I opened the history books and checked, and found that there was no currency in this history. Instead, the four words "get rich soon" were written crookedly on every page.

I couldn't sleep anyway, so I looked carefully for half the night, and finally I could make out the words between the lines. The whole book was filled with the two words "leek"!

CT is not a hospital device, but the abbreviation of Crypto Twitter. To be honest, although I am a KOL, I have always paid more attention to protocols than hot topics, and more attention to data than gossip, which resulted in my information flow focusing only on how to do projects, and learning and imitating how others do projects.

I quietly discovered that CT's "mouth-rubbing" has become a major camp in Chinese crypto Twitter. Once again, I am more concerned about the Kaito project itself, which combines the extreme marketing of KOLs with the standardization of the "rubbing" concept.

Kaito has successfully built a communication platform between project owners and KOLs, just like Internet products such as Meituan/Pinduoduo. After StepN, it has once again become a project that can survive after issuing tokens.

Kaito is not a completely original concept product. From the media annual frame to promoting KOL internal circulation, Kaito itself is the epitome of Chinese information flow in the past 10 years.

In the group: 2018-2021

The crypto ETFs, stablecoins, and DeFi that are now popular may make many old miners feel extremely unfamiliar. At that time, the currency circle was very pure, and everyone regarded Bitcoin and mining as the absolute core industries. Although there was nothing, everyone just stubbornly believed that the "big pie" would rise.

Louis XVI has no head, but professional content production, that is, KOL mainly based on UGC, has a clear beginning.

It was generally agreed that it should be designated as the 3 o'clock community in 2018. From then on, WeChat groups and AMAs became the marketing method that lasted for several years, with founders and potential "community members" communicating face to face.

The arrival of Shen Nanpeng was the most direct symbol of the public recognition of this niche public opinion feast, just like Zhu Xiaohu who bought BAYC many years later.

To use the words that people in the cryptocurrency circle are most familiar with, AMA is the way of issuing information assets, the WeChat group is the launch pad, and the 3 o'clock community is the Binance of the time, constituting the absolute memory of the first real bull market of Bitcoin after 2017.

We will not discuss the many controversies surrounding the first generation KOL Yuhong here, as they are actually not important.

However, it must be admitted that although the first generation of KOLs already existed at that time, the “Thousand Media War” still appeared in the form of media. This was mainly due to two reasons. First, people did not particularly recognize the distribution capabilities of KOLs at that time; second, it was at the end of the peak period of entrepreneurship in the self-media industry triggered by WeChat public accounts.

Image description: Three o'clock community Image source: @JinseFinance

In other words, the market is more accepting of the combination of traditional media professionals and media brands. The war among thousands of media is about to break out. Liandede emerged from Titanium Media, Planet Daily came from 36kr, and Babbitt, which was established in 2011, received RMB 100 million in financing in 2017.

Lianwen is the best among them, and it can even be said to be the only one. It just happened to appear in 2017.

2017-2021.5.19, this is the most beautiful era of encryption, no adjectives are needed, I will miss it forever.

Twitterscan at an untimely time: 2022

Then came May 19, 2021, the helpless immigration under a ban. Physically, the boss and the mining machine crossed the ocean together, and spiritually, the crypto group performed a Weibo post. From then on, the information advantage of the Chinese media was completely defeated.

Prior to this, SBF secretly invested in Planet Daily, Vitalik flew to Shanghai in person, and BM of EOS learned to use WeChat. Under this structure, Chinese media is even the first party, sitting on the world's largest computing power market and consumer market, and there is no reason to post content on Twitter.

But after May 19, the situation suddenly became unfavorable. Cryptocurrency has gradually become mainstream overseas. From VC to the final listing of coins, Silicon Valley and Wall Street have gradually controlled every link. Chinese media must learn to lower their posture when dealing with overseas project parties.

A key variable, Lianwen also disappeared with the ban. The best content producers and disseminators disappeared after becoming rich, leaving only confused Chinese encrypted users on Twitter.

Before the advent of the cryptocurrency world, Chinese users on Twitter were actually just some unspeakable Cthulhu-like existence, and the influence of the remaining Chinese media plummeted.

The KOL trend had just started, and technology and investment research-oriented KOLs were the first to get the results. At that time, Do Kwon, SBF, Zhu Su, and CZ were the main content output forces, and in-depth research represented by Pan Zhixiong and Blue Fox Notes was the mainstream.

KOLs who make a career out of KOL are just getting started, but there is no need to rush. Starting from 2022, everything will be very different.

1. FTX went bankrupt, Luna-UST collapsed, and CEX regulation became stricter. The market is at an absolute freezing point. No matter how well the project analysis is written, it cannot be self-consistent.

2. The technology narrative gradually collapsed, and the gap between the super high financing amount and the delivery results became larger and larger, but it only exploded in 2024.

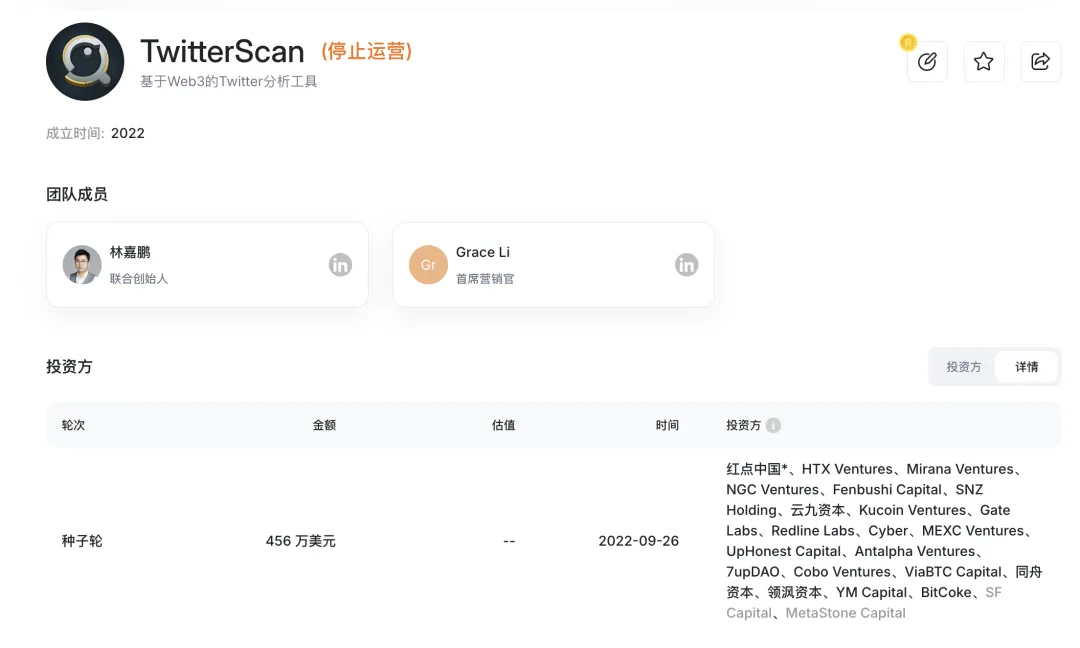

Image caption: Twitterscan Fundraising Image source: @RootDataCrypto

With the two-way collapse of investment research and technology, KOLs who make a living as KOLs have finally had their highlight moment, and its representative is TwitterScan, which completed a financing of US$4.56 million in September 2022. The participation of Yunjiu Capital played a role in public recognition.

The product idea of Twitterscan is not complicated. It helps users discover market trends by organizing encrypted users and encrypted content on Twitter. We have to thank Twitter here because the API was still very cheap at that time.

But Twitterscan has a fatal problem: how to complete the business loop?

Referring to the monetization methods of information flow products such as Nansen and Dune, they can only make profits through paid APIs and segmenting user levels. Obviously, Twitterscan cannot justify itself. It extracts public information from Twitter and cannot convince users to pay a second time.

I think FT has learned some of the lessons from Twitterscan - it has to be commercialized and token economics has to be incorporated.

Friend Tech for Chip Startups: 2023

Friend.Tech in 2023 is not far away from us, and it is also the first stress test of KOL’s monetization ability, and Yap is the second.

The FT team went completely in the opposite direction of the Twitterscan information flow display. FT encouraged KOLs to trade their own "influence" - Key, and even create false influence on each other. This is not surprising, as FOMO sentiment is a conductive factor in trading volume.

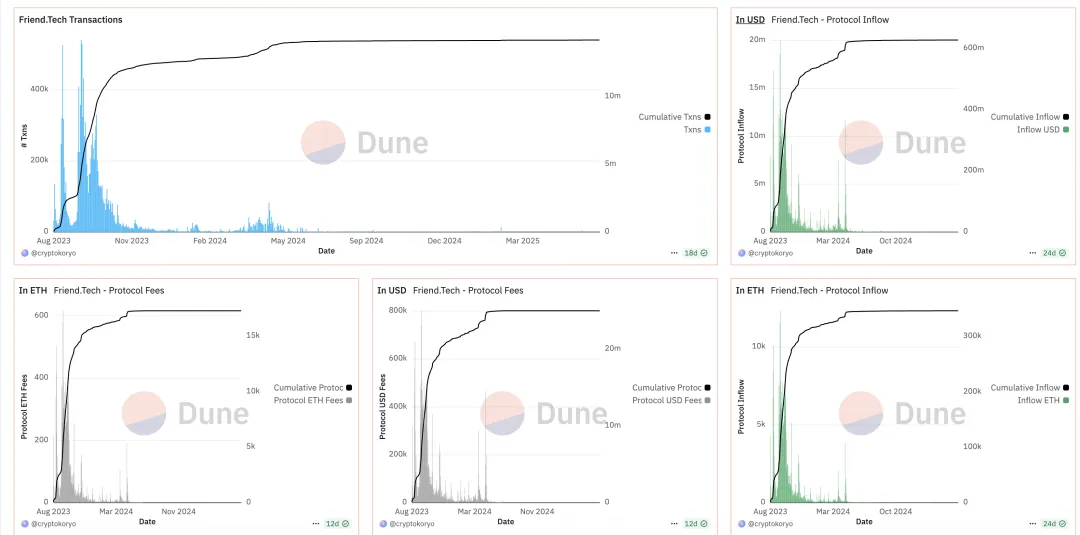

FT is also the first popular application after Coinbase launched Base, and as far as I can remember, the last large-scale application successfully developed by an anonymous developer. According to Dune data, FT has more than 100,000 daily active users.

Although an address cannot be equated with a person, I think this data is relatively authentic. Although Kaito's English push is ranked high, its influence is obviously not as good as FT. The cryptocurrency users around the world can be gathered together to have about 100,000 active users.

Image caption: FT Dune data source: @CryptoKoryo

From August 10 to September 1, FT's daily revenue fell from a peak of 1,165 coins to a mere handful. Although it has since revived several times and even accepted investment from Paradigm, its plans to issue coins in 2024 are nothing more than clichéd plots similar to PumpFun, Blur, and OpenSea.

Did PumpFun learn this from FT?!

FT helps us prove:

1. Content is not valuable. As a transaction subject, content can only serve as an intermediary between information flow and capital flow, and cannot directly bear the impact of transactions;

2. SocialFi has failed again and again: Bodhi, Nostr, Farcaster, the only model that can be emulated in the cryptocurrency world is "asset issuance".

Well, Twitterscan shows that there is no future in information flow, and FT tells us that capital flow can last for two to three weeks, but they have discovered more information together:

1. Encrypted Twitter information is very valuable, but it should be handled in a proper way. It is best to separate the information flow from the capital flow.

2. Turning to KOL for subsequent entrepreneurship is an inevitable path. KOL is in the middle ground between exchanges, project parties and retail investors.

Kaito: 2024-2025

There is a misunderstanding that Kaito had nothing to do with the KOL business in the beginning.

Kaito is a direct product of ChatGPT's world-shaking cryptocurrency FOMO AI. GPT came out in February 2023, and Gen AI has shown signs of being able to do everything. After experiencing internal injuries (SBF!) in 2022 and the mess in the Metaverse, Crypto is eager to be empowered by AI.

Kaito's earliest business model was AI search, but it was more focused on cryptocurrency content. Similar products include Adot and others, but Kaito seemed to realize that something was wrong.

1. Traditional blockchain browser tools have high R&D costs, poor profitability, and fierce competition;

2. Information analysis tools are not easy to use, especially the ability to discover information. Twitter has not solved the problem.

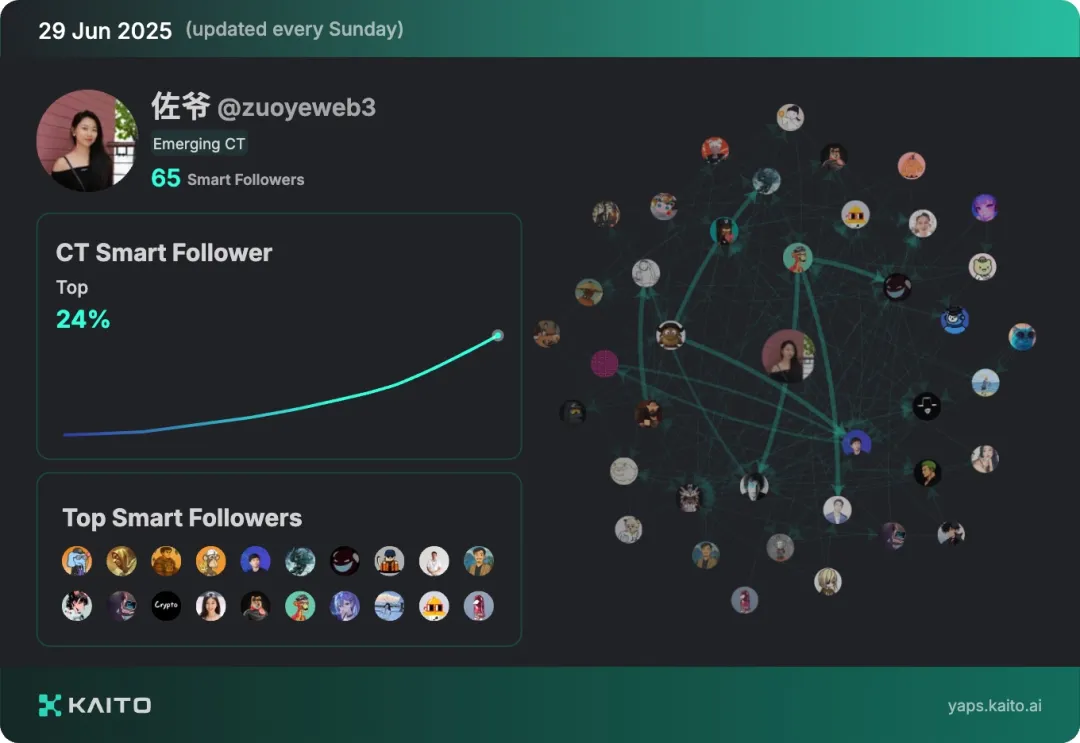

During Kaito’s early development, what impressed me most was the long internal testing period, and it is no exaggeration to say that it was hard to come by a code. It is meaningless to judge when Kaito will turn to KOL ranking, because Yap successfully prompted KOLs to actively roll inward.

Image caption: Let’s Yap together. Image source: @KaitoAI

Kaito relies on product strength rather than time to promote KOL adoption. Before Yap, crypto KOLs have been surrounded by robots and spam for a long time after professionalization and commercialization since 2022. Kaito gave "real KOLs" the opportunity to come forward for the first time.

I dare say that I don’t believe Kaito relies solely on algorithms to complete KOL rankings and score calculations. The manual component may be more effective than AI efforts. After all, there are not many crypto Twitter KOLs. Under the 80/20 rule, statistics of 1,000-10,000 are still within human reach.

Therefore, Kaito completes the following three steps:

1. Separate the information flow and capital flow. KOLs only care about increasing their own rankings. Yap will naturally appear. Machine teams and V followers will be excluded. Project marketing only needs to look at Yap to identify KOLs.

2. Yap is not a token, but more like a fair market list. Everyone will swipe it, but it is mainly KOLs who swipe it. Emotions and enthusiasm are controllable, but KOLs will mobilize the attention of project owners and exchanges, completing the most thrilling leap: information flow leads to capital flow

3. Kaito ended the glory of Agency. Kaito has actual business, which is the basis for it to maintain its business model after issuing coins. Kaito itself is the largest and most standardized Agency in the market.

However! The $LOUD incident proves that it is still difficult for information flow platforms to explore more tokenization attempts besides airdrops, staking, and listing. Curve can continue to split small caps, but information flow platforms are still severely restricted.

As for industries or business lines such as InfoFi, Kaito Connect, and Kaito Pro, they have not created any new frontiers outside of Yap, so we will not introduce them in detail.

In short, Kaito has successfully promoted the internal circulation of KOLs and occupied an indispensable part of the market. Even if Binance comes to grab it, the effect will definitely be good. As I said before, the fair value of the market is difficult to measure. The fact that Binance Feeds has not snatched away Crypto Twitter is proof of this.

Conclusion

What's next for Kaito?

It is very simple. Products that can bridge the information flow and capital flow can directly generate transactions based on the information flow.

It’s complicated. Crypto users do not recognize the value of information flow, and liquidity will only be a path to liquidity.