This week, as Trump's tariff trade trend improved, the market saw a massive general rise, led by Ethereum ecology and AI, all of which rose by more than 20%. At the same time, the crypto market was in turmoil again. Movement was accused of manipulating the market-making agreement, which led to the collapse of the coin price, involving operators such as Web3Port, which triggered the market to reflect on industry ethics and supervision; at the same time, AI and PayFi tracks accelerated their development, BNB Chain promoted the MCP standard, OKX and Binance laid out the payment ecology, and the policy trends indicated that the crypto market is facing a new round of reshuffles and opportunities.

1. Movement event - the crash caused by the market making protocol

This week, with Movement's trading being suspended by Coinbase and Binance's subsequent postponement of Movement (MOVE) HODLer airdrop, Movement was once again at the center of public opinion. The project raised more than 40 million yuan and was selected into the World Liberty Financial crypto investment portfolio supported by Trump.

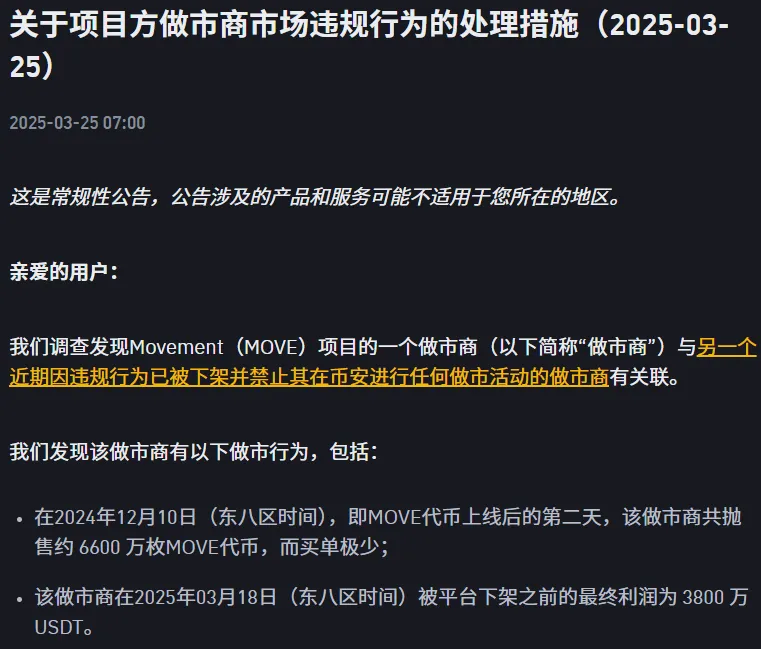

Suspicion of manipulation is at the core of the Movement incident, involving a market-making agreement between Rentech and the Movement Foundation, which was accused of incentivizing price manipulation. According to CoinDesk, the contract between the Movement Foundation and Rentech handed over about half of the circulating MOVE tokens to Rentech for control, and the contract incentivized Rentech to push up the token valuation to $5 billion and then sell it for profit, resulting in 66 million tokens (worth $38 million) being sold on December 9, 2024, the day after the launch, and the price of the token plummeted.

Interestingly, after the sell-off, the Movement Network Foundation announced that it would repurchase 38 million USDT worth of MOVE on Binance in the next three months in an attempt to stabilize community sentiment, but a few days later it deposited 17.15 million MOVE into Coinbase.

Rentech’s role and contractual disputes:

- Rentech is a company with almost no digital footprint, but it sold 66 million tokens (worth $38 million) after MOVE went online. The contract disclosed by CoinDesk shows that Rentech played the dual role of Web3Port subsidiary [Web3Port is accused of similar operations in other projects (such as MyShell and GoPlus Security), and the community calls it a "harvester"] and Movement Foundation agent in the transaction, suspected of self-dealing.

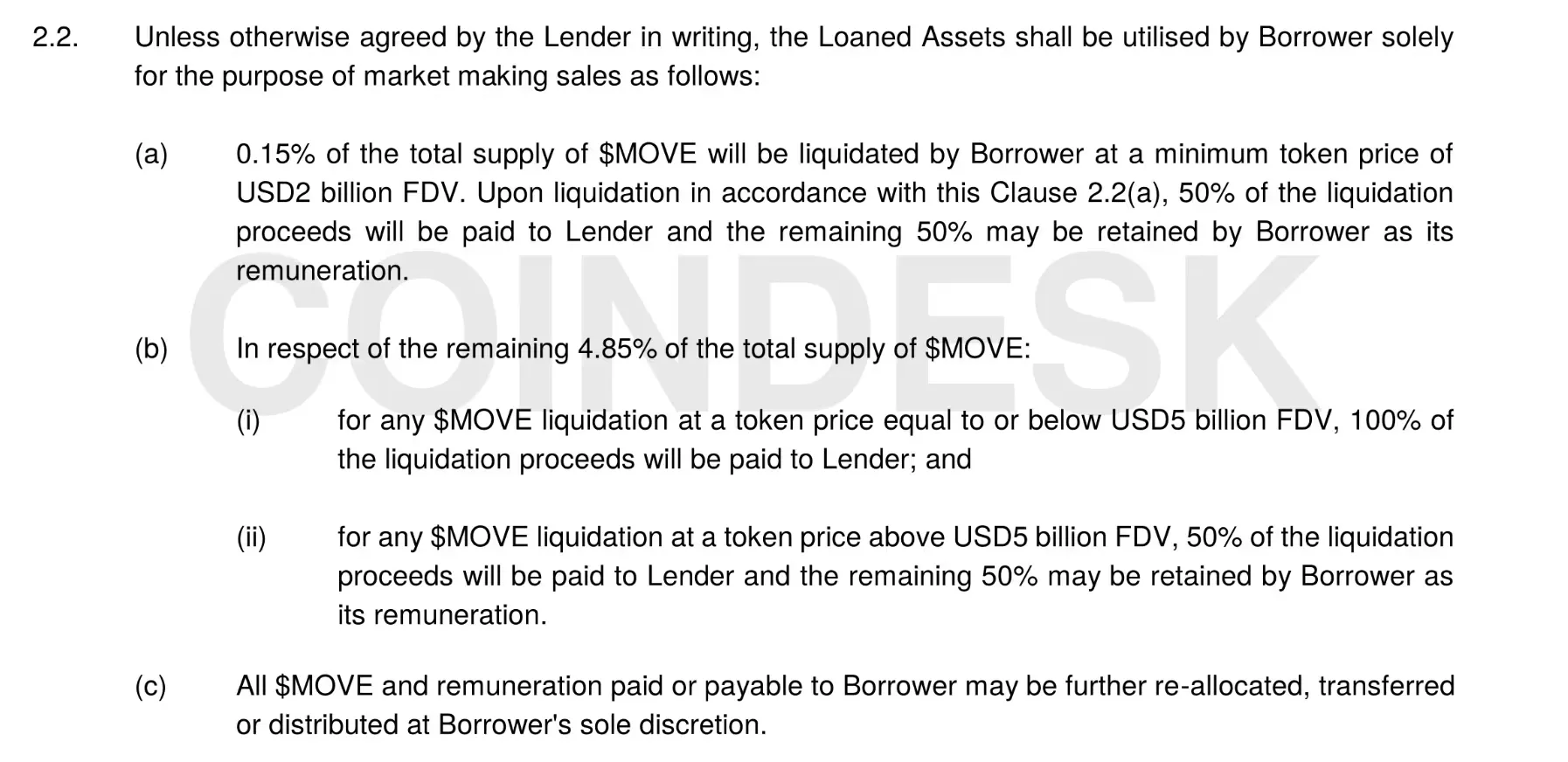

- The contract terms include an incentive mechanism : if the fully diluted valuation (FDV) of MOVE exceeds $5 billion, Rentech can liquidate the tokens and split the profits with the foundation at a 50:50 ratio. Crypto expert Zaki Manian criticized this clause for "encouraging artificially inflated prices and then selling them," posing a potential risk of manipulation.

- Movement Foundation legal counsel YK Pek initially called the agreement "the worst agreement" and foundation director Marc Piano also refused to sign it. However, co-founder Rushi Manche pushed for a revised version of the agreement to be signed on December 8, 2024, deleting some controversial clauses but retaining the core incentive structure. Web3Port can still borrow 5% of the total supply of MOVE tokens and sell them in a certain way to achieve profits.

- According to three people familiar with the negotiations and legal documents obtained by CoinDesk, Rentech claimed to be a subsidiary of Chinese market maker Web3Port and offered to provide $60 million in collateral assets out of its own pocket, a move that impressed the foundation to some extent. It is worth noting that Rentech’s domain name “web3portrentech.io” was registered on the day the agreement was signed, indicating the temporary and suspicious nature of the operation.

Web3Port

Previously, CZ forwarded Kuai Dong (@_FORAB)’s disclosure article on market maker Web3Port, which stated:

May Liu, a core figure of Web3Port, and her team established a "brokerage pipeline for listing on Binance", from Spark Digital Capital to Web3Port, and then to Whisper.

Initially, Spark operated under the name of VC, but actually relied on market outsourcing + FA business, allowing VC to invest in projects and obtaining free tokens. After the industry involution in 2021 and 2022, project parties were no longer willing to give tokens for free, so they turned to the incubator model and established Web3Port, providing project packaging and VC docking in exchange for 1-3% tokens.

However, the incubator alone could not realize the funds, so the market maker Whisper was established. In the name of market making, it actually created a delivery window for the free tokens in its hands. In the end, this system became a complete assembly line from packaging financing to exit, and Binance retail investors became the final payers.

What is even more shocking is that Web3Port signed a similar agreement with Rentech as early as November 25, 2024, bypassing the Foundation's review. Rentech was marked as a representative of "Movement" in the document. This shows that key arrangements have been implemented in advance in informal channels, laying the groundwork for the subsequent thunderbolt.

In addition, cryptocurrencies are usually supposed to have a lock-up period to prevent early selling. However, in the Movement incident, Web3Port obtained tokens through the protocol and immediately sold them, which became the core issue of outside doubts about insider trading.

After the incident broke out, Movement Labs, market makers Rentech/Web3Port, co-founders and founders blamed each other. Movement claimed that it was misled by Rentech and Web3Port, while Rentech insisted that the agreement was approved by Movement. At present, the project has commissioned the Groom Lake audit agency to investigate the market making anomalies, and many executives and legal advisors have been reviewed. The credibility and governance of the project have been seriously challenged, and the price performance of Move is not optimistic in the future.

This incident exposed in detail for the first time the lack of supervision of the market-making mechanism and the dark areas of the opaque legal framework, but it is worth considering that the movement incident may be just the tip of the iceberg in the dark areas. In theory, market makers are entrusted by the project party to provide liquidity for new tokens and maintain price stability and market depth through buying and selling operations. However, in actual operations, if there is a lack of supervision or transparent mechanisms , market makers may be abused as a tool to manipulate the market and secretly transfer a large number of tokens, which will damage the rights and interests of ordinary investors and undermine market fairness.

2. AI & PayFi

This week, BNB Chain officially released an article about MCP and the bnbchain AI revolution. The main idea of the article is that BNB Chain hopes to provide developers with a standardized and secure AI integration framework through MCP [MCP (Model Context Protocol) is an open protocol that standardizes two-way communication between AI applications and external systems. It allows AI to more easily access the required context and tools, such as the "USB interface" provided for AI models. ] and a series of AI support plans, aiming to promote AI innovation in the Web3 ecosystem, solve blockchain data access and security challenges, and help build an "agentized" future.

BNB Chain will support AI in three parts: BNB AI Hackathon (encouraging developers to build AI+Web3 applications on BNB Chain), Al Agent Solution (helping developers create, deploy and monetize AI agents), and MVB Program (an AI-focused incubator that provides funding, mentors and business support for AI projects). This tweet received widespread attention because it was forwarded by CZ.

In the previous review of the highlights of the Hong Kong Conference, we also focused on the fact that AI has always been a hot topic since GPT. Not only is AI in traditional Web2 hot, but in the Web3 world, various AI memes or altcoins that use the AI concept are emerging in an endless stream. This shows the important position of AI in the mainstream narrative.

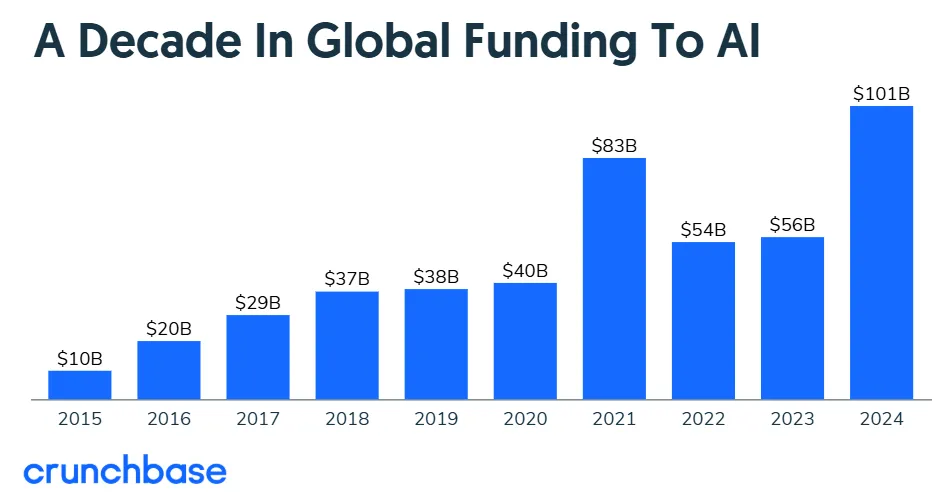

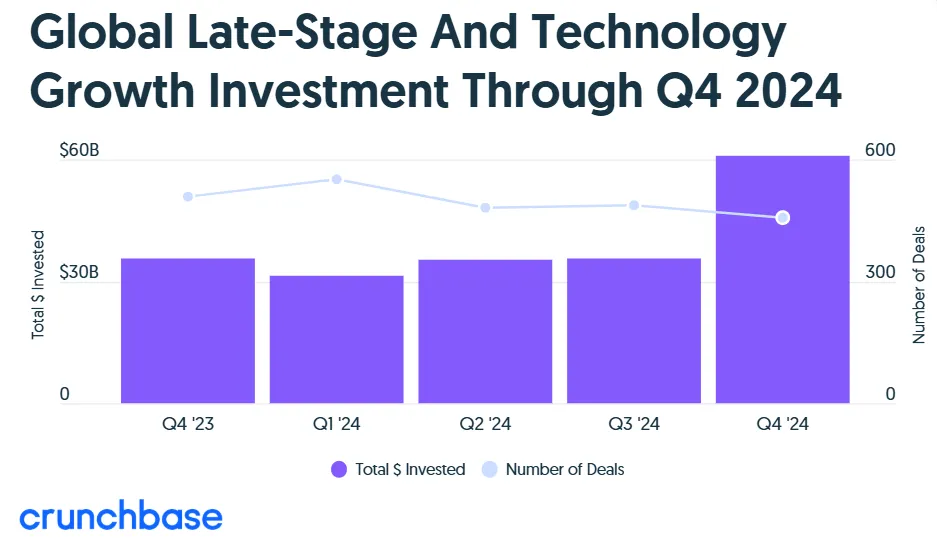

In particular, the past 2024 was a breakthrough year for AI company financing. Nearly one-third of global venture capital went to companies in AI-related fields, making AI a leading financing field. Crunchbase data shows that funding for AI-related companies exceeded $100 billion, an increase of more than 80% year-on-year from $55.6 billion in 2023. The amount of funding in the AI industry in 2024 exceeded every year of the past decade, including the global financing peak year in 2021.

Late-stage financings reached $61 billion in the fourth quarter of 2024, up more than 70% quarter-over-quarter and up year-over-year from the $36 billion invested in the fourth quarter of 2023, according to Crunchbase data. The biggest change in the fourth quarter compared to the same period last year was the increase in $1 billion rounds. Significant funding was raised in a variety of sectors including artificial intelligence, applied AI, energy, semiconductors, banking, security, and aerospace.

In addition, according to data from May 2024, AI startups received more VC financing in the seed, A and B rounds than non-AI startups.

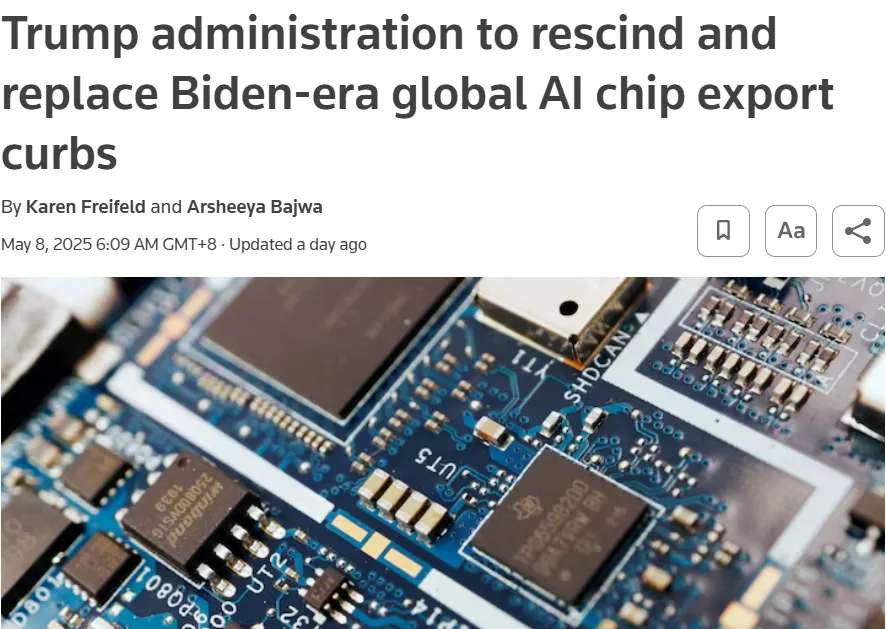

And the Trump administration plans to roll back Biden-era restrictions on artificial intelligence chips as part of a broader effort to revise semiconductor trade restrictions that have drawn strong opposition from major technology companies and foreign governments, according to people familiar with the matter. The policy divides countries into three categories to regulate chip exports from companies such as Nvidia Corp (NVDA.O).

The United States dominates AI financing, accounting for 46.4% of the value of US VC transactions in 2024, totaling about $97 billion, with nearly 4,000 transactions. According to the development situation, the number of Web3 AI projects is expected to usher in explosive growth this year. Although it is not discussed whether they will divert the existing market liquidity, it is certain that they will bring new wealth opportunities and value creation space to the market.

Currently, the un-coined AI projects worth noting are: 0G (raised $105 million), Sentient (raised $85 million)

In the payFi track, OKX launched OKX Pay on April 28, focusing on stablecoin payments. The initial support is USDT and USDC, and more stablecoins will be gradually connected in the future. Binance cooperated with the Kingdom of Bhutan on May 7, jointly with Binance Pay and DK Bank to launch the world's first national encrypted tourism payment system. The layout of the two leading exchanges seems to confirm the potential of this round of payFi track, especially in the context of stablecoin regulatory compliance.

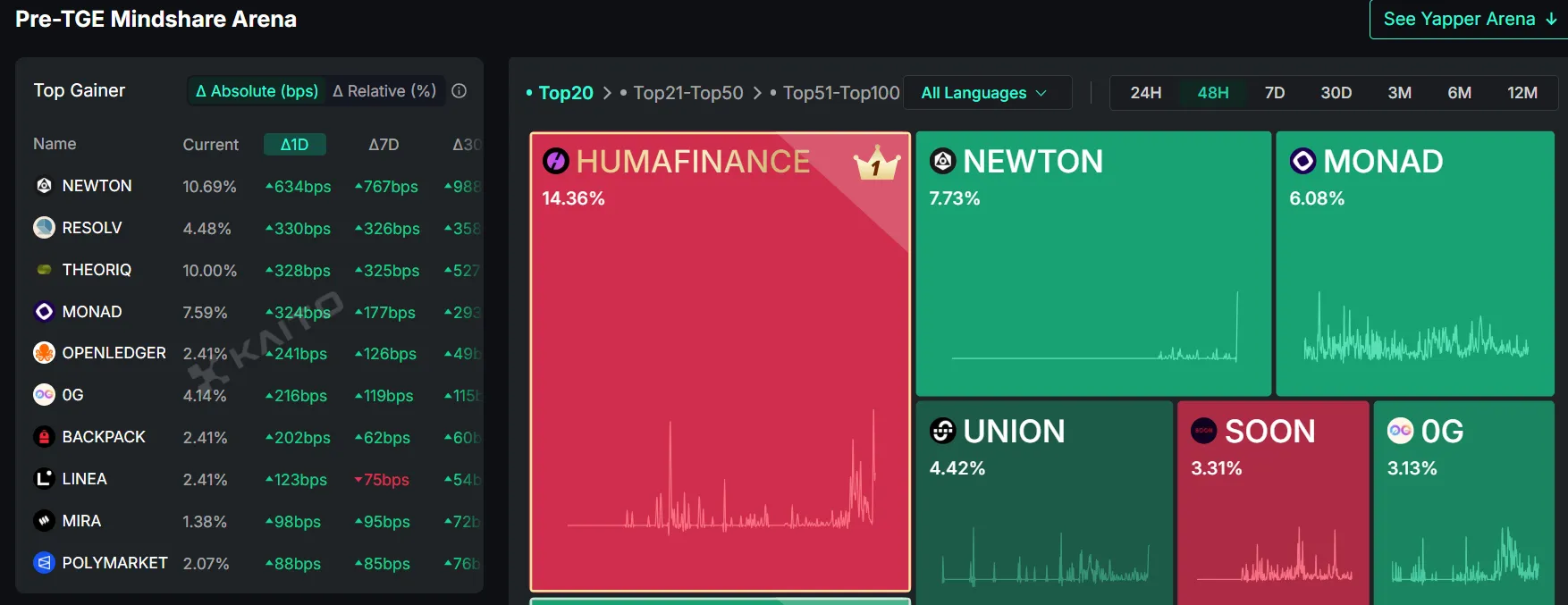

The deposit activity of Huma Finance, which was previously recommended in the payFi track, is very popular and has also become popular on Kaito. Its team said that it will issue tokens in Q2. If you want to participate now, you can also seize the last opportunity. The project has raised a total of US$46.3 million in two rounds of financing, and has received investments from well-known American institutions such as Distributed Global and Circle Ventures (issuer of stablecoin USDC). Lily Liu, chairman of the Solana Foundation, also participated in the investment.

III. Policy Supervision

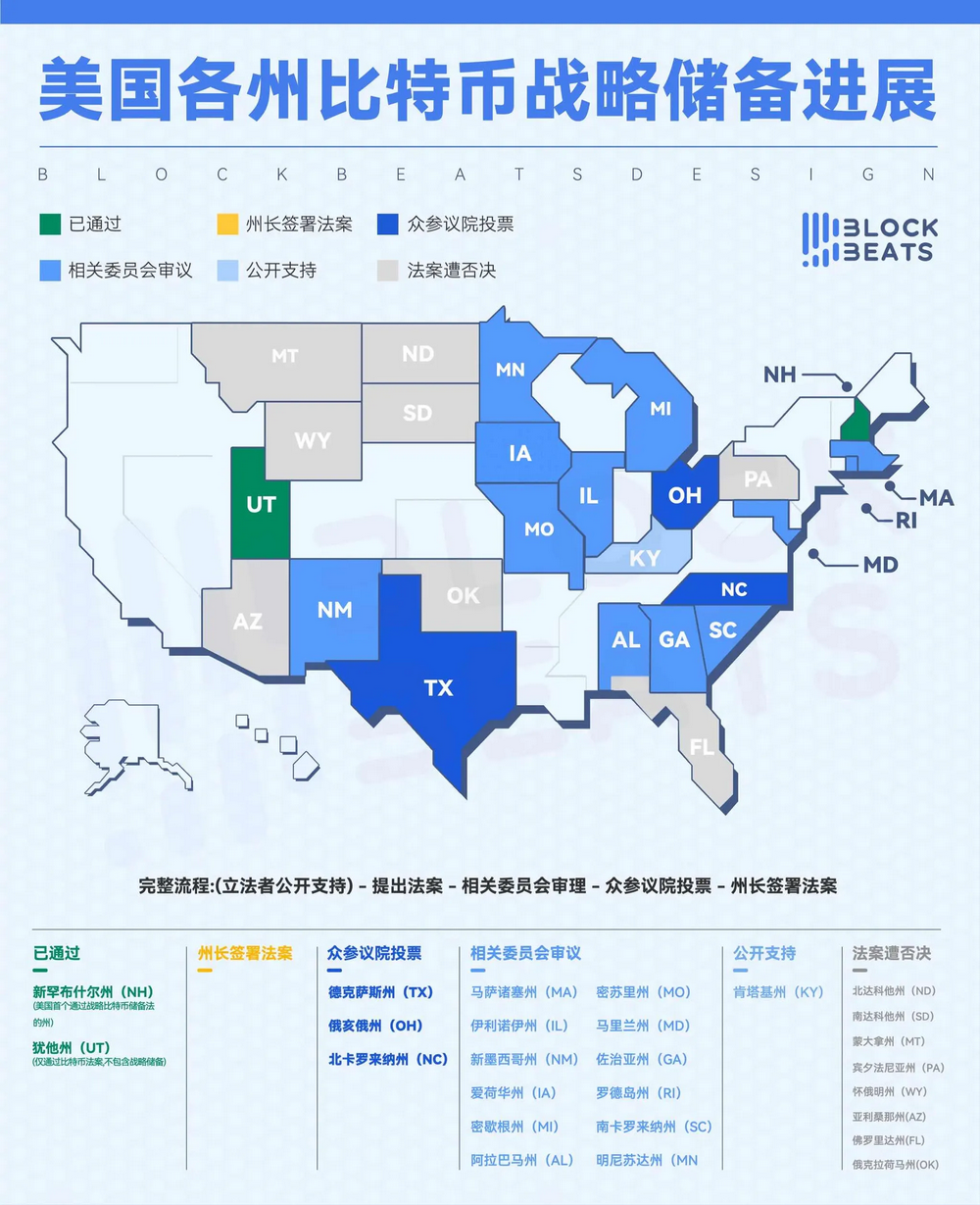

1.【5.7】New Hampshire passed the Strategic Bitcoin Reserve Act, authorizing state finance officials to purchase Bitcoin

- After the “veto machine” Democratic Governor Katie Hobbs vetoed Arizona’s digital asset strategic reserve bill, preventing it from becoming law, on May 7, crypto journalist Eleanor Terrett revealed that New Hampshire became the first state in the United States to pass a strategic Bitcoin (BTC) reserve law, authorizing state treasurers to purchase the world’s largest digital asset directly or through exchange-traded products (ETPs).

- The bill allows state finances to invest up to 5% of funds (approximately $280 million to $770 million) in precious metals and cryptocurrencies with a market value of more than $500 billion. Currently, only Bitcoin meets the requirements (market value of $1.88 trillion). This move marks the United States' entry into the field of cryptocurrency compliance investment, indicating that more states may follow suit. At the same time, it requires the implementation of U.S. regulatory custody to ensure security and transparency. The bill will take effect in 60 days.

- It is worth noting that New Hampshire is not the only state to take the lead in the state's strategic reserve of Bitcoin. The Bretton Woods System was also born in New Hampshire. From July 1 to 22, 1944, 730 representatives from 44 allied countries held the United Nations Monetary and Financial Conference (Bretton Woods Conference) at the Mount Washington Hotel in Bretton Woods, New Hampshire. The conference established the International Monetary Fund (IMF) and the International Bank for Reconstruction and Development (World Bank), and established a fixed exchange rate system based on the US dollar and gold, namely the Bretton Woods system. The system collapsed until 1971 due to the decoupling of the US dollar from gold.

2.【5.9】The U.S. Senate rejected the Stablecoin Innovation and Security Act (GENIUS Act) by a vote of 48:49, and the Democrats collectively rejected the motion to advance the bill.

- The GENIUS Act aims to create a clear federal regulatory framework for US stablecoins, defining payment stablecoins as digital assets pegged to a fixed currency value and requiring 1:1 reserve backing. Regulatory details The bill stipulates that issuers with a market capitalization of less than $10 billion are regulated by the state, while those with a market capitalization of more than $10 billion are regulated by the federal government (such as the Federal Reserve and the Office of the Comptroller of the Currency). Monthly liquidity reports and reserve disclosures are required to ensure market stability.

- The bill was originally intended to establish the first U.S. stablecoin regulatory system, but the Democrats demanded that government officials be prohibited from holding crypto assets, etc. The bill was not included. Democrats demanded the inclusion of clear clauses prohibiting administrative officials, including former President Trump and his family members, from holding or trading cryptocurrencies, and strengthening anti-corruption clauses. Senate Republicans said they would push for another vote in the coming days, and it was revealed that another vote could be held as early as next week.

- The failure of the Stablecoin Innovation and Security Act (GENIUS Act) to pass has resulted in the U.S. stablecoin market maintaining existing state-level regulation and lacking a unified federal framework, which may limit market growth and weaken the U.S. competitiveness in global digital finance.

- If passed, ETH may benefit. Ethereum is the main issuance platform of USDC, and currently about 65.6% of the USDC supply (about 3.997 billion) is on Ethereum. The GENIUS Act may increase the use of stablecoins because it provides regulatory clarity and attracts more companies and users to adopt it. Stablecoin transactions on Ethereum require gas fees, and ETH is the only way to pay gas fees. Therefore, the increase in transaction volume may push up the demand for ETH, especially in the DeFi and payment fields.

Special thanks

Creation is not easy. If you need to reprint or quote, please contact the author in advance for authorization or indicate the source. Thank you again for your support.

Written by: Nora / WolfDAO

Editorial review: Mat / Nora

Thanks to the above partners for their outstanding contributions to this weekly report. This weekly report is published by WolfDAO for learning, research or appreciation only.