Launchpad is a decentralized platform, usually operated by blockchain projects or decentralized exchanges (DEX), which is used to help emerging blockchain projects issue tokens to the public through IDO. These platforms provide fundraising channels for project parties and provide investors with opportunities to participate in high-quality projects at an early stage. The Launchpad introduced in this issue refers more to meme launch platforms. Compared with traditional Launchpads, the market value of online tokens is lower, basically 100% of the circulation, most of the tokens are memes, the threshold for users to issue tokens is low, and the potential wealth effect is higher.

effect:

- Project Fundraising: Provide financing channels for new blockchain projects, raise funds by selling tokens to the community for project development, marketing, etc.;

- Token distribution: Help project owners distribute tokens to early investors, usually listing them at a lower market value to attract user participation;

- Traffic acquisition: Hot events or IPs are important ways for the current Launchpad platform to issue coins and obtain traffic, which can gain a lot of attention;

- Providing wealth effect: The market value of on-chain tokens is low. Once they are recognized by the market through FOMO purchases or listed on the top Cex in the future, early purchasers may obtain huge profits, thus quickly spreading within the community.

Since the huge success of Pump Fun last year, LaunchPad has been the first choice for many development teams and even public chain startups, but in the end they all ended up in failure. The consensus on meme coins in the market is concentrated on Pump Fun.

But in addition to Pump Fun, Solana's old meme coin BONK also recently launched its own LaunchPad - Letsbonk.fun. The highest market value of its multiple meme coins has exceeded 10 million US dollars, which is a good start.

Virtuals Protocol, the leader of AI Agent LaunchPad, has recently launched new ways to participate and activities. Regardless of the performance of its tokens, the price of the parent coin $VIRTUAL has doubled within a week, and the launch of new activities seems to have achieved certain results.

So, although Pump Fun, LetsBonk and Virtuals Protocol are all LaunchPads, what are the differences in their functions? Which tokens under these three platforms need to be paid attention to recently? Let WOO X Research show you.

Pump Fun

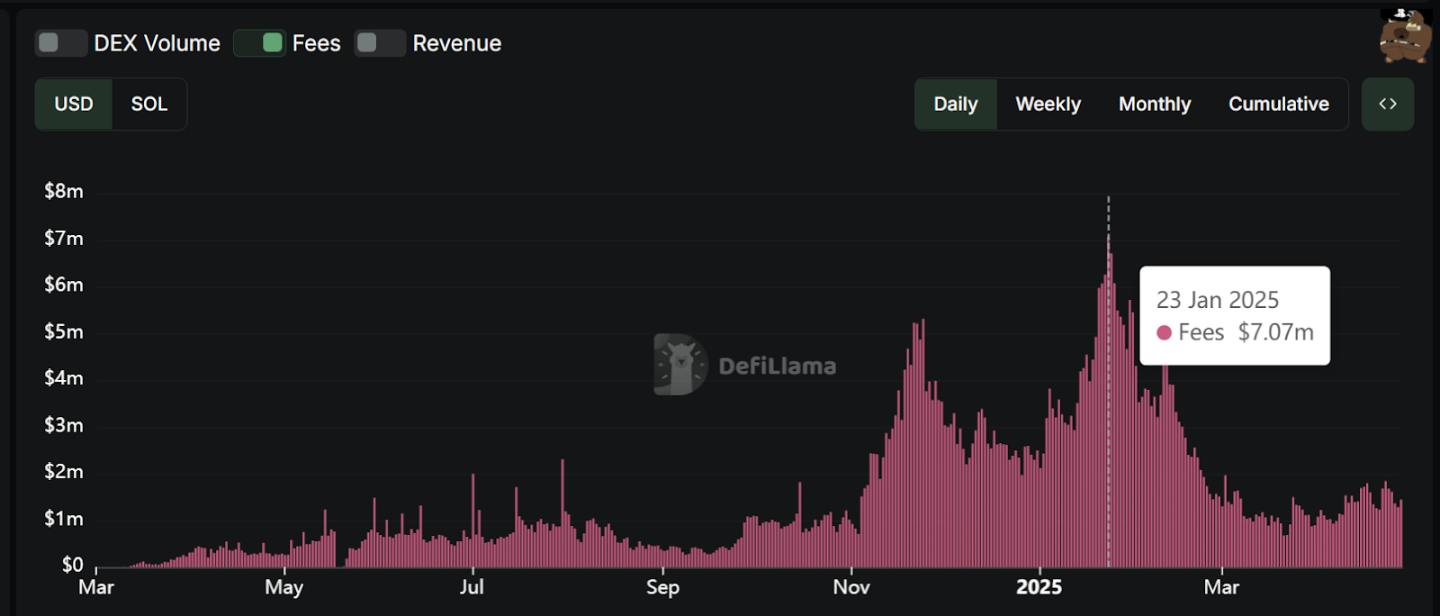

I believe Pump Fun must be familiar with it. The meme craze in the second half of 2024 started from here. At its peak, it could earn more than 7 million US dollars a day. Even now that the memes have cooled down, it is still at a level of about 1.5 million US dollars a day. It has earned a total of more than 600 million US dollars since its launch, making it a well-deserved money printing machine in the currency circle.

Pump Fun's income is all denominated in SOL. Usually, native projects on Solana, in order to avoid being criticized for "scamming" and to be closer to Solana officials, usually pledge the SOL they earn or operate nodes on their own. However, Pump Fun does the opposite and keeps selling its SOL in exchange for USDC.

Since 2025, they have sold a staggering $317 million worth of SOL tokens.

Not only does this move look bad, but coupled with previous scandals such as live broadcasts and lawsuits, although Pump Fun is extremely profitable in the Solana ecosystem, it is not the object of support from the foundation.

In terms of its meme coins, Pump Fun has become the first choice for coin issuance platforms. It is an entry traffic website and a non-segmented track, so you can see a variety of themes in it, including animals, homophones, news events, AI, etc. Basically, as long as you can think of something or a concept, it can be turned into a meme coin. Therefore, in terms of the platform, its tokens do not have any special features. Currently, the preferred platform for token issuance is still Pump Fun.

LetsBonk

Compared with Pump Fun, LetsBonk is obviously more politically orthodox. The main reason is that BONK is the most representative meme coin on the Solana chain, the original meme coin with wealth effect, and a project that has been deeply rooted in Solana for more than four years. In addition to Toly's recent retweet, BONK can be seen in various offline activities of Solana. In terms of relationships, BONK is obviously more pleasing than Pump Fun's behavior of selling coins all day long.

In terms of platform mechanism, LetsBonk is also more selfless than Pump Fun, with a revenue of 1% of transaction fees, of which the amount will be used for:

- Platform operations and growth

- To BONKsol validators to promote DeFI growth & protect the network

- Buy back and destroy BONK (Bonk will be launched soon)

Coupled with the cooperation with Raydium's LaunchLab, it can be said that LetsBonk's overtures to the Solana ecosystem are quite sincere.

At present, the token with the highest market value of Letsbonk is Hosico, which is 38 million US dollars. It is inspired by a Scottish straight-eared cat named "Hosico". Hosico is a golden short-haired cat born on August 4, 2014. With nearly 2 million fans on social media (such as Instagram) due to its round face, big eyes and cute appearance, it has become a world-renowned Internet celebrity cat.

Other tokens worth noting include the same-name tokens Letsbonk and Grassiot

Letsbonk was initially regarded as the representative of the official platform currency. On the first day of the platform's launch, the market value of the currency reached a maximum of 30 million US dollars. Subsequently, due to the emergence of various tokens and the division of attention, it fell sharply, and now the market value is only 4 million US dollars.

Grassiot became popular because BONK founder TOM bought the coin, destroyed it later, and then bought it back. In simple terms, the token price rose through the attention of the founder, but later TOM said that he bought the coin only for support, without any inside information and not a developer, and even disclosed that he also held Hosico and LetsBonk, and disclosed the purchase amount. Grassiot's market value also dropped from a peak of $13 million to about $4.3 million at the time of writing.

Virtuals Protocol

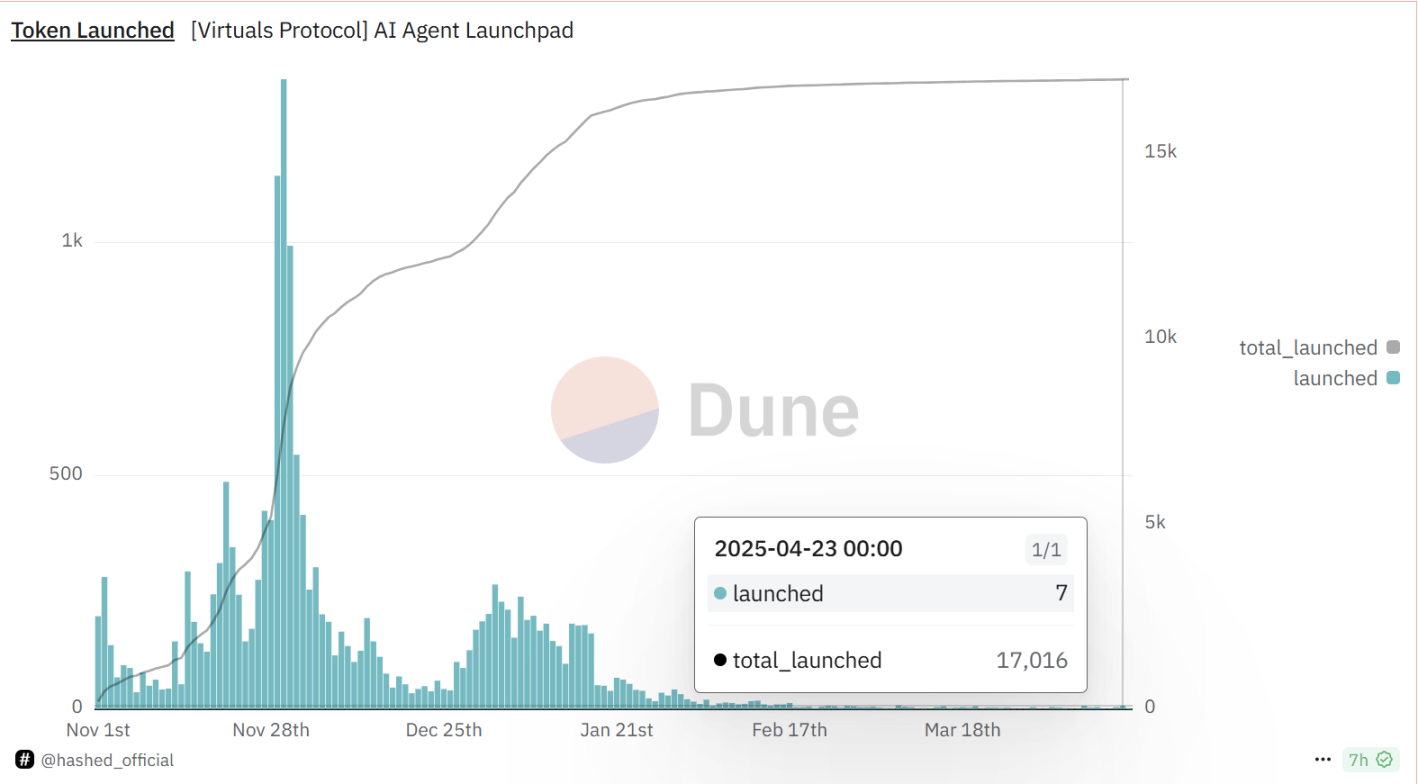

AI Agent LaunchPad, which was originally built on Base, has been expanded to the Solana chain. The business model is simple, and users need to consume VIRTUAL to create and trade tokens on the platform. However, the AI craze has subsided, and now less than 10 tokens are successfully issued on VIRTUAL per day, which is a huge gap from the previous day when at least 100 tokens could be issued.

They had a major update recently.

Virgen Points: This system is an important mechanism for Virtuals Protocol to encourage user participation. It is used to access pre-TGE token allocations, especially "giga AI Agent launches". These points directly affect the user's participation qualifications and rights on the launch platform.

AI Agents launches with a fixed fully diluted market cap of 336,000 $VIRTUAL (~232.58k USD), with all Virgens receiving equal early access through Virgen Points pledges. Allocation is determined after a 24-hour Points bidding period, and if funding targets are not met, no tokens will be minted and all $VIRTUAL and Points will be fully refunded.

Ways to earn:

- Trenchor Points: Earned by trading Sentient and Prototype Agent tokens.

- $VIRTUAL Points: Earned by holding $VIRTUAL tokens.

- Yap for Points: Earn points by creating content related to Virtuals Protocol (such as post X). According to post X on April 23, 2025, the event encourages users to "Yap" (i.e. participate in discussions or create content). For submission methods, please refer to the relevant submission link. The post mentioned "Stronger signal. Higher rewards", suggesting that content with greater influence may receive more points.

- $VADER Stakers: Earn by staking $VADER tokens

How to participate?

1. Key points of pledge:

- Participate using Virgen Points to pledge and receive up to 0.5% of the total supply.

- The final allocation depends on the proportion of points you pledged relative to the total pledged points.

- Over-committing increases your chances of getting the maximum allocation.

- If the Genesis Launch is successful, only the points used for the allocation will be destroyed and the remaining points will be refunded.

2. Invest $VIRTUAL tokens:

- Invest up to 566 $VIRTUAL to ensure maximum allocation.

- If participation exceeds expectations, the allocation will be diluted and excess $VIRTUAL will be refunded.

3. Receive tokens:

- After the Genesis Launch is successful, go to the Agent page to claim the purchased tokens.

- If the launch fails, all points and $VIRTUAL will be fully refunded.

In summary, Virtuals Protocol is creating a smaller-scale, more loyal LaunchPad, which is somewhat similar to the recent Binance Wallet's points-based new IPO activity, and is essentially hoping that users can participate more in the ecosystem. If you continue to be optimistic that Virtual's system will work in the future, there are three ways to participate:

- Buy $VIRTUAL tokens directly to go long

- Buy $VADER tokens directly to go long

- Participate in activities

The logic of the first two items is simple, and the trend of $VIRTUAL & $VADER has shown amazing growth recently, making them the biggest beneficiaries of the event. If you want to participate in the event, you must first accumulate points. You can hold $VIRTUAL tokens in your wallet. At the same time, if you are worried about the risk of $VIRTUAL falling in the future, you can open a short position of the same number of $VIRTUAL in a centralized exchange. The advantage is that you can ensure that your profits will not be swallowed up by potential declines while participating in the event, and the event is designed not to lose money, but only to have a state where the profits are not as expected. The disadvantage is that since an additional amount of funds is required to open a short position, the overall use of funds will be greatly reduced.

Conclusion

In general, Pump Fun, LetsBonk and Virtuals Protocol each have their own advantages and concerns: Pump Fun consolidates its traffic entrance with aggressive selling and huge profits, but is also questioned for frequent "cashing out" and negative events; LetsBonk, on the other hand, shows goodwill to the ecosystem by deepening its community and offering low-fee profit sharing, but the platform currency and secondary tokens are distracting, and whether it can continue to attract long-term participation remains to be seen; Virtuals Protocol's points mechanism and AI Agent stepping stone are innovative in laying out a new track, but it has not yet demonstrated stable issuance capabilities, and whether user enthusiasm can continue remains to be seen.

Looking forward, the key to the next wave of enthusiasm in the LaunchPad track lies in "value landing" and "community resilience": Can the platform take into account both short-term popularity and long-term ecological construction through mechanism design? Can the project party continue to provide real utility instead of relying solely on gorgeous narratives? When the hot money recedes, which model is more sustainable will become an important indicator for market testing. For researchers and participants, in addition to paying attention to platform traffic and token price fluctuations, they should also deeply consider the core risks and future upgrade potential of each mechanism, so as to find the one that is truly worth betting on in the long term among the hundreds of schools of thought.