What is private equity financing?

Private equity investment and financing is a broad and complex field, but in simple terms, its essence is a financial transaction. In traditional private equity financing, private equity investment and financing is a financial transaction in which legal currency is exchanged for equity.

Although private equity financing is just a financial transaction, it involves a lot of complex and professional work and collaboration.

From an investment perspective, an investment usually needs to go through four stages: fundraising, investment, post-investment management, and exit. During this process, the work of institutions or fund managers involves entity registration, investor onboarding and management, financial management, due diligence, and a large number of agreement signing, legal affairs, auditing, etc. As an investor, you need to identify investment institutions and fund managers, and review very complex fund prospectuses. From a financing perspective, start-ups usually also need a lot of complex work to complete financing, including entity registration, financing planning and management, equity structure management, financial management, etc.

These tasks often exceed the professional capabilities of the participants. Startup founders usually have no financing experience and relevant professional skills. Many investors are also confused by a large number of contracts (such as fund prospectuses) and complicated onboarding processes. Creating and running a private equity fund is an even more complex project. In order to complete these tasks, they need to pay additional financial costs, time costs, manpower costs, learning costs, and introduce more additional collaboration, such as hiring lawyers and financial managers. Therefore, private equity investment and financing is a business with a high threshold.

What is AngelList?

In the previous chapter, we mentioned that private equity investment and financing involves a lot of complex and professional work and collaboration, which not only makes it difficult to participate, but also causes problems such as high cost, low efficiency, and limited business boundaries.

AngelList is an online toolkit for the private equity investment and financing sector. In simple terms, it abstracts the complex and professional work in each link of private equity investment and financing transactions into various components and programs (different components and programs can be combined into different business flows, such as investor onboarding), and then uses Internet technology to run it online, so that people around the world can participate in these business flows efficiently, even with just a simple click, without having to worry about the professional and complex specific matters involved. For example:

Investment institutions and fund managers : Investment institutions or fund managers can easily create an online operating framework through the tools provided by Angellist, such as Rolling Funds, Venture Funds, Syndicate, and Scout Funds. Through these online tools, investment institutions and fund managers can easily and efficiently implement fundraising, investment, and other related work. Through the fund management tools provided by Angellist, investment institutions can easily create or bind multiple bank accounts around the world and use them as fundraising and investment accounts while ensuring asset security (such as the sweep accounts function). In addition, Angellist also provides some tools to facilitate investment institutions in signing agreements, sharing in different tiers, notifications, and public announcements.

Investors : Investors can easily find excellent investment institutions through Angellist, and can easily contact and join them through the tools provided by Angellist (investor onboarding). After investors join one or more investment institutions, they can easily view and track the operating status of the investment institutions through the tools provided by Angellist.

Startups : Startups can use the financing tools provided by Angellist to quickly start and manage financing. At the same time, Angellist also provides a series of management tools for startups, such as Cap table, legal entity establishment, etc. In addition, startups can also use Angellist to manage funds, such as transfers, taxes, etc., by binding a bank account.

Two key words: program and online.

Online

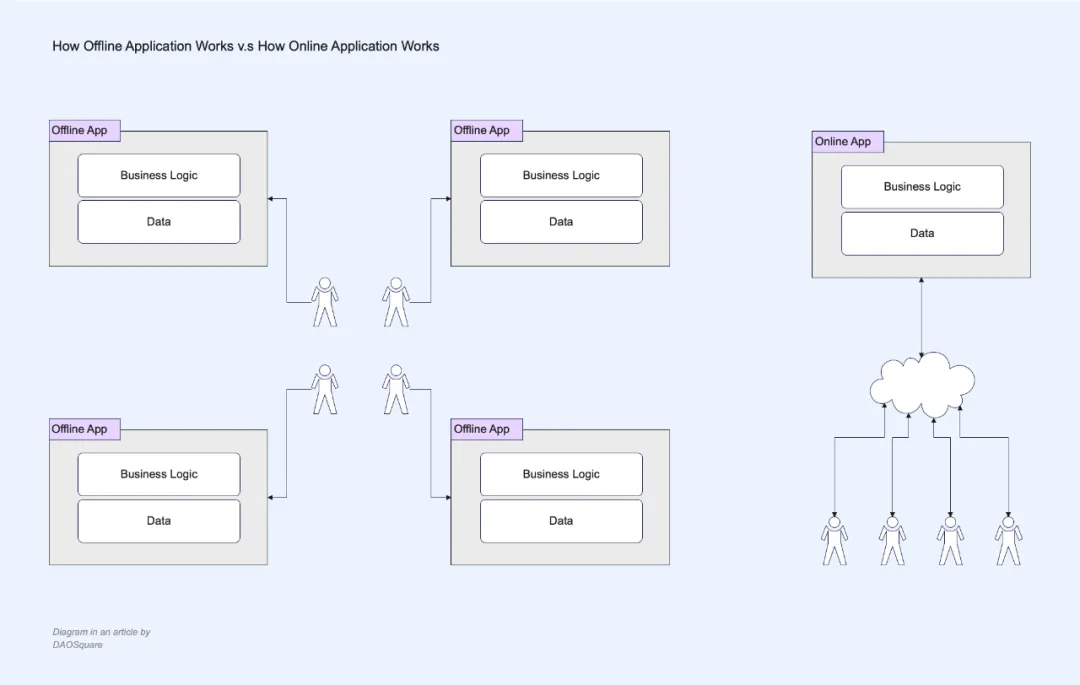

Before the online wave, applications were usually offline local applications, such as early financial management, text processing, etc. From a technical perspective, in simple terms, the business logic and data of these applications are stored on the client and do not need to rely on the network environment. Online applications deploy and run the business logic and data of applications on cloud services and interact with users through the Internet. We can call such applications online applications (the typical representative is Web applications).

For example, before Google Docs was released in 2006, word processing applications such as Word were offline native applications. If I wanted to invite others to edit a document together, I could only export my document as a .doc file and send it to others (such as email). They imported the file into Word to complete the editing, and then exported the edited document as a .doc file again and sent it to me. I needed to open everyone's document one by one, summarize everyone's edits and finally form the final version. And this process often needs to be repeated many times, which is simply a disaster. Google Docs has brought us into a new era. As you can see today, we can not only edit and modify, comment and discuss in real time with multiple people, but also call any supported third-party application in Google Docs, such as inserting a Google Sheet, a Youtube video, etc. This is the huge change brought about by online.

The work involved in private equity investment and financing is much more complicated than document collaboration. For example, in a financing of a startup, the startup needs to prepare financing materials and contact investors through different channels, and then discuss and sign investment agreements with all potential investors. Next, it is necessary to manage financing funds, formulate employee option pools, manage equity distribution and other tasks. Before the birth of online tools represented by Angellist, these processes were completely separated, and we could only use some simple tools to complete these tasks manually. As the number of financing rounds increases, these tasks will become more and more complicated. Online tools make it all simple. For example, using the financing tool (Raise) provided by Angellist, startups can complete all the processes in the financing process online in one stop, and because the modules can be called from each other, the entire fundraising process can be highly automated. For example, when a fundraising is completed, Raise will automatically help the startup update the equity structure table.

As you can see, Online has very significant advantages: improving efficiency, expanding boundaries, and reducing financial and time costs.

Improve efficiency : By moving workflows online, the efficiency of matters such as investor onboarding, investment processes, startup fundraising, and legal agreement signing has been greatly improved.

Expanding boundaries : Online allows us to break through traditional social circles. Investors have more opportunities to participate in venture capital, venture capital firms have raised funds from more investors, start-ups have connected with more venture capital firms, and venture capital firms have obtained more investment targets.

Reduce costs : While improving efficiency and expanding business boundaries, thanks to a wealth of online tools, Online has also greatly reduced the financial and time costs of private equity investment and financing. For example, Cap table management, as AngelList said:

AngelList's Cap Table takes the hassle out of managing your startup's largest asset: equity. Make better decisions by leveraging unparalleled automation while maintaining compliance.

This is the paradigm shift that technological change brings to specific industries.

New Challenges Brought by Crypto

There is one most significant difference between Crypto private equity investment and financing and traditional private equity investment and financing. The investment currencies of Crypto private equity investment and financing are usually cryptocurrencies (such as USDT, USDC, ETH, etc.). Since private equity investment and financing tools such as AngelList cannot be used, most Crypto private equity investment and financing currently use simple management methods, such as using multi-signature wallets to manage fundraising assets, completing fundraising and investment through manual transfers, and using traditional financial management software to record and manage funds and Portforlio. This rough operation and management model not only causes efficiency and complexity problems, but more importantly, it brings many risks.

Financial risks

Usually, after a Crypto investment institution completes fundraising, the investor's money is managed by the investment institution (using a multi-signature wallet or even a personal wallet), and the relevant personnel of the investment institution have the management rights of the funds, while the investors (such as the LP of the fund) have no substantial protection. Therefore, technically they can embezzle the money or even run away with it. As you can see, such things have already happened. Since the Crypto private investment and financing industry is far from standardized, and the support for Crypto in most jurisdictions is far from perfect, it is difficult to protect the rights and interests of investment institutions and investors through legal means.

Default risk

At present, all transaction links of Crypto investment and financing use paper contracts to constrain both parties. For example, investment institutions raise funds from investors, investment institutions invest in start-ups, and start-ups release tokens to investment institutions. This constraint method that relies on traditional trust mechanisms is effective in traditional equity private equity investment and financing, but its binding force is limited in Crypto, because most jurisdictions currently support Crypto far from perfect. In particular, Crypto investment and financing are usually cross-jurisdictional, which will further increase the difficulty.

Venture Capital Chaos

In the field of Crypto private investment, there are a large number of organizations and individuals called VCs who are actually cryptocurrency speculators and second-hand dealers. They get investment shares of start-ups under the name of VC, and then exaggerate through social means to push up the price of the currency in the short term and then sell it, or sell it to other institutions and individuals at a premium after getting the shares. Such institutions not only fail to bring practical help to start-ups, but also cause many troubles, obstacles and even harm to start-ups, which is extremely detrimental to the development of start-ups. It is usually difficult for start-ups to effectively identify these cryptocurrency speculators and second-hand dealers.

The above only discusses the core interests of the various players in the field of Crypto investment and financing. There are many other issues, but there is no doubt that asset-related issues are what we need to pay special attention to. So when traditional trust mechanisms (such as the judicial system) cannot effectively protect the rights and interests of Crypto investment and financing participants, do we have a way to solve these risks?

New opportunities brought by Crypto

Cryptocurrency has brought new challenges to private equity investment and financing, but on the other side of the coin, cryptocurrency has also brought new opportunities to private equity investment and financing.

In the section "What is Private Equity Investment and Financing", we talked about how traditional private equity investment and financing can be seen as a financial transaction in which legal currency is exchanged for equity. Since the two transaction objects are in different accounting systems (currency and equity structure), the transaction can only be carried out asynchronously, namely 1) payment of investment funds and 2) distribution of equity. Therefore, in order to ensure the performance of both parties to the transaction, a third party must be introduced, that is, a traditional trust mechanism (such as the judicial system) to constrain both parties to the transaction. The investment currency of Crypto private equity investment and financing is usually cryptocurrency, and start-ups usually use cryptocurrency to represent their corporate value (such as ETH, CRV, RICE, etc.).

This means that we can regard Crypto private investment and financing as a currency-to-currency transaction, and a currency-to-currency transaction in the same accounting system (blockchain).

Compared with traditional private equity investment and financing, this type of currency-to-currency transaction not only simplifies various investment and financing links such as fundraising, investment, management, and exit, but also, thanks to the many technical characteristics of cryptocurrencies, transactions in these links can be achieved without relying on the intervention of traditional judicial, insurance, arbitration and other trust mechanisms. It constrains both parties to the transaction from a technical level to protect their rights and interests, thereby solving many of the risks mentioned above.

Let us take a brief look at cryptocurrency through several technical concepts (smart contracts, programmable currency, data availability), and why it can solve the risk issues mentioned above and bring new opportunities to private equity investment and financing.

Smart Contracts

In the context of blockchain, a smart contract is a program deployed and stored on the blockchain that receives user instructions and executes results according to programming logic (internal or external). This is like a vending machine. When a user selects a bottle of Coke and pays the amount set by the program (for example, 1 USD), the vending machine will "spit out" a bottle of Coke.

Unlike vending machines, smart contracts are usually irreversible and immutable once deployed to the blockchain. This means that no one can tamper with it. In other words, we cannot modify the programming logic of this "vending machine" after it starts running to make it "spit out" 10 bottles of Coke after the user selects 1 bottle of Coke and pays 1 USD. It will always run according to the logic of 1 bottle of Coke for 1 USD. Of course, you will say that hackers can do it, but this is another topic.

In addition, due to the permissionless nature of smart contracts, no one can prevent users from using smart contracts.

Programmable Money

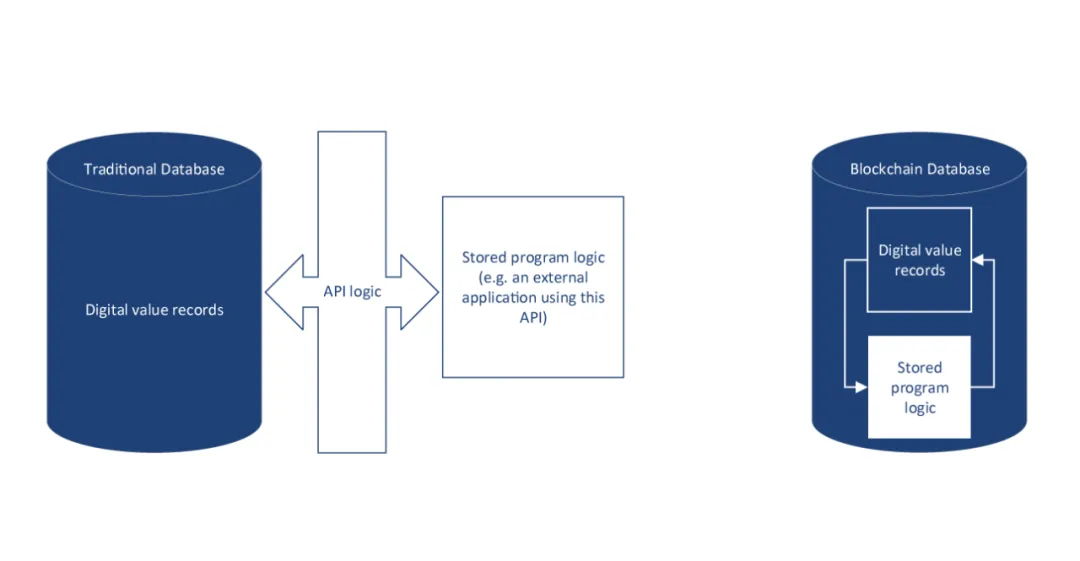

Whether it is the traditional financial system or the blockchain, both use "digital value records" to digitize currency, and they can all be called digital currency. In the traditional Internet financial system, digital currency is a set of digital records representing tradable value stored in an online database. It allows programming logic outside the database (such as online banking apps) to adjust the digital value records in the database through APIs.

In blockchain, digital currency is a smart contract (such as ERC20) designed for monetizable valuables, which is deployed and stored in the blockchain database. It also contains digital records representing tradable values, but the adjustment of its digital records is different.

It is constrained by its own programming logic , just like the vending machine example mentioned above.

And under the premise of complying with its own programming logic, the programming logic of other smart contracts in the blockchain database is allowed to adjust its digital value records . This is like a vending machine connected to a lucky wheel. When the user puts in 1 USD, instead of choosing Coke, he can authorize the vending machine to use the lucky wheel to control which drink the vending machine "spits out". You know, there may be Coke, cars, but it may also be "thank you" on the lucky wheel.

Due to its programmable properties, this digital currency running on the blockchain is also called programmable currency, but we usually call it cryptocurrency.

Data availability

Blockchain is not only an open network (anyone can access it and use it), but also has the characteristics of data availability. This means that we can access any user's blockchain account to verify any transaction of that user on the blockchain. Therefore, it can help us:

Verify the investment history of the investment institution.

Verify the investment preferences of investment institutions.

Verify the investment strategy of investment institutions (long-termism or speculation).

Monitor and track the flow of funds of investment institutions. For example, when an institution misappropriates funds, take timely action to stop it, or assist relevant institutions (such as judicial institutions) in handling it.

As you know, in traditional finance, these are simply fantasy.

Now, let’s look at how to use these technical features to address the three types of risks mentioned above.

Fund security

For example, we can deploy a fund management contract for investment institutions on the blockchain. Investment institutions can invite investors to deposit funds (such as USDT) into the contract to complete fundraising. The fund control rights of the contract account are subject to the programming logic of the contract. When deploying the contract, the investment institution can set up a management team to control the funds through a voting mechanism (fund model), or give the fund control rights to all investors (investment club). This can technically avoid the problem of internal personnel of investment institutions misappropriating funds.

We can also deploy a redemption contract to enhance the security of the fund management contract. We can set a fixed redemption period, like a traditional open fund, for example, every 30 days. In this way, every 30 days, investors can decide whether to continue to put their funds in the investment institution or withdraw their funds based on their own judgment of the performance of the investment institution. Alternatively, we can set the redemption period after each investment transaction is initiated, so that investors can decide whether to participate in the investment based on whether they agree with a specific investment. Due to the permissionless nature of smart contracts, investors cannot be prevented by any party from protecting the security of their funds through redemption.

Contract safety

Take the example of a SAFT investment agreement. We know that although we can regard Crypto private investment and financing as a currency-to-currency transaction, it is usually not a simple transaction like Swap, where one hand pays the other hand delivers the goods. Instead, there is usually a Vesting Schedule, which means that the investee will release the Payback currency to the investor at a certain time in the future after receiving the investment funds according to certain release rules. Therefore, the Vesting Schedule is usually the most important part of the SAFT investment agreement, and it is also the part that is most likely to cause breach of contract and disputes.

We can deploy an investment agreement contract on the blockchain and use programming logic to implement the transaction rules in the SAFT agreement, including investment currency, payback currency, price, vesting schedule, etc. When the investment institution and the investee create an investment transaction through the smart contract (agree on various parameters, such as vesting schedule) and "sign" the transaction, when the investment institution pays the investment, the investee's payback currency will be escrowed to the smart contract, and then the investor can autonomously receive the payback token from the smart contract according to the timeline agreed in the vesting schedule (no one can stop him). Take an example:

Investor Bob uses the investment agreement smart contract to create a SAFT investment transaction with entrepreneur Lisa. The transaction details are as follows:

Investment Currency: USDT

Investment Amount: 100,000

Investor: 0x1Bfe1F47a3566Ee904d5C592ab9268B931516B56 (Bob’s wallet address)

Investment Fund Receiver: 0xEF72177cb6CE54f17a75c174C7032BF7703689b4 (Lisa’s wallet address)

Payback Currency: RICE

Payback Amount: 100,000

Vesting Start: 10/01/2025

Vesting End: 10/01/2028

Claim Interval: 30 Days

When Bob and Lisa "sign" the transaction on the chain, the 100,000 USDT in Bob's wallet will be transferred to Lisa's wallet address, and at the same time, the 100,000 RICE in Lisa's wallet will be transferred to the escrow contract. Starting from October 1, 2025, Bob can collect RICE from the escrow contract once every 30 days, and the amount collected each time is one thirty-sixth of the total amount until October 1, 2028, and a total of 100,000 RICE can be collected. And,

Bob will definitely be able to collect RICE from this smart contract starting October 1, 2025, without anyone's permission.

It is impossible for Lisa to prevent the execution of the investment agreement after the transaction is successful.

It is impossible for Lisa to retrieve RICE from the escrow contract.

It is impossible for anyone to prevent Bob from using this contract to collect RICE.

Venture Capital Identification

Due to the openness and data availability of blockchain, we can access the fund management accounts of investment institutions on the blockchain at any time and analyze their historical transactions to verify whether the investment performance and investment philosophy promoted by the institution are true. For example, Bob claims that he is very optimistic about Lisa's project and will hold RICE for a long time, but his transaction records show that Bob sells all the RICE immediately after receiving it. So when Bob finds you and expresses his desire to invest in your project, you should be careful. Or, if Bob transfers RICE to a group of people in batches immediately after receiving it, then it is likely that Bob is a second-hand dealer.

In addition, we can also summarize the investment preferences of investment institutions, such as investment areas, by analyzing these historical transactions, which can also greatly save the time cost of start-ups in seeking investment institutions and communicating with investment institutions.

Onchain

Above, we briefly introduced how to put Crypto investment and financing transactions on the chain to introduce its advantages in asset security, and how to make use of the technical characteristics of blockchain data availability to help us better identify investment institutions. As you know, there are a lot of other transactions and management links in Crypto investment and financing. If we put all these transactions and management links on the chain, that is, build a corresponding smart contract for each transaction link, and allow these contracts to be freely combined and called each other, we can build an on-chain investment and financing tool set, that is, the on-chain Angellist.

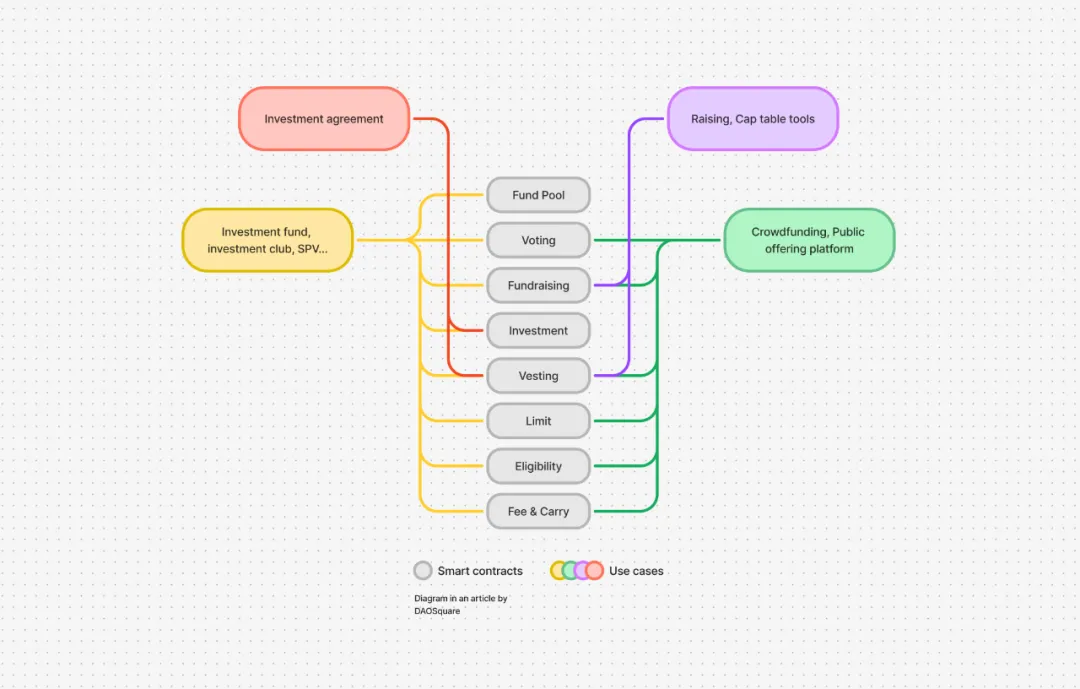

The above figure lists some basic smart contracts, such as the Fundraising contract for fundraising, the Limit contract for limiting the number of fundraising participants, the Fund Pool for storing funds, the Voting contract for controlling the fund pool, the Investment contract for investment, the Vesting contract for releasing project tokens, the Eligibility contract for limiting the qualifications of fundraising participants or fund managers, and the Fee & Carry contract for helping investment institutions obtain returns.

We can freely combine these contracts to achieve different functions, just like Lego. As shown in the figure above, we can use the combination of Investment and Vesting contracts to form a simple on-chain investment agreement. Once confirmed by both parties, it will be automatically traded according to the agreement, which cannot be blocked or tampered with, and does not require the intervention of any third-party trust mechanism.

Startups can use a combination of Fundraising and Vesting contracts to build an on-chain enterprise management tool to manage fundraising and Cap table.

Going further, we can use a combination of Fundraising, Vesting, Limit, Eligibility, and Voting contracts to build an on-chain crowdfunding platform or Launchpad, which will be truly decentralized, permissionless, and community-based, without the asset risks brought by centralized control.

We can also use all the contracts listed above to build more complex businesses, such as running a private equity fund, investment club, SPV, etc. With more functional modules, we can achieve more complex business needs, such as setting redemption periods and redemption fees for funds, or implementing a GP + LP fund operation architecture, etc.

These contracts not only provide us with trustless transaction guarantees, but also model the transaction process of private equity investment and financing, allowing us to easily complete professional work without having to master relevant professional knowledge and skills. Therefore, it has all the advantages of Online (efficiency, boundaries, costs), while ensuring the transaction security and performance of private equity investment and financing from a technical level.

This is a new paradigm shift brought about by blockchain technology for private equity investment and financing.

Today & Future

Since the birth of The DAO in 2016, a large number of developers and builders have been working towards the vision of "Onchain Ventures", including Moloch, DAOhaus, TheLAO, Nouns, Juice Box, PartyDAO, Gnosis Auction, Superfluid, Syndicate, Furo, Kali, DAOSquare, etc. These builders build solutions in their respective areas of focus based on their respective understanding of Onchain Ventures. Many people gave up halfway, but more people continue to work hard to iterate and improve these solutions.

As the founder of DAOSquare, I am also honored to be the promoter and builder of this vision. The direction of my efforts with DAOSquare is to build an AngelList on the chain, provide a complete set of tools for Crypto private investment and financing, technically guarantee the asset security and performance issues of all parties to the transaction, and reduce the financial and time costs of all parties to the transaction while improving investment and financing efficiency and expanding business boundaries.

Like all other solution builders, I believe in the importance of Onchain Ventures to Crypto private investment and financing and the development of Crypto as a whole. I also believe in the future prospects of Onchain Ventures, because whether in traditional fields or Crypto, capital will always be an important driving force for the development of the industry. Therefore, I believe that in the near future, as the Crypto private investment and financing industry continues to improve and standardize, these products serving Crypto investment and financing will shine. Let us wait and see.