Crypto market predictions and guidance for next week:

Macro volatility factors were large in January, BTC was under pressure, and altcoins showed signs of recovery

- Macro trends and policy impacts

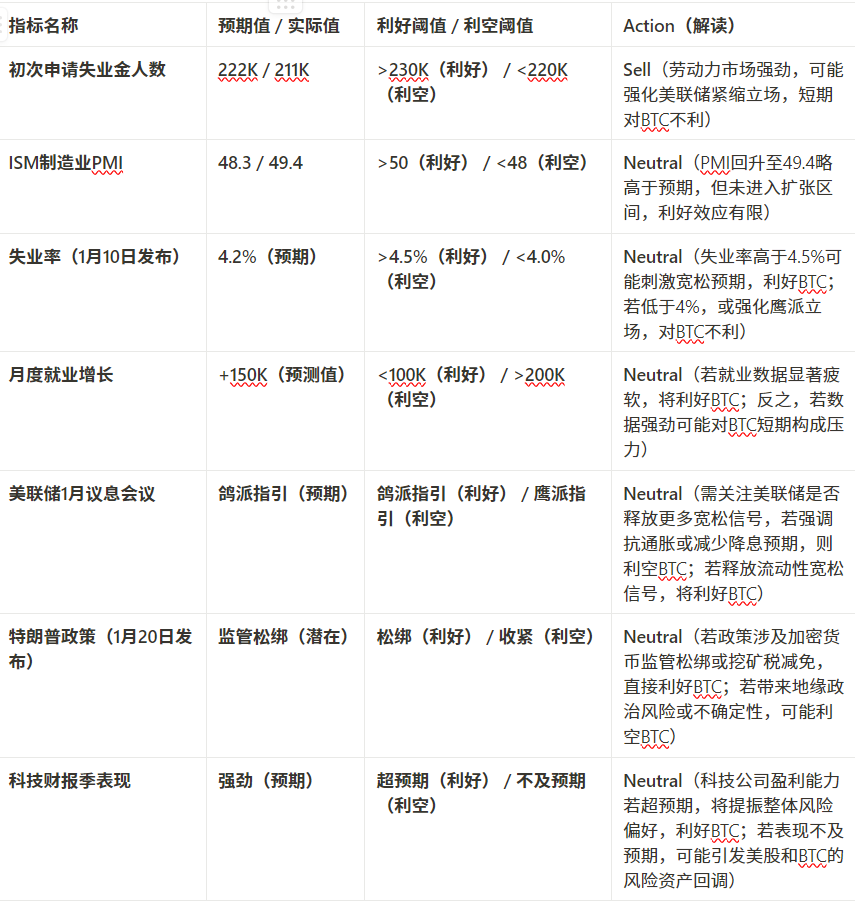

- The strong job market (initial unemployment benefits of 211K were lower than expected) is good for risky assets in the short term, but it reinforces expectations of Fed tightening, and medium-term liquidity may be suppressed.

- The manufacturing PMI rebounded to 49.4 , still in the contraction range. Expectations for interest rate cuts may increase, providing potential support for the crypto market.

- Trump Policy (January 20) : If crypto regulation is relaxed or mining taxes are reduced, it will directly benefit Bitcoin and PoW projects, but policy uncertainty may cause market fluctuations.

- Fund Flow and Liquidity Changes

- The supply of stablecoins has dropped for two consecutive weeks : a decrease of US$1.442 billion from December 27 to January 2, and the shrinking liquidity has suppressed the market.

- ETF net inflows have resumed (+USD 250 million), with limited new capital, mainly for the reallocation of existing funds, providing limited support for BTC prices.

- USDT premium continues to discount (99.49%), USDC maintains its premium , capital preference shifts to compliant assets (USDC), and USDT trust crisis emerges.

- BTC market trends

- BTC Dominance dropped from 57.8% to 57.3%, indicating that funds flowed to ETH and high-quality altcoin markets, and BTC's dominance weakened in the short term.

- The price rebound lacks volume support : trading volume decreased by 48% compared with before the holiday, and the market rebound was mainly driven by existing funds. If the trading volume does not pick up significantly, the rebound may be weak.

- Altcoin market recovery signals

- The outflow of copycat funds slowed down : the net outflow this week decreased by 98% month-on-month, and some tracks (AI and Agent) showed a net inflow trend.

- OTHERS market share support is formed : the copycat market share breaks through the Fibonacci 0.236 support, and has rebound momentum in the short term; in the medium term (January-March), the copycat season is still expected.

- USDT market share fell below support : short-term positive for altcoin rebound, but we need to be wary of volatility risks brought about by overall insufficient liquidity.

- Summary and Strategy

- BTC investors : Pay attention to the support of $96,500 and the resistance of $98,000 in the short term, and remain cautious until the trading volume recovers significantly.

- Altcoin investors : pay attention to the trend of capital inflows, give priority to high-liquidity projects, participate in the altcoin rebound moderately, but guard against the risk of overall market volatility.

- Overall market : The market is expected to be highly volatile in January, and we need to pay close attention to the impact of macro events (such as the Federal Reserve's interest rate meeting and Trump's policies) on liquidity and market sentiment. </aside>

1. Macro trends

Outlook for important events in the first quarter of 2025

1. January 10: US monthly employment report released

- Event Overview : Reflects the health of the U.S. economy, including job growth and unemployment rate (target 4.2%).

- Market Impact :

- If job growth is solid and the unemployment rate remains at 4.2%, it will reflect a strong U.S. economy, which could be positive for U.S. stocks and cryptocurrency markets.

- Strong employment data may lead the Federal Reserve to maintain its tight policy, thereby suppressing liquidity and being bearish for the crypto market in the short term.

- If the employment data is weak, it may stimulate expectations of interest rate cuts, which will be good for the cryptocurrency market, especially assets with "digital gold" attributes such as Bitcoin.

2. Fourth quarter earnings season (starts in January)

- Event overview : U.S. listed companies will release their fourth quarter 2024 financial reports, and the performance of the technology and AI sectors in particular will receive close attention from the market.

- Market Impact :

- If earnings reports are generally strong, it could lead to a rally in risk assets overall, including cryptocurrencies.

- The connection between the AI industry and the crypto market is gradually strengthening (such as AI chain projects and computing power coins, etc.). If technology companies perform well, it may boost confidence in the crypto market.

- On the contrary, if the financial report is lower than expected, it may exacerbate market risk aversion and cause cryptocurrency prices to fall.

3. January 20: Trump’s inauguration and policy announcement

- Event Overview : Trump is expected to issue at least 25 executive orders covering immigration, energy and cryptocurrency policies.

- Market Impact :

- Expectations of loosening of crypto regulation : Trump has expressed friendliness towards cryptocurrencies. If policies are relaxed (such as relaxing securities law regulations), it may directly stimulate a market rebound.

- A weaker dollar and risk aversion : If policies lead to escalating geopolitical tensions or trade frictions, it may stimulate capital to flow into the crypto market for risk aversion.

- Taxation and mining policies : If it involves reducing or exempting taxes on cryptocurrency mining or increasing the freedom of energy use, it may directly benefit PoW projects (such as Bitcoin).

- Uncertainty risk : However, there is a high degree of uncertainty in the implementation of policies, and market volatility may increase, especially as Trump’s execution capabilities in the early days of his presidency remain to be seen.

4. Federal Reserve January interest rate meeting

- Event overview : The Federal Reserve will evaluate inflation and economic data and may provide guidance on the number of interest rate cuts in 2025.

- Market Impact :

- Hawkish statement : If the Federal Reserve continues to emphasize curbing inflation and reduces the number of interest rate cuts, it may lead to liquidity tightening, which will be bearish for cryptocurrencies.

- Dovish bias : If the Fed hints at easing monetary policy or indicates that expectations of rate cuts are rising, it will be positive for the cryptocurrency market as increased liquidity can drive risk assets higher.

- Bitcoin sensitivity : As a liquidity-sensitive asset, Bitcoin prices may be directly affected by the results of interest rate meetings.

Macro indicators trigger signal table-BTC market trend guidance

Summary and Market Expectations

- Positive factors :

- A solid jobs report without inflationary pressure, an excellent earnings season, and Trump's policies leaning toward lighter regulation would be bullish for the crypto market.

- Negative factors :

- If the Federal Reserve takes a hawkish stance or Trump's policies bring uncertainty, it may trigger risk aversion in the market, which will be unfavorable for the rebound of the crypto market in the short term.

- High volatility expected :

- Due to the concentrated occurrence of four events, the crypto market is expected to be highly volatile in January, and we need to pay close attention to data releases and policy details.

2. Macroeconomic data to watch next week

2. Industry Analysis

Interpretation of the impact of this week's on-chain data on BTC

Combined with this week’s on-chain data, the following analyzes the impact of these data on the BTC market from the aspects of capital flow , price indicators , and trading volume , and evaluates the key risks and opportunities in future trends.

2.1 Fund Flow

2.1.1 Stablecoin Fund Flow

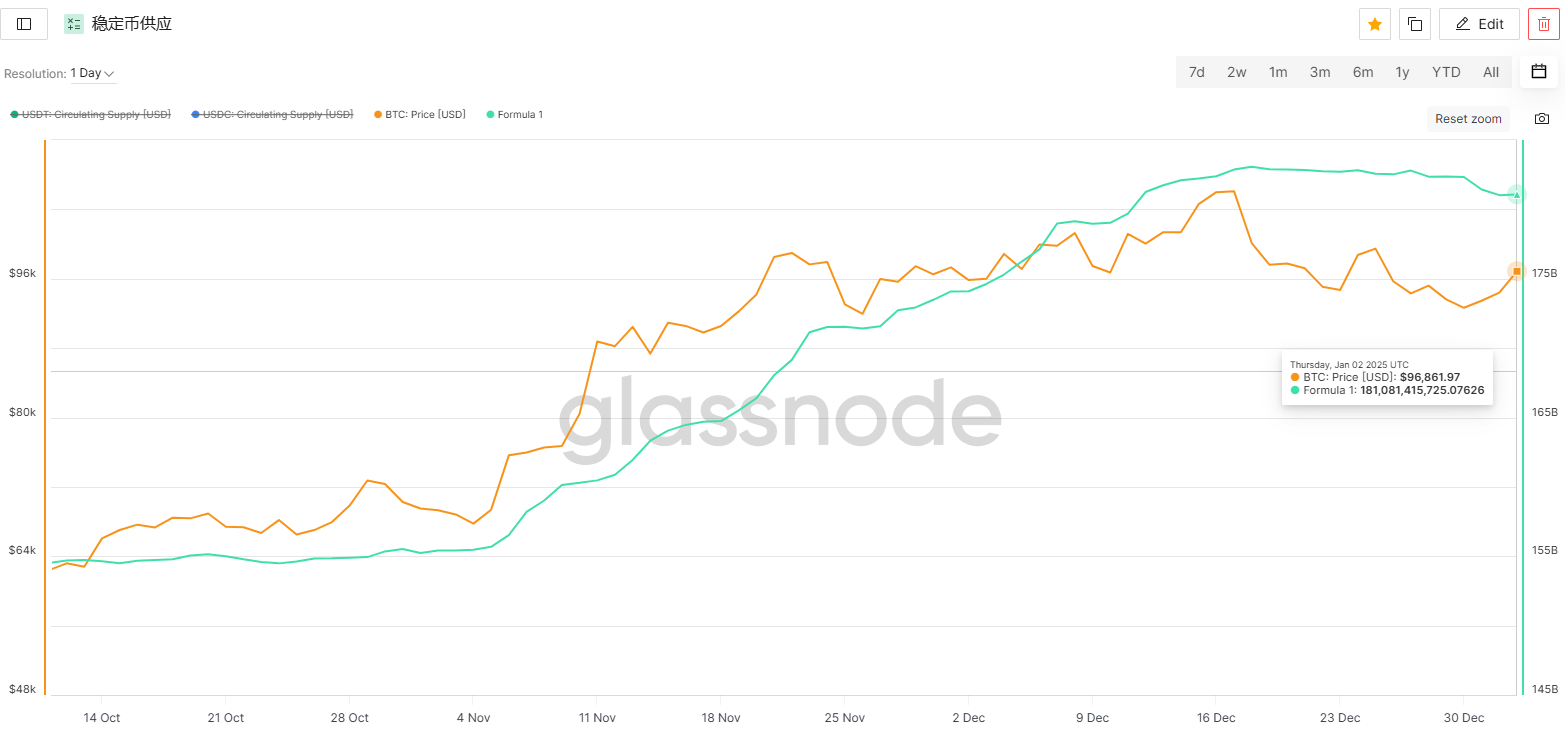

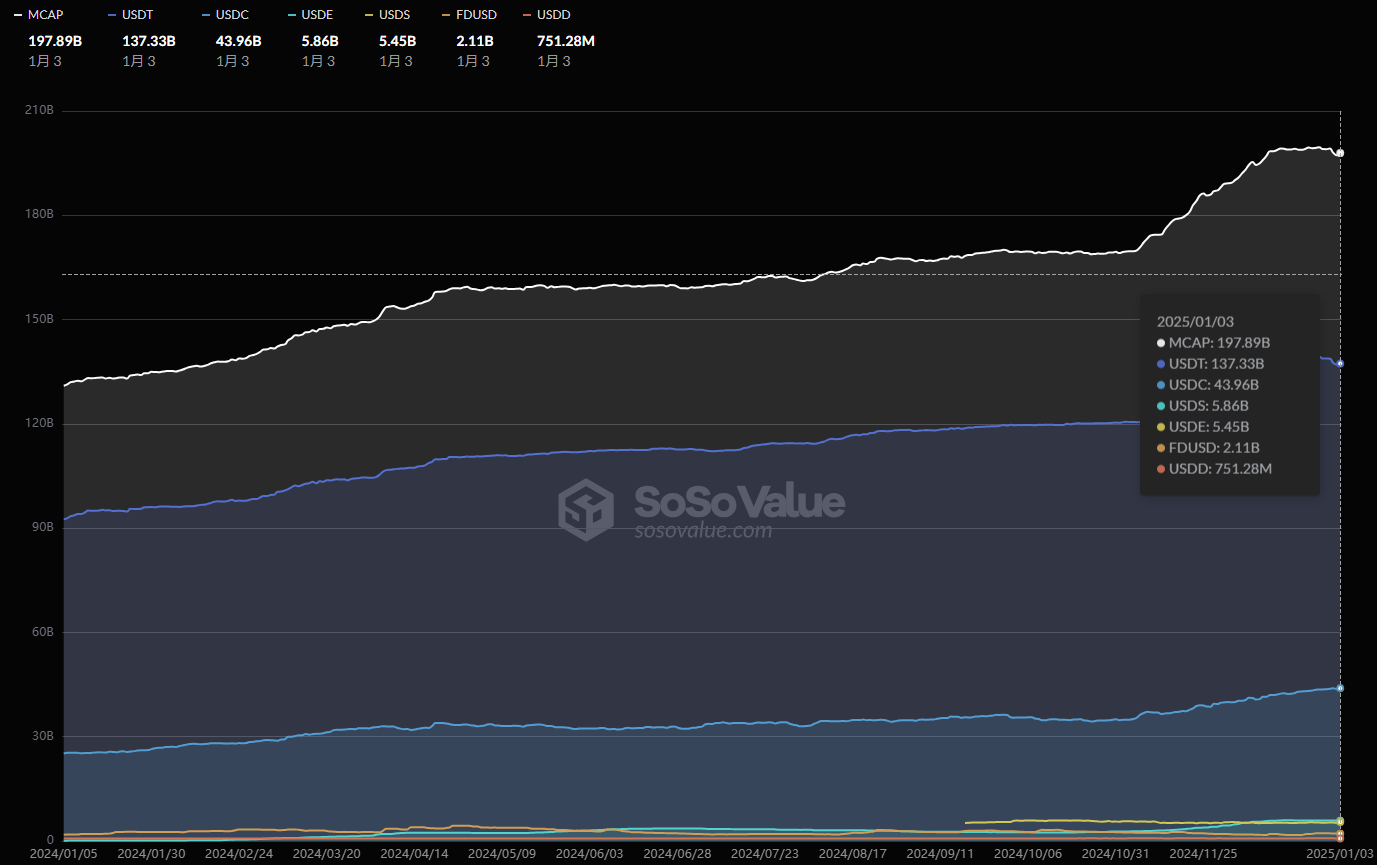

(1) Characteristics of stablecoin supply

- This week's supply showed a net decrease :

- The supply of stablecoins decreased by 1.442 billion (-0.8%) between December 27 and January 2, with an average daily decrease of 206 million .

- The supply volume has decreased for two consecutive weeks, reflecting a continued decline in market liquidity and significant signs of net capital outflow.

- Potential reasons for the drop in supply :

- Year-end fund settlement : The year-end fund settlement peak may cause some funds to flow out of the stablecoin market for fiat currency withdrawals or annual liquidation needs.

- Macroeconomic impact : Against the backdrop of continued tightening of the Federal Reserve’s policy, investors may temporarily withdraw from risky assets and reduce their stablecoin holdings.

(2) The relationship between BTC price and stablecoin supply

- Supply decreases but BTC price increases :

- Despite the stablecoin supply falling from 181.29B on Dec 27 to 181.08B on Jan 2, BTC price rose from $95,745 to $96,861, an increase of about +1.16% .

- The decline in supply diverges from the rise in BTC prices, indicating that the rise in BTC is not driven by new capital inflows, but may be due to the reconfiguration of existing funds within the market or improved trading sentiment.

- Fluctuations in market sentiment :

- From December 30 to December 31, the price of BTC fell and the supply of stablecoins decreased, indicating weak market capital confidence.

- From January 1 to January 2, despite the continued decline in supply, the price of BTC rose significantly, which may reflect that some funds flowed back from altcoins or stablecoins to BTC trading pairs, driving the price rebound.

(3) Liquidity changes in the stablecoin market

- A decline in stablecoin supply could suppress market liquidity :

- Stablecoin supply usually reflects the available liquidity in the market. A decline in supply indicates weakening market liquidity, which could limit BTC’s further upside.

- If supply continues to decrease, it may have a negative impact on the overall trading depth and activity of the market.

- Changes in capital allocation structure :

- Despite the decline in overall supply, some existing funds may flow back into the BTC market from other assets (such as altcoins), supporting BTC's short-term rebound.

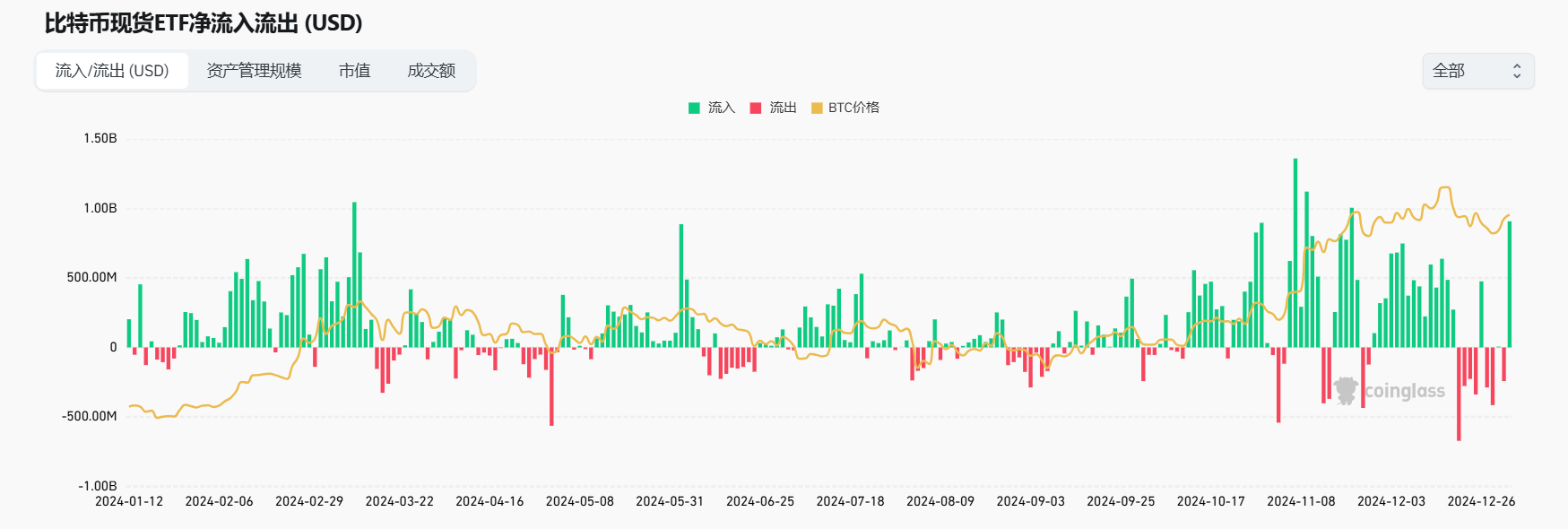

2.1.2 ETF Fund Flow

(1) Characteristics of ETF inflows and outflows

- Net inflows resumed :

- After recording a net outflow of USD 378 million between December 23 and December 27, 2024, ETF inflows recovered to +USD 250 million between December 30 and January 2.

- The inflow volume is low and accounts for only 0.015% of the BTC circulation, indicating that the new capital inflow into the market is limited and it is difficult to form a sustained driving force in the short term.

- Alternating fund flows :

- Inflows and outflows alternate: on December 30th, funds flowed in +200M, on December 31st, funds flowed out -400M, followed by inflows of +150M and +300M on January 1st and January 2nd.

- The fluctuation of ETF funds reflects that market sentiment has not yet fully stabilized, and capital flows are still affected by macro uncertainties and year-end settlement needs.

- Limited additional funding :

- The ratio of ETF inflows (about 3,000 BTC) to circulation is only 0.015% , indicating that the proportion of new funds is extremely low.

- The inflow of funds is more of a reallocation of existing funds rather than a large-scale injection of new funds into the market.

(2) The impact of ETF fund flows on BTC prices

- Fund Flow and Price Lag :

- Dec 30: +200M inflow, but BTC price fell -1.59% (from $93,740 to $92,739), likely dominated by selling pressure due to year-end settlement.

- January 2: Inflow +300M, BTC price rises +3.51% (from $93,579 to $96,861), reflecting that capital inflows are supportive of short-term prices.

- New insufficient funds limit the price to continue to rise :

- Although ETF inflows have pushed up BTC prices to a certain extent, the proportion of new funds is extremely small and cannot form a sustained driving force.

- If the inflow fails to expand, BTC prices may face resistance in the $96,500-$98,000 range.

(3) Impact of year-end settlement needs

- 12/31 outflow zoom :

- Net outflow of -400M is the main outflow point within the time interval and is highly correlated with the year-end fund settlement needs.

- The decline in liquidity at the end of the year led to capital outflow from the market, while creating downward pressure on BTC prices.

- Signs of capital inflow at the beginning of the new year :

- On January 1st and January 2nd, inflows of +150M and +300M were recorded respectively, indicating that market sentiment has recovered at the beginning of the new year and there are obvious signs of capital inflows.

(4) Changes in liquidity of ETFs and the overall market

- Market sentiment gradually improved :

- Although the overall inflow of funds is small, the inflow for two consecutive days reflects that market confidence is gradually recovering and the impact of year-end selling pressure is weakening.

- The rebound in BTC prices indicates that capital inflows provide certain support to the market, but we need to be vigilant as to whether the subsequent inflow scale can be sustained.

- External capital inflows remain insufficient :

- The proportion of ETF fund inflows to the total circulation is only 0.015%, indicating that the scale of new funds is insufficient and the effect on improving the overall market liquidity is limited.

- If subsequent capital inflows fail to increase significantly, the momentum for BTC price rebound may gradually weaken.

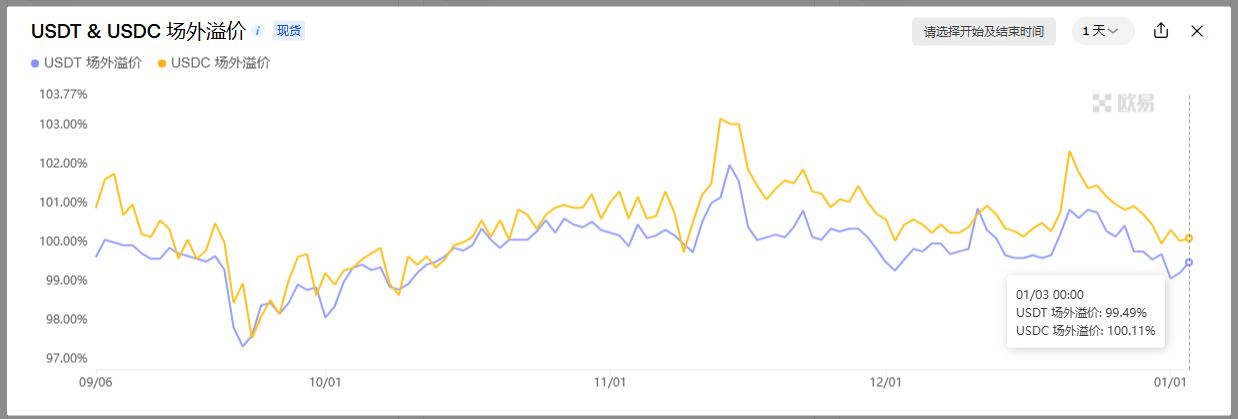

2.1.3 Premium or discount in over-the-counter transactions

- USDT OTC premium :

- It fell from 99.78% (December 30) to 99.49% (January 3) , showing a trend of continuous discount expansion .

- This reflects the weakening market demand for USDT, which may be due to the transfer of funds to other stablecoins, increased selling pressure during the year-end fund settlement period, and a decline in trust in USDT.

- USDC OTC premium :

- It rose from 100.02% (December 30) to 100.14% (January 1) , and then fell slightly to 100.11% (January 3) .

- It is manifested as a stable and slight premium , reflecting the market's continued demand for USDC and higher credit recognition.

- Changes in demand and competition landscape :

- The MiCA Act pushes exchanges (such as Coinbase and Kraken) to delist USDT trading pairs, giving compliant stablecoins such as USDC a higher priority, and market demand is clearly differentiated.

- Demand for USDT in non-European markets (such as Asia) remains supported, but the global confidence crisis is weakening its market position.

2.2 Related price indicators

2.2.1 Cryptocurrency Market Value

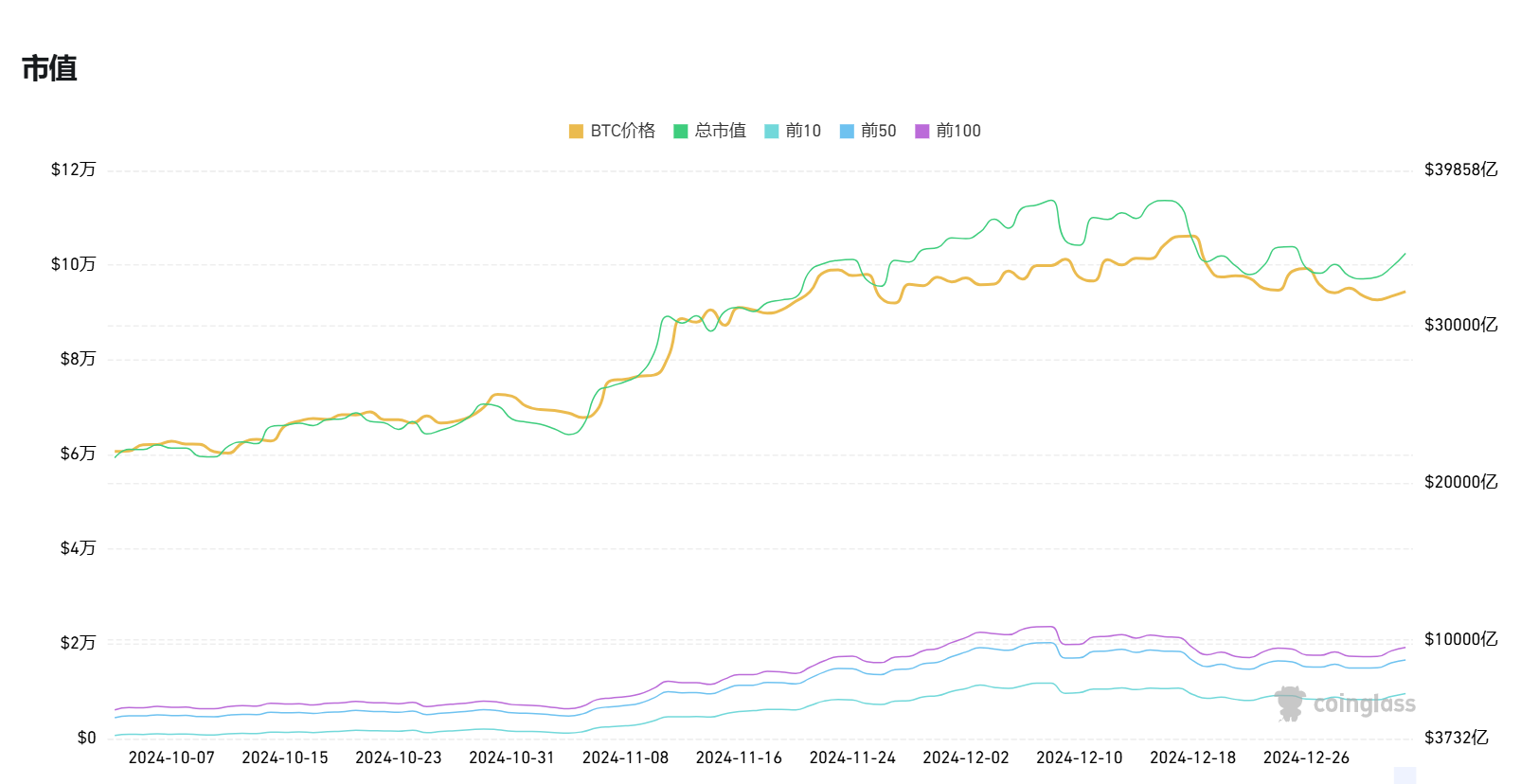

(1) Total market value of cryptocurrencies

- Key Stats :

- Lowest point : On December 30, 2024, the total market value of cryptocurrencies hit this week’s lowest value of 3.394 trillion , down about 5.77% from last week’s highest point of 3.602 trillion .

- Statistical point : On January 3, 2025, the total market value rebounded to 3.559 trillion , basically recovering the previous decline.

- Overall changes : The total market value as a whole showed a trend of "first falling and then rising", with a cumulative decline of about 1.19% this week.

- Trend observation :

- Market capitalization fluctuations are mainly driven by BTC price fluctuations: BTC rebounded from $93,740 (December 30) to $96,861 (January 3), an increase of about +3.33% .

- The market value of the top 10 assets fluctuates with the total market value, and the proportion remains stable, indicating that funds are concentrated in mainstream assets (BTC, ETH).

- The market value fluctuations indicate that the market is gradually entering a stage of capital repatriation after experiencing the pressure of holidays and year-end fund settlement.

- The recovery of market value mainly depends on the reallocation of existing funds. The insufficient scale of new capital inflows limits the further upside of the market.

2.2.2 BTC overall transaction volume

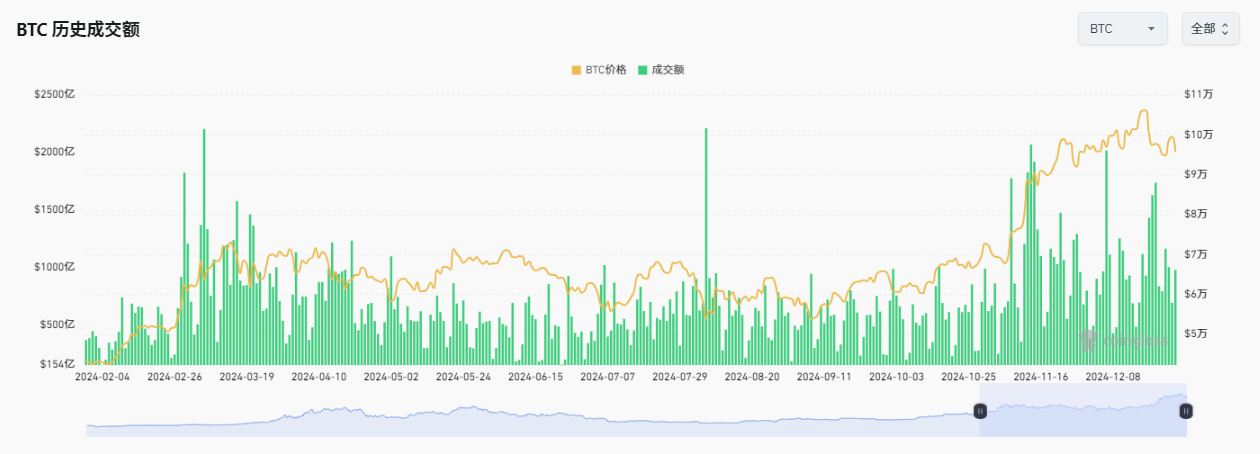

(1) Changes in BTC overall transaction volume

- Trading volume performance :

- December 30 : Trading volume drops to around $120 billion , a recent low.

- December 31 : Trading volume recovers slightly to around $150 billion .

- January 1st - January 2nd : Trading volume remained low with no significant fluctuations.

- January 3 : Trading volume was approximately $130 billion , slightly higher than the trading volume on December 30.

- Overall trend :

- The trading volume showed a fluctuating upward trend , but the increase was limited and failed to effectively recover to the previous active level.

- Compared to before the holiday ( $250 billion in trading volume on December 27), overall trading volume decreased by about 48% , indicating a significant decrease in market activity.

(2) Relationship between price and trading volume

- BTC price changes :

- December 30 : BTC price is $93,740 .

- January 3 : BTC price rebounded to $96,861 , an increase of about +3.33% .

- Volume-price divergence :

- While prices rose slightly, trading volume failed to pick up simultaneously, indicating that the rebound lacked volume support.

- The disconnect between the decline in trading volume and the rise in prices indicates that the market rebound is mainly driven by existing funds rather than new funds.

2. Data characteristics and trend analysis

(1) The core reason for the continued low trading volume

- Year-end holiday effect :

- The time period coincided with the year-end holiday, and some investors chose to close their positions or leave the market to wait and see, resulting in a decline in market trading volume.

- The holiday effect and the year-end settlement demand suppress market activity.

- Insufficient new capital inflow :

- The market rebound lacked new external capital inflows, and trading volume failed to increase effectively.

- Insufficient market liquidity further limits the sustainability and strength of the price rebound.

- Market trading sentiment is low :

- The decline in trading volume reflects the sluggish market trading sentiment, cautious investor confidence and the market's tendency to wait and see.

(2) The relationship between trading volume and market trends

- The divergence between volume and price limits the strength of the rebound :

- The price increase is accompanied by a decrease in trading volume, which means that the rebound lacks volume support and the rebound strength may be limited.

- If trading volume continues to be sluggish, BTC price may find it difficult to break through key resistance levels (such as $98,000).

- Low activity increases the risk of callbacks :

- Insufficient trading volume may lead to increased market volatility. The market lacks new buying support and is prone to pullback risks.

- If trading volumes fail to pick up in the short term, market confidence could be further dampened.

- Possibility of fund diversion :

- The decline in volume could indicate that some of the funds are being diverted to other assets such as ETH or the premium altcoin market.

- The decline in BTC Dominance also verifies the trend of funds shifting to other assets. (This will be explained in detail in the following Fengshen Rotation on the overall trend of cottage industry)

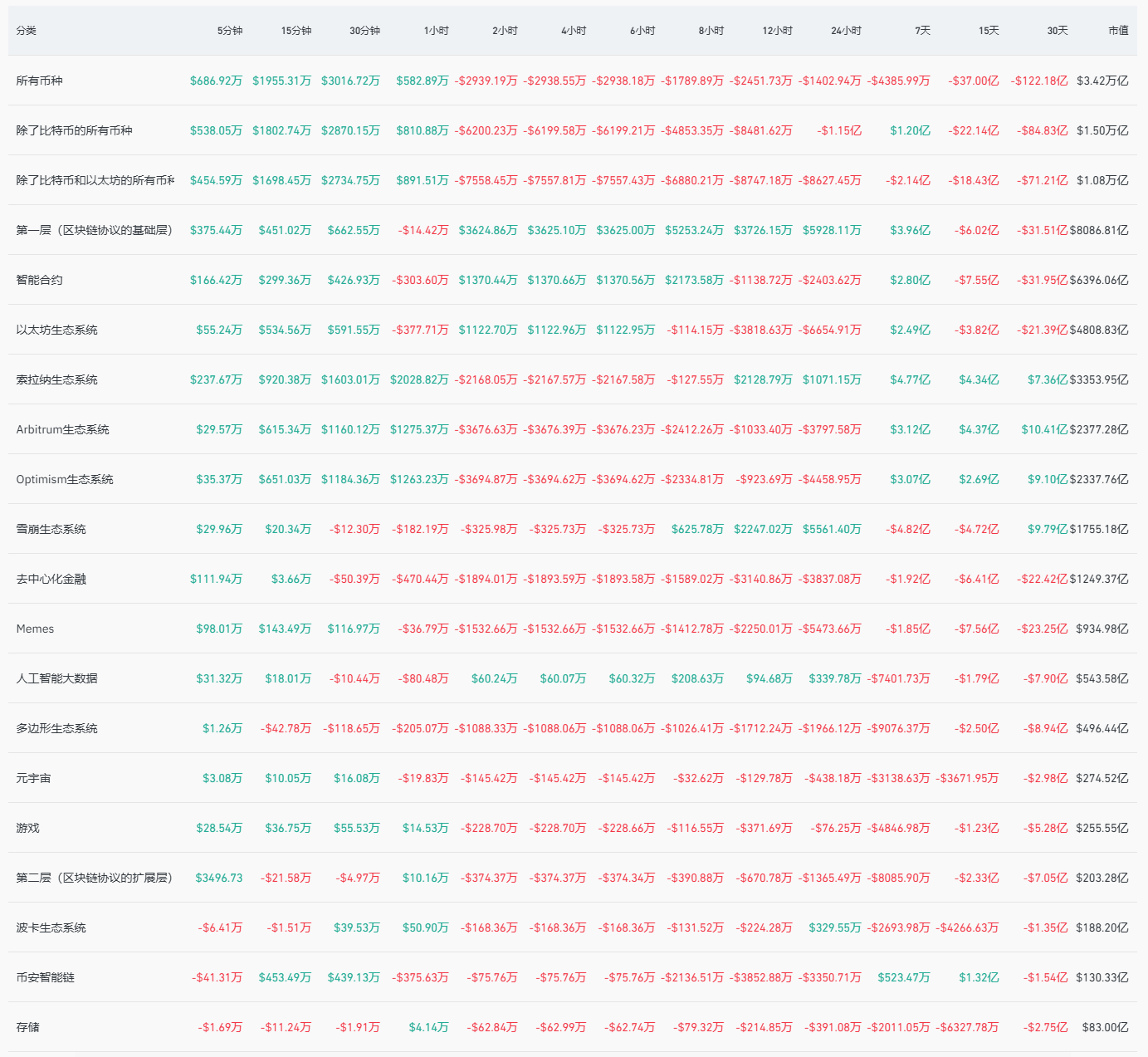

3. Fengshen Wheel Movement

Summary and outlook for this week

1. Short-term summary

- Altcoin rebound : This week, the altcoin market continued its good performance from last week, and the Agent track shined this week.

- Capital outflow has been significantly repaired : the net outflow rate slowed down this week, and the outflow volume decreased by 98% compared with last week.

- BTC market share and USDT market share : The trend during the week is favorable for altcoins, but short-term uncertainty remains high.

2. Mid- to long-term outlook

- Altcoin market share : We are still very close to the Altcoin season, considering the Altcoin lag effect brought by BTC ETF.

3. Risks and recommendations

- Risk : The market value of stablecoins is declining, which poses certain risks to the market.

- Strategic advice : If you have any positions, keep them unchanged and observe the trend of BTC and the impact of Trump on the subsequent market.

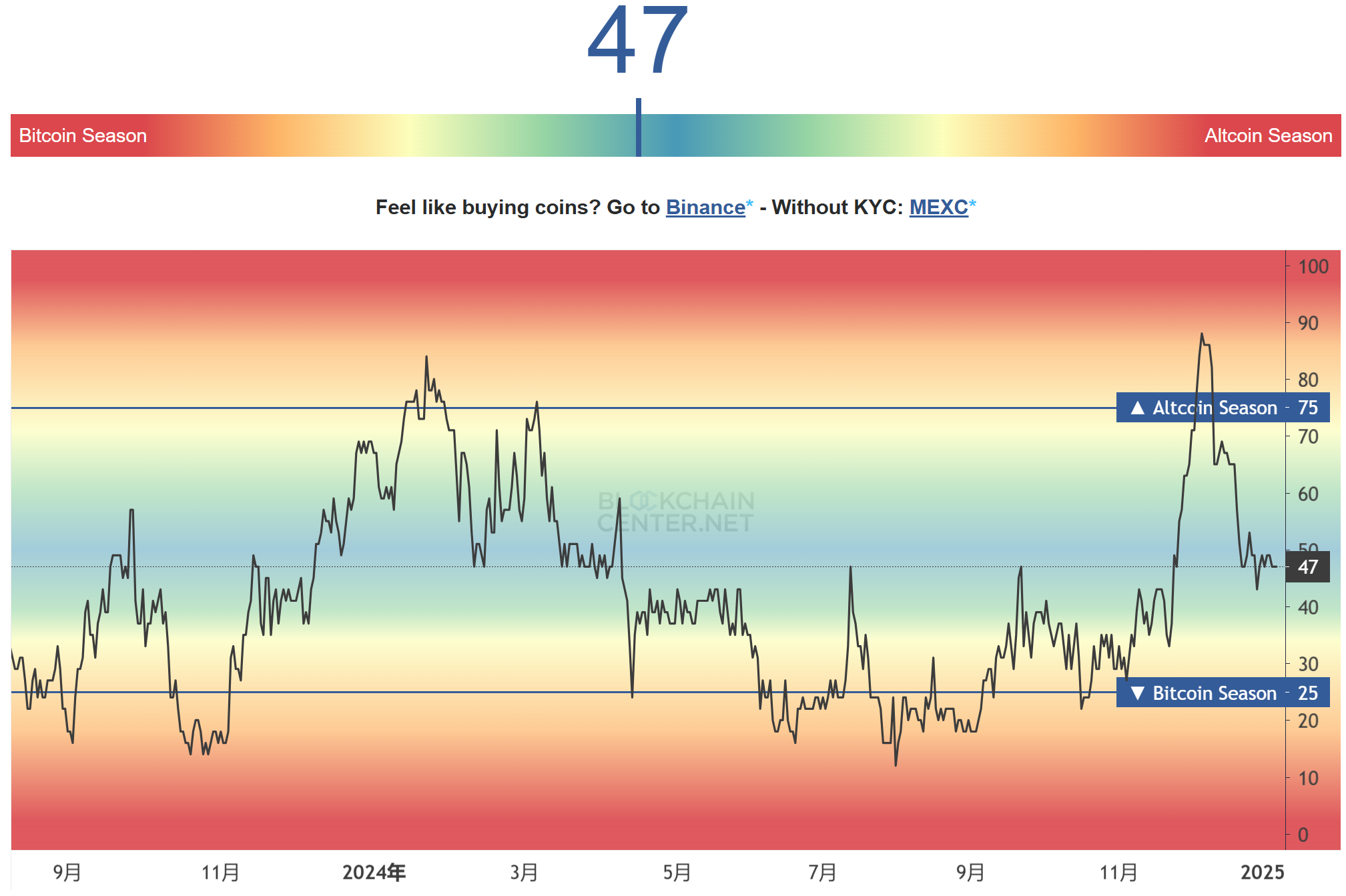

Combining this week's macroeconomic indicators and market data analysis, the altcoin market is experiencing continuous adjustments and capital outflow pressure. The following is an analysis of this week's altcoin market performance from multiple dimensions, including altcoin season indicators, capital flows, BTC market share, OTHERS market share, and USDT market share , and looks forward to possible future development paths.

Cottage Season Indicators

This Friday, the Altcoin Index was 47, almost the same as last Friday, indicating that the Altcoin has clearly bottomed out. As we concluded last week, as long as BTC does not fall further, the Altcoin will have the hope of slowly recovering to its previous high.

2025.01.03It can be clearly seen from Crypto Bubbles that the altcoin rebounded significantly this week. Other tracks all increased by about 10~25%. The Agent track had the largest increase, reaching more than 30%, and AI16Z even increased by 135%.

Inflow of copycats

This week's inflow data finally improved, from a net outflow of US$2.347 billion last week to a net outflow of US$43.86 million this week. The outflow of funds decreased by 98% month-on-month. Many tracks have shown a net inflow trend during the week.

However, as we mentioned earlier, the pullback in the market value of stablecoins is a major hidden danger for the market that is undergoing recovery. Therefore, there are still risks in the short term, so investors are advised to pay attention.

BTC market share (ratio, growth rate)

BTC's market share is still falling compared to last week, and the daily MACD crosses. This test failed to successfully break through the resistance range, and the trend of stepping back to the long-term support line is quite obvious. Compared with the performance of BTC's weekly closing this week, BTC rose and the market share fell. In addition, the net inflow of $120 million of all currencies except BTC is enough to show that the overall altcoins were relatively active this week, and BTC's strong position has not been sustained for the time being.

As for the overall direction of BTC's market share in the future, we still need to wait for Trump or other important macro news factors to have an impact on BTC prices before we can make further judgments.

OTHERS.D

The total market capitalization share of tokens outside the top ten was repeatedly tested above the Fibonacci 0.236 level this week, forming support once again, and the daily MACD confirmed the golden cross.

In order to better observe the big cycle trend, we look at the monthly line. On the monthly line, we have reached the end of the triangle pattern, and MACD is about to cross underwater, which may mean that there will be considerable potential upward momentum waiting for the cottage this year.

If we stick to the old ways, based on the rise of OTHERS.D in the last cycle: the cycle lasted for one year, and the rise was about 244%. We start from the current Fibonacci 0.236 and calculate that OTHERS.D has risen by 244% this year, which is close to the 2.618 level, which is almost the same as our previous view of OTHERS.D to escape the top. After cross-comparing with the BTC trend in the last cycle, we get the following pattern:

- PreQ1: BTC starts first, and the altcoin is at the bottom of the stage

- Q1: OTHERS.D rises sharply with the price of BTC;

- Q2: A large-scale pullback occurs, BTC may be cut in half, and OTHERS.D may pull back by more than 30%;

- Q3: Strong V-reversal, bull market reaches its peak;

- Q4~early next year: The bull market ends.

At present, the conditions for BTC to start in Q1 this year need to focus on whether the Trump effect and the macro environment can be met. The incremental growth of altcoins is not obvious at present. Coupled with the current intervention of ETFs, the altcoin market has a significant lag effect in terms of time dimension. Therefore, the limitation of cutting the boat to find the sword is large, and it is for reference only. However, we are still optimistic about the start of the altcoin season in the medium term, and maintain the original conclusion that the altcoin season will be around January to March.

USDT Market Share

Finally, USDT.D has failed many times in its attempts to break through the white long-term support line, and the support has turned into resistance. The daily line has retraced to the resistance range of the 22-year bull tail, and the MACD has formed a death cross, and it is expected to continue to fall back into this resistance range, which is undoubtedly a short-term positive for the copycat.

Special thanks

Creation is not easy. If you need to reprint or quote, please contact the author in advance for authorization or indicate the source. Thank you again for your support.

Written by: Sylvia / Jim / Mat / Cage / WolfDAO

Edited by: Punko / Nora

Thanks to the above partners for their outstanding contributions to this weekly report. This weekly report is published by WolfDAO for learning, research or appreciation only.