🧩 Why does Altseason need QE?

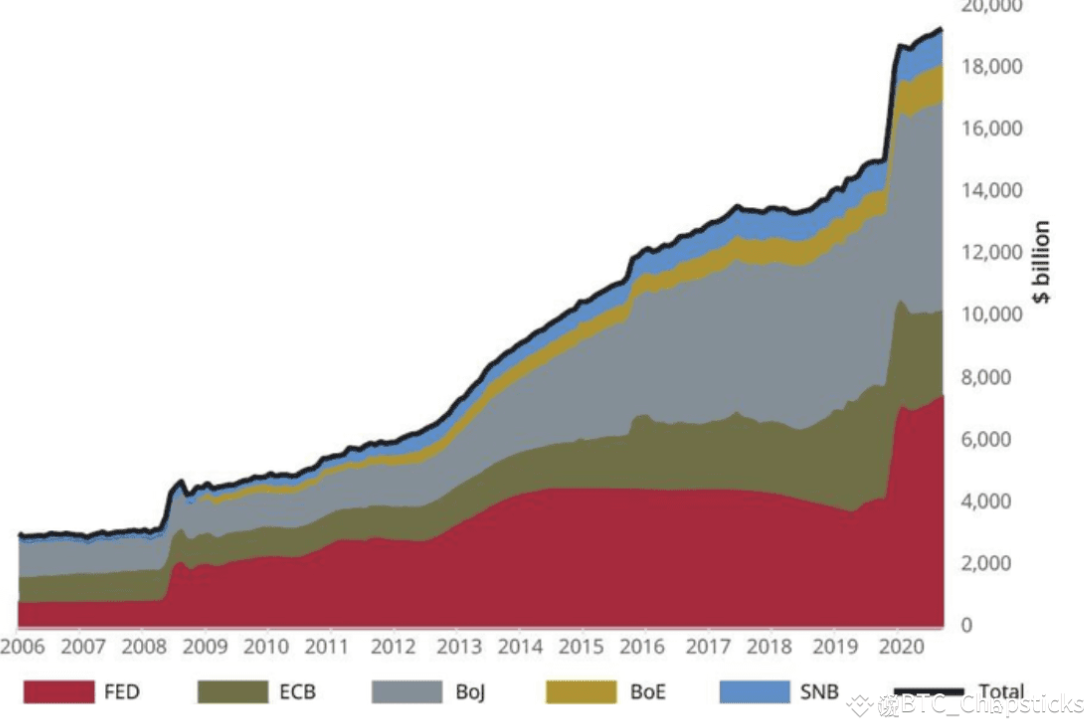

Every altcoin bull run is inseparable from one of the following two things:

The central bank initiated quantitative easing (QE);

The Federal Reserve ends quantitative tightening (QT).

At present, neither of the above has really appeared, which is also the core reason why altcoins have performed poorly in this cycle.

🏦 What is QE? How does it ignite risk assets?

During a QE cycle, the central bank electronically prints money to buy government bonds and other financial assets. This behavior:

Increase liquidity in the banking system and encourage more capital to flow into the market;

Push up bond prices, push down bond yields, and reduce financing costs;

Stimulate funds to flow to high-risk assets (including stocks, crypto assets, etc.).

This is exactly the main mechanism by which we saw the surge in Altcoins during the 2020–2021 cycle.

🚫 Why can’t we count on the Federal Reserve?

The Federal Reserve currently faces multiple constraints:

U.S. Treasury yields rose;

Tariff policies lead to inflation risks;

The Federal Reserve has made it clear that it will not restart QE until interest rates are close to zero.

Even if the Federal Reserve injects capital into the market due to a liquidity crisis in the future, the scale will be difficult to support a complete Altseason.

🎯 The real liquidity boost comes from Japan

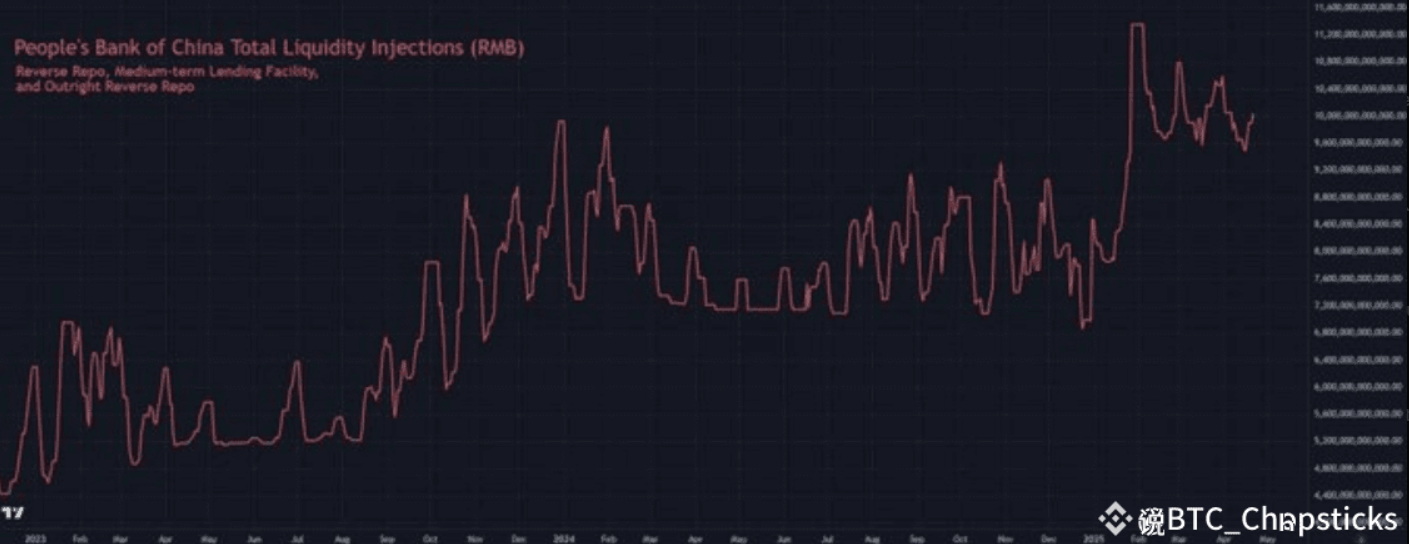

Just recently, China has injected 500 billion RMB into the money market. What's more, Japan may also join the ranks of liquidity release.

Japan is currently facing:

Treasury yields rise;

The yen strengthened and export competitiveness declined.

Under internal and external pressure, Japan's most likely response is large-scale quantitative easing + exchange rate intervention.

🌀 History repeats itself: Japan's classic operating methods

Looking back at the 2008 financial crisis, Japan adopted a two-step strategy:

Printing a large amount of Japanese yen and actively devaluing the currency;

Massive purchases of U.S. dollars in the foreign exchange market further depress the value of the yen.

At the same time, Japan used the dollars it received to buy U.S. Treasury bonds, which directly pushed down the U.S. Treasury yields and indirectly boosted Japan's exports.

📈 SoftBank, Tether and Bitcoin Fund: The signal is clear

SoftBank recently partnered with the son of the U.S. Secretary of Commerce and Tether to launch a $3 billion Bitcoin fund.

This is by no means a coincidence - Asian capital has quietly laid out its plans for the next crypto bull market.

✅ Conclusion:

Each of us is looking forward to a round of Altseason similar to 2021, but the reality is that the number of tokens in the crypto market has increased dozens of times, and the demand for liquidity is far greater than ever before.

Without a new round of global QE, it will be difficult to drive altcoins to take off across the board relying solely on the market itself.

Fortunately, China has already started and Japan is about to follow.

The real liquidity flood is coming, and patient layout is more valuable than any FOMO.