Macroeconomic Review

The impact of the trade war on US stocks and BTC

1. Impact on US stocks

- Short term: Tariffs will push up prices (+2.5%), consumer power will decline, US stocks may fall by 3%-5%, and the risk of recession will increase.

- Industry: Import-reliant companies such as technology and automobiles will be harmed, while domestic manufacturing industries such as steel may benefit.

- Medium term: If tariff revenue is reduced, the stock market will stabilize; if the deficit is reduced, the decline will be aggravated.

2. Impact on Bitcoin (BTC)

- Short term: Risk aversion may push up BTC, but the plunge in US stocks may drag it down.

- Medium to long term: Inflation + weak US dollar, BTC may rise; high interest rates will put pressure on it.

- Range: USD 85,000-80,000.

On-chain data analysis

Fund Flow:

- Stablecoin fund flow: 5.343 billion new issuances in March, overall in a relatively weak state

- ETF fund flows: In March, ETF outflows amounted to 770 million, which was a smaller outflow compared to February, but it has not yet turned positive.

- BTC.D: Current value 63%, located on the upper track of the parallel channel since 23 years, BTC still maintains a strong dominant position

1. Macro Market Analysis

Tariff information analysis

Impact on US stocks

1. Short-term shock: increased market volatility

- Economists generally warn that tariffs will push up prices (for example, ING Group expects US prices to rise by 2.5%, an additional $1,350 per person per year), weakening consumer purchasing power. This may lead to lower earnings expectations for consumer goods and retail-related companies, which in turn will trigger short-term selling pressure on US stocks.

- Bill Adams of Comerica Bank noted that rising prices will drag down economic growth and employment in 2025. If the negative 1.4% growth rate predicted by the Atlanta Fed's GDPNow model comes true, market concerns about a recession will intensify and the stock market may face greater downside risks.

- Historical precedents, such as the Smoot-Hawley Act, suggest that high tariffs could trigger a contraction in global trade, weighing on share prices of U.S. companies that rely on exports, such as technology, autos and manufacturing.

2. Industry differentiation: winners and losers

- Industries that will suffer: Companies that rely on import supply chains (such as tech giant Apple and automakers Ford and GM) could see their profits squeezed by rising costs. If tariffs push up inflation, the Federal Reserve could delay rate cuts or even raise them, which would be particularly unfavorable for high-valuation growth stocks (such as Nasdaq components).

- Potential beneficiaries: Some domestic manufacturing industries (such as steel and energy) may benefit in the short term from the import substitution effect, but the premise is that tariffs do stimulate the repatriation of production rather than simply pushing up costs.

3. Policy flexibility and long-term expectations

- Samuel Toombs of Pantheon Macroeconomics believes that the "quickly reversible" nature of tariffs could prevent a hard landing for the economy. If the Trump administration adjusts its policies based on market reactions, the stock market could stabilize after an initial decline.

- Neil Shearing of Capital Economics pointed out that if the $500 billion in tariff revenue is used to cut taxes or stimulate consumption (as Stephen Milan said), it may partially offset the pressure of economic slowdown and boost market confidence. However, if it is used to reduce the deficit, fiscal tightening may increase the risk of recession and put greater pressure on the stock market.

4. Comprehensive judgment

- In the short term, US stocks may fall due to uncertainty and rising inflation expectations, especially the S&P 500 and Nasdaq, which may experience a 3%-5% correction, or even higher (if recession expectations heat up). The medium-term impact depends on the use of tariff revenues and the intensity of global retaliatory measures. If the trade war escalates across the board, the S&P 500 may enter a technical adjustment range (a drop of more than 10%).

Impact on Bitcoin (BTC)

1. Short-term reaction: risk aversion and volatility

- The global economic uncertainty caused by tariffs may boost demand for safe-haven assets. Bitcoin is often regarded as "digital gold" and may rise in the short term due to safe-haven fund inflows. However, if the plunge in US stocks triggers a liquidity crisis, investors may sell high-risk assets (including BTC) in exchange for cash, causing BTC to fall simultaneously.

- If Trump's tariffs push up the dollar (due to a reduction in the trade deficit or increased safe-haven demand), BTC as a non-dollar denominated asset may come under pressure.

2. Impact of inflation and monetary policy

- Rising inflation due to tariffs (e.g., 2.5% price growth) could force the Fed to maintain high interest rates or even raise them, which is bad for Bitcoin. A high interest rate environment generally weakens the appeal of non-yielding assets (such as BTC).

- However, if the tariff revenues were used to deliver large-scale tax cuts (as Milan has suggested), stimulating the economy and weakening the long-term value of the dollar, BTC could benefit due to its “inflation-resistant” properties.

3. Global Economic Background

- If tariffs hit the economies of Vietnam, the European Union and other places hard, the global crypto market may be under pressure due to the decline in risk appetite. As a global asset, the price of BTC is not only affected by the United States, but also closely related to international capital flows.

- Historical comparison: BTC did not exist during the Great Depression following the Smoot-Hawley Act in the 1930s, but if a similar recession were to reoccur, BTC could attract safe-haven funds due to its “decentralized” nature.

4. Comprehensive judgment

- In the short term, BTC may fluctuate with the U.S. stock market and may rise slightly in the early stages due to risk aversion, but if the risk of recession intensifies, it may fall along with risky assets.

- In the medium to long term, if tariffs trigger sustained inflation and the US dollar weakens, BTC may benefit and hit new highs; conversely, if the Federal Reserve raises interest rates to combat inflation, BTC may be under pressure in the $85,000-80,000 range.

The impact of this "tariff tsunami" is full of uncertainty, and the final result will depend on the implementation of Trump's policies, the global retaliatory response, and the Federal Reserve's monetary policy adjustments. It is recommended to pay close attention to the implementation of tariffs starting from April 5 and subsequent market data.

Key data to watch next week

2. On-chain analysis

1. Changes in short- and medium-term market data that affect the market this week

1.1 Stablecoin Fund Flow

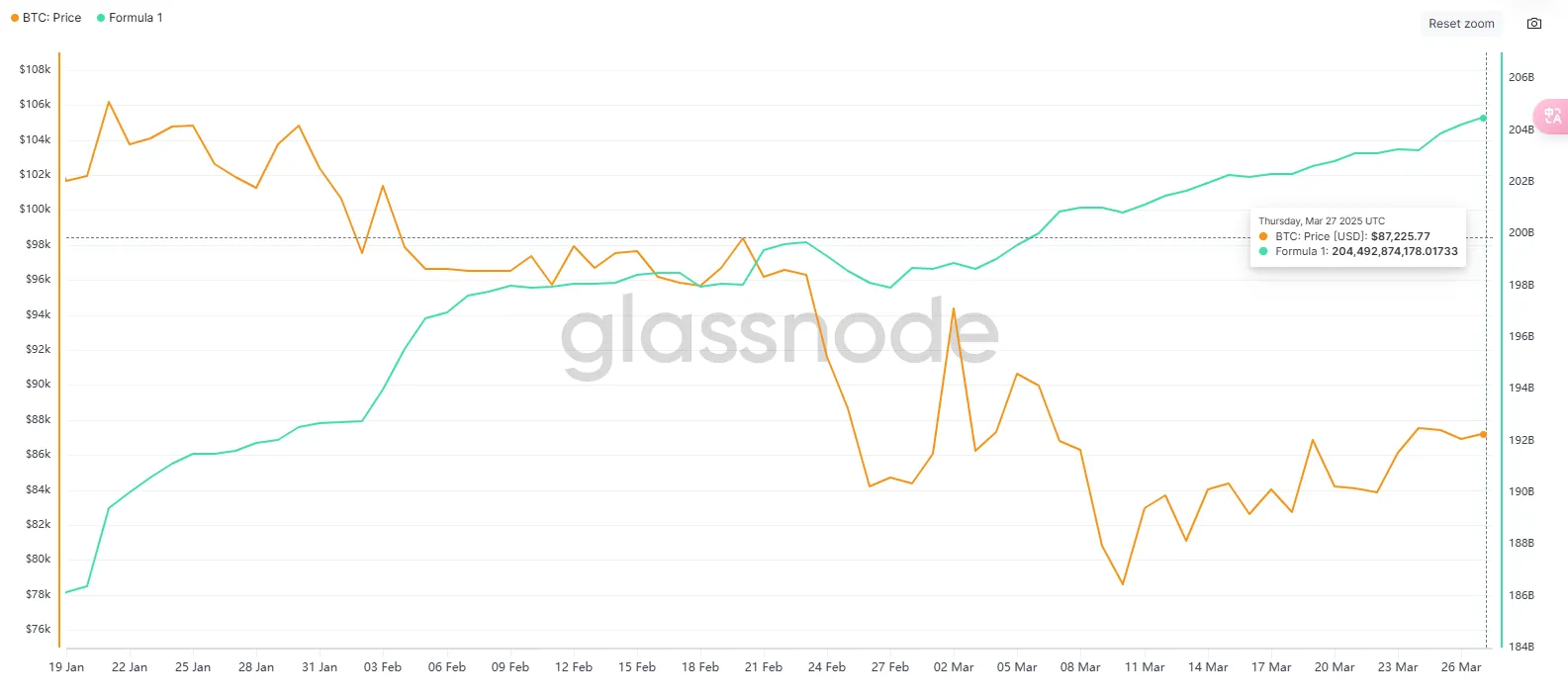

The supply of stablecoins in the market continued to grow this week, with the total amount increasing to 204.657 billion, setting a new record. The weekly issuance was 164 million, with an average daily issuance of 27 million, which was a significant decrease compared with the previous three weeks. From a monthly perspective, the monthly issuance was 5.343 billion, with an average daily issuance of 172 million, an increase of 1.77% compared with the 5.25 billion stablecoins issued in February, and a decrease of 57.3% compared with the average issuance of 12.5 billion stablecoins during the main uptrend from November 24 to January 25.

Short-term impact: The market may enter a period of volatile adjustment

- The issuance of new bonds dropped sharply, and short-term liquidity was under pressure: The issuance volume dropped sharply this week, which may lead to a decrease in market trading depth and increased volatility.

- The upward momentum is weakening: If the supply of funds cannot be restored, it will be difficult for the market to see a trend of upward movement in the short term.

Medium- and long-term impact: The sustainability of capital inflows still needs to be observed

- In March, overall funds rebounded slightly, but it was far below the main upward wave level, which means that the market is still in the adjustment and recovery stage.

- Subsequent key observation points:

Whether stablecoin issuance will pick up again in the coming weeks.

The capital flows of USDT and USDC.

Whether institutional funds will continue to enter the market and bring in additional liquidity.

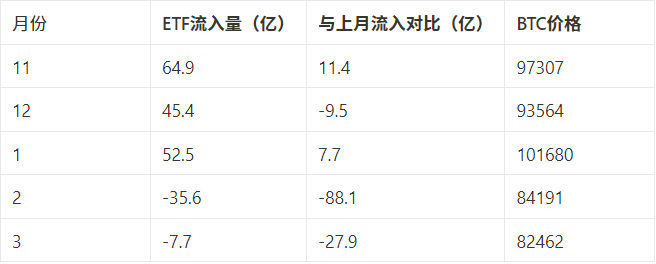

1.2 ETF Fund Flow

In March, the net outflow of ETFs was 770 million US dollars, a decrease of 78.4% from the net outflow in February, showing a shrinking outflow but still not returning to positive, indicating that institutional buying has not yet recovered. Compared with the average monthly inflow of 5.43 billion in the main rising wave from November to January, the inflow of ETFs is still far behind.

Short-term market impact: Buying is still weak, BTC price is under pressure

- In March, the price of BTC remained in a volatile downward trend. Although the outflow of ETFs slowed down, the lack of incremental buying led to a lack of breakthrough momentum in the market.

- As an important source of funds for institutional investors, the continued outflow of ETFs indicates that the market has not yet recovered strong institutional bullish sentiment.

- The key point to observe in the next few weeks: Whether ETFs turn to net inflows will determine whether the market can return to an upward trend.

Medium- to long-term impact: The market is still in a period of adjustment, but may be close to the bottom

- The large outflow of ETFs in February triggered a sharp correction, but the outflow slowed down in March and the decline in BTC prices decreased significantly, indicating that the market has adapted to the impact of institutional capital outflows.

- If ETF funds return in April, it may become a catalyst for BTC to strengthen again. If ETF funds continue to flow out, it may cause BTC to enter a longer period of shock consolidation.

1.3BTC Market Share

BTC.D has maintained a steady rise since 2024, running along the rising channel, and its current value of 63.00% is currently close to the upper track area of the channel. The current market value share has exceeded the previous high of 62.5%, indicating that BTC's dominance in the market continues to increase.

Potential Market Impact

- The increase in BTC’s market capitalization share indicates that more funds are flowing into BTC, which has relatively suppressed the performance of altcoins.

- If BTC.D continues to break through the upper channel, it may trigger a larger level of capital inflow back to BTC, forming a more obvious dominant market.

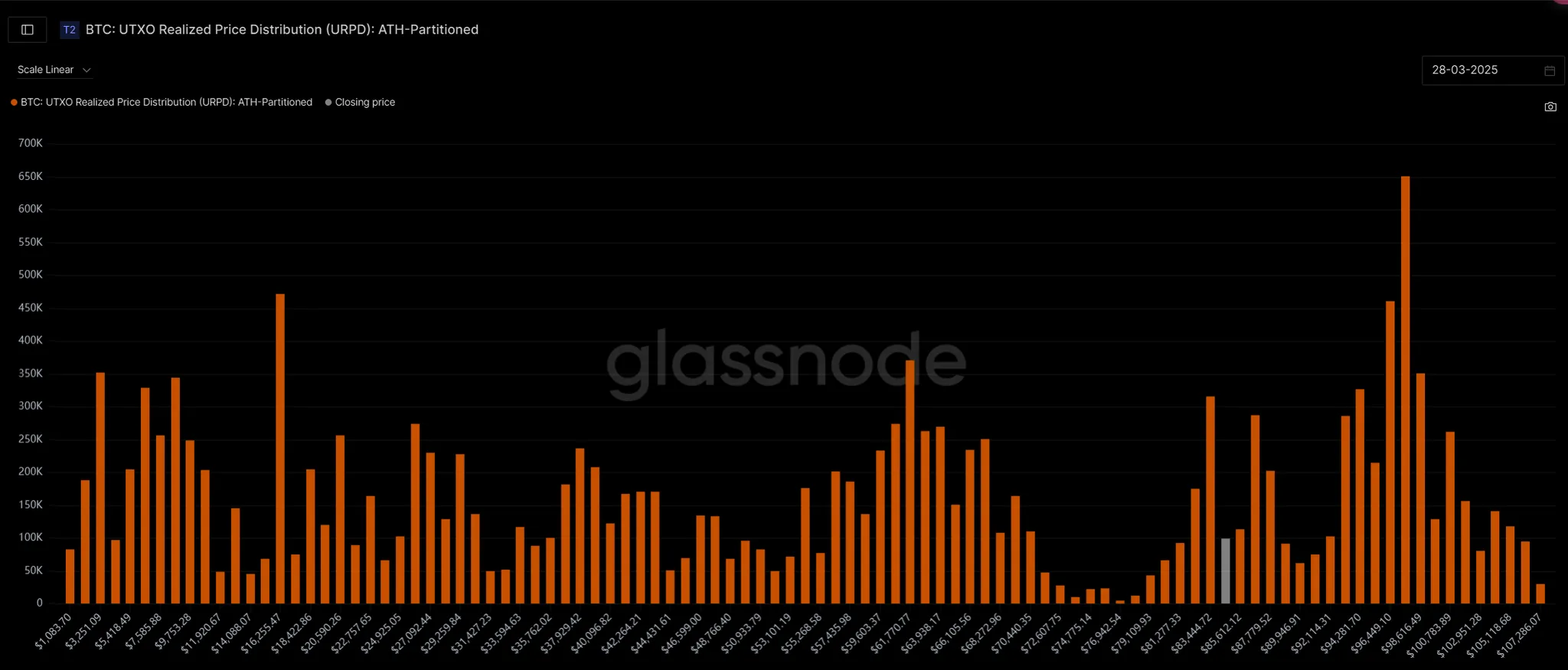

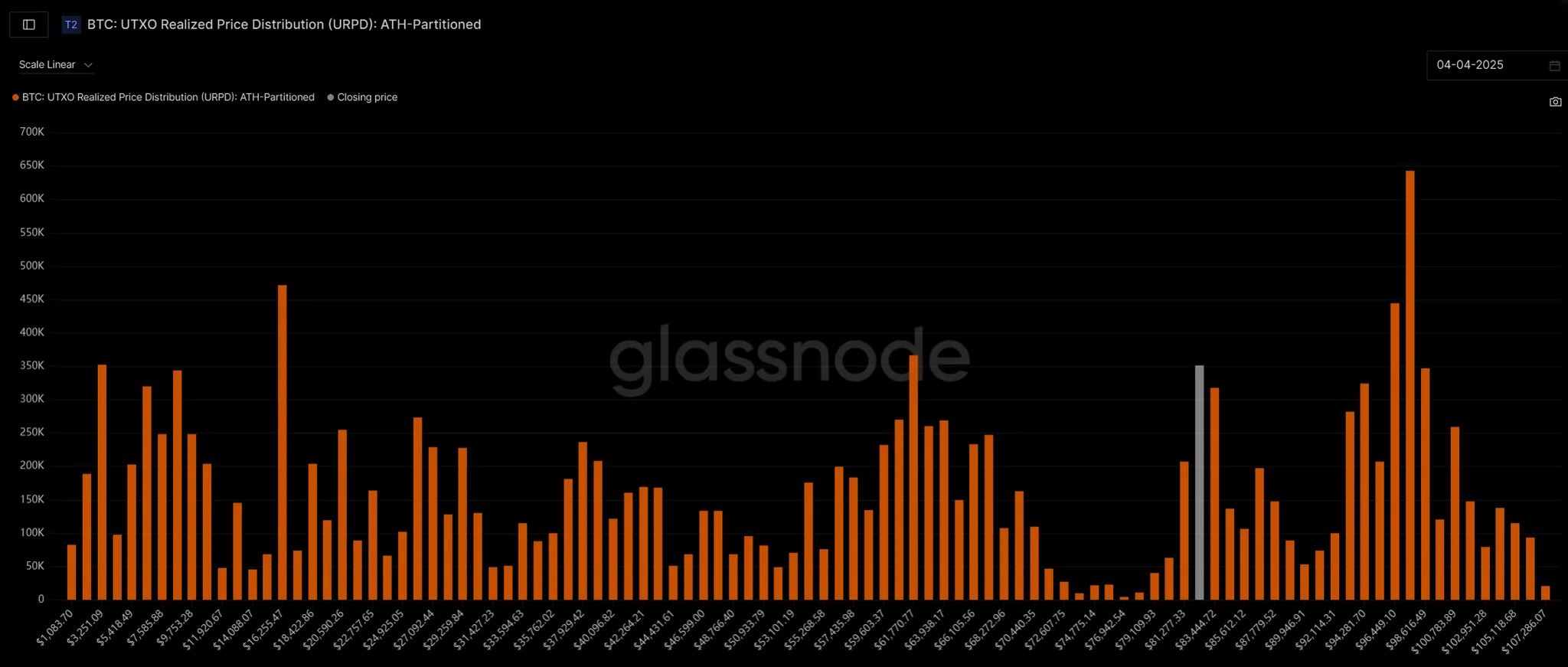

1.4URPD

Comparing with the BTC on-chain chip structure chart on March 28, we found that on April 4, an obvious chip concentration area was formed at the 97532 position on the chain. Currently, a small chip concentration area has been formed at the 81200-83400 position (4.41%). We also noticed that the chips at 97532 above have not decreased much (3.24%). The current price has not returned to above 90,000. Now, this part of the chips is relatively firm, but if the price goes down and this part of the chips is reduced, it will be a selling pressure shock to the market.

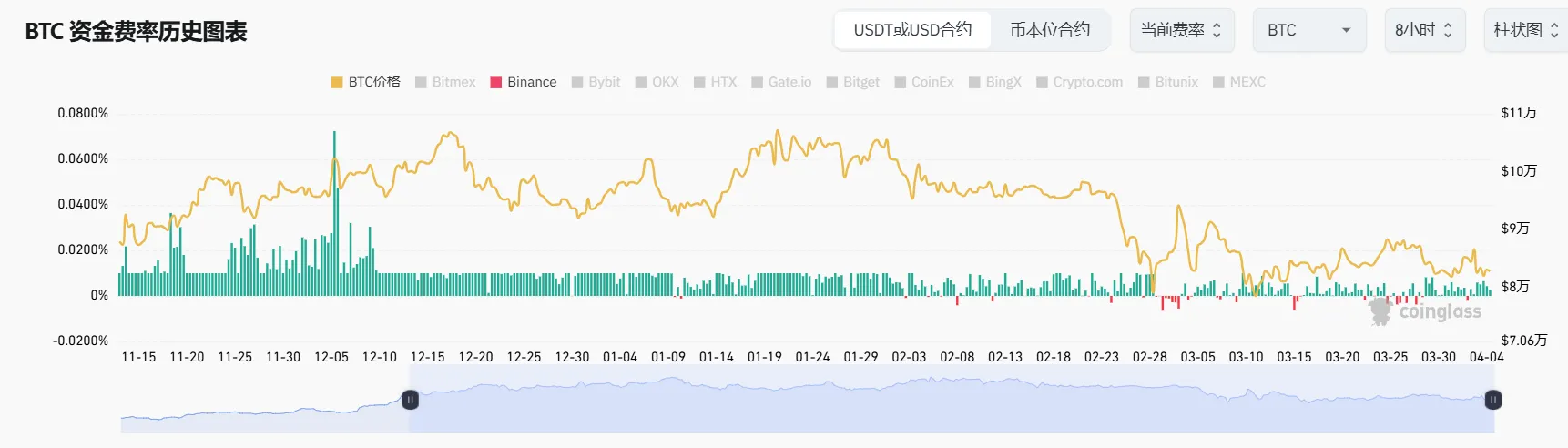

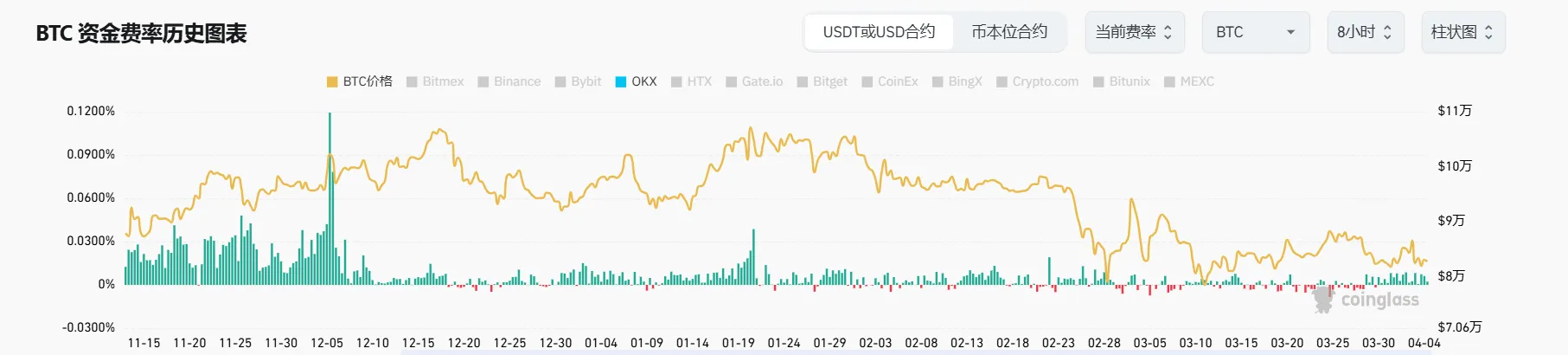

1.5 Funding Rate

The funding data for this period has slightly rebounded. Compared with the two months before this week, the data from the OKX exchange shows that the market sentiment has stabilized relatively, and the negative value of funding is not obvious. For the market, it is a sign of recovery.

2. Changes in mid-term market data that affect the market this week

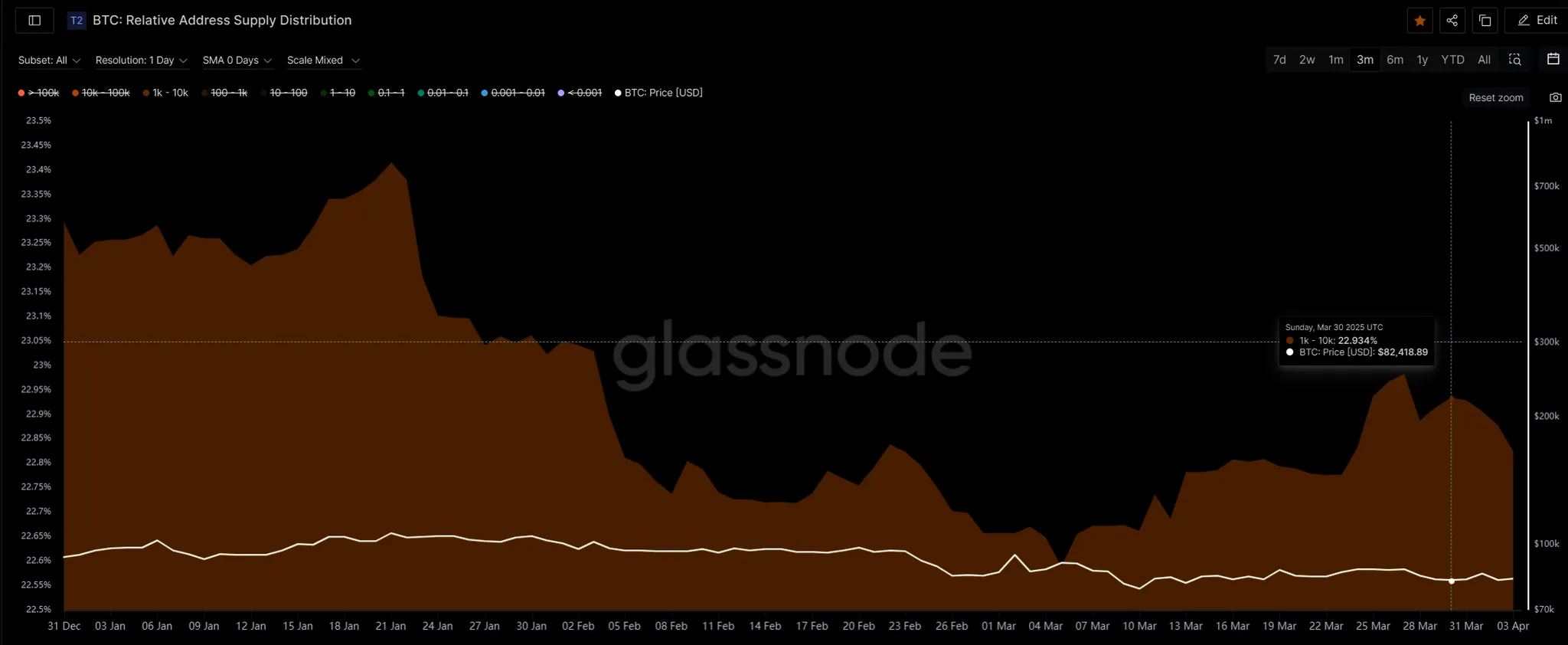

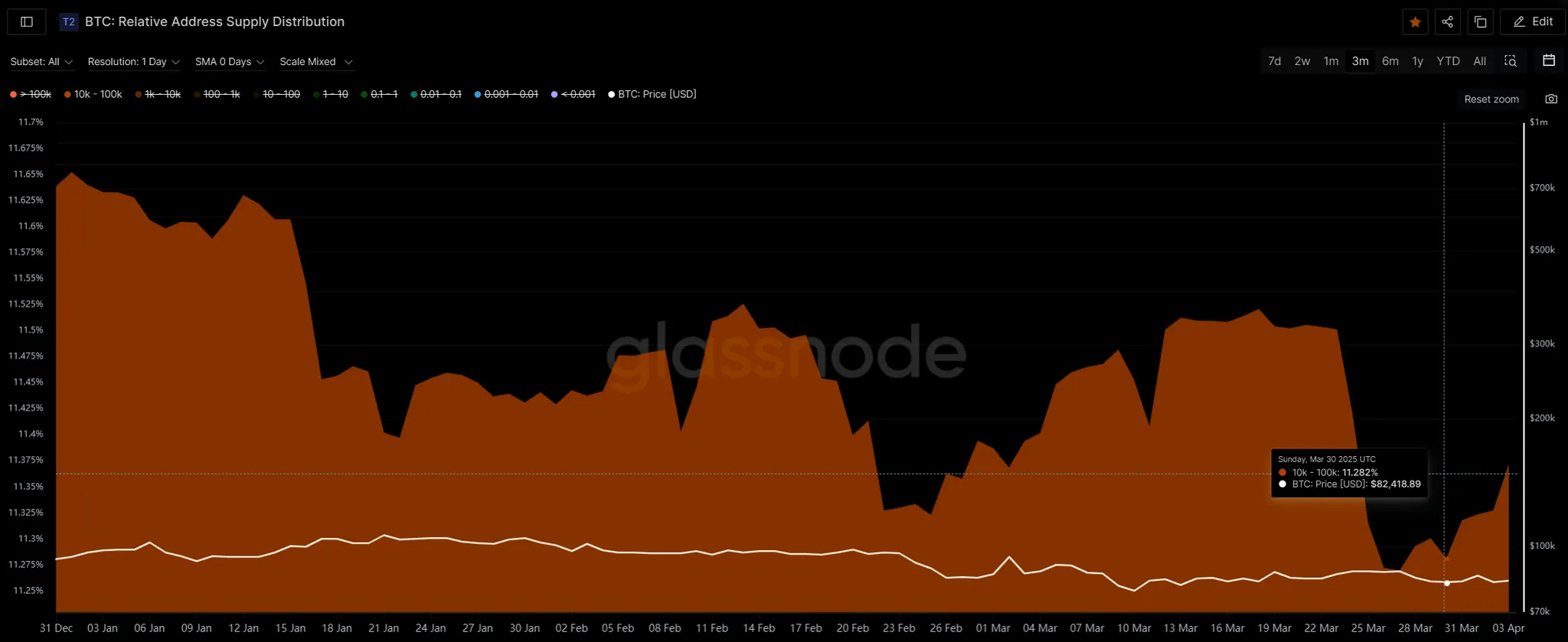

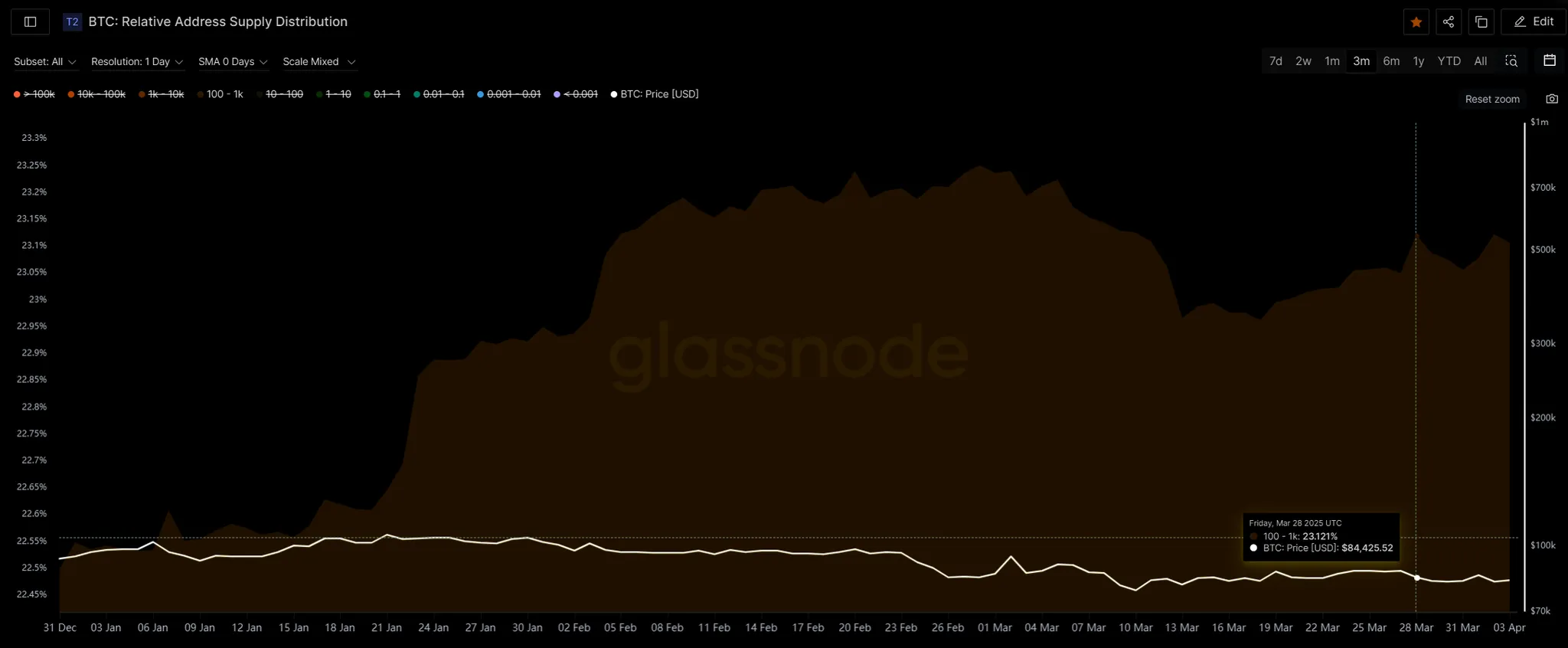

2.1 Proportion of coins held by coin holding addresses

The number of chips holding 1K-1W has slightly decreased this period. As we mentioned before, the flexibility of these chips is very adaptable. When the tariffs were announced, they reduced their positions. The number of addresses holding 10,000-100,000 coins has slightly increased, but the overall increase in this period is not particularly large. The chips are still transferred internally.

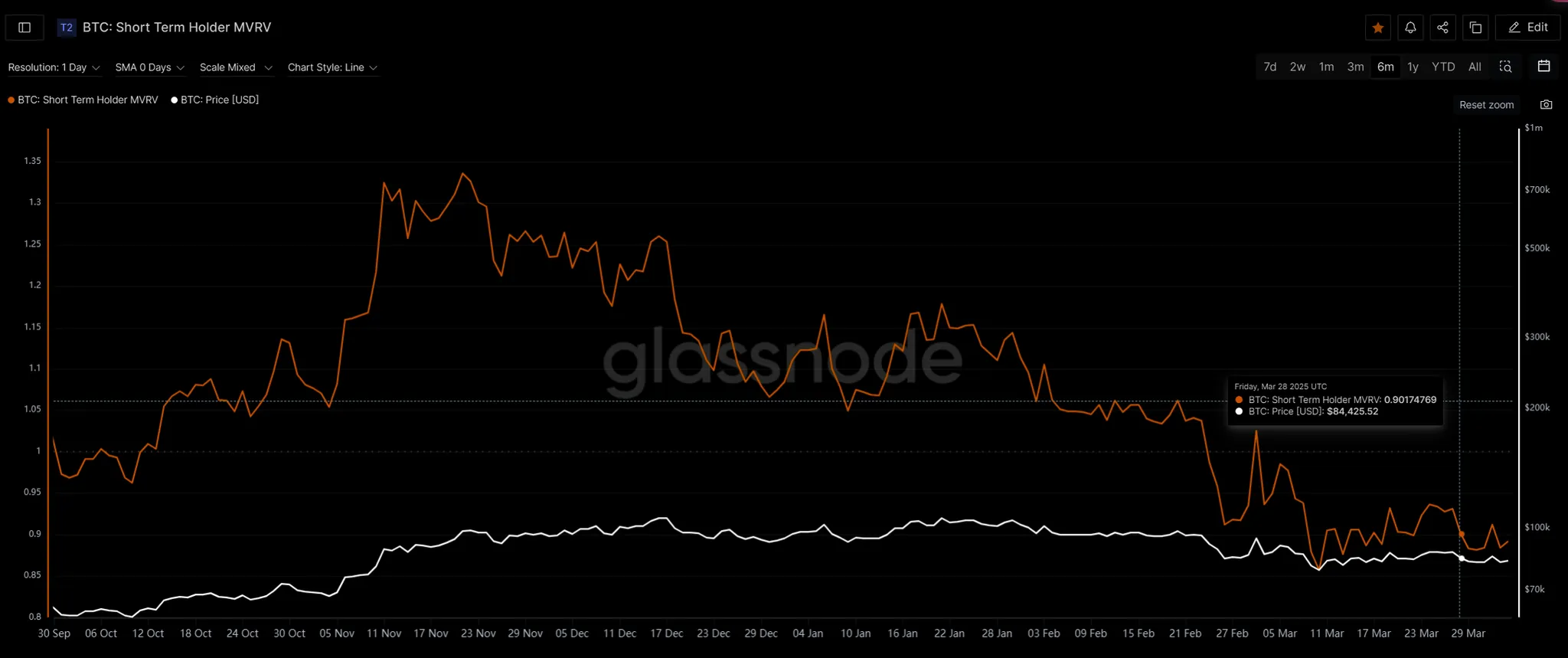

2.2 Short-term chips-MVRV

The MVRV of short-term chips in this period has remained at a low level of around 0.8-0.9. Although the market has rebounded to around 88,000, this value has not increased significantly, indicating that there are not many short-term chips participating in the chain during this decline and rebound process. It is not that the market is still under price pressure, but the selling pressure of short-term chips is not expected to be particularly large, so we must pay attention to the changes in long-term chips.

Special thanks

Creation is not easy. If you need to reprint or quote, please contact the author in advance for authorization or indicate the source. Thank you again for your support.

Written by: Sylvia / Jim / Mat / Cage / WolfDAO

Edited by: Punko / Nora

Thanks to the above partners for their outstanding contributions to this weekly report. This weekly report is published by WolfDAO for learning, communication, research or appreciation only.