Author: Monchi | Editor: Monchi

1. Bitcoin Market

From April 12 to April 18, 2025, the specific trend of Bitcoin is as follows:

April 12: Bitcoin rose rapidly in the early morning, rising straight from $82,122 to $84,067, and then maintained a high level of consolidation, with prices fluctuating in a narrow range around $83,800. After a brief correction to $82,817, it rose again, reaching a high of $85,152, indicating that bulls dominated the market in the short term.

April 13: Continuing the previous trading day's strong performance, the market continued to fluctuate upward, reaching a high of $85,758. A technical correction followed, with the price falling back to around $84,400 for consolidation. It fell to $83,541 in a short period of time, but quickly rebounded to $84,828, indicating that the market still has some support.

April 14: After opening, it quickly fell back to $83,044, then rebounded, and the intraday volatility intensified. It quickly rose to $85,241 in the short term and then fell back to $83,778, and finally stabilized around $84,500. Overall, the market's long and short divergences intensified, and volatility increased significantly.

April 15: The price started a new round of slow climb, and the fluctuation range converged. The overall price rose steadily from $84,450 to $85,858, and broke through $86,075 after a brief correction. However, it then fell significantly, quickly falling to $85,078, and then further adjusted to $84,760, indicating that the market may enter a short-term adjustment phase.

April 16: Continuing the correction trend of the previous day, the price continued to decline during the day, falling from around $85,000 to $83,274. Although it rebounded briefly to $83,924, it failed to form effective support and fell again to $83,195. Buying picked up in the late trading, pushing the price above the $84,000 mark, rising to a high of $85,324, but the upward momentum was insufficient and it eventually fell back to close at $83,769.

April 17: Bitcoin maintained a narrow range of fluctuations as a whole, and volatility further shrank. The price range mainly operated between $84,000 and $85,000. The intraday trend showed a slow upward trend, and the price successively reached $84,580, $84,927 and $84,811, indicating that the market bulls are trying to gently push the price higher, but the overall upward momentum is limited.

April 18: Bitcoin continued its volatile upward trend of the previous trading day, successfully breaking through the short-term resistance level of $85,000 and hitting $85,342 in the early trading. It then fell back to around $84,900. As of writing, the price of Bitcoin is temporarily reported at $84,936.35

Summarize

This week, Bitcoin prices rebounded strongly from last week's lows and are currently trading around $84,000, and are generally above $82,000. During this period, the price has repeatedly surged to around $86,000, but has not been able to form an effective breakthrough, and then fell back and adjusted, showing a mild upward channel pattern overall. The future market trend is still highly dependent on changes in the macroeconomic environment, especially key variables such as Trump's tariff policy, inflation data and global risk appetite. If there is no obvious negative disturbance on the macro side, Bitcoin is expected to test a higher technical resistance range in the coming weeks.

Bitcoin price trend (2025/04/12-2025/04/18)

2. Market dynamics and macro background

Fund Flows

1. Fund flow of exchanges

Net outflow from exchanges continues to expand, and funds are turning to cold wallets

According to monitoring by the on-chain analysis agency IntoTheBlock, more than $467 million worth of Bitcoin flowed out of exchanges on April 15, showing that investors tend to transfer assets to self-hosted wallets, indicating that the market's willingness to hold has increased and short-term selling pressure has decreased.

2. Institutions and Whale Activities

Whales’ large withdrawals are concentrated on OKX and Binance

According to Lookonchain data, on April 15, a whale withdrew 1,500 BTC from OKX within 20 hours, with a total value of approximately US$128 million, indicating that large investors are still confident in the market price performance.

In addition, on April 16, a wallet address associated with the hedge fund Abraxas Capital withdrew 747 BTC (about US$63.78 million) from Binance after two months of silence, which may indicate that it is re-positioning the spot market.

Whales reduced their holdings of 30,000 Bitcoins this week, and the net accumulation rate hit a new low since February

On April 16, the on-chain analysis platform CryptoQuant pointed out that whales’ holdings have decreased by about 30,000 bitcoins this week, reflecting that some large investors are gradually cashing out their previous profits. It is worth noting that on April 7, miners’ daily outflow reached 15,000 BTC, when the average profit margin of miners had fallen back to 33%.

Currently, the net accumulation rate of Bitcoin in the overall market has dropped to the lowest level since February, which means that the holding behavior of new growth lines in the market has slowed down significantly, indicating that the attitude of major funds has become more cautious, or they are waiting for clearer trend signals.

3. ETF-related dynamics and fund flows

Net capital inflows pick up

On April 14, according to Farside Investors data, the US Bitcoin spot ETF achieved a net inflow of $1.5 million, ending seven consecutive trading days of net outflows. Among them, IBIT (BlackRock) had a net inflow of $36.7 million, and FBTC (Fidelity) had a net outflow of $35.2 million.

On April 15, net inflows expanded to US$76.89 million (Trader T data), and funds clearly flowed back into the crypto asset market.

Short-term funds are still volatile

On April 16, ETFs had a net outflow of $170.77 million (Trader T monitoring), and market attitudes remain unstable.

On April 17, according to Lookonchain, 10 Bitcoin ETFs had a net inflow of 672 BTC, of which BlackRock received 455 BTC and currently holds 571,869 BTC worth $40.01 billion.

During the same period, 9 Ethereum ETFs had a net outflow of 2,578 ETH, of which Fidelity had an outflow of 2,248 ETH and currently holds 363,525 ETH, worth $573.28 million.

The overall situation is still in the stage of monthly net outflow

According to CoinDesk, as of mid-April, the U.S. Bitcoin spot ETF had a cumulative net outflow of more than $800 million, which may be the second highest single-month capital outflow in history.

The reason behind this may be related to the short-term shift of institutions to U.S. Treasuries. The current 3-month U.S. Treasury yield has risen to 4.225%. Some institutions have reduced their holdings of risky assets and instead allocated safe-haven instruments.

Total open interest breaks through key level

According to Dune Analytics, as of April 13, the total on-chain holdings of the U.S. spot Bitcoin ETF reached 1.133 million BTC, accounting for 5.71% of the current total supply, and the total on-chain value was close to US$96.5 billion.

Technical indicator analysis

1.14-day Relative Strength Index (RSI 14)

As of April 16, 2025, Bitcoin's 14-day RSI is 52.00, indicating that the market is in a neutral state, neither overbought nor oversold. RSI values around 50 usually indicate that the market lacks clear directionality. It is worth noting that Bitcoin's weekly RSI recently broke through the long-term trend line, which may indicate a shift in price momentum. Investors should pay close attention to RSI changes in the coming weeks.

2. Moving Average (MA)

As of April 17, Bitcoin’s moving average data is as follows:

50-day moving average (MA50): $87,918

200-day moving average (MA200): around $81,000

It is worth noting that on April 6, Bitcoin's 50-day moving average crossed below its 200-day moving average, forming a "death cross" pattern, indicating that the market may enter a downward trend.

3. Key support and resistance levels

Key Support: $82,900; below this level, the price could fall further to $81,100.

Key Resistance: $85,200; a break above this level could open up upside with a target of $87,000.

Market sentiment analysis

Prices recover, sentiment cautious

This week, Bitcoin prices rebounded from last week's lows, trading around $84,000 after falling below $77,000. Despite the price recovery, trading volumes declined as investor risk appetite was affected, mainly due to concerns about a bear market and recession following the re-election of U.S. President Donald Trump and his uncertain trade policies.

Key Sentiment Indicators (Fear and Greed Index)

As of April 18, the Fear and Greed Index was 32, indicating that market sentiment was neutral to cautious. Previously, the index had fallen to 25 in February, indicating extreme fear.

Macroeconomic Background

US Tariff Policy and Trade Tensions

On April 16, 2025, the Trump administration announced that it would close the loophole in the "de minimis" import policy starting May 2. Previously, the policy allowed goods worth less than $800 to enter the United States without paying tariffs. This move will affect Chinese e-commerce platforms Shein and Temu, forcing them to raise product prices.

Trump's tariff measures have triggered strong reactions from many countries, leading to increased global trade tensions:

China: Expressed strong opposition to the US tariff measures, criticizing them as "irrational" unilateralism and refusing to negotiate on the basis of lack of equality and mutual respect.

Canada and Mexico: Have retaliated against the U.S. tariffs with tariffs covering billions of dollars worth of U.S. goods.

European Union: The European Central Bank was forced to cut interest rates again to counter the deteriorating economic growth outlook caused by the Trump administration's 20% tariff on EU imports.

3. Hash rate changes

Between April 12 and April 18, 2025, the Bitcoin network hash rate fluctuated as follows:

On April 12, the hash rate showed a "first rise and then fall" trend, rising rapidly from 905.02 EH/s to 947.25 EH/s and 975.18 EH/s during the day, and then fluctuated at a high level, falling sharply near the close, reaching a low of 830.19 EH/s. On April 13, the computing power continued to rise, showing a steady climbing trend throughout the day, maintaining a high of 1080 EH/s for a long time, and reaching a high of 1113.03 EH/s, setting a new high. On April 14, the high computing power fell back, and continued to decline from 1113 EH/s to 876.98 EH/s during the day, and the lowest was 847.77 EH/s. It rebounded quickly to 1009.16 EH/s in the late trading stage, reflecting that the network has a certain computing power repair ability.

On April 15, the overall computing power was running above 900 EH/s, with large fluctuations in the range. The hash first fell from 961.95 EH/s to 922.10 EH/s, then quickly rose to 998.33 EH/s, and then fell to 952.13 EH/s again before rising to 1021.94 EH/s. Near the end of the day, the computing power fluctuated violently, rising from 920.99 EH/s to 972.97 EH/s and then quickly falling to 834.15 EH/s. On April 16, the computing power continued its downward trend, falling to 792.45 EH/s and 780.16 EH/s, hitting this week's low. After that, it stabilized slightly and rebounded to 906.92 EH/s, indicating that some miners may be back online and the stability of mining has improved marginally. On April 17, the hash rate continued its upward trend, rising to 1024.14 EH/s, before falling back to 894.83 EH/s. On April 18, the correction continued, falling to about 850 EH/s, ending this week's volatility cycle.

In summary, the overall hash rate of the Bitcoin network showed a wide range of fluctuations this week, showing significant periodic concentrated access and retracement characteristics, reflecting the current miners' behavior continues to be more sensitive to market expectations, energy costs and macro policy changes. Despite several sharp fluctuations during this period, the overall computing power remained relatively resilient at a high level, indicating that network security and mining activity remain at a relatively strong level. In the future, we still need to pay attention to the further impact of electricity prices, changes in miners' income and potential policy disturbances on the distribution of computing power.

Bitcoin network hash rate data

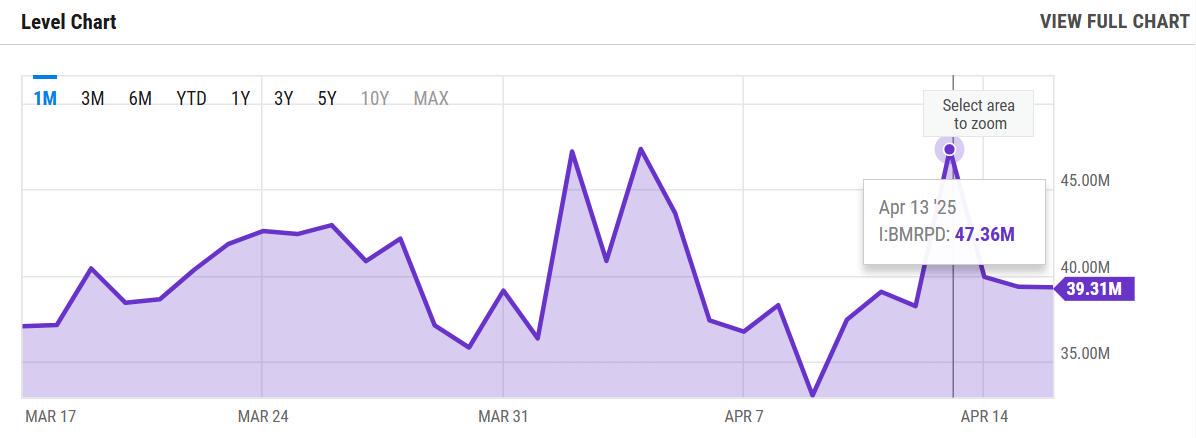

4. Mining income

According to YCharts data, the total daily revenue of Bitcoin miners this week (including block rewards and transaction fees) is as follows: April 12: 38.21 million US dollars; April 13: 47.36 million US dollars; April 14: 39.92 million US dollars; April 15: 39.34 million US dollars; April 16: 39.31 million US dollars. Although the revenue on April 13 briefly climbed to a high of 47.36 million US dollars, the overall trend was relatively stable, with the average daily revenue remaining at around 39 million US dollars. Compared with the daily level of about 71.88 million US dollars in the same period last year, miners' revenue has dropped by about 45%, indicating that the mining industry is facing greater revenue pressure.

At the same time, as the total network computing power continues to rise, the unit computing power revenue (hashprice) has dropped to below $42 per PH/s, a record low. According to TheMinerMag analysis, $40/PH/s is considered the break-even point for many publicly listed mining companies. The current hashprice level means that these companies have difficulty making profits after deducting electricity and operating costs.

In addition, Jefferies' report pointed out that in the first two weeks of April 2025, miners' average daily block reward income per EH/s was about US$41,500, a decrease of 12% from March. This further exacerbated the operating pressure of miners, especially for small and medium-sized mining companies with high cost structures or lack of economies of scale, whose profitability is facing severe challenges.

Bitcoin miners daily income data

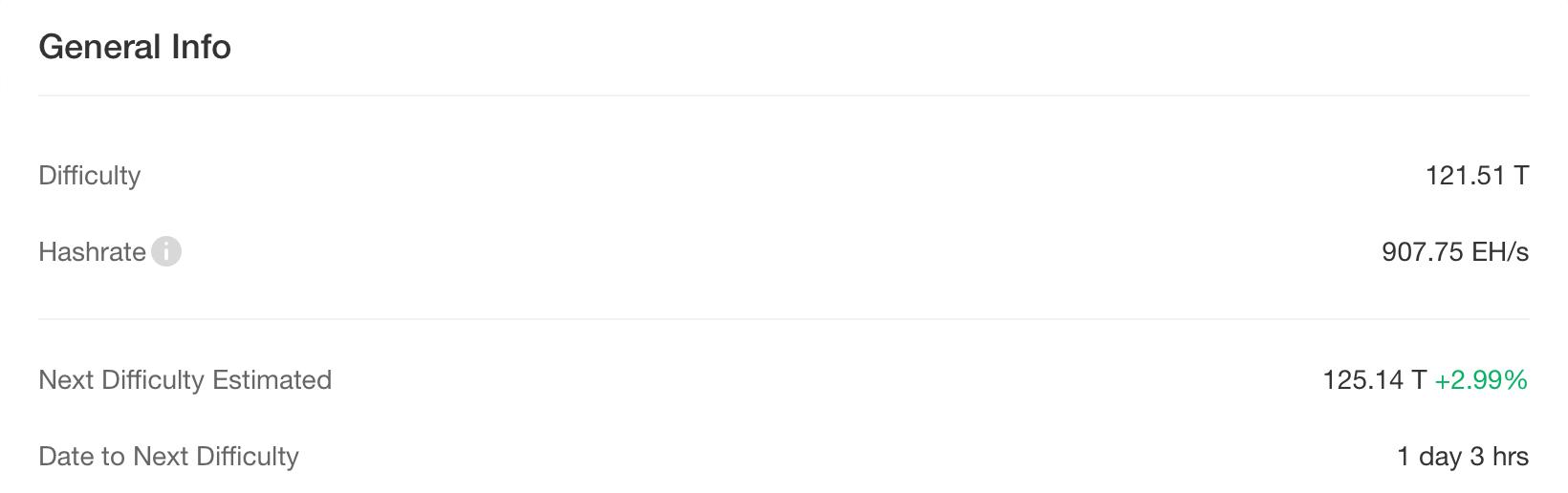

5. Energy costs and mining efficiency

According to CloverPool data, as of April 18, 2025, the total computing power of the Bitcoin network is about 907.75 EH/s, and the current mining difficulty of the entire network is 121.51 T. The next round of difficulty adjustment is expected to be carried out on April 20, and the increase is expected to be 2.99%, and the difficulty will increase to 125.14 T. This trend shows that miners continue to invest in computing power, and the intensity of network competition continues to intensify.

It is worth noting that on April 13, the total Bitcoin network computing power once exceeded 1000 EH/s, setting a record high, showing that network security and computing power concentration have significantly improved. As computing power continues to rise and the halving event in 2024 leads to a reduction in block rewards, the mining cost of a single Bitcoin has risen simultaneously, further squeezing the profit space of small miners, and may accelerate resource integration within the industry and the clearance of marginal mines.

According to MacroMicro's latest model, as of April 16, 2025, the unit production cost of Bitcoin is approximately $90,019.68, while the spot price on that day is $84,033.87. The mining cost-to-price ratio calculated from this is 1.05, significantly higher than 1, reflecting that the current Bitcoin price is lower than the average mining cost of the entire network, and miners are operating below the break-even line as a whole. The vast majority of miners are facing the pressure of narrowing profit margins or even losses.

In terms of energy consumption, The Bitcoinist estimates that the annual electricity consumption of the global Bitcoin network is about 185.82 terawatt hours (TWh), which is equivalent to the average annual electricity consumption of a medium-sized country. This data once again highlights the high dependence of Bitcoin mining on energy resources.

In addition, according to FingerLakes1, Bitcoin mining accounts for about 2.3% of the country's total electricity consumption in the United States, and causes consumers to bear an additional electricity cost of about $1 billion each year. This phenomenon is causing the public and regulators to continue to pay attention to the energy sustainability of mining activities.

Bitcoin mining difficulty data

6. Policy and regulatory news

The US Senate proposes to impose emission fees on high-energy-consuming data centers, which may affect Bitcoin mining companies

On April 12, according to Bloomberg, U.S. Senate Democrats proposed a draft of the Clean Cloud Act, which intends to impose fees on data centers that support blockchain networks and artificial intelligence models that exceed federal emission targets. The bill requires the U.S. Environmental Protection Agency to develop emission standards for data centers and crypto mining facilities with installed IT nameplate power exceeding 100 KW, with the goal of reducing emissions by 11% per year. Emissions exceeding the limit will be fined $20 per ton of carbon dioxide equivalent, and the amount will increase by $10 per year with inflation. It is worth noting that Bitcoin mining companies including Galaxy, CoreScientific and Terawulf are gradually turning to providing high-performance computing (HPC) computing power for artificial intelligence models. The bill has not yet been passed by the Senate.

Oklahoma Senate Committee Votes to Reject Bitcoin Reserve Proposal

On April 16, the Oklahoma Senate Taxation Committee rejected House Bill 1203 (also known as the Strategic Bitcoin Reserve Act) by a narrow margin of 6 to 5. HB1203 was proposed by Congressman Cody Maynard in January of this year. The bill allows the Oklahoma Treasurer to invest in Bitcoin and other eligible digital assets. Qualified digital assets are defined as any asset with a market value of more than $500 billion in the past year. Currently, only Bitcoin meets this threshold. The earlier committee passed the bill in February with an overwhelming advantage of 12 to 2, setting the stage for this significant showdown on Monday.

North Carolina's HB 92 allows the state treasurer to invest in eligible digital assets such as Bitcoin

On April 17, North Carolina's HB 92 bill was passed by the House Pension and Retirement Committee, which allows the state treasurer to invest in eligible digital assets such as Bitcoin.

Related images

7. Mining News

CryptoQuant: Miners are increasing their Bitcoin sales as Bitcoin prices fall and mining difficulty increases

On April 16, CryptoQuant said in a report on Tuesday that as the price of Bitcoin fell below $80,000, miners accelerated their pace of selling Bitcoin last week. The company said that on April 7, miners sold a total of 15,000 Bitcoins, which was the third largest single-day outflow this year. Based on the lowest price of less than $75,000 that day, it was worth at least $1.12 billion.

“Miners’ profit margins have been squeezed by falling prices, coupled with low transaction fees and record highs in the Bitcoin network hashrate, which means higher mining costs, causing their average operating profit margin to fall from 53% at the end of January to 33% today,” CryptoQuant said.

The firm also noted that Bitcoin has been in one of its most bearish phases since November 2022. Bitcoin reached a high of nearly $109,000 before President Trump took office, but has since struggled to break through $90,000.

JPMorgan Chase: In the first two weeks of April, the US-listed Bitcoin mining companies rose and fell, and the overall market value fell by 2%.

On April 16, JPMorgan Chase released a research report pointing out that in the first two weeks of April, US-listed Bitcoin mining companies experienced mixed performance, but pure Bitcoin cross-operators performed better than those involved in high-performance computing (HPC), and only MARA Holdings and CleanSpark performed better than Bitcoin. In addition, the total market value of 13 US-listed Bitcoin mining companies fell 2% in April to $16.9 billion; in the first two weeks of this month, miners' daily block reward income per EH/s was about $41,500, a 12% decrease from March.

Related images

8. Bitcoin related news

Bitcoin holdings of global companies and countries (statistics for this week)

1. BlackRock’s IBIT holdings exceed 570,000 Bitcoins

According to news on April 14, as of April 11, BlackRock's spot Bitcoin ETF IBIT held 570,983 Bitcoins, with a market value of more than US$47 billion, accounting for more than 2% of the total supply of Bitcoin.

2. Japan’s Metaplanet increases its holdings by 319 bitcoins

On April 14, Japanese listed company Metaplanet increased its holdings of 319 bitcoins, bringing its total holdings to 4,525 bitcoins, with a cumulative investment of 58.145 billion yen.

3. Strategy (formerly MicroStrategy) purchased another 3,459 bitcoins in one week

Strategy purchased 3,459 bitcoins in one week, with a total holding of 531,644 bitcoins and a total investment of approximately US$35.92 billion.

4. Hong Kong Asia Holdings slightly increased its holdings by 10 bitcoins

On April 14, it was reported that Hong Kong-listed company Asia Pacific Holdings purchased another 10 bitcoins, bringing its total holdings to 28.88 bitcoins, with a total investment of approximately US$2.52 million.

5. El Salvador added 8 Bitcoins in one week

The Salvadoran government has increased its holdings of 8 bitcoins in the past 7 days, and its current total holdings are 6,147.18 bitcoins, with a total value of approximately US$521 million.

6. Australia's Monochrome Bitcoin ETF holdings increased to 331

Australia's Monochrome Spot Bitcoin ETF (IBTC) holdings increased from 330 on April 14 to 331 on April 15, with a market value of approximately US$44.58 million.

7. Japan’s Value Creation announces additional purchase of Bitcoin

On April 15, Japanese listed company Value Creation invested an additional 100 million yen to purchase Bitcoin, strengthening its long-term bullish stance on Bitcoin.

CMC Altcoin Seasonal Index Hits 18, Showing Market Still Dominated by Bitcoin

On April 13, the CMC altcoin seasonal index hit 18, showing a slight recovery in the market, but it was still a sharp drop from the March average of 32 points and the February average of 43 points, indicating that the market is still dominated by Bitcoin.

The CMC Altcoin Season Index is a tool that helps determine whether the market is in an altcoin season or a bitcoin season by tracking the performance of the top 100 cryptocurrencies over the past 90 days. When 75% or more of altcoins outperform Bitcoin, the market is considered to be in an altcoin season.

President Trump’s Digital Asset Advisor: US May Use Tariff Revenue to Buy Bitcoin

On April 15, according to Bitcoin Magazine, Bo Hines, executive director of President Trump’s Digital Asset Advisory Committee, said that the United States may use tariff revenue to purchase Bitcoin.

Bitcoin's 14-year return rate reached 7.2 million%, far exceeding the S&P 500's 306% and gold's 116%.

On April 15, Bitcoin performed well in all time periods, outperforming the S&P 500 index every year for the past 14 years. During this period, Bitcoin achieved a return rate of about 7.2 million%, far exceeding the 116% return rate of gold and the 306% return rate of the S&P 500 index. In a shorter period of time, Bitcoin's return rate in the past two years was 173%, further consolidating its dominance over traditional investment assets such as gold and the S&P 500 index.

Related images

Executive Director of Trump’s Digital Asset Advisory Committee: The significance of Bitcoin strategic reserves lies in the recognition of BTC’s value

On April 15, Bo Hines, executive director of Trump’s Digital Asset Advisory Committee, published an interview on the X platform, in which he explained the importance of the US Bitcoin strategic reserve. He said that Trump launched the Bitcoin strategic reserve to accumulate assets for the American people rather than plunder assets. At the same time, the significance of the Bitcoin strategic reserve is to recognize the value of BTC. Since the number of Bitcoin is limited, the Bitcoin strategic reserve may trigger a global asset accumulation competition.

Bitcoin wallets using ESP32 chips have serious vulnerabilities that can lead to the theft of private keys

According to Protos on April 16, Bitcoin wallets using ESP32 chips, including Blockstream's Jade wallet, have discovered a serious vulnerability (CVE-2025-27840). Cybersecurity research company Crypto Deep Tech said the vulnerability could lead to the theft of private keys.

Analysis: Bitcoin poised for 2023-like rally

On April 16, the U.S. dollar index (DXY) fell below the psychological mark of 100 and hovered near multi-year lows. Andre Dragosch, head of European research at asset management company Bitwise, pointed out that Goldman Sachs' research still indicates that DXY still has room for downside in the future.

Trader BitBull said that DXY is falling at the fastest rate since 2023. In early 2023, Bitcoin and altcoins are rebounding from the trough of the 2022 bear market. At that time, Bitcoin had bottomed out in the fourth quarter of 2022 and rose by more than 200% in a year. Bitcoin is expected to see a similar rebound in 2023 as Bitcoin optimism will continue to focus on the weakening momentum of the US dollar.

Analyst: When gold hits new highs, history shows "Bitcoin will follow within 150 days"

On April 18, the price of gold soared to an all-time high of $3,357 per ounce on April 17, sparking speculation about whether Bitcoin would follow suit. In 2017, Bitcoin soared to $19,120 after gold rose 30% a few months ago. Similarly, during the 2020 COVID-19 pandemic, gold reached a new high of nearly $2,075, and then Bitcoin soared to $69,000 in 2021. Historically, whenever gold rises, Bitcoin has broken through its previous all-time high, reflecting the dynamic relationship between the two assets during times of economic uncertainty and when investors are looking for alternatives to the dollar.

Further highlighting the correlation between the two assets, Theya Head of Growth Joe Consorti noted that Bitcoin follows gold’s directional movements with a lag of 100-150 days. “When the printing presses start, gold will smell it first, and then Bitcoin will follow more aggressively,” Consorti said. Considering Consorti’s views, Bitcoin is expected to reach new all-time highs between Q3 and Q4 of 2025. Anonymous Bitcoin supporter apsk32 expects a similar result or bull run between July and November.