Text: Lin Wanwan

At midnight on October 23, 2025, Zhao Changpeng, the richest Chinese crypto investor, was announced to have received a presidential pardon from President Trump of the United States.

According to public information, President Trump previously told his advisers that he sympathized with Zhao Changpeng's claim that he was facing "political persecution in the United States."

However, just one year ago, on April 30, 2024, Zhao Changpeng was experiencing the darkest moment of his life: he was stripped naked, subjected to a humiliating body search, his buttocks exposed, and then locked up in a cold cell. His cellmates were muscular men with tattoos all over their faces and patterns carved on their heads[1].

In a Seattle federal courtroom, Zhao Changpeng, wearing prison clothes, pleaded guilty. The man known as the "richest Chinese man" voluntarily paid a $4.3 billion fine and stated in front of the media, "I'm choosing to pay a political fine."

If someone had told him back then that he would not only be pardoned by the US in a year but also be able to set foot in China again, and that the cold stares and beatings in the Seattle jail, along with the $4.3 billion political fine, would all be wiped out, he would probably have cursed inwardly, saying, "What kind of black humor is this?"

The signal regarding Zhao Changpeng's pardon is that he will be released starting September 17, 2025. On that day, CZ suddenly updated his Twitter profile, changing "ex-@binance" back to "@binance." This, to some extent, indicated that his return to Binance was finalized.

At the same time, in October, the two major "compliant trading portals" in the United States gave signals almost at the same time: the cryptocurrency listing platform Coinbase and the mainstream brokerage firm Robinhood regulated by the SEC successively opened BNB trading. This platform currency from the Binance ecosystem founded by Zhao Changpeng obtained an official entrance into the mainstream financial system of the United States for the first time.

White House Press Secretary Karoline Leavitt announced the pardon was effective, while emphasizing: "The Biden administration's war on cryptocurrency has come to an end."

Let's rewind the clock to 180 days before the amnesty. When Zhao Changpeng, the richest man in China and founder of Binance, was just one step away from "political amnesty," what was he doing?

In the spring of 2025, the air of Victoria Harbour was filled with a long-lost bustle, and a group photo quickly went viral.

There are four people standing in the C position in the group photo: Huobi founder Li Lin, Zhao Changpeng CZ, Sun Yuchen, and Kong Jianping.

Group photo: Huobi founder Li Lin (9th from left), Binance founder Zhao Changpeng (10th from left), Kong Jianping (6th from left)

To others, this is just a group photo of several bigwigs in the cryptocurrency circle, but in the eyes of those who know the business, this scene itself is a signal.

Eight years ago, China banned all ICOs and trading platforms, prompting Binance to rush overseas. Zhao Changpeng became the person least likely to return to China. Eight years later, he reappears in this photo. This is his opening statement to reconnect with local capital and institutions.

The host of the gathering, Li Lin, was the founder of Huobi, once one of the world's top three trading platforms. Three years ago, he sold the company he founded to Justin Sun, who was also at the dinner. After the dinner, the person who interacted most with CZ was Kong Jianping, who was standing next to them.

Kong Jianping was once the co-chairman of the board of directors of Canaan Inc., a well-known mining machine manufacturer. In 2020, he founded Nano Labs and served as its chairman. He is also a director of Hong Kong Cyberport and a member of the Hong Kong "Task Force for Promoting Web3 Development". He was even appointed by the Secretary for Financial Services and the Treasury of the Hong Kong Special Administrative Region Government to serve as a member of the tribunal [2].

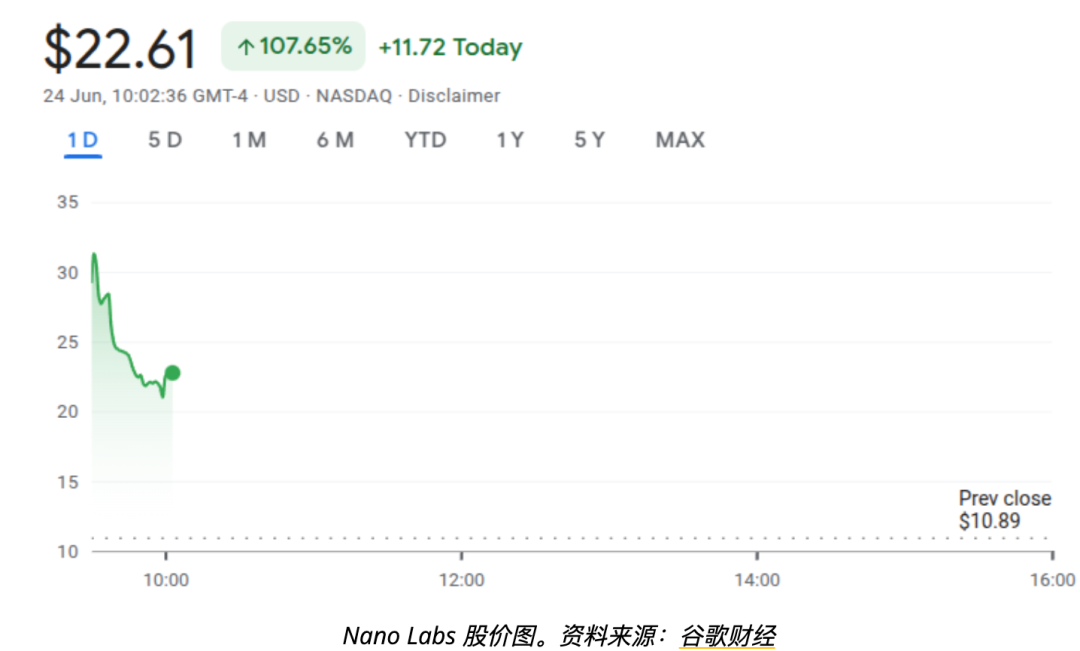

Two months after the party, Kong Jianping announced that he would create a $1 billion BNB treasury, with the goal of hoarding 5%-10% of the circulating supply and packaging Binance's platform coin BNB into a "US-listed company."

CZ's personal retweet immediately ignited market sentiment, sending the stock soaring, with intraday gains reaching over 107%. Changpeng Zhao emphasized that he and his associated entities "did not participate in this round of financing," but they "remain very supportive."

Since then, Kong Jianping can be seen behind most of Zhao Changpeng's public speaking activities in Hong Kong.

Four months later, when Changpeng Zhao returned to Hong Kong for his second time, he was no longer just a "mystery guest" at a Binance event. Instead, he arrived with a clear agenda: First, he officially announced his partnership with Huaxing Capital before the event; second, he finalized his partnership with OSL afterward. These two coordinated efforts signaled that his path to landing in Hong Kong was becoming increasingly clear.

The story of Huaxing Capital shares many similarities with Binance: a mixture of glitz and glitz. Its founder, Bao Fan, was once a prominent figure in investment banking, having brokered historic mergers like Didi and Kuaidi, and Meituan and Dianping, and even invested in Circle, the largest publicly listed stablecoin company.

But in February 2023, Bao Fan suddenly disappeared, and Huaxing became a sensitive name in the capital market. Its investment banking business remained operational, but with its founder in custody, it remained in a state of flux: traditional finance hesitated to fully trust it, while emerging internet capital markets viewed it as doomed.

At the end of August 2025, Binance officially announced its cooperation with Huaxing Capital.

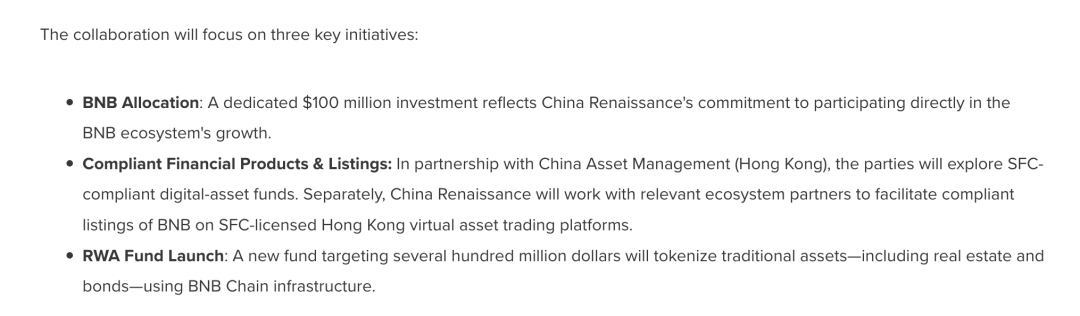

Before Huaxing Capital's partnership with BNB was finalized, a subtle coincidence occurred. On August 8, 2025, Caixin reported that Huaxing founder Bao Fan had been released, concluding a two-and-a-half-year disappearance investigation. Just three weeks later, Huaxing announced a $100 million investment in BNB and the launch of a compliant fund in partnership with Changpeng Zhao's family foundation, YZi Labs. Bao Fan's wife, Xu Yanqing, who is also the current chairperson of Huaxing's board of directors, was a guest speaker at the BNB ecosystem's fifth anniversary event.

In addition, Zhao Changpeng and Huaxing have also implemented a seemingly insignificant initiative: to promote the compliant listing of BNB on a virtual asset trading platform licensed by the Hong Kong Securities and Futures Commission.

Just 12 days later, OSL, Hong Kong's first licensed trading platform, announced online that Binance's platform coin BNB became the fifth cryptocurrency asset approved for trading on a licensed trading platform in Hong Kong.

As one of the first licensed trading platforms in Hong Kong, OSL is backed by its parent company, BC Technology, a licensed fintech group listed on the Hong Kong Stock Exchange. OSL itself holds one of Hong Kong's first virtual asset trading platform licenses, offering both custody and brokerage services, and boasts direct access to local brokerages, ETF custodians, and institutional distributors.

This company's uniqueness within the industry is believed to be related to the financial background of its early management team. Its largest shareholder, holding a 25.43% stake, originally came from a traditional brokerage firm and later ventured into crypto. He is also the founder of the Bitget trading platform, demonstrating his deep integration of regulatory compliance with the capital markets.

Zhao Changpeng's return to China was written between these coincidences and operations, relying on capital and politics to complete the puzzle piece by piece.

In the 180 days before receiving the pardon from the US President, Zhao Changpeng's seemingly loose little actions actually served the same goal: first, to restore the legitimacy of CZ's return to China.

At an event at the University of Hong Kong, Zhao Changpeng said, "When I left mainland China four years ago, I thought I would never return to the core stage of the Chinese-speaking world. But standing in Hong Kong today, I clearly know that my previous wandering was just a prelude, and the real story has just begun."

Some people think that this is just a polite remark, but once they know the story behind it, they will find that this may be a heartfelt statement.

Binance launched in Shanghai in July 2017. Two months later, China banned all ICOs and trading platforms, forcing CZ and his team of over 30 people to evacuate. Over six weeks, they migrated data from Alibaba Cloud to AWS and secured visas for engineers who had never been abroad. Like a makeshift expedition, they arrived in Tokyo.

At the time, Japan seemed like an ideal safe haven, with the government having legalized virtual currencies. So Binance rented an office, packed with about ten people, and declared it its "global headquarters."

The 2017 bull market surged, sending Bitcoin soaring from $3,000 to $19,000. Binance climbed to the top of the global trading volume in just five months. During that time, they worked almost non-stop, with registrations skyrocketing to the point where they were forced to shut down account openings.

But the tide quickly turned. In early 2018, scammers used fake Google ads to steal investors' Binance accounts and funds. Japan's Financial Services Agency suddenly tightened regulations, issuing a direct warning in March regarding Binance's unlicensed operations in Japan. The regulatory cold shoulder was more terrifying than the hackers themselves, and CZ once again packed his bags and left Tokyo.

After retreating from Tokyo, CZ placed his bets on Malta in the Mediterranean. In 2018, Prime Minister Muscat coined the slogan "Blockchain Island." Zhao Changpeng then partnered with the local government and announced that Binance's global headquarters would be located there. Within three months, the team had expanded to employees from 39 countries. However, two years later, the Malta Financial Authority issued a cold statement: Binance had never been registered.

This back and forth, with Japan's indifference and Malta's regret, forced CZ to simply announce: Binance will no longer look for a headquarters.

In September 2021, this "headquarterless model" began to play a special role in regulation. In 2021, a trading platform rival sued Binance in the United States, and a class action lawsuit brought Binance, CoinMarketCap, and Changpeng Zhao to court.

Here comes the myth: a subpoena could find the company, but the lack of a headquarters meant they couldn't find an address. Ultimately, they had to go after the founder. So the plaintiff's lawyers hired a private investigator, a retired Marine, to track down CZ. The investigation spanned Asia, Europe, and the Middle East, scouring flight data, business registrations, and social media. Months passed, but nothing came of it.

At the very end, the detective left a sentence in the report: "We have made great efforts to track down Zhao Changpeng, but Zhao Changpeng's whereabouts are almost impossible to find."

The lawyer even suggested serving the subpoena directly through Twitter, as CZ was posting on it daily. Of course, this was rejected by the judge.

Wandering is just a prelude. The headquarters can disappear and the passport can be changed. But soon, Zhao Changpeng will face another more difficult identity test - when Americans point the finger at his Chinese ancestry, what answer can Zhao Changpeng give?

At the table of the world's power game, the first thing to be shown is one's background, followed by one's passport. As for ability, it is often just the last topic of conversation.

From being imprisoned in a US prison to being pardoned by the US President, Zhao Changpeng's efforts in so-called "compliance" have always been "more than just" compliance.

At the end of 2022, FTX, the second-largest US exchange, collapsed, leaving a massive funding gap due to losses. Seven months later, the US SEC began suing Binance's CZ for illegal operations, issuing a whopping $4.3 billion fine by the end of the year.

Outside the courtroom, the power play in Washington never ceases. The Democratic-led regulatory storm has made CZ a perfect target: a Chinese entrepreneur who controls half of the crypto world, yet is suspected of violating anti-money laundering laws and sanctions regulations. The prosecutor's indictment accuses Binance of "facilitating illegal activities," and CZ's background—born in China and having spent his early years in Shanghai—provides the cheapest and most effective entry point for attack.

On November 24, 2023, a trending post on Reddit, a social media platform, dominated the crypto search engine. The thread discussed whether Binance could truly afford the $4.3 billion fine, comparing it to FTX's $6.8 billion deficit. Many American netizens even suggested that the government was "squeezing" Binance to fill the gap in the US crypto industry.

But money can only solve the accounting problems, and questions about one's origin always follow.

At a hearing, US Congresswoman Stacey Plaskett bluntly stated: “Although he is a Canadian citizen, he is Chinese.”[3]

Congresswoman Stacey Plaskett (Photo source: Federal Newswire Report)

In the Forbes article, Zhao Changpeng said: "My Chinese identity is being brought up again, as if it is very important." Zhao has been a target of discrimination in the past because of his Chinese ancestry, especially when some people tried to link him to relevant governments in Asia.

In the spring of 2024, Zhao Changpeng paid a $4.3 billion fine and, donning prison garb, was sentenced to death in a Seattle prison. This period of imprisonment, which he described as "the most difficult time of my life," did not fully lead to a political reset.

The real turning point was the return of Republican Trump to the White House, which gave the crypto industry an "amnesty."

The 4.3 billion yuan fine Zhao Changpeng paid to the Democratic Party became a sunk cost of political sacrifice. He had to start betting again.

In March 2025, Binance announced a $2 billion investment from Abu Dhabi's sovereign wealth fund, MGX. Details of the investment, governance rights, and intended use of the funds were not disclosed, but the settlement method was truly striking. It wasn't US dollar cash, but rather the USD1 stablecoin—backed by World Liberty, a company closely tied to the Trump family.

Soon after, Zhao Changpeng posted a photo on social media with Zach Witkoff, co-founder of USD1 and a Trump ally. His father, Steve Witkoff, currently serves as the Trump administration's special envoy for the Middle East.

This gave a financial investment more political significance, with the entry of Middle Eastern capital, the Trump family's stablecoin coming on stage, and CZ gaining a new layer of protection.

Just two weeks later, the Trump family's stablecoin USD1 was officially launched on the Binance ecosystem BNB Chain.

USD1's slogan is simple: "America's Digital Dollar." And CZ's first move was to integrate it into his core ecosystem. BNB Chain is already a bustling marketplace, offering everything from lending and borrowing to decentralized exchanges (DEXs) and memes. As soon as USD1 was listed, lending pools launched, cross-chain tools were integrated, and the Trump Family Foundation even boosted the meme tokens of Binance's Four.meme project.

In fact, nearly 90% of the total issuance of USD1 stablecoin is circulating on the BNB chain.

Ostensibly, this was a product collaboration; in reality, everyone envied this hard-to-get political patronage. Even so, Zhao Changpeng formally applied for a presidential pardon from Trump in April of this year, and it took a full five months before he received the official document stating that his pardon had been approved.

Bob Dylan once sang in his famous song "Blowin' in the wind":

How many roads must a man walkdown

How many roads does a person have to walk?

Before you can call him a man

Only then can you be called a real man.

For Binance, the question is equally daunting: “How many roads must be traveled and how many hurdles must be overcome before we can truly stand on the stage of compliance?”

For Changpeng Zhao, this was a personal calamity; for Chinese entrepreneurs, it was a collective problem. The nationality page on a passport can be changed, but in political narratives, Chinese identity has become an indelible label in the game.

This labeling creates structural fragility. While business competition operates within a legal framework, war is different. Opponents rarely consider any rules or restrictions and will resort to any means necessary to achieve their strategic goals.

Changpeng Zhao once said, "If there's an audience, I might be willing to privately mentor a few emerging entrepreneurs. If nothing else, I can at least tell them what not to do."

After all, for Chinese entrepreneurs, "compliance" is not just compliance, it often also means a higher threshold of "identity redemption."

On the surface, this is the institutional friction behind commercial competition, but more deeply, it's a projection of identity politics in the global market. Even when facing regulation, a German, Japanese, or Korean entrepreneur rarely has their "nationality" exaggerated. But when the subject is Chinese, identity naturally takes on geopolitical overtones, as if every expansion of a business implies the will of the nation.

Shein's CEO, Xu Yangtian, obtained a Singaporean passport, but was unable to successfully list Shein; TikTok replaced its CEO with Singaporean Chow Shou-chi, but was unable to stop Congress's continued questioning of its "Chinese identity"; Temu moved its headquarters to Ireland, but was unable to move away from Washington's accusations of "forced labor."

Because of this, there's always a disconnect between the "passport" and "identity" of Chinese entrepreneurs. Passports can be changed over and over again: Canada, Singapore, Grenada... But "identity" is a deeper stigma, etched on the face and etched into the experience, difficult to erase. This invariably forces these entrepreneurs to pay an extra price on the road to cross-border expansion: more explanations, more scrutiny, and even more compromises.

Some say this is inevitable as globalization reaches its peak: capital can flow freely, but personal identities cannot easily transcend political barriers. The successes and difficulties faced by Chinese entrepreneurs epitomize this contradiction.

On the one hand, they have demonstrated the hard work of the Chinese community; on the other hand, they are constantly reminded that no matter how big the market or how much capital they have, they are always in a position where they need to prove that they are harmless.

This may be the common pain of Zhao Changpeng and others: they can change the company structure and embrace different markets, but they must learn to seek shelter in different power structures in the United States, Europe, and the Middle East; they must accept that passports can become tools and identity is another fate that is difficult to escape.

Zhao Changpeng tweeted immediately after receiving the pardon: Thank you President Trump for the pardon, and I will do everything I can to help the United States become the capital of cryptocurrency.

Perhaps for Chinese entrepreneurs, this game about "identity" is far from over.

- END -

References:

[1] Binance CZ talks about his prison experience for the first time: the body search was embarrassing, his roommate turned out to be a double murderer, an in-depth interview with Farokh Sarmad and CZ

[2]. Hong Kong SAR Government Gazette

[3].Plaskett uses “anti-Asian discrimination” against Canadian crypto CEO in congressional hearing, Federal Newswire Report