Article author: Lean View

Recently, Nano Labs (Nasdaq: NA), a Nasdaq-listed company, announced a private placement plan, raising a total of US$36.25 million. Participants in the private placement include Fenbushi Inc -US, Longling Capital, Golden Forest Management Limited, etc.

Nano Labs was listed on the Nasdaq in July 2022. Nano Labs was founded by Mr. Kong Jianping, the former co-chairman of Canaan Inc., and it was under the leadership of Kong Jianping that Canaan Inc. successfully entered the Nasdaq and became the first listed company in the global blockchain industry, creating the industry history of blockchain industry companies "eating crabs" in the traditional securities market. Kong Jianping has been in contact with Bitcoin since 2012 and has been deeply involved in the industry for more than ten years. The second largest shareholder of Nano Labs is another legendary figure in the encryption field, "Forest Man" - Sun Qifeng, the founder of the world's earliest Bitcoin magazine "One Bit". At that time, Bitcoin was given with the purchase of each magazine.

A major highlight of this private placement is that several godfather-level capitals in the crypto industry participated in this private placement to a large extent. It is possible that they will strategically participate in the development of Nano Labs in the future rather than simply invest in finance. In addition, HashKey Group and the family fund of Li Lin, the former founder of Huobi, have already invested in Nano Labs in the Pre-IPO round. It can be said that after the completion of this round of private placement, Nano Labs has gathered a group of top giants in the native Chinese crypto circle, and the lineup can be called the "Chinese Crypto Team". And the Chinese in the Bitcoin ecosystem, from the proportion of computing power to the amount of BTC held, from the ecological layout to application development, are all areas with relative advantages and influence in the crypto industry.

The proportion of new shares added in this private placement is relatively large, and the strategic shareholders introduced are basically industry giants who have been deeply involved in the encryption industry for many years, have a deep understanding of the industry, and possess top industry resources and huge influence. It can be foreseen that Nano Labs will usher in a major strategic transformation, upgrading and change in the future.

Therefore, since last year, the company's chairman Kong Jianping has also been active in the field of Bitcoin ecological construction. By investing in Satoshi Labs and BTC liquidity protocols, he has supported the development of a large number of important Bitcoin ecological infrastructures around the world, and participated in and organized many industry summits around the world that have a significant impact on Bitcoin. He has accumulated a high influence and industry prestige in the Bitcoin ecosystem. After this private placement, Nano is expected to take advantage of the trend to carry out a comprehensive strategic transformation and upgrade, focusing on BTC as the focus of business development, purchasing, holding and managing BTC, participating in BTC ecological construction, liquidity support, etc.

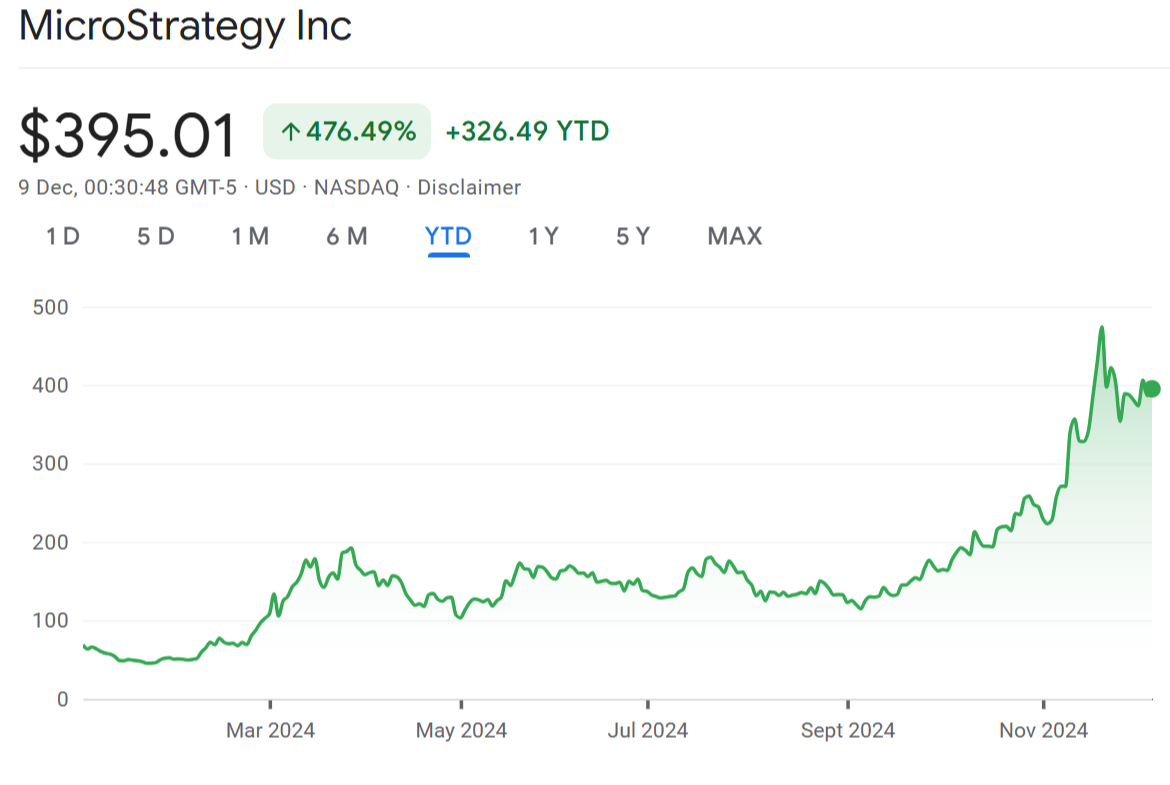

Although many listed companies have announced that they will purchase Bitcoin as the company's reserve assets this year, most of these listed companies are mainly for financial investment or to get in on the BTC concept. There are actually very few companies that truly use BTC as their main business direction and have a deep understanding of BTC and the crypto industry. The most typical company in the U.S. stock market that directly uses BTC as its main business direction is Microstrategy, the "hotshot" of the U.S. stock market this year. Since the current bull market, the stock price has risen from around US$30 to a maximum of US$543, an increase of more than 15 times, and the highest market value has exceeded US$100 billion. The current market value is also above US$80 billion.

MicroStrategy has innovated its investment and financing model to hold a large amount of Bitcoin. Since August 2020, MicroStrategy has invested its idle funds in Bitcoin, becoming the world's first listed company to implement a Bitcoin funding strategy. Since then, it has continued to buy. As of December 1, 2024, it and its subsidiaries hold a total of approximately 402,100 Bitcoins, with a total purchase cost of approximately US$23.4 billion, becoming an important holder of Bitcoin, affecting the market supply and demand and price trend of Bitcoin to a certain extent.

MicroStrategy raises funds to increase its holdings of Bitcoin by issuing convertible bonds and other means. Most of its convertible bonds are medium- and long-term zero-interest bonds, and the option of conversion to stock and cash repayment is in MicroStrategy, which reduces financing costs and debt default risks. It also closely links stocks with Bitcoin price fluctuations, realizes triple arbitrage of stocks, bonds and coins, and provides a new source of funds and operation mode for Bitcoin investment.

Similar to MicroStrategy, Nano Labs will also focus on BTC in the future. Based on the company's shareholders' strong native cryptographic resources and profound industry knowledge, we can even expect Nano Labs to have a more groundbreaking layout and strategy in the BTC ecosystem. As an industry OG, Kong Jianping, chairman of Nano Labs, has been a firm believer in BTC since he entered the crypto industry in 2012. He is also a well-known prophet of Bitcoin prices and has a deep understanding of the development of the industry. Ten years ago, he expressed in an interview with Yang Yang that Bitcoin will exceed $100,000 in the future and Bitcoin should not be sold within ten years. At that time, the price of Bitcoin was still hovering around $50. During the 2019 Bitcoin bear market cycle, at the Bitcoin Mining Conference, he reiterated that Bitcoin would exceed $100,000. The sentence "The only obstacle for Bitcoin to break through $100,000 is time" was a widely influential viewpoint at the time. At that time, Bitcoin was less than $5,000. Fenbushi Inc.-US, founded by Shen Bo and Wanxiang, is one of the two major early investment and incubation institutions of the second largest cryptocurrency ETH. As one of the oldest investment institutions in the crypto industry, they have participated in investing in a large number of industry-leading public chains and projects. HashKey Group has also obtained the first compliant exchange license in Hong Kong. Cai Wensheng, one of the leading figures in China's mobile Internet, the founder of Longling Capital and the chairman of Meitu Group, is also an early participant in cryptocurrency and a believer in Bitcoin. It is rumored that Kevin Ren's CGV Capital, Jademont, the founder of Waterdrip Capital, Vito, the founder of MetaEra, Patrick, the founder of K24 Ventures and other senior people and institutions with influence in the crypto industry also participated in this private placement.

In terms of grasping the macro direction and macro breakthrough capabilities, Kong Jianping can basically make accurate judgments and even participate in promoting changes and breakthroughs in the industry landscape. Not only does he have the ability to predict the long-term price of Bitcoin, and lead Canaan Technology to successfully impact the world's first blockchain stock, Kong Jianping also played a very important role in the "Crypto New Policy" released by Hong Kong in October 2022, proposing a large number of targeted policy suggestions in multiple fields, and acting as a role in communication, coordination and even popular education. Today, Kong Jianping, as an industry representative, has also been appointed by the Hong Kong Special Administrative Region Government as a director of Hong Kong Cyberport (an important carrier for the development of Web3 and crypto finance in Hong Kong), a member of the Hong Kong Government's Third Generation Internet Group, and has played a major role in promoting Hong Kong to become a crypto financial center in the Far East. And this hugely influential fixed increase and major adjustments in the business direction of Nano Labs are very likely to be the beginning of a new round of strategic layout for Kong Jianping.

After the completion of this private placement, according to the latest closing price, Nano's market value is less than 200 million US dollars, which is seriously undervalued compared with MicroStrategy's current market value of more than 80 billion US dollars. Once Nano officially starts its business direction with Bitcoin as the core, the Chinese "crypto team" led by Kong Jianping will most likely start to exert its strength from multiple angles and fields, replacing MicroStrategy as one of the most important purchasing forces for BTC spot in the current period. In turn, Nano will also become one of the biggest beneficiaries of this round of bull market. Due to the deep layout of the major shareholders in the Bitcoin ecosystem, Nano is likely to have advantages in the asset management field and the native Bitcoin ecosystem in the future that other listed companies and even MicroStrategy cannot match, including obtaining high BTC risk-free returns by building a multi-layer infrastructure liquidity system, etc. These require not only a deep understanding and cognition of BTC itself, but also a deep understanding and participation in various BTC infrastructures and extensive industry resources to achieve. This gives Nano the opportunity to become a unique target with barriers in the capital market. It is even possible that it will catch up and surpass MicroStrategy to become a leading listed company with Bitcoin as its main business.

On December 5, BTC broke through $100,000. Kong Jianping, chairman of Nano Labs, sent a tweet, which read:

"In 2019, I expressed a view at the New Era Mining Summit: the only obstacle for Bitcoin to break through $100,000 is time. At that time, Bitcoin had been hovering around a few thousand dollars for a long time, and many people did not believe that this would happen. Just now, on December 5, 2024, Bitcoin broke through $100,000. In the future, the only obstacle for Bitcoin to break through $1 million is still time!"

Now that Trump, known as the crypto president, has won the US election, the United States, the world's leading economy in science, technology, economy and finance, has fully turned to crypto-friendliness. Prior to this, in early 2024, a large number of BTC ETFs had been approved for issuance. After Trump's victory, the US federal government and the Federal Reserve's plans to reserve Bitcoin were put on the agenda. Some US state governments and state federal reserves have already passed the bill and are about to implement the reserve plan. Once these plans begin to enter the implementation stage, they will have a significant leading and exemplary role on a global scale, and a large number of related countries and emerging countries may follow suit. Coupled with a large number of listed companies with heavy capital and the continued increase in the giant asset management companies, the limited total amount of BTC will usher in a huge explosion of consensus buying power on a global scale in the future.

Perhaps, as Kong Jianping said, everything has just begun. It is only a matter of time before Bitcoin breaks through 1 million US dollars. Nano, as the flagship of the aircraft carrier led by him, is about to set sail in the great era of BTC with the joint support of a group of "crypto-team" bosses.