflows have slowed down and market sentiment has become more cautious, which may lead to a lack of momentum for continued increases in BTC prices in the short term.

- Funds are diverted to altcoins : The decline in BTC’s market capitalization share and the flow of funds to altcoins may limit Bitcoin’s gains and prevent it from completely dominating the market trend.

- Premium Fluctuation : Sharp fluctuations in the USDC premium may mean liquidity issues in the market, which may exacerbate market uncertainty and affect the price stability of BTC.

Key opportunities:

- Warming market sentiment : If the external economic environment improves, especially with the introduction of macroeconomic stimulus policies or capital inflows into ETFs, Bitcoin may rebound.

- Trading volume remains high : If BTC’s trading volume remains active and funds flow back into Bitcoin, BTC has the potential to break out of the current price range and move towards the target of $100,000.

2.1 Fund Flow

2.1.1 Stablecoin Fund Flow

Data interpretation

- Between 1/17 and 1/23, the issuance of stablecoins was large, which means that the inflow of funds into the market accelerated, which may have provided impetus for the rise in BTC prices.

- From 1/24-1/30 to 2/7-2/13, the reduction in the amount of additional issuance indicates that the inflow of funds has begun to slow down. This slowdown may be related to the market's price fluctuations and changes in investor sentiment.

- Specifically, during the period from February 7 to February 13 , the issuance of new stablecoins dropped significantly to 1.131 billion, indicating that new capital inflows into the market have become more cautious and the flow of funds may be more conservative.

Impact on BTC market:

- A large amount of stablecoin issuance usually means that funds are preparing to enter the market, pushing up asset prices (such as BTC). The recent reduction in the issuance of stablecoins may mean a decrease in the inflow of new funds, which may put some pressure on the further rise of BTC prices.

- The decline in stablecoin supply may also indicate that the market has entered a more cautious state, with investors perhaps waiting for clearer market direction.

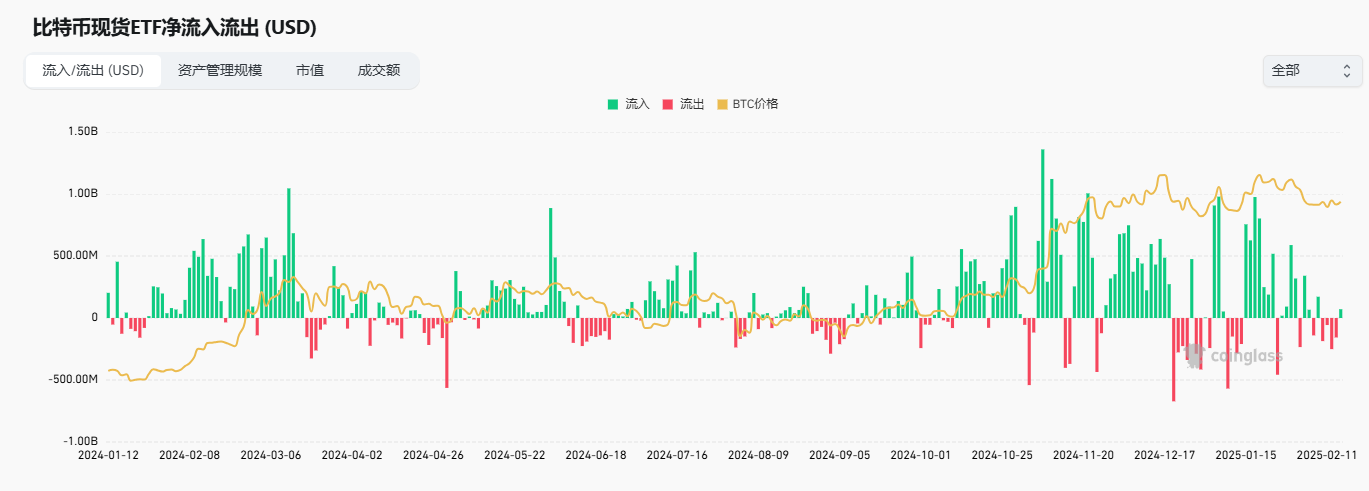

2.1.2 ETF Fund Flow

Data interpretation:

- Changes in ETF inflows : From January 20 to February 7, ETF inflows gradually decreased from 1.603 billion to 103 million, indicating that the market demand for Bitcoin has gradually slowed down. In particular, from February 10 to February 14, ETFs experienced outflows of -466 million, indicating that investors' interest in holding Bitcoin has declined.

- Relationship between inflow/outflow and price : There is a strong correlation between BTC price and ETF inflow and outflow. As the inflow gradually decreases, the BTC price also falls, which shows that ETF has a significant impact on the price as a funding channel.

Impact on BTC market:

- Declining inflows and falling prices : With declining ETF inflows and increasing outflows, BTC prices may face further downward pressure. In particular, outflow data from February 10 to February 13 suggests that market sentiment may have become more cautious and investors are withdrawing funds.

- Increase in outflow : This outflow behavior may mean that the market’s confidence in Bitcoin has weakened, and investors are more inclined to avoid risky assets, which may affect the trend of BTC in the short term.

Chance :

- Possibility of a short-term rebound : If market sentiment turns positive or new funds flow back into ETFs, BTC may rebound. However, at present, it is necessary to observe the changes in the supply of stablecoins in late February and whether the external economic environment supports capital inflows.

- Catalysts for capital re-inflows : Any news that may drive capital reflows, such as the introduction of macroeconomic stimulus policies or a recovery in market demand, may bring about market reversal opportunities.

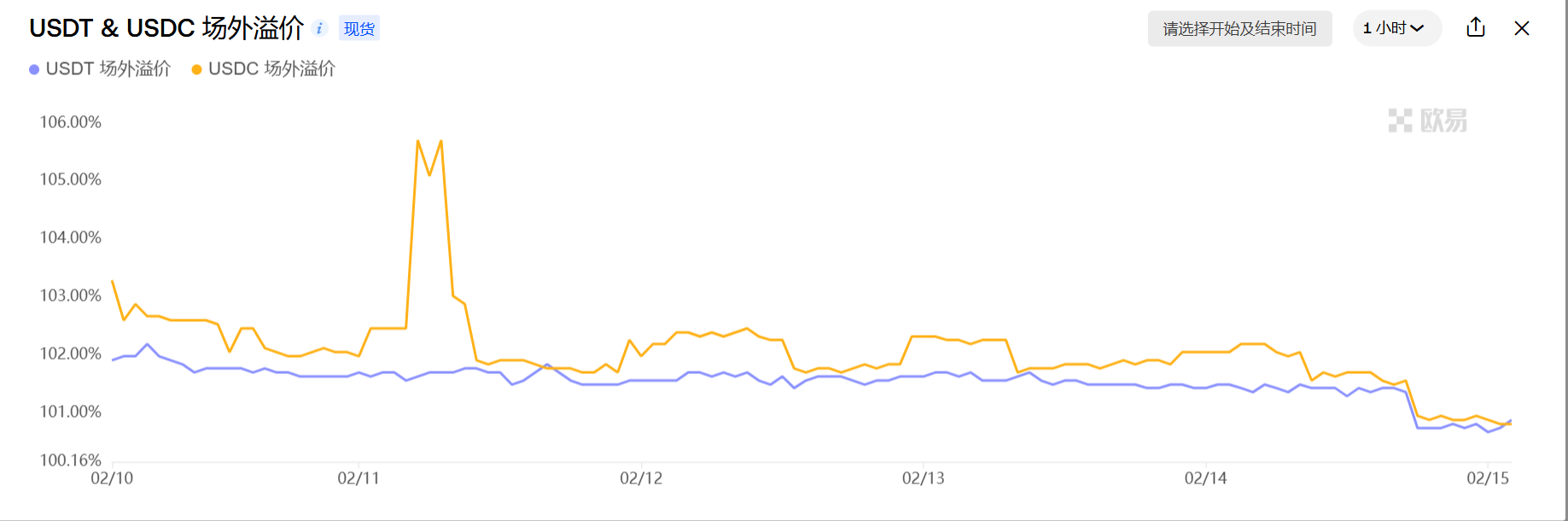

2.1.3 Premium or discount in over-the-counter transactions

- As can be seen from the figure, the USDC premium experienced a significant increase from February 11 to February 12 , reaching about 105% , and then fell back to close to 101% on February 13 , while the USDT premium fluctuated relatively steadily, remaining around 101%.

- The sharp rise in USDC's premium may be due to a sharp increase in demand for USDC in the market, reflecting tight liquidity or increased market uncertainty. Such premium fluctuations, especially increases, usually mean that there is a shortage of funds in the market and investors may be looking for a stable value storage tool.

- USDT's premium remains stable , indicating that the USDT market is relatively stable and there is no obvious surge in demand.

Impact on BTC market:

- Unstable capital inflows : If the demand for USDC remains strong and the market continues to flow to stablecoins, BTC may face capital outflows, especially in the short term. If the funds flowing into the BTC market fail to flow back effectively, it may lead to a pullback in BTC prices.

- Potential price shocks from premium fluctuations : Sharp fluctuations in the USDC premium may exacerbate market uncertainty, especially after the premium peak. If market sentiment changes or liquidity cannot be restored, BTC prices may be subject to volatile pressure.

2.2 Related price indicators

2.2.1 Cryptocurrency Market Value

1. Cryptocurrency Market Cap

- Market value rebound : According to charts and data, the total market value of cryptocurrencies showed a weak rebound trend this week. It rebounded from the lowest point on February 8 (US$3.256 trillion) to US$3.362 trillion on February 13 , with a weekly increase of 3.26% . This rebound shows that the overall market sentiment has recovered, especially when the market value is close to US$3.25 trillion, investors' confidence in the cryptocurrency market has increased.

- Market capitalization trend : Despite the rebound in total market capitalization, it has not yet recovered to the high point of last December (nearly $3.75 trillion), indicating that market sentiment remains cautious. The recovery of the overall market capitalization is accompanied by the relative strength of the BTC market, which may indicate that funds are flowing into Bitcoin at a faster rate, driving Bitcoin to dominate the market.

2. BTC Dominance

- BTC's share has declined : According to the data in the second figure, Bitcoin's market capitalization share (BTC Dominance) has declined this week, from about 62.47% to 60.37% , a decrease of 1.91% . This shows that although Bitcoin's dominance in the market is still strong, funds may also flow to other assets in the near future, especially some altcoins .

- Retracing to the middle track of the channel : BTC Dominance is currently retracing to the middle track of its parallel channel , which usually means that Bitcoin's market share is facing a technical support area. If this support can be effectively maintained, it may lead to a rebound in Bitcoin's share; but if it breaks through this support area, it may further decline, resulting in a decline in Bitcoin's market share.

3. Impact on the BTC market

- Funds flow to Bitcoin : Although the market value rebounded, the decline in BTC's market share shows that while funds flow into Bitcoin, some funds may also flow into other crypto assets or altcoins. Therefore, the price increase of Bitcoin may be limited to a certain extent, and the capital flow in the market is more dispersed.

- BTC's safe-haven properties : The rebound in market value may be related to investors' increased safe-haven demand for Bitcoin. Especially when economic uncertainty intensifies, investors may be more inclined to concentrate their funds on Bitcoin. However, as BTC's share falls, the flow of funds may not be completely concentrated on Bitcoin, but there is a phenomenon of diversion.

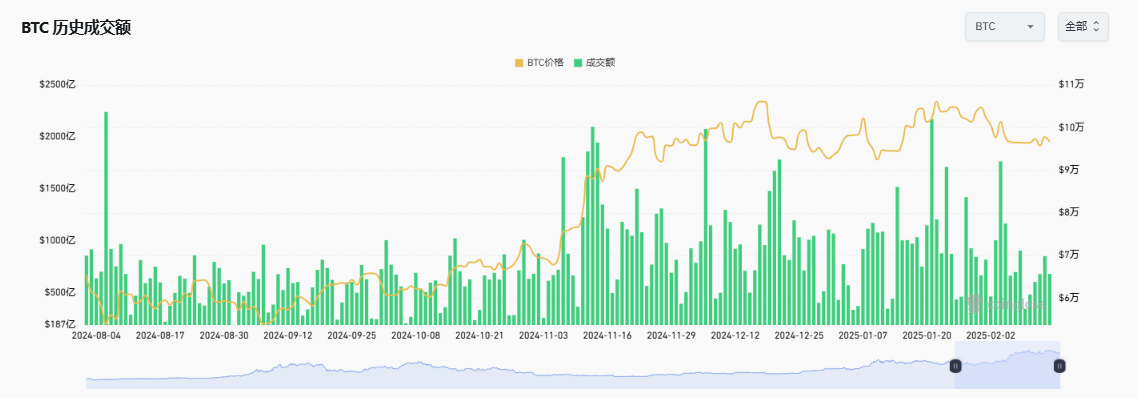

2.2.2 BTC overall transaction volume

Changes in trading volume:

- The transaction volume started at about 904 million on February 7, gradually decreased to 343 million on February 8, and then rebounded to 849 million on February 12, and 679 million on February 13.

- The trading volume was highly volatile, especially between February 7 and February 8, when there was a significant drop. After that, the trading volume gradually recovered, especially on February 12, when the trading volume rebounded to 849 million, and the price also rebounded, breaking through $97,000.

Price Fluctuations:

- The BTC price fluctuated greatly during the week. The price was $96,490 on February 7, and fell slightly to $96,412 on February 8. It then reached highs of $97,379 and $97,816 on February 10 and February 12, respectively, but also experienced a pullback to $95,784 on February 11.

- Overall, despite the volatility of trading volume, the BTC price has remained in the range of $96,000 to $98,000, showing relative stability.

Impact on BTC market:

- Acceleration of capital inflows: If trading volumes continue to remain at high levels, especially against the backdrop of rising volumes on February 12, BTC may further break out of the current range and challenge the key psychological level of $100,000. The continued inflow of institutional funds may drive prices to continue to rise.

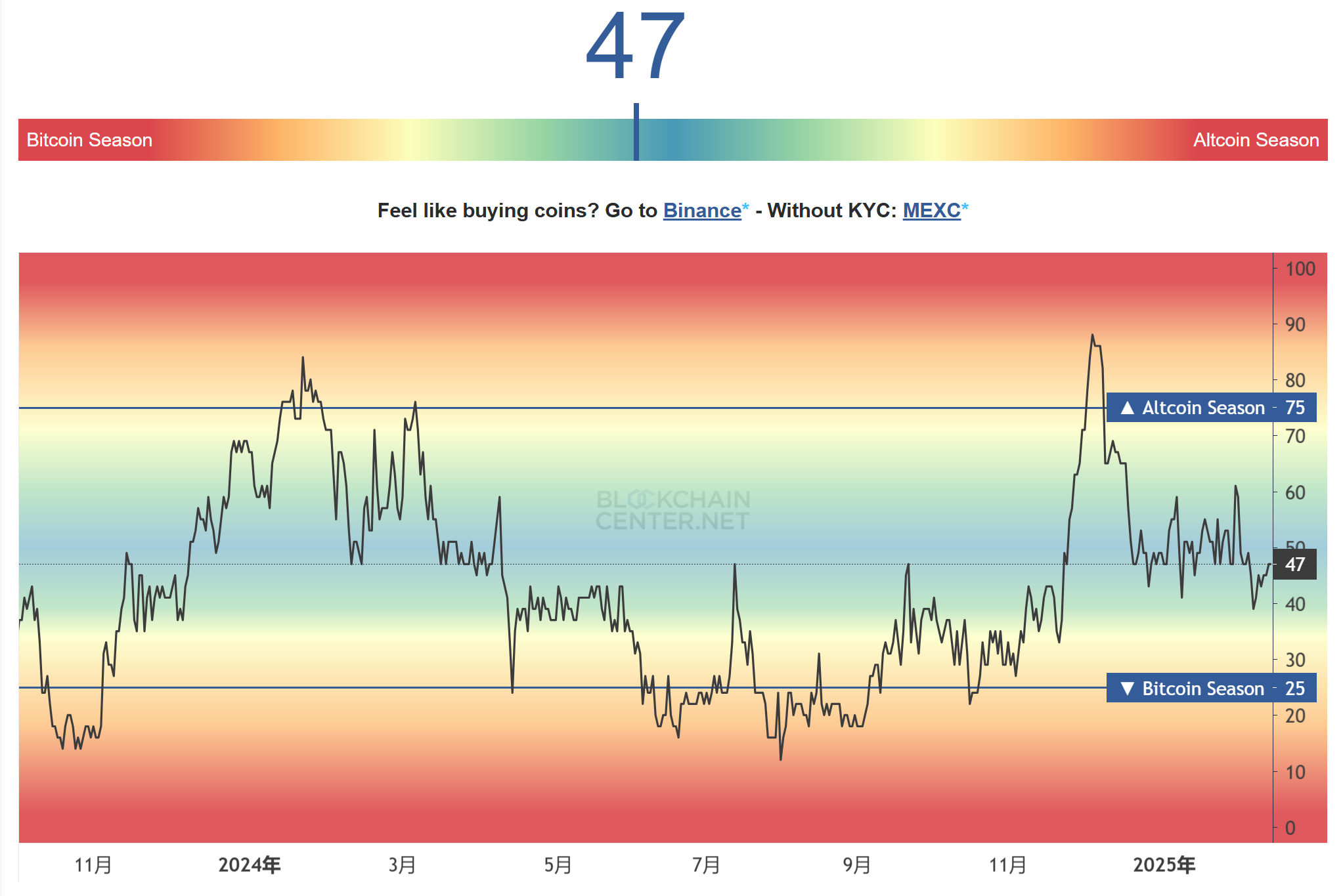

Analysis of the Shanzhai Section

Combining this week's macroeconomic indicators and market data analysis, the altcoin market is experiencing continuous adjustments and capital outflow pressure. The following is an analysis of this week's altcoin market performance from multiple dimensions, including altcoin season indicators, capital flows, BTC market share, OTHERS market share, and USDT market share , and looks forward to possible future development paths.

1. Shanzhai Season Indicators

The Shanzhai Index was 47 this Friday. The index showed that some Shanzhai stocks rebounded this week, but whether this rebound can continue remains to be seen.

Cryptobubbles shows us that this week’s altcoin rebound is generally on exchanges:

*2025.02.14*Our understanding of this week's rebound is that, except for the BSC ecosystem, the other tokens are basically oversold rebounds against the backdrop of BTC bull and alt-bear markets. The reasons are:

- There was no substantial positive news in the macroeconomics this week, but several important data showed that the expectation of the Fed's interest rate hike has increased.

- In the copycat market, only the BSC ecosystem was affected by CZ's orders and absorbed a large amount of market heat and liquidity. The other tracks had basically no fundamental improvements or surge in inflows.

Therefore, this rebound is more likely to be an oversold rebound. As to whether this rebound can at least provide support for altcoins in general, thereby starting a new round of rising prices, we still need to gradually verify it through subsequent data and the market.

2. Bull market escape indicator list

Although the market rebounded this week, it is still far from our bull market peak escape standard, so none of the indicators have been hit.

3. Inflow of copycats

The market inflow situation showed a slight improvement this week. The net outflow of all currencies reached US$2.034 billion on the 7th, a decrease of -58% from last week (4.957 billion). The net outflow rate has eased significantly, but it has not yet returned to normal. Macroeconomic positive factors are still needed to boost market confidence.

*2025.02.14*In addition, BSC showed a net inflow of $11.9143 million on a 12-hour basis. As we mentioned above, this is due to the increase in funds brought by CZ's recent activity and shouting. However, we believe that this trend is not sustainable. It is limited by the performance of BSC itself and CZ's gameplay, which failed to bring wealth effects. Instead, it was another round of insider trading, which was bound to be criticized by the community. It is expected that some funds will continue to return to Solana after this wave of market conditions ends.

4. BTC market share

This week, BTC market share finally began to decline after the sharp rise last week and before the New Year. The daily MACD and RSI both showed signs of overbought and dead cross, but due to the lack of substantial positive factors in the cottage industry, funds did not return in large quantities, so this decline should be interpreted as a normal decline. The white dotted trend line and the red resistance range below are still potential support points. What we need to observe is whether this support will be tested and whether it can be broken. We believe that this depends largely on the macro environment. We are currently pessimistic in the short term, and interest rate cuts may need to wait until the second half of the year.

5.OTHERS.D

In contrast to BTC.D, both the daily MACD and RSI of OTHERS.D show a golden cross after oversold. Perhaps we can expect a sustained rebound, with the upward resistance level reaching the long-term support line.

6. USDT market share

Finally, USDT market share and BTC market share began to decline after a strong period, and USDT market share has now fallen back above the long-term support line. Based on previous experience, before a major change in the market comes, we may continue to fluctuate around this support line for a period of time.