By Hedy Bi, OKG Research

When tariffs become an American TV series, "no new plot today" becomes the news itself. From gold prices hitting new highs to Bitcoin returning to over $80,000, risk aversion is quietly returning. The world is increasingly like a makeshift team. Every news push about upward revisions to inflation expectations, escalating geopolitical frictions, or increased trade barriers may become a fuse that ignites market sentiment.

Today, when macro uncertainty has become the norm, "certainty" is no longer a condition that is taken for granted, but a scarce asset. In an era where black swans and gray rhinos coexist, investors are not only pursuing returns, but assets that can survive fluctuations and have structural support. The "crypto-interest-bearing assets" in the on-chain financial system may represent a new form of this kind of certainty.

These crypto assets that promise fixed or floating income financial structures are returning to the attention of investors and becoming an anchor for them to find stable returns in turbulent markets. But in the crypto world, "interest" is no longer just the time value of capital; it is often the product of the joint action of protocol design and market expectations. High returns may come from real asset income, but they may also cover up complex incentive mechanisms or subsidy behaviors. If investors want to find real "certainty" in the crypto market, they need not only an interest rate table, but an in-depth analysis of the underlying mechanism. As the eighth article in the "Trump Economics" series, this article will start with interest-bearing assets, analyze the true source and risk logic of crypto interest-bearing assets, and find certainty in uncertainty.

Since the Federal Reserve started the interest rate hike cycle in 2022, the concept of "on-chain interest rate" has gradually entered the public eye. Faced with the long-term risk-free interest rate of 4-5% in the real world, Crypto investors have begun to re-examine the income sources and risk structure of on-chain assets. A new narrative has quietly taken shape - Yield-bearing Crypto Assets , which attempts to build financial products on the chain that "compete with the macro interest rate environment."

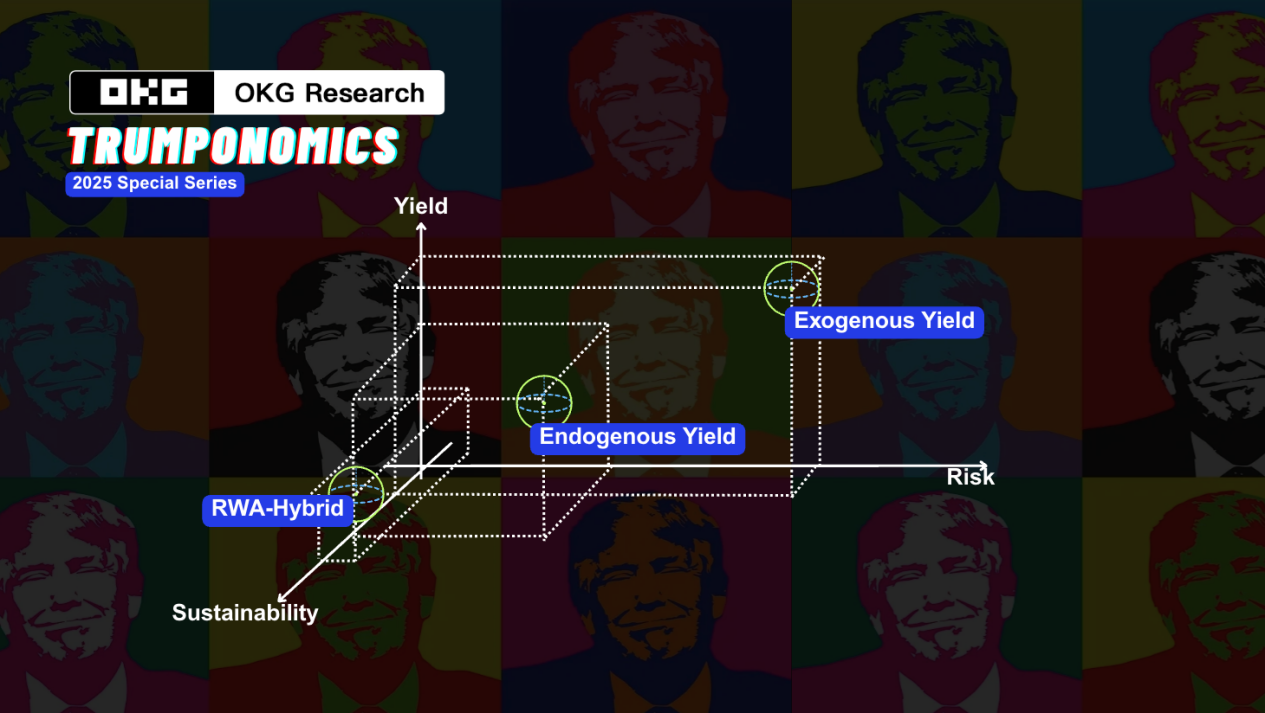

However, the sources of income for interest-bearing assets are very different. From the cash flow generated by the protocol itself, to the illusion of income that relies on external incentives, to the grafting and transplantation of the off-chain interest rate system, different structures reflect completely different sustainability and risk pricing mechanisms. We can roughly divide the interest-bearing assets of current decentralized applications (DApps) into three categories, namely exogenous income, endogenous income, and real-world asset (RWA) linkage.

Exogenous benefits: subsidy-driven interest illusion

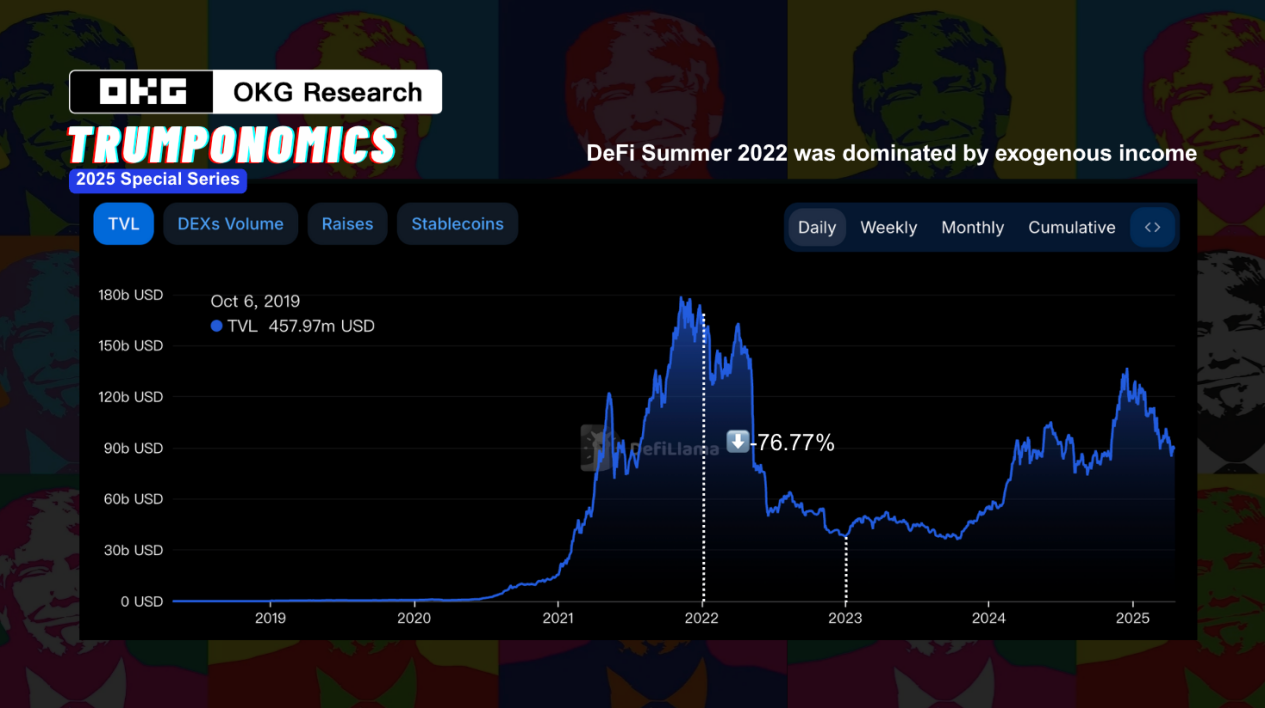

The rise of exogenous income is a microcosm of the logic of rapid growth in the early stages of DeFi development. In the absence of mature user demand and real cash flow, the market replaced it with "incentive illusion". Just like the early ride-hailing platforms used subsidies to exchange for users, after Compound launched "liquidity mining", SushiSwap, Balancer, Curve, Avalanche, Arbitrum and other ecosystems also launched huge token incentives in succession, trying to buy user attention and locked assets in the form of "investment income".

However, this type of subsidy is essentially more like a short-term operation in which the capital market "pays" for growth indicators, rather than a sustainable revenue model. It once became the standard for the cold start of new protocols - whether it is Layer2, modular public chain, or LSDfi, SocialFi, the incentive logic is exactly the same: relying on new capital inflows or token inflation, the structure is similar to "Ponzi". The platform uses high returns to attract users to deposit money, and then delays cashing through complex "unlocking rules". Those annualized returns of hundreds or thousands are often just tokens "printed" out of thin air by the platform.

This is the case with the Terra crash in 2022: the ecosystem attracted a large number of users by offering an annualized return of up to 20% on UST stablecoin deposits through the Anchor protocol. The income mainly came from external subsidies (Luna Foundation reserves and token rewards) rather than real income within the ecosystem.

From historical experience, once external incentives weaken, a large number of subsidized tokens will be sold, damaging user confidence, which will cause TVL and token prices to often fall in a death spiral. According to Dune data statistics, after the DeFi Summer craze faded in 2022, the market value of about 30% of DeFi projects fell by more than 90%, which was mostly related to excessive subsidies.

If investors want to find "stable cash flow" from it, they need to be more vigilant about whether there is a real value creation mechanism behind the income. Using future inflation to promise today's income is not a sustainable business model after all.

Endogenous benefits: redistribution of use value

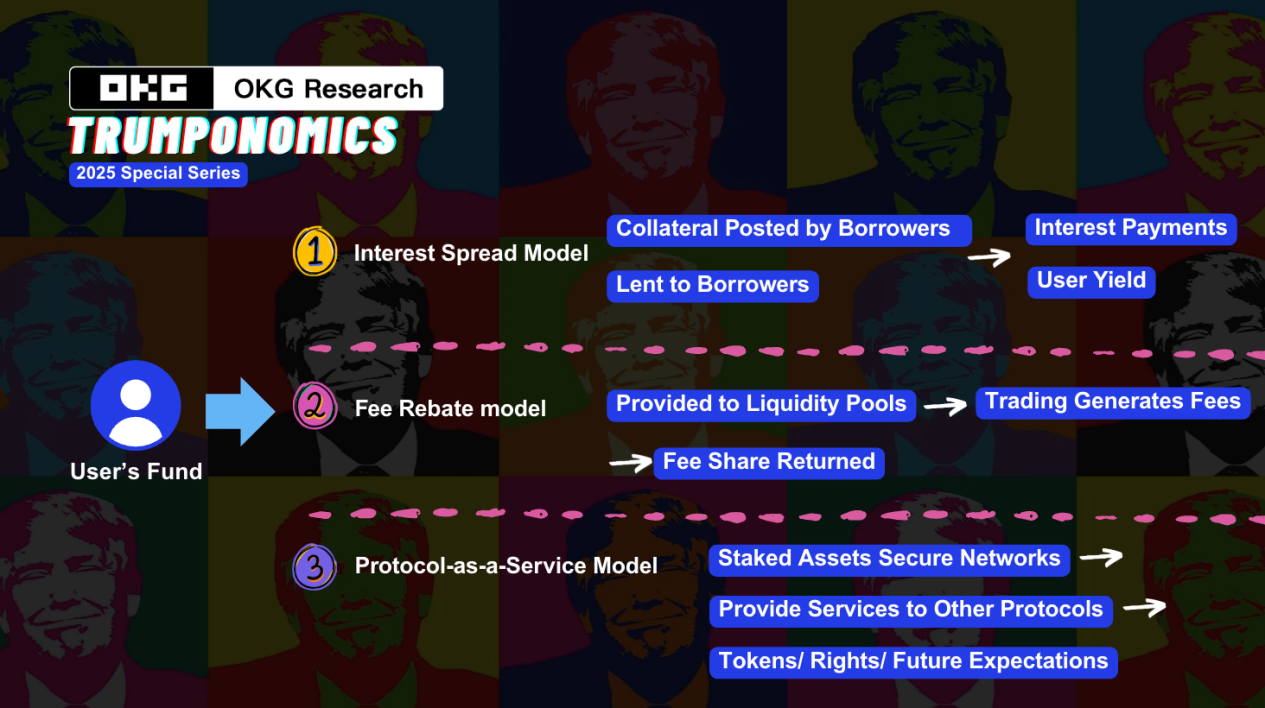

Simply put, the money earned by the protocol itself through "doing real things" is then distributed to users. It does not rely on issuing coins to attract people, nor does it rely on subsidies or external transfusions, but on income naturally generated through real business activities, such as loan interest, transaction fees, and even fines in default liquidation. These incomes are somewhat similar to "dividends" in traditional finance, so they are also called "dividend-like" crypto cash flows.

The biggest feature of this type of income is its closed loop and sustainability : the logic of making money is clear and the structure is healthier. As long as the protocol is operating and there are users using it, there will be income coming in, and there is no need to rely on market hot money or inflation incentives to maintain operation.

Therefore, we can more accurately judge how certain its income is by figuring out how it is "generated". We can divide this type of income into three prototypes:

The first type is the "lending and borrowing spread type". This is the most common and easiest to understand model in the early days of DeFi. Users deposit funds into lending protocols such as Aave and Compound, which match borrowers and lenders and earn interest spreads from them. Its essence is similar to the "deposit and loan" model of traditional banks - the interest in the fund pool is paid by the borrower, and the lender receives part of it as income. This type of mechanism has a transparent structure and efficient operation, but its income level is closely related to market sentiment. When the overall risk appetite declines or market liquidity shrinks, interest rates and income will also decline.

The second type is the "fee return type". This type of revenue mechanism is closer to the model of shareholders participating in profit dividends in traditional companies, or the revenue sharing structure in which specific partners are rewarded according to the proportion of revenue. In this framework, the protocol returns part of the operating income (such as transaction fees) to the participants who provide resource support for it, such as liquidity providers (LPs) or token stakers.

Taking the decentralized exchange Uniswap as an example, the protocol will distribute a portion of the transaction fees generated by the exchange to users who provide liquidity for it in proportion. In 2024, Aave V3 provided an annualized return of 5%-8% for the stablecoin liquidity pool on the Ethereum mainnet, and AAVE stakers could receive an annualized return of more than 10% in certain periods. These revenues come entirely from economic activities endogenous to the protocol, such as lending interest and transaction fees, and do not rely on external subsidies.

Compared with the "borrowing spread type" mechanism, which is closer to the bank model, the "fee refund type" income is highly dependent on the market activity of the protocol itself. In other words, its return is directly linked to the protocol business volume - the more transactions, the higher the dividend, and when the transactions decrease, the income fluctuates accordingly. Therefore, its stability and anti-cyclical risk ability are often not as robust as the lending model.

The third category is "protocol service" income. This is the most structurally innovative type of endogenous income in crypto finance, and its logic is similar to the model in traditional business where infrastructure service providers provide key services to customers and charge fees.

Taking EigenLayer as an example, the protocol provides security support for other systems through the "re-staking" mechanism and obtains rewards for it. This type of income does not rely on loan interest or transaction fees, but comes from the market-based pricing of the protocol's own service capabilities. It reflects the market value of on-chain infrastructure as a "public good". This type of return is more diverse and may include token points, governance rights, and even expected returns that have not yet been realized in the future, showing strong structural innovation and long-term nature.

In traditional industries, it can be compared to cloud service providers (such as AWS) providing computing and security services to enterprises and charging fees , or financial infrastructure institutions (such as custody, clearing, and rating companies) providing trust guarantees for the system and earning income . Although these services do not directly participate in terminal transactions, they are the indispensable underlying support for the entire system.

Realistic interest rates on the chain: RWA and the rise of interest-bearing stablecoins

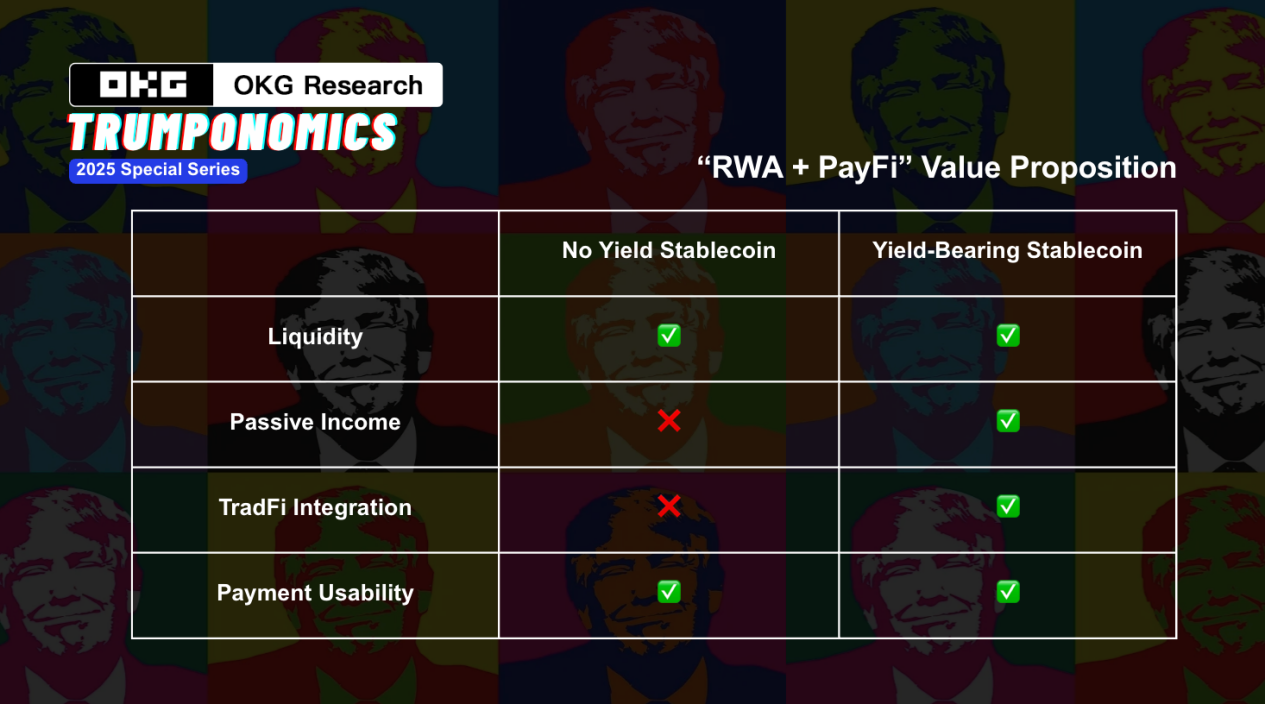

Currently, more and more capital in the market is beginning to pursue a more stable and predictable return mechanism: on-chain assets are anchored to real-world interest rates. The core of this logic is to connect on-chain stablecoins or crypto assets to low-risk off-chain financial instruments, such as short-term government bonds, money market funds, or institutional credit, so as to obtain "certain interest rates in the traditional financial world" while maintaining the flexibility of crypto assets. Representative projects include MakerDAO's allocation of T-Bills, Ondo Finance's OUSG (connected to BlackRock ETF), Matrixdock's SBTB, and Franklin Templeton's tokenized money market fund FOBXX. These protocols attempt to "import the Federal Reserve's benchmark interest rate onto the chain" as a basic income structure. This means that

At the same time, interest-bearing stablecoins as a derivative form of RWA have also begun to come to the fore. Unlike traditional stablecoins, this type of asset is not passively anchored to the US dollar, but actively embeds off-chain income into the token itself. Typical examples include Mountain Protocol's USDM and Ondo Finance's USDY, which are interest-bearing and income-generating from short-term government bonds on a daily basis. By investing in US Treasury bonds and, USDY provides users with a stable income, with a yield of nearly 4%, higher than the 0.5% of traditional savings accounts.

They are trying to reshape the usage logic of the "digital dollar" to make it more like an on-chain "interest account."

Under the interconnection of RWA, RWA+PayFi is also a scenario worth paying attention to in the future: embedding stable income assets directly into payment tools, thus breaking the binary division between "assets" and "liquidity". On the one hand, users can enjoy interest-bearing income while holding cryptocurrencies, and on the other hand, payment scenarios do not need to sacrifice capital efficiency. Products such as the USDC automatic income account on Base L2 launched by Coinbase (similar to "USDC as a checking account") not only enhance the attractiveness of cryptocurrencies in actual transactions, but also open up new usage scenarios for stablecoins - from "dollars in the account" to "capital in running water."

Three indicators for finding sustainable interest-earning assets

The logical evolution of crypto "interest-bearing assets" actually reflects the process of the market gradually returning to rationality and redefining "sustainable returns". From the initial high inflation incentives and governance token subsidies, to now more and more protocols emphasizing their own hematopoietic ability and even connecting to the off-chain yield curve, structural design is moving out of the extensive stage of "involutionary money-making" and turning to more transparent and refined risk pricing. Especially at a time when macro interest rates remain high, if crypto systems want to participate in global capital competition, they must build stronger "return rationality" and "liquidity matching logic". For investors seeking stable returns, the following three indicators can effectively judge the sustainability of interest-bearing assets:

- Is the source of income “endogenous” and sustainable?

The income of truly competitive interest-bearing assets should come from the protocol's own business, such as loan interest, transaction fees, etc. If the return mainly depends on short-term subsidies and incentives, it is like "pass the parcel": the subsidy is still there, the income is still there; once the subsidy stops, the funds are gone. Once this short-term "subsidy" behavior becomes a long-term incentive, it will exhaust the project funds and easily enter a death double spiral of falling TVL and coin prices.

- Is the structure transparent?

Trust on the chain comes from openness and transparency. When investors leave the familiar investment environment, that is, the traditional financial field with banks and other intermediaries as endorsements, how should they judge? Is the flow of funds on the chain clear? Is the interest distribution verifiable? Is there a centralized custody risk? If these questions are not clarified, they will all be black box operations, exposing the system's vulnerability. A clear financial product structure and an open and traceable mechanism on the chain are the real underlying guarantees.

- Are the benefits worth the realistic opportunity costs?

In the context of the Federal Reserve maintaining high interest rates, if the returns of on-chain products are lower than the yield of government bonds, it will undoubtedly be difficult to attract rational funds. If the on-chain returns can be anchored on a real benchmark like T-Bill, it will not only be more stable, but may also become the "interest rate reference" on the chain.

However, even "interest-bearing assets" are never truly risk-free assets. No matter how robust their income structure is, we still need to be vigilant about the technical, compliance and liquidity risks in the on-chain structure. From whether the clearing logic is sufficient, to whether the protocol governance is centralized, to whether the asset custody arrangement behind RWA is transparent and traceable, all of these determine whether the so-called "certain income" has real redeemability. Not only that, the future market for interest-bearing assets may be a reconstruction of the on-chain "money market structure" . In traditional finance, the money market assumes the core function of capital pricing with its interest rate anchoring mechanism. Today, the on-chain world is gradually establishing its own "interest rate benchmark" and "risk-free income" concepts, and a more substantial financial order is being generated.