Since Bitcoin fell from its high in December, the crypto market has experienced months of volatility, and many investors have suffered heavy losses in this turmoil. Liquidity continues to tighten, pessimism in the community spreads, and the market is full of noise in the divergence between long and short positions.

1. Market differentiation intensifies, and the fate of Bitcoin and altcoins is very different

The current crypto market is undergoing a profound transformation. Compared with previous bull markets, the money-making effect in this round of Bitcoin bull market has significantly weakened. The market structure is more like a high-risk, high-volatility arena, which places higher demands on traders' market sensitivity and operational agility.

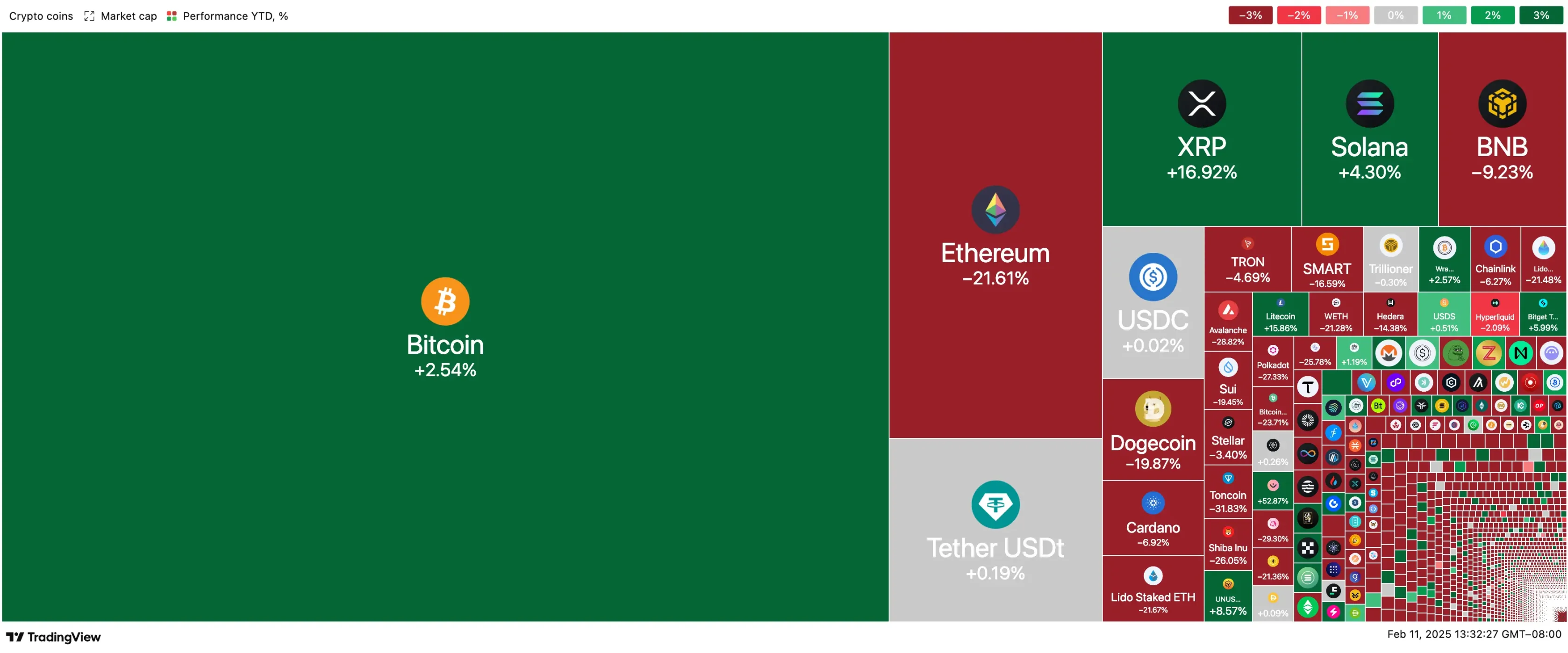

In the past few cycles, the strategy of buying altcoins in a bear market and holding them for a long time has been tried and tested, but now this strategy has basically failed. The differentiation between Bitcoin and altcoins is increasing day by day. If you fail to hold a large position in BTC or SOL in a bear market, you are likely to face serious losses.

Cryptoasset Year-to-Date Returns

The main reason for this change is that giant institutions such as BlackRock and Fidelity pay more attention to risk control and robustness. With large amounts of funds and limited choices, they prefer to invest in super large-cap coins such as Bitcoin to resist inflation and obtain returns. At the same time, there are many altcoins on the market, with market capitalizations of tens of billions. There is not enough money in the market to rise together, let alone a surge of dozens or hundreds of times. Bitcoin profits will not flow to altcoins, and altcoins continue to emerge, competing for market attention and capital flows, exacerbating market differentiation.

The disappearance of the money-making effect of altcoins has dealt a heavy blow to investor confidence. In the past cycle, everyone generally believed that "this technology represents the future", but now this belief has been greatly weakened or even destroyed. The crypto industry has not made substantial progress, and there is no disruptive 0→1 breakthrough like DeFi, which has made many people begin to doubt the long-term prospects of the industry. Under the contradictory mentality of losing faith in the market but having to participate, investors are more inclined to short-term speculation, and high-risk assets such as Meme coins have become a gathering place for funds. The market rotation is shorter and faster, and the investment style tends to high-frequency gaming.

2. The bottom is showing signs, and the market may see a turnaround

This cycle is indeed difficult, but the reality is that each cycle is more difficult than the previous one. When the number of people who believe in a logic of making money increases from a few to a large number, and from a large number to a consensus, the competition becomes increasingly fierce, and the money-making effect tends to decrease sharply, and eventually turns into a general loss of money. When investors are generally trapped in the quagmire of losses, confusion and doubt begin to spread in the market, and the market turnaround may be quietly brewing.

Bitcoin has fluctuated wildly in recent times, but has generally fluctuated around $95,000-98,000. This hesitant trend is mainly a response to Trump's threat to impose tariffs on many countries, which may trigger a trade war, providing investors with an uncertain macroeconomic background. In addition, the unexpectedly strong US economic data and the expected time and frequency of interest rate cuts have been pushed back, which has also led to a slightly tight liquidity environment.

The market is divided into two camps: the panic-stricken people shout "bull turns to bear", while the rational people think it is just a "healthy correction". Since the market fell from the top in December, the market has been fluctuating for more than two months. The recent round of decline also shows that Bitcoin has strong support. More and more signs show that this correction is more like a mid-way gas station in the bull market, rather than the terminal.

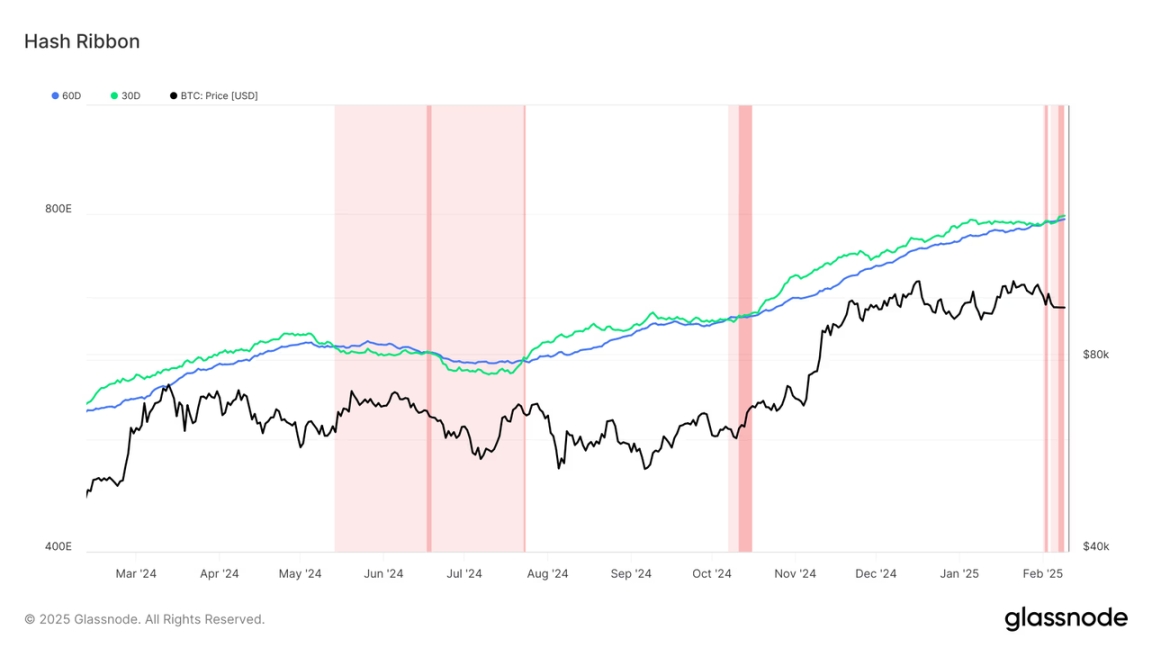

1. Miner surrender and increased mining difficulty: According to F2pool data, many mainstream mining machines such as Shenma M30S, Avalon A1246, and Ant S17 Pro have approached or reached the shutdown price. Miner surrender is usually regarded as one of the important reference indicators of the market bottom. Since 2024, Bitcoin miners have surrendered in June and October last year. Since 2025, Bitcoin miners have surrendered for the first time since February.

At the same time, the difficulty of Bitcoin mining hit an all-time high of 114.7 T, indicating that miners are still optimistic about the long-term value of Bitcoin, otherwise they would not continue to invest in computing power, which may have a positive impact on market sentiment.

2. Fear Index Running Low: The CMC Fear and Greed Index is an important indicator to measure the overall sentiment of the cryptocurrency market. Since February, the index has fallen below 40 several times, indicating that the market is in a state of extreme fear. Historical data shows that from July to early October last year, the market had seen the Fear Index fall below 40 several times, which corresponded to the low point of the price.

3. Stablecoin market value continues to grow: Stablecoin data is an important reference for observing market capital inflows. In the past month, the market value of stablecoins has grown steadily amid the turbulent market, increasing by a total of US$18.3 billion, an increase of 8.9%, indicating that funds are flowing into the crypto market.

4. Bitcoin ETFs continue to flow in: Institutional funds are pouring into the crypto market at an unprecedented scale through ETFs. At the same time, the attitude of regulators such as Washington towards cryptocurrencies has also changed from threatening to supporting, and the realization of Bitcoin strategic reserves seems to be just around the corner. Since the beginning of this year, about 47,000 Bitcoins have been purchased, and companies such as MicroStrategy have purchased about 57,000 Bitcoins.

3. Deal with short-term market fluctuations and look for opportunities with certainty

Although the market is still fluctuating, several key data indicators show that it may have entered a staged bottom area. However, in the short term, the market may still be affected by macroeconomic factors (such as changes in the Fed's interest rate cut expectations and Trump's tariff policy). Any subsequent disturbances may cause market fluctuations beyond expectations. We still need to pay attention to risk prevention and stay away from gambling mentality.

Looking back at history, bull markets often fall sharply, and the correction at the beginning of 2025 may be just a wave in the super cycle. The real risk is never the volatility of the market, but that you lose your anchor in the wave.