Highlights of this issue

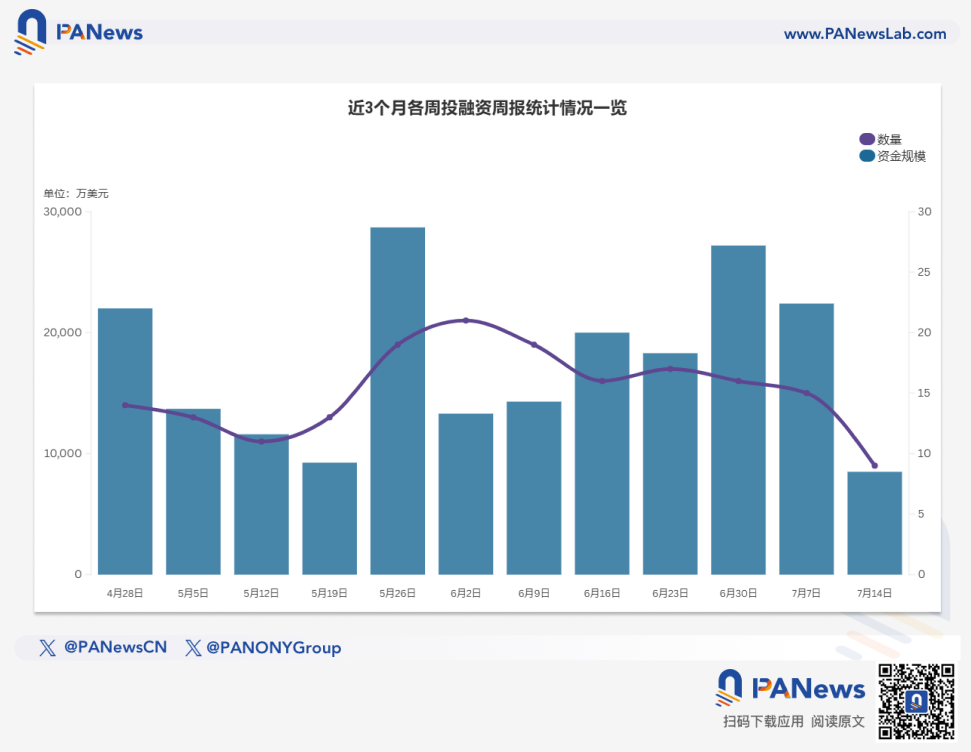

According to incomplete statistics from PANews, there were 9 investment and financing events in the global blockchain last week (July 7-13); the total scale of funds exceeded US$85 million; in addition, the total amount of financing for listed companies' crypto asset reserves exceeded US$874 million. The overview is as follows:

- DeFi announced one investment and financing event. The hybrid decentralized exchange Kuru Labs completed a $11.5 million Series A financing, led by Paradigm.

- The Web3 game track announced one investment and financing event. The game development platform Remix completed a $5 million seed round of financing, with Coinbase Ventures and others participating in the investment;

- The Web3+AI track announced two investment and financing events. Among them, Velvet Capital, a DeFAI trading and asset management platform, announced the completion of a $3.7 million financing, with YZi Labs participating in the investment;

- The Infrastructure & Tools sector announced four investment and financing events, among which the stablecoin startup Agora received a $50 million Series A financing led by Paradigm;

- The centralized finance sector announced one investment and financing event. NEXBRIDGE completed an $8 million Series A financing led by Fulgur Ventures.

DeFi

Kuru Labs announced the completion of a $11.5 million Series A financing led by Paradigm, and is committed to building a new decentralized exchange that integrates the automated market maker (AMM) and centralized order book (CLOB) architecture on the Monad blockchain. Kuru adopts a default AMM strategy to provide basic liquidity for each order book, aiming to improve the flexibility and depth of on-chain transactions. The project has previously completed a $2.2 million seed round of financing . Investors also include 0xDesigner, Zagabond and other angel investors.

Web3 Games

Game development platform Remix has completed a $5 million seed round of financing, led by Archetype, with participation from Variant, Coinbase Ventures, Lemniscap and Zynga co-founder Justin Waldron, with a total financing amount of $6.75 million. The platform combines AI code generation with hyper-casual games, and currently 570,000 players have experienced 800 games on the platform. Remix, formerly known as Farcade, is characterized by allowing creators to quickly generate games through text prompts and to "mix and match" existing games. The platform plans to make profits through in-game advertising and props commissions, and will soon launch on-chain monetization tools. Currently supports Telegram (based on the TON network) and World App, and will be launched on the new version of Coinbase wallet in the future.

Solana Blockchain Strategy Game Honeyland Acquired by BRAVO READY

Honeyland, the Solana blockchain strategy game launched by Hexagon Studios, announced that it has been acquired by game infrastructure developer BRAVO READY. The specific acquisition amount has not been disclosed. Honeyland previously raised $4 million at a valuation of $20 million. After the acquisition transaction is completed, Honeyland will be included in BRAVO READY's real-time revenue-generating product portfolio.

( Not included in this issue's financing weekly report statistics )

AI

DeFAI trading and asset management platform Velvet Capital completes $3.7 million financing

Velvet Capital, a DeFAI trading and asset management platform, announced the completion of a $3.7 million financing round, with participation from YZi Labs, Blockchain Founders Fund, FunFair Ventures, Selini Capital, Mucker Capital, PAKA, LucidBlue and others. Its new system integrates AI multi-agent operating system, trading terminal, asset management suite and API, aiming to bring seamless on-chain asset management and trading experience to funds, DAOs and individual traders. VELVET tokens can unlock multiple rights and interests such as platform governance, profit dividends, and fee discounts through staking.

AI-driven crypto trading platform OlaXBT completes $3.38 million seed round led by Amber Group

AI-driven crypto trading platform OlaXBT announced the completion of a $3.38 million seed round of financing, led by Amber Group, with participation from DWF Ventures, Mindfulness Capital, Web3Labs club, Credit Scend, etc. According to reports, OlaXBT uses proprietary MCP (Model Context Protocol) technology and reinforcement learning to achieve automated market making, sentiment analysis, and trade execution. It is built on the BNB Smart Chain and includes a market consisting of interoperable MCP servers and chat-to-earn trading terminals.

Infrastructure & Tools

Stablecoin startup Agora receives $50 million in Series A funding led by Paradigm

Agora, a stablecoin startup, announced that it has received $50 million in Series A funding led by blockchain venture capital giant Paradigm. Agora was co-founded by Nick van Eck, Drake Evans and Joe McGrady. It focuses on the AUSD stablecoin and helps other companies issue their own stablecoins through white label services. Agora's current AUSD market value is $130 million, far lower than industry giants such as Tether and Circle, but the company said it will continue to focus on overseas markets to meet the demand for stablecoins caused by cross-border payments and local currency fluctuations. In addition, Agora's model also shares the income of US dollar assets with partners, aiming to encourage more financial institutions to participate in this field.

Crypto OTC settlement platform BridgePort completes $3.2 million seed round

Cryptocurrency OTC settlement platform BridgePort has completed a $3.2 million seed round of financing, led by Further Ventures, with participation from Virtu, XBTO, Blockchain Founders Fund, Fun Fair Ventures, and Humla Ventures. The company plans to enhance its collateral and credit capabilities in subsequent updates. The company provides a middleware solution that connects exchanges, custodians, and trading firms. The solution aims to optimize capital allocation and post-trading processes through real-time messaging and collateral management, while addressing issues such as pre-funding requirements, credit risk, and settlement inefficiencies.

Memecore Receives Strategic Investment from Klein Labs

Memecore, a Layer1 public chain focusing on Meme culture, officially announced that it has received strategic investment from Klein Labs, a compliance-driven liquidity strategy agency. It is reported that Memecore's native token $M has recently been launched on the Binance Alpha market, and core ecological projects such as MemeX have been launched. Since its launch, $M has risen by more than 1000% in a short period of time. Klein Labs said that this investment is aimed at supporting Memecore's long-term development in infrastructure and ecological construction.

YZi Labs announces investment in blockchain infrastructure platform Aspecta

YZi Labs announced a strategic investment in Aspecta, a blockchain infrastructure platform. Aspecta is committed to providing intelligent authentication, price discovery, and lifecycle liquidity for illiquid assets such as pre-TGE stocks, locked tokens, private equity, RWA, etc. This financing will help Aspecta expand its network scale, strengthen collaboration with major partners, and promote the global application of its "Alpha Assets" open economic framework.

other

Crypto asset reserves: ( not included in this period's financing weekly statistics )

Sequans Completes $384 Million Strategic Investment and Launches Bitcoin Reserve Program

Sequans Communications, a French 5G/4G IoT semiconductor company, announced the successful completion of a total of $384 million in debt and equity private placement financing, and will use all net proceeds to purchase Bitcoin, officially launching a Bitcoin reserve strategy. This move reflects Sequans' firm confidence in Bitcoin as a high-quality asset and long-term investment value. The company plans to continue to purchase Bitcoin through surplus cash and new funds generated by its main business in the future, and cooperate with the Swan Bitcoin platform to ensure security, governance standards and market transparency.

Remixpoint raises 31.5 billion yen to buy Bitcoin, plans to increase holdings to 3,000 Bitcoins

Japanese listed company Remixpoint announced that it has raised about 31.5 billion yen (about 215 million U.S. dollars) through financing, and plans to use all the funds to buy Bitcoin. The company currently holds 1,051 BTC, and the near-term goal is to increase its holdings to 3,000. The company said that this move is based on its firm belief in the future of Bitcoin and the results of long-term internal discussions.

NASDAQ-listed Upexi announces that it has entered into a securities purchase agreement with certain accredited investors, qualified purchasers and institutional investors and Allan Marshall, the Company’s Chief Executive Officer, to purchase and sell 12,457,186 shares of its common stock (or common stock equivalents in lieu thereof) at a price of $4.00 per share (with management participation at a price of $4.94 per share) for gross proceeds of approximately $50.0 million (the “Equity Offering”).

Concurrently with the Equity Offering, additional securities purchase agreements have been entered into with certain institutional investors and qualified purchasers to purchase Convertible Notes, in the form of locked and spot SOLs, for a total original principal amount of approximately $150 million (the "Note Offering"). The Convertible Notes are collateralized by SOLs provided by their respective holders. The Convertible Notes bear interest at 2.0%, payable quarterly, with a fixed conversion price of $4.25 per share and a term of 24 months. Big Brain Holdings is the lead investor.

The note issuance is expected to be completed on or about July 16, 2025, subject to customary closing conditions. The SOL (Solana) underlying the note issuance will become part of the company's Solana asset pool upon completion of the transaction. It is expected that approximately 1.65 million SOL will be held after the bond issuance, more than double the previously disclosed balance of 735,692 SOL. The net proceeds from the stock issuance will be used to acquire more SOL in the coming weeks.

The Swedish H100 Group has raised an additional 516 million Swedish kronor (approximately 54 million U.S. dollars) through the sixth and seventh rounds of financing (previously announced on June 16, 2025), which will be used to advance investment opportunities within the framework of the Bitcoin Reserve strategy. So far, the group's total cumulative financing has reached 921 million Swedish kronor (96 million U.S. dollars), a significant increase from the previous 405 million Swedish kronor (42 million U.S. dollars).

The listed company Hilbert Group announced that it has obtained over 200 million Swedish kronor (about 21 million US dollars) in long-term financing from its US institutional partners. Part of the funds will be used to support its crypto asset library strategy, focusing on promoting the application of Bitcoin in the European corporate market. The company plans to launch a transparency dashboard to display the holdings of the crypto asset library in real time. CEO Barnali Biswal said that this financing reflects the market's recognition of Hilbert as a European listed digital asset company.

Centralized Finance

NEXBRIDGE Completes $8 Million Series A Funding, Led by Fulgur Ventures

NEXBRIDGE and its trading platform NEXPLACE have completed an $8 million Series A financing led by Fulgur Ventures, aiming to expand the compliant digital asset issuance and trading ecosystem based on the Bitcoin Liquid Network. NEXBRIDGE has previously launched the first compliant digital asset backed by US debt, USTBL. This round of financing will accelerate the launch of more assets and their distribution across licensed platforms. The two platforms will be fully integrated in the second half of 2025, and the regulatory compliance and asset transparency structure will be strengthened.

Venture Capital

Ego Death Capital Completes $100 Million Fund to Invest in Bitcoin Companies

Ego Death Capital has completed its second fund of $100 million, focusing on promoting the development of software companies based on the Bitcoin protocol. The fund mainly invests in companies with annual revenue between $1 million and $3 million that are hindered by funding constraints and focus on supporting Series A financing. It has invested in Bitcoin-related companies such as Roxom, Relai and Breez. Ego Death Capital said it is committed to investing in Bitcoin companies that truly solve real-world problems, rather than in the areas of cryptocurrency tokens or hardware and mining.