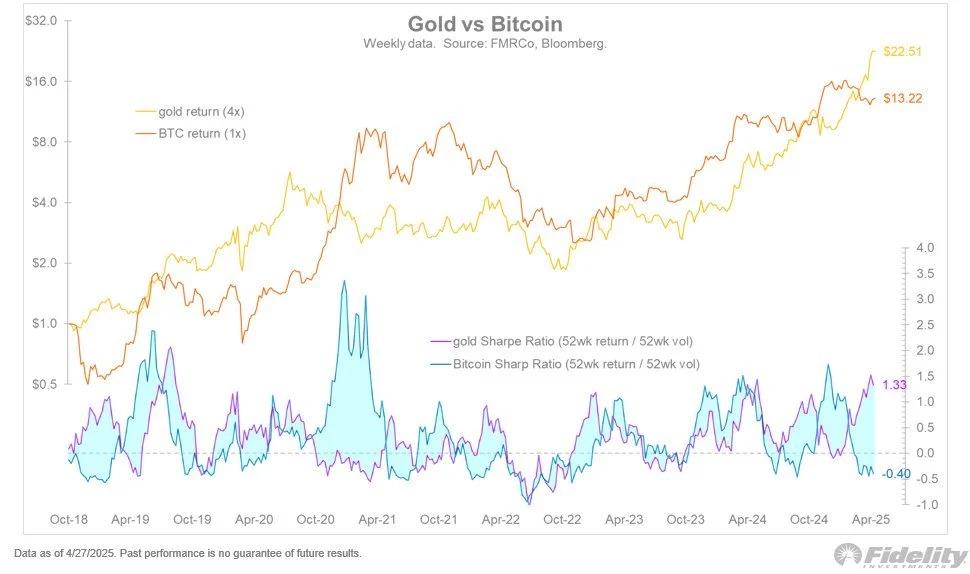

PANews reported on May 4 that Jurrien Timmer, global macro director of Fidelity Investments, recently published an article analyzing in detail the dynamic relationship between Bitcoin and gold. He cited data from Fidelity Management and Research Company (FMR Co) and Bloomberg, analyzed the changing trends of the Sharpe ratio (a measure of risk-adjusted returns) of the two assets, and pointed out that their relative performance may be at a turning point.

“Ironically, there is a negative correlation between gold and Bitcoin. As can be seen in the chart below, the Sharpe ratios of the two assets have been alternating recently,” he commented, adding: “It looks like Bitcoin’s lead moment may be next, as its Sharpe ratio is currently -0.40, while gold’s is 1.33. Therefore, we may be witnessing a baton handover from gold to Bitcoin.”

Jurrien Timmer recommends that investors start with a portfolio of four parts gold to one part Bitcoin, as gold’s volatility is only one-fourth that of Bitcoin, although they have similar Sharpe ratios.