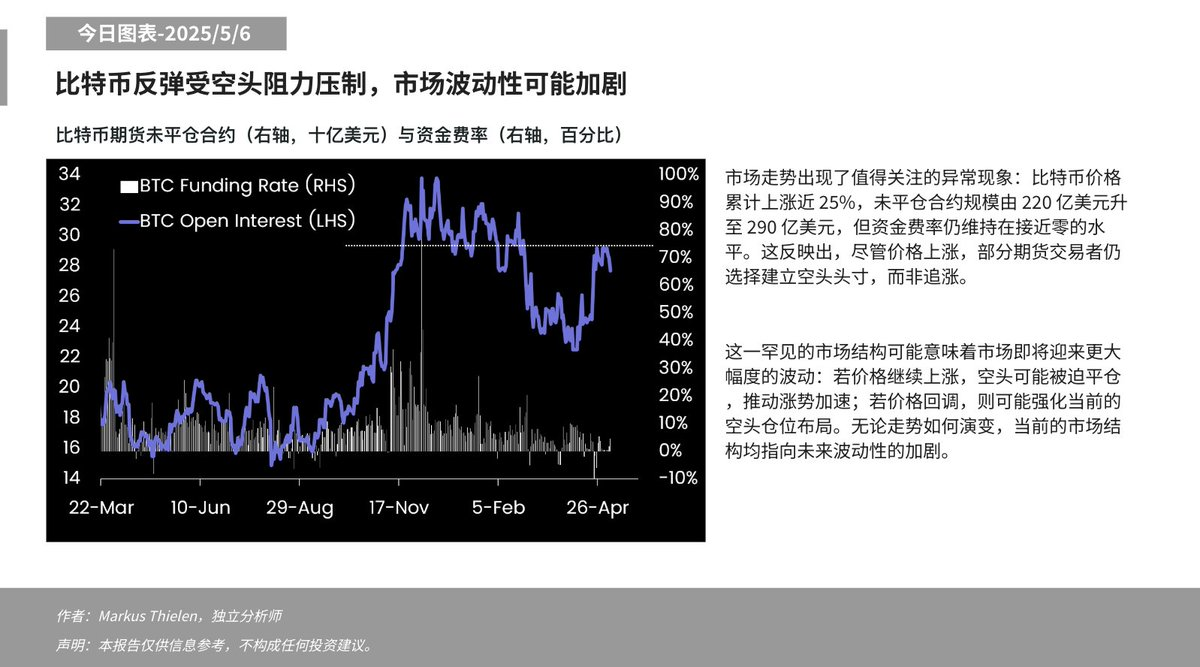

PANews reported on May 6 that according to Matrixport analysis, the price of Bitcoin has risen by nearly 25% in total, and the size of open contracts has risen from US$22 billion to US$29 billion, but the funding rate is still close to zero, indicating that some futures traders choose to establish short positions rather than chase the rise. This rare market structure may indicate greater volatility: if prices continue to rise, shorts may be forced to close their positions to promote the rise; if prices fall back, short positions may be strengthened. The overall market structure points to increased volatility in the future.