1. Vitalik’s Ethereum Simplification Plan: From “Functionalism” to “Minimalism”

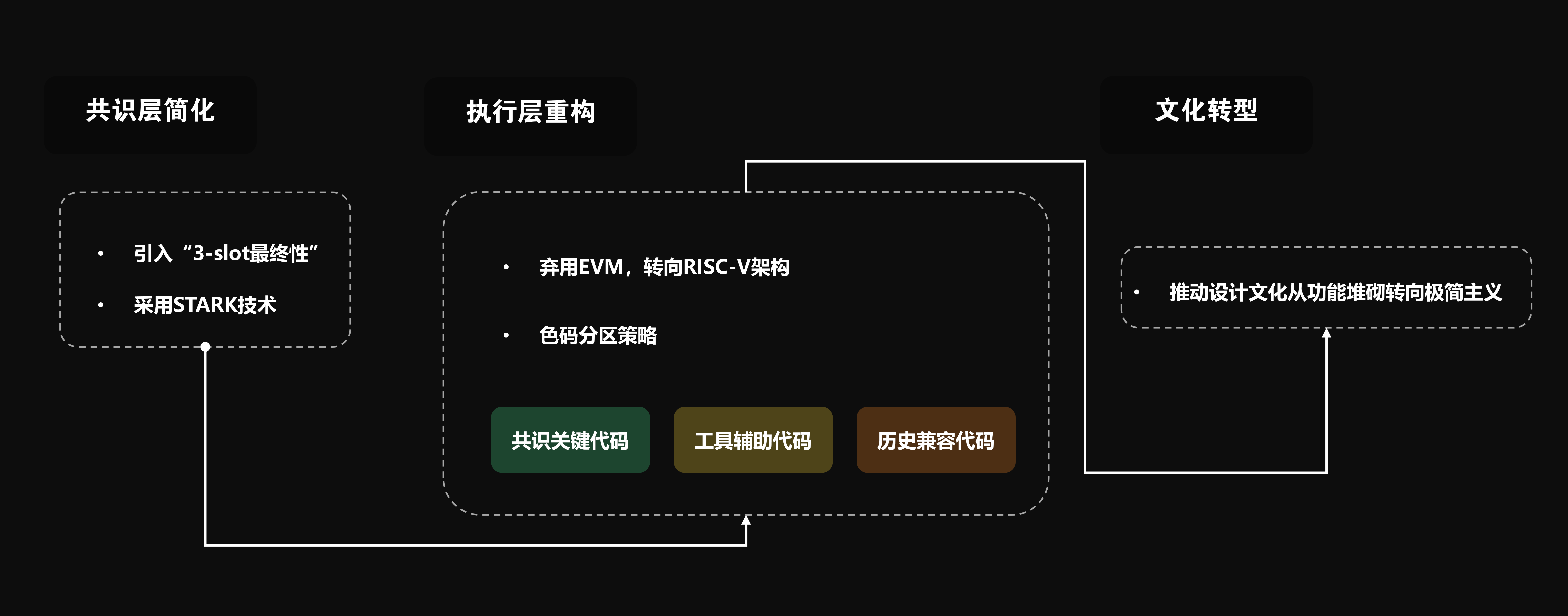

Ethereum co-founder Vitalik Buterin proposed a disruptive long-term plan in 2025 to simplify Ethereum's core protocol to a level close to that of Bitcoin. The core idea of this plan is to improve resilience and decentralization by reducing protocol complexity. The specific paths include:

2. Simplicity and functionality

3. Layer 2 melee: Why is Ethereum’s “clone” caught in internal friction?

Although Ethereum has expanded through Layer2 (similar to a "sub-network"), the ecosystem has encountered three major crises:

Game of Thrones: Where is the promised decentralization?

The core controllers of the top Layer2 (such as Arbitrum) are still in the hands of the development team, and users are worried about the "restoration of centralization";

Token economy failed: ARB and other tokens plummeted as soon as they were launched, while Coinbase's Base chain made a comeback by "not issuing tokens + engaging in social networking";

2. External strong enemies siege

Solana attracts users with "second-level transactions", while TON grows wildly with Telegram's 900 million users;

Ethereum's Layer2s are caught in homogeneous competition: issuing points and airdrops, but their functions are similar;

3. Developers complain

“Now making DApp is like opening a chain store - every Layer2 has to be renovated, the cost is too high!”

IV. ETF clearance: an opportunity but also a shackle

SEC gives the green light: Ethereum spot ETF approved in May 2024, officially traded in July, attracting $9 billion in the first week;

Price roller coaster: ETH once rose to $3,700, but fell back to the $3,000 range because it could not be pledged (for fear of being identified as a security);

Future Impact:

Institutional funds may flow into Layer 2 tokens and AI projects (such as the rendering network RNDR), exacerbating market differentiation;

Regulatory sequelae: ETFs cannot be pledged, which is equivalent to buying gold but not being able to deposit it in a bank to earn interest, which reduces its long-term appeal;

5. The biggest challenge of the five-year plan: ideals are very promising, but reality is too bleak

Switching to the RISC-V architecture requires rewriting smart contracts. Old developers bluntly said: "What's the difference between this and learning a new language?"

Risk of community division: Some people think that the existing ZK-Rollup technology is sufficient and there is no need to mess around with it;

The user growth rate cannot keep up with the decline in gas fees, and the money earned by the DA layer (data storage) cannot support the ecosystem;

The envisioned "modular application explosion" has not yet been seen. Do you think Vitalik's five-year gamble will pay off?