Author: Scof, ChainCatcher

Editor: TB, ChainCatcher

On April 1, several low-market-cap tokens collectively crashed on the Binance platform, with ACT falling as much as 55%. This sudden drop triggered extensive discussions in the community and also brought to the surface the deep-seated contradictions hidden beneath the surface of the crypto market.

What’s the on-chain truth behind the crash?

The market first focused its attention on the market maker Wintermute. On-chain data showed that before and after the flash crash, Wintermute liquidated a number of altcoins, including ACT, DEXE, HIPPO, KAVA, etc. These tokens were the hardest hit in this round of decline.

Although the founder of Wintermute responded that the selling was to arbitrage the price fluctuations of the AMM pool, and the operation occurred after the sharp price fluctuations, it was not an active dump. However, from the on-chain timing, the departure of this batch of funds highly coincided with the time of the plunge.

As a leading market maker in the industry, Wintermute's basic profit model is to maintain liquidity and obtain price difference income through high-frequency market making and cross-market arbitrage. In a normal market, it not only provides buying and selling depth, but also maintains price stability. However, in extreme market conditions, its strategy may also turn to actively withdrawing liquidity or even liquidating positions to stop profits due to risk control or profit maximization. This behavior is no different from "dumping" on the surface.

Binance’s risk control logic and strategic game

At the same time, Binance's contract adjustment also became the core trigger of this incident. At 15:32 on April 1, Binance issued an announcement, deciding to lower the maximum position limit of multiple U-based contracts including ACT from 18:30 on the same day. Taking ACT as an example, the position limit was reduced from 4.5 million US dollars to 3.5 million US dollars. This means that all positions exceeding the new limit will be forced to reduce positions or directly closed at the market price.

It is worth noting that this is the third time that ACT’s contract parameters have been adjusted in just four days.

On March 28, the leverage limit was reduced from 25x to 10x; on March 31, the maximum position was reduced from $9 million to $4.5 million; and on April 1, it was further reduced to $3.5 million. Such high-frequency adjustments are unusual. Combined with market data, it can be inferred that Binance may have noticed that unaffiliated and unverified large investors have accumulated huge positions in ACT contracts, and there is a risk of liquidation when the market depth is insufficient.

This is also a common "bubble squeezing" mechanism in contract risk control: by lowering the limit to guide the liquidation of risky positions, it can avoid large losses to the insurance fund when the market fluctuates violently. From the subsequent data, the ACT contract holdings dropped by 75% during the period when the adjustment took effect, and the Binance Insurance Fund did lose about 2 million US dollars.

However, this technical operation of risk prevention and control has quickly evolved into a chain stampede at a time when the Meme ecosystem is extremely fragile.

The fog of responsibility in the responses of multiple parties

The project party ACT also spoke out after the incident, stating that the price movement was "completely out of control" and promised to release a post-event review report after the dust settles.

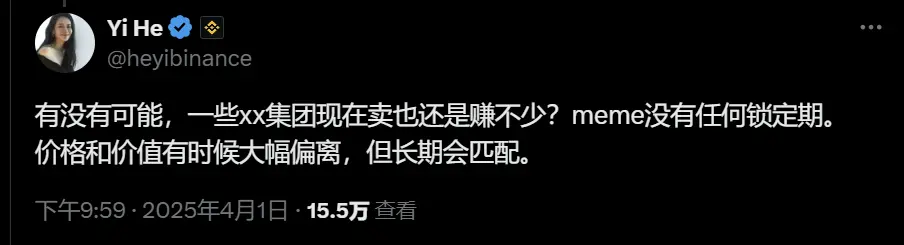

At this point, many parties involved are trying to “disclaim” their responsibilities, but there may be more than one truth. Binance stressed that it was the users who sold 1.05 million USD of ACT spot in a short period of time that caused the crash; Wintermute stressed that it was arbitrage rather than a market crash; users accused the exchange of not communicating enough in advance about the rule adjustment, while the project team responded tactically and calmly.

But no matter which side it is, the structural problems of the industry exposed by this incident deserve more attention. The core contradiction in the current crypto market is the contradiction between the rapid collapse of junk assets and the damage to user interests. The large number of fast-food assets such as Meme is essentially a greater fool game driven by emotions. They lack fundamental support, but enter the mainstream trading platform through listing, hype, and community operation.

In the era of de-bubble, who is the sacrificed party?

As a leading matching platform, Binance is caught in the middle. On the one hand, it has to ensure systemic security and prevent chain liquidations caused by low-liquidity assets; on the other hand, it also carries users' trading freedom and asset confidence. In some extreme cases, its risk control behavior will trigger price stampedes, which in turn harms user interests. This trade-off under dual pressure is precisely the "role paradox" faced by current platforms.

The role of market makers is equally complex. They are not only providers of market liquidity, but also the first players to withdraw when the market is turbulent. When their strategies change, ordinary investors often have not noticed that they are already deeply involved.

More realistically, when junk assets are cleared, there will always be people who profit from the chaos—whether it is an institution that identifies risks in advance and withdraws, or a strategic account that takes advantage of volatility arbitrage. De-bubbling and risk-cutting are necessary stages for a healthy market, but when this mechanism lacks openness and transparency, it will trigger a crisis of trust.

Ultimately, the ACT incident is not only an asset crash, but also a mirror that reflects the deep institutional dilemma of the current crypto market.

In a rapidly evolving market, each role, including platforms, project owners, market makers, and users, is not isolated, and the stability of the system depends on the dynamic balance between all parties. If there is no sufficient mechanism to coordinate the tension between "value" and "liquidity", "clearance" and "protection", any small-scale risk control operation may evolve into a systemic trust decline.

And all of this will ultimately be borne by every participant in the market.