In the market outlook the day before yesterday, I mentioned: "The U.S. stock chain is an annual narrative that I am more optimistic about."

Let me talk about my thoughts today.

The reason I’m paying attention to this narrative again is because of @BackedFi . These things have appeared in the market before, but they ended up in vain due to regulatory issues. After Trump took office, a series of changes in regulatory policies made it feasible to put US stocks on the blockchain again.

There is only one core reason for being optimistic about the narrative of US stocks being put on the blockchain

The hype in the crypto market is nothing more than stories and models. AI, AI Agent and RWA are stories, while DeFi, GameFi and mining machines are (Ponzi) models. The stories are about mindshare, that is, stories that can attract market buying. Among them, Web2 Attention stories are the most, such as AI Metaverse. I won’t go into details about the model, which is basically a Ponzi plate. In essence, the front wave cuts the back wave.

The U.S. stock market is on the blockchain. I personally think this is a story that the market is willing to pay for — that’s why I’m optimistic about this narrative, and this narrative will definitely integrate DeFi and RWA in the process of development, bringing new growth to these old narratives.

In the "WEB3 MINT TO BE" column of Mint Ventures @xuxiaopengmint , Mr. Mindao mentioned that the benefits of putting U.S. stocks on the blockchain can be summarized into the following four points:

1. Improved financial efficiency: The traditional financial clearing system is inefficient, while blockchain can significantly increase the speed of fund settlement, reduce costs, and enable round-the-clock transactions.

2. Users are “empowered” with new uses: Tokenized stocks are not just equity certificates, but can also have usage functions (such as deducting handling fees, participating in pledges, exchange services, etc.).

3. Break through territorial regulatory restrictions: Tokenized stocks can be circulated globally, providing a larger capital pool for US stocks.

4. Enhance integration with DeFi: As new tradable assets, stock tokens are naturally adapted to DeFi infrastructure (DEX, lending protocols, etc.).

Of course, when this narrative becomes bigger, it will inevitably attract supervision. In the end, it can be summed up in two words: "compliance". The core issue at present is also the uncertainty of supervision.

Nothing else matters to the end.

At present, apart from regulation, there are no obstacles for Crypto. Infrastructure including DEX, mortgage lending, cross-chain, etc. can basically be found ready-made.

For example, @injective now supports futures trading of US stock indices, Nvidia, McDonald's and Tesla. The trading takes place on its on-chain exchange Helix (Injective is not a real US stock on-chain, but supports futures trading of US stock related tickers).

The core architecture of this product is iAssets. On the trading side, users and users, users and market makers are counterparties to each other, and use order books to match transactions. On the DeFi side, thanks to the programmable properties of iAssets, it can be used for lending collateral, income strategies, leveraged positions, structured products, re-mortgage and other scenarios.

To put it simply, iAssets transforms static RWA assets into dynamic assets that can be used in DeFi.

For now, Injective does not need to worry too much about regulation, but it is indeed planning to put US stocks on the blockchain. This part of the layout may become a growth point for $INJ in the future.

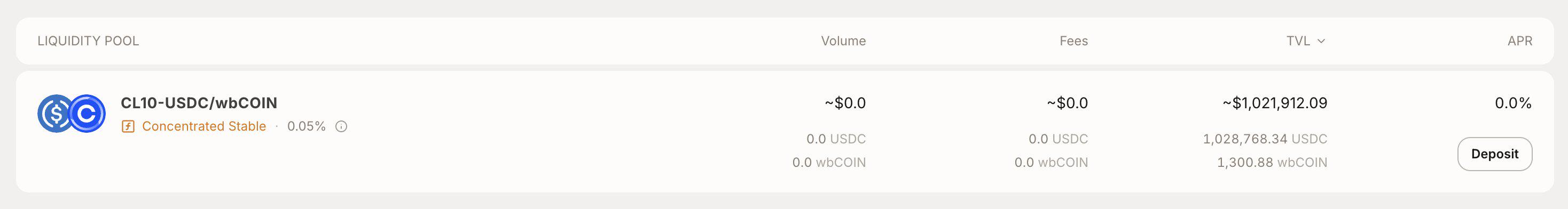

Backed is on Base, backed by the big tree of Coinbase (invested by Coinbase Ventures), and it is really putting US stock assets on the chain. For example, this month, Backed launched the tokenized Coinbase stock wbCOIN on Base. It directly uses Aerodrome as the liquidity exchange place for wbCOIN. The assets it issues are all fully collateralized by real assets at a 1:1 ratio.

The regulatory risk it faces is higher (it uses Europe’s MiFID II framework and Swiss DLT regulations to enable permissionless tokenized shares, at least in Europe it is compliant).

My attitude towards it is to participate if you can (be an LP), firstly, before it gets too late, and secondly, for future airdrops. Perhaps after the US regulation is clear, it is not impossible for its native protocol token to be listed on Coinbase. But this is a "vague prediction", so don't invest too much money, you can do a small amount to do more.