1. Attention Value-Market Key Points

1. Market conditions

(1) Macro environment:

Grayscale executives predict that the crypto industry will see several small-scale breakthroughs in 2025

Zach Pandl, managing director of research at Grayscale, said that with the approval of spot ETFs and the election of Trump in 2024, the crypto industry will see more small-scale breakthroughs in 2025. These breakthroughs include increased institutional adoption, a more comprehensive legislative framework from Congress, and the prospect of Bitcoin becoming a reserve asset in the United States. In a conversation with Ric Edelman, founder of the Digital Asset Financial Professionals Committee, Pandl mentioned that it is not "completely impossible" for Bitcoin to reach $500,000 in 2030. He pointed out that pension funds and endowment funds that have been on the sidelines of cryptocurrencies in the past decade are actively approaching this field, and some portfolio managers have begun to allocate up to 5% of crypto assets, and it is expected that the approval process for more institutions will be completed within 6 to 12 months. In addition, Pandl also expects sovereign wealth funds outside the United States to increase their investments in crypto assets in the coming months. He is particularly optimistic about the prospects for institutional adoption of Ethereum, calling it "one of the most important open source software projects." In terms of private equity funds, decentralized finance (DeFi), tokenization of physical assets, and artificial intelligence tokens may also attract institutional attention.

(2) Web3 field:

Crypto markets rise on CPI data and Trump news; investors remain cautiously optimistic

Min Jung, a research analyst at Presto Research, noted that the rise in the crypto market was mainly driven by lower-than-expected CPI data, which temporarily eased inflation concerns. The core CPI data for December was 3.2%, lower than market expectations and the 3.3% level in November. In addition, news related to Trump also played an important role, including his plan to list cryptocurrencies as a "national priority" and his openness to supporting reserves in cryptocurrencies created in the United States. Min Jung said that the market as a whole is cautiously optimistic, and the macroeconomic level is still concerned about inflation. Although the lower CPI data provided a short-term relief, investors are still closely watching for any signals that may indicate that inflationary pressures persist. He predicted that further news about Trump's possible establishment of a national Bitcoin reserve could exacerbate market volatility in the short term.

2. Hot events

(1) Macro environment:

SEC General Counsel Megan Barbero will leave on Trump's inauguration day, joining the wave of crypto industry executives leaving

Megan Barbero, the chief legal officer and general counsel of the U.S. Securities and Exchange Commission, will leave next week, joining a wave of departures from senior officials who have engaged in legal battles with the crypto industry in recent years. Barbero's departure is scheduled for January 20, which coincides with the swearing-in of U.S. President-elect Donald Trump. SEC Chairman Gary Gensler said in a statement that Barbero's advice and judgment are critical to the commission's decision-making. Her departure follows the departure of the SEC's enforcement chief Gurbir Grewal in October, and accounting chief Paul Munter, who was responsible for the agency's controversial crypto accounting policies, also announced this week that he was leaving.

(2) Web3 field:

Litecoin ETF is expected to become the first altcoin ETF in 2025. Solana ETF may have to wait until 2026 to be approved.

Eric Balchunas, senior ETF analyst at Bloomberg, said that the Litecoin ETF has met all the conditions and is expected to become the first altcoin ETF in 2025. He pointed out that considering that the SEC has commented on the S-1 filing and considers Litecoin a commodity, and against the background of the new leadership of the SEC, the reason for withdrawing the application is not obvious. At the same time, James Seyffart, an analyst at Bloomberg Industry Research, mentioned in an interview that despite the White House's friendly attitude towards cryptocurrencies, the Solana ETF may not be launched in the United States until 2026. Seyffart pointed out that after Trump's election, issuers may see an improvement in the lag in Solana ETF applications, but since it usually takes 240-260 days for the SEC to review documents, this timeline may be extended. In addition, the SEC has filed a lawsuit against cryptocurrency exchanges, alleging that SOL constitutes an unregistered security, which further complicates the review process.

3. Hot topic narrative

The future of the gaming industry: AI Agents lead the rise of the Agentic Metaverse

Recently, with the help of platforms such as Solana and Base, the production speed of AI Agents has increased rapidly. In just a few months, thousands of personalized AI Agents have emerged. Multimodal AI projects such as Hive and arc are emerging, promoting interaction and collaboration between agents. The development of Agentic game engines will enrich the interaction between players and dynamic NPCs. There are successful cases in the market, such as the Digimon game under the background of a16z, which allows players to interact deeply with AI. As an open source game engine, Moddio has achieved significant growth after its transformation to Web3, providing developers with low-threshold and high-efficiency solutions. Agentic Metaverse/Game is gradually coming to us, solving the problem of insufficient players in the early stage of Web3, accelerating the development of new games, promoting the Mass Adoption of Agentic Games, and laying the foundation for future development.

2. Attention Value-Hot Projects

1. Project Introduction

$AGIXT | AI Agent | @AGi_XT

- AGiXT is a dynamic AI agent automation platform that seamlessly orchestrates instruction management and complex task execution from different AI providers. AGiXT combines adaptive memory, intelligent functions, and a versatile plug-in system to provide an efficient and comprehensive AI solution.

- github: Written in Python, the project started two years ago, and currently has more than 2,700 likes on GitHub. These likes are not recent. Judging from its Star history, AGIXT was launched as early as the beginning of last year, and the number of likes has been steadily increasing since July 2023. The project is not hastily laid out to cater to the current AI Agent craze, but is the result of long-term investment.

- DEV is @Josh_XT, a person who is keen on continuously contributing to the field of AI open source and has submitted 8,000 code contributions on GitHub in the past year.

- A total of 450M DEV tokens are transferred to the streamflow contract, of which 5% are released linearly over a period of two years, starting from January 16, 2025, and automatically unlocked every two weeks until January 28, 2027.

- Within 4 hours of going online, the market value exceeded US$94 million and the trading volume reached US$128 million.

3. Attention Value-Sector Rotation

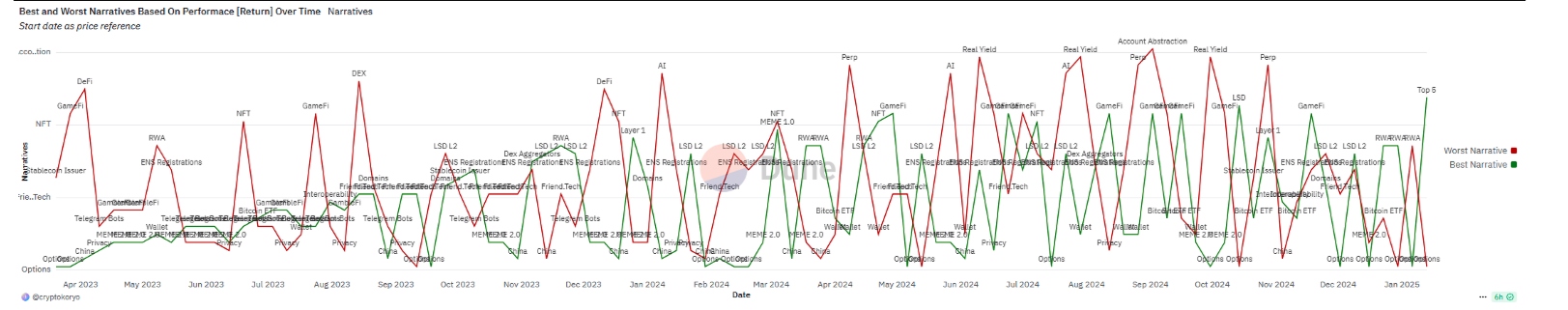

1. Hot topics

Source: Dune, Dot Labs

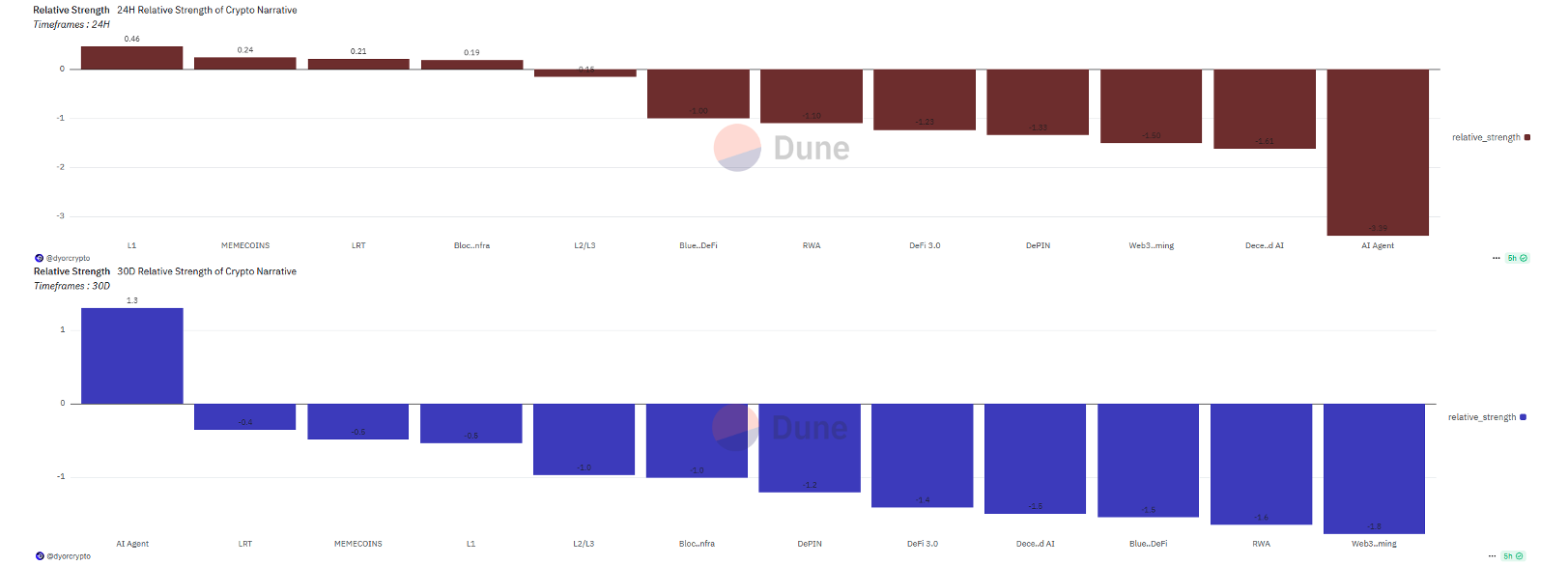

Source: Dune, Dot Labs

2. Inside the plate

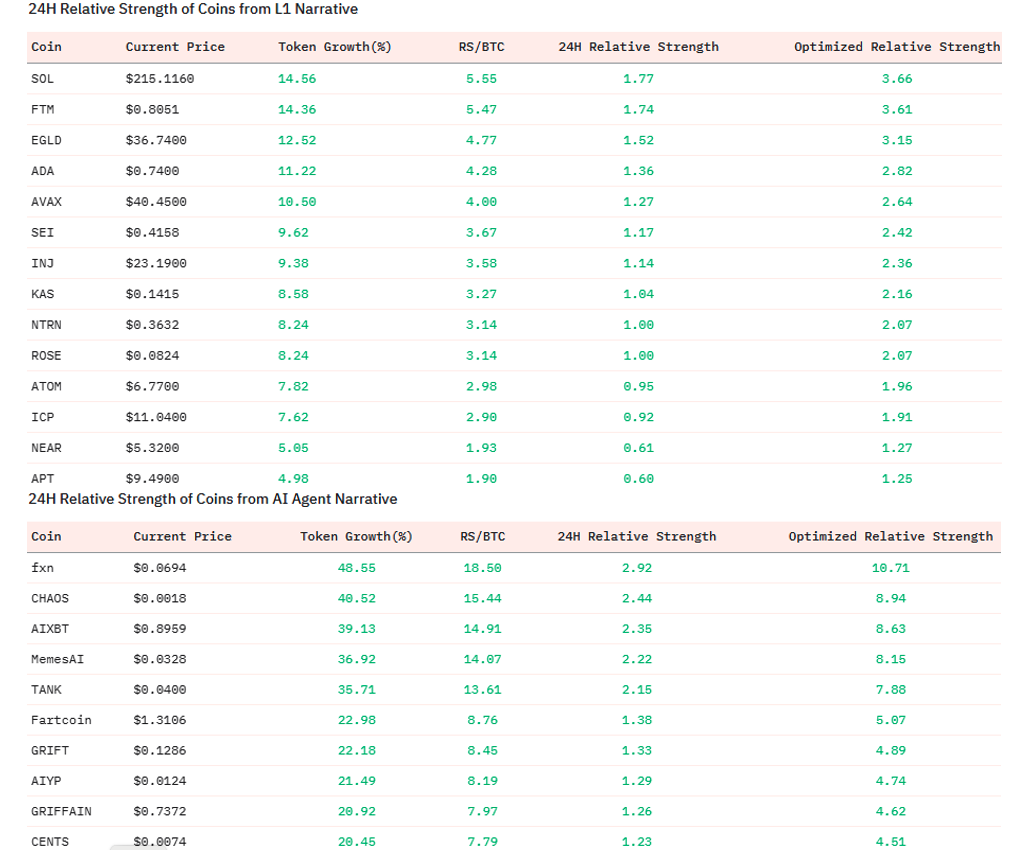

Source: Dune, Dot Labs