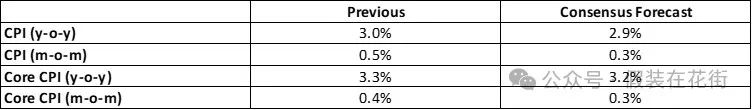

The U.S. CPI data for February will be released this Wednesday, and the market consensus is that inflation may fall slightly.

But even if the data is in line with expectations (overall CPI +0.3% month-on-month, core +0.3%), the annualized inflation rate is still as high as 3.9%, nearly double the Fed's target, and it is far from optimistic.

We need to see a month-on-month decline to 0.2 or lower before the market can feel confident in going long, but we need to be wary of data noise (such as fluctuations in energy prices); if unfortunately the actual data is higher than expected, the market may plunge again.

The second thing to pay attention to is the lagged impact of tariffs:

- In early February, the United States imposed a 10% tariff on Chinese imports, including furniture (accounting for 32% of imports), clothing (26%), and electronic products (21%).

- As a result, inflation for core commodities (excluding used cars) is expected to rebound to 0.2% in February (-0.1% in January). Education commodities may be most affected, with prices increasing by 2.8% month-on-month (only 0.1% in January). Some companies may stock up in advance, resulting in short-term price fluctuations, but they will not be sustainable.

The future risk is that import data usually lags behind by 1-2 months. Even if the current data does not reflect the relevant impact, the CPI in March and April will most likely face a second shock.

Because sea shipping from China to the United States takes an average of 25-35 days, goods shipped after February 1 will not arrive at the port until early March; then it will take 1-2 weeks to complete customs declaration, and the new tariff costs will be included in wholesaler costs starting in mid-to-late March; most of the goods currently sold by American retailers are inventory from the fourth quarter of 2023 (without tariff costs), and newly purchased taxed goods will not enter terminal sales until April.

Therefore, the real test will be from March to April when CPI starts

1. Household products: Wholesale costs rose in March, and retail prices may be adjusted in April and May (expected to increase by 0.3%-0.5% month-on-month);

2. Clothing: Spring clothing costs rose by 5%-8%, and the clothing sub-item of the April CPI may turn positive month-on-month;

3. Consumer electronics: Mobile phones and computer accessories will increase in price by 3%-5% starting from March (e.g. Anker chargers have announced a price increase in April).

Historical reference: Lessons from the 2018 tariff war

In July 2018, the United States imposed a 25% tariff on $34 billion worth of Chinese goods. The impact of tariffs on CPI usually reaches its maximum two quarters after the policy takes effect.

- The CPI increase lagged by 3 months: the clothing CPI jumped by 0.5% month-on-month in October 2018 (previous value: 0.1%);

- Peak lagged by 6 months: Household Furnishings CPI rose to 3.2% year-on-year in January 2019 (1.5% before tariffs).

Therefore, if the market only focuses on the February data and believes that "the worst has passed", this may sow the seeds of misjudgment of risk; this is mainly because the recent downward trend in bond yields has been too fast, and the risk-averse behavior of the stock market has diluted inflation expectations. The expectation of interest rate cuts is still around 2 times, so it is somewhat priced in. Assuming that the data this time is in line with expectations and the interest rate market's expectations of interest rate cuts remain unchanged, it can be considered that the market underestimated the risk of inflation rebound.

If core commodity inflation rebounds to above 0.4% in March (high probability), it may trigger the Federal Reserve to reassess the conclusion that "inflation is under control", and the expectation of a rate cut in 2025 may once again disappear completely.

In addition, the previously announced non-farm hourly wages in January increased by 4.3% year-on-year. The high labor costs of service industry companies may force price increases. Whether this will trigger the risk of a wage-inflation spiral is also a development that needs attention in addition to tariffs.

High-frequency data that can be tracked:

1. U.S. Import Price Index (released on March 15): directly reflects tariff costs;

2. Retailer earnings calls (such as those released by Walmart and Best Buy in April): Pay attention to management’s comments on price increases.