Article written by: Andrew Singer

Article translation: Block unicorn

A few years ago, many in the crypto community described Bitcoin as a “safe haven” asset. Today, fewer and fewer people call it that.

Safe haven assets retain or increase their value during times of economic stress. They can be government bonds, currencies like the U.S. dollar, commodities like gold, or even blue chip stocks.

A global tariff war sparked by the United States and troubling economic reports have caused stock markets to plummet, as has Bitcoin - something that shouldn't happen for a "safe haven" asset.

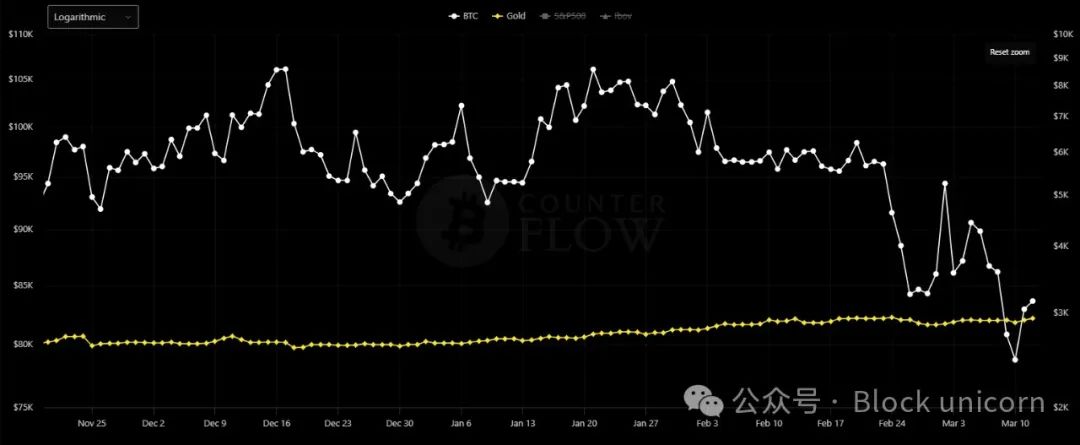

Bitcoin has also underperformed compared to gold. “Since January 1, gold prices are up +10%, while Bitcoin is down -10%,” Kobeissi Letter noted on March 3. “Cryptocurrencies are no longer considered a safe haven.” (Bitcoin fell even more last week.)

But some market watchers said it was not entirely unexpected.

Bitcoin (white) and gold (yellow) price charts from December 1 to March 13. Source: Bitcoin Counter Flow

Was Bitcoin Ever a Safe Haven Asset?

“I have never viewed Bitcoin as a ‘safe haven asset,’” Paul Schatz, founder and president of financial advisory firm Heritage Capital, told us. “Bitcoin is too volatile to be classified as a safe haven, although I do think investors can and should have an allocation to this asset class in general.”

"For me, Bitcoin is still a speculative instrument, not a safe haven asset," Jochen Stanzl, chief market analyst at CMC Markets (Germany), told us. "Safe haven investments like gold have intrinsic value and will never go to zero. Bitcoin could drop 80% in a major correction. I don't think that will happen with gold."

Cryptocurrencies, including Bitcoin, "have never been a 'safe haven' in my opinion," Buvaneshwaran Venugopal, assistant professor of finance at the University of Central Florida, told CNN.

But things are not always as clear-cut as they first appear, especially when it comes to cryptocurrencies.

One might argue that there are different types of safe haven assets: one for geopolitical events, such as wars, pandemics, and recessions, and another for strictly financial events, such as bank failures or a weaker dollar.

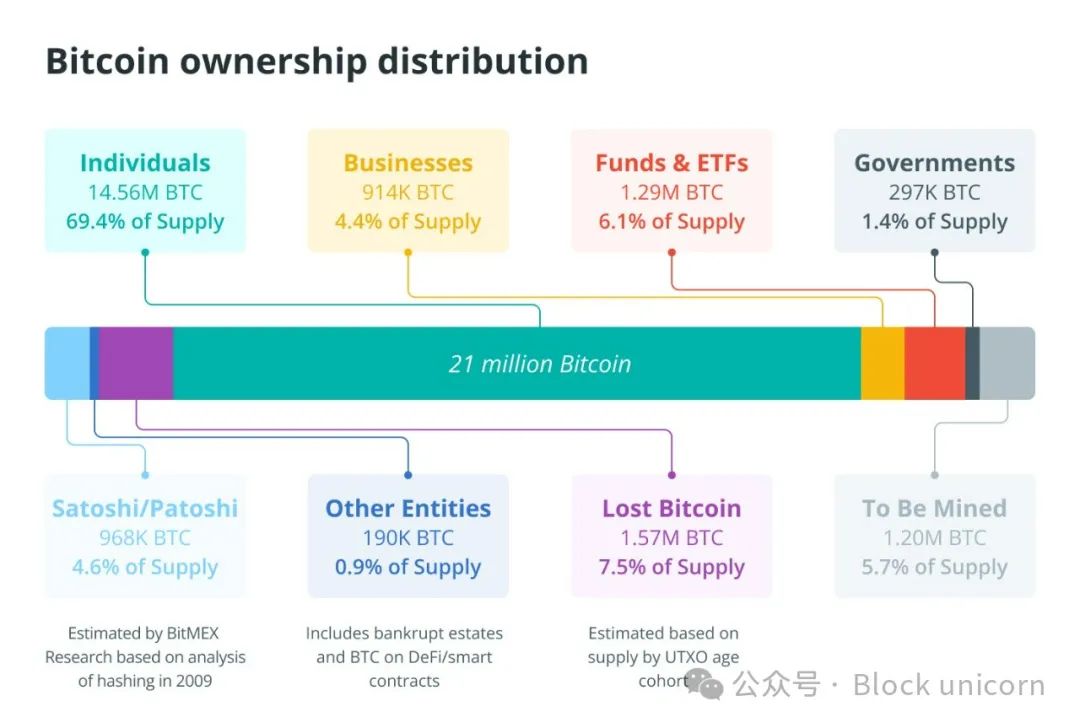

Perceptions of Bitcoin may be changing. In 2024, exchange-traded funds (ETFs) issued by major asset managers such as BlackRock and Fidelity included it, expanding its ownership base but also potentially changing its “narrative.”

It is now more broadly viewed as a speculative or “risk-on” asset, similar to technology stocks.

“Bitcoin, and cryptocurrencies as a whole, have become highly correlated to risk assets, and they often move inversely to safe haven assets like gold,” Adam Kobeissi, editor-in-chief of the Kobeissi Letter, told us.

He went on to say that there is a great deal of uncertainty about Bitcoin’s future amid “greater institutional participation and leverage,” and that “the narrative has shifted from Bitcoin being viewed as ‘digital gold’ to being a more speculative asset.”

One might think that acceptance by traditional financial giants like BlackRock and Fidelity would make Bitcoin’s future more secure, which would strengthen its safe-haven narrative — but according to Venugopal, this is not the case:

“Big companies piling into Bitcoin doesn’t mean it’s getting safer. In fact, it means Bitcoin is becoming more like any other asset that institutional investors tend to invest in.”

Venugopal continued that it will be more influenced by conventional trading and retracement strategies used by institutional investors. “If anything, Bitcoin is now more correlated with risk assets in the market.”

The Dual Nature of Bitcoin

Few would deny that Bitcoin and other cryptocurrencies are still subject to wild price swings, and that recently retail adoption of cryptocurrencies has increased, particularly driven by the meme coin craze, “which is one of the biggest crypto on-ramps in history,” Kobeissi noted. But perhaps that’s the wrong focus.

“Safe haven assets are always long-duration assets, which means that short-term volatility is not a factor in their character,” Noelle Acheson, author of the Crypto is Macro Now newsletter, told us.

The big question is whether Bitcoin can maintain its value against fiat currencies over the long term, which it has been able to do. “The numbers prove it — Bitcoin has outperformed gold and U.S. stocks over almost any four-year time frame,” Acheson said, adding:

“Bitcoin has always had two key narratives: it is a short-term risk asset, sensitive to liquidity expectations and overall sentiment. It is also a long-term store of value. It can be both, as we have seen.”

Another possibility is that Bitcoin may be a safe haven asset for some events but not for others.

Gold can serve as a hedge against geopolitical issues, such as trade wars, while both Bitcoin and gold can serve as a hedge against inflation. “Both can therefore be useful hedges in a portfolio,” Kendrick added.

Others, including Ark Investment’s Cathie Wood, agree that Bitcoin acted as a safe haven asset during the SVB and Signature bank runs in March 2023. When SVB collapsed on March 10, 2023, Bitcoin was trading at around $20,200, according to Coingecko. A week later, it was trading near $27,400, up about 35%.

Bitcoin prices fell on March 10 and rebounded a week later. Source: Coingecko

Schatz doesn’t see Bitcoin as a hedge against inflation. The events of 2022, when FTX and other crypto companies collapsed and the crypto winter began, “damaged that argument tremendously.”

Maybe it’s a hedge against the dollar and Treasuries? “It’s possible, but the scenarios are pretty dark and hard to imagine,” Schatz added.

Don’t overreact

Kobeissi agreed that short-term fluctuations in the asset class are “generally least correlated over long-term time frames.” Despite the current pullback, many of Bitcoin’s fundamentals remain positive: a crypto-friendly U.S. government, the announcement of a U.S. Bitcoin reserve, and a surge in cryptocurrency adoption.

The biggest question facing market participants is, “What’s the next major catalyst to move higher?” Kobeissi told us. “That’s why markets pull back and consolidate: to find the next major catalyst.”

“Ever since macro investors started viewing Bitcoin as a high volatility, liquidity sensitive risk asset, it has been behaving like one,” Acheson added. Furthermore, “it is almost always the short-term traders who set the last price, and if they are exiting risk assets, we will see weakness in Bitcoin.”

The market is struggling overall. “The re-emerging specter of inflation and economic slowdown weighs heavily on expectations,” which is also affecting the price of Bitcoin. Acheson further noted:

“Given this outlook, and Bitcoin’s dual nature as both a risk-on asset and a long-term safe haven, I’m surprised it hasn’t fallen further.”

Venugopal said Bitcoin has not been a short-term hedge or safe haven asset since 2017. As for the long-term thesis that Bitcoin is digital gold due to its 21 million supply cap, this only holds true "if a large portion of investors collectively expect Bitcoin to increase in value over time," which "may or may not be true."