Highlights of this issue

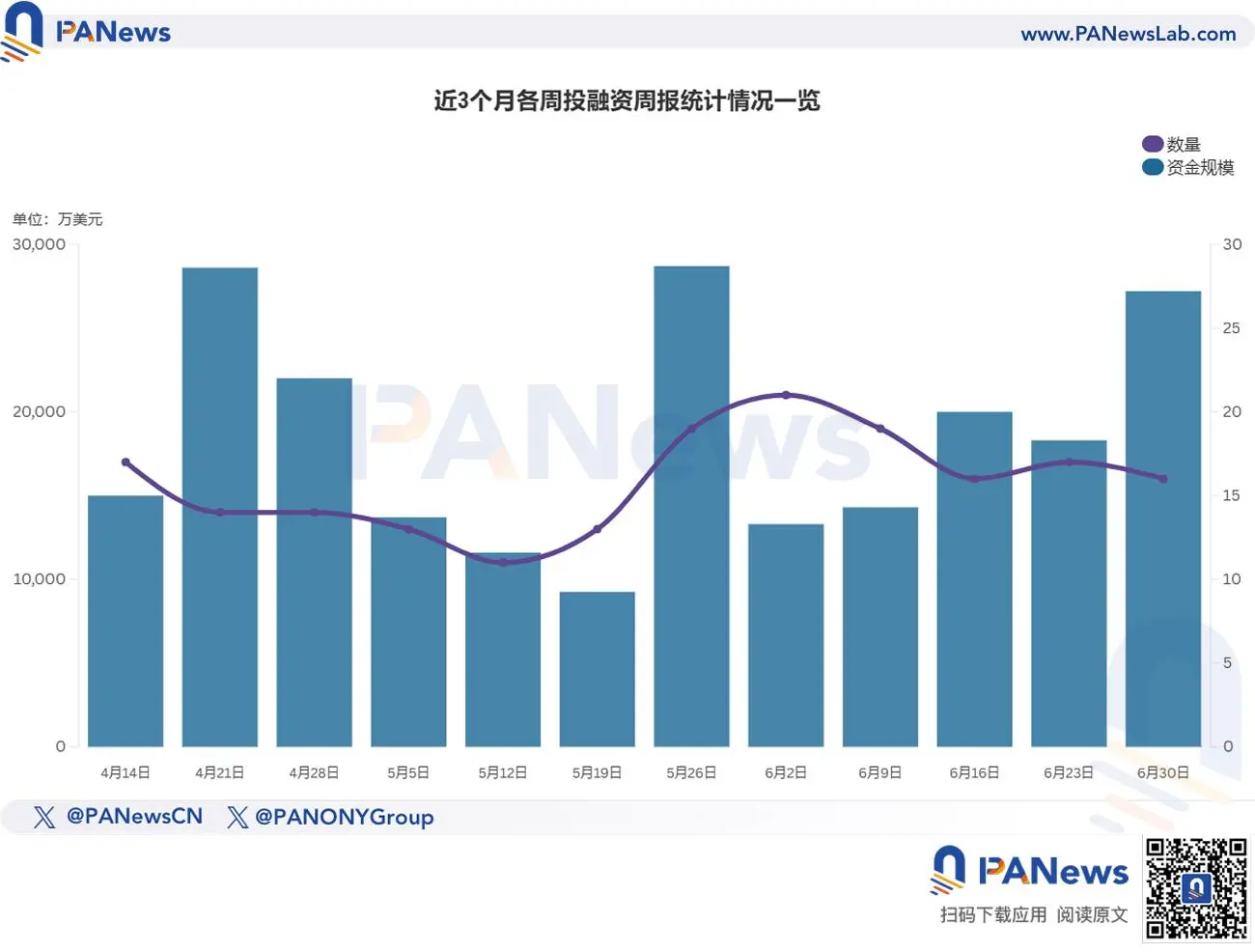

According to incomplete statistics from PANews, there were 16 investment and financing events in the global blockchain last week (June 23-June 29); the total scale of funds exceeded US$272 million; in addition, the total amount of financing for listed companies' crypto asset reserves exceeded US$1.25 billion. The overview is as follows:

- DeFi announced 8 investment and financing events, among which DeFi infrastructure company Veda completed $18 million in financing, led by CoinFund;

- The Web3 game track announced two investment and financing events, among which game developer Spekter Games Inc. completed a $5 million pre-seed financing, a16z speedrun;

- DePIN track announced 1 investment and financing event. DePIN and enterprise-level cloud platform dKloud have completed US$3.15 million in financing to date, Animoca Brands;

- The Infrastructure & Tools sector announced eight investment and financing events, among which Digital Asset, the developer of the privacy blockchain Canton Network, completed a strategic financing of US$135 million, led by DRW Venture Capital and Tradeweb Markets.

- In terms of other applications, one investment and financing event was announced. YZi Labs announced that it invested in the decentralized entertainment platform MEET48 through the BNB Chain MVB Accelerator.

- The centralized financial sector announced one investment and financing event. Bitcoin financial platform Castle completed a $1 million Pre-Seed round of financing, led by Boost VC

DeFi

DeFi infrastructure company Veda completes $18 million financing, led by CoinFund

DeFi infrastructure company Veda has completed a $18 million financing led by CoinFund, with participation from Coinbase Ventures, Animoca Ventures, GSR, Mantle EcoFund, BitGo and Draper Dragon. Veda provides a modular vault framework that supports developers to build simplified DeFi yield products. It has processed over 100,000 user deposits and managed over $3.7 billion in assets. Its collaborative projects include ether.fi, Plasma and Berachain.

MegaETH-based DEX GTE completes $15 million Series A financing, led by Paradigm

Well-known crypto venture capital firm Paradigm exclusively led the $15 million Series A financing of decentralized exchange startup GTE. GTE calls itself "the world's fastest decentralized exchange", and its founding team said that the platform uses a centralized limit order book (CLOB) mechanism, and the transaction delay is on par with centralized exchanges such as Binance and Coinbase, while maintaining decentralized characteristics. GTE aims to solve the problems of "blind trust" in centralized exchanges and high latency and high cost of traditional DEX. The platform has been built on the EVM-compatible MegaETH blockchain, and the test network has attracted about 700,000 users. Previously, GTE has received a total of $10 million in investment through three rounds of financing .

YZi Labs participates in Blueprint Finance’s $9.5 million funding round

YZi Labs announced that it has made a strategic investment in Blueprint Finance, a multi-chain DeFi infrastructure company, to help it expand its ecosystem and accelerate institutional-level DeFi innovation. As the core development team of Concrete on Ethereum and Glow Finance on Solana, Blueprint Finance currently has a total locked value (TVL) of more than $650 million.

According to Fortune, New York crypto startup Blueprint Finance announced the completion of a $9.5 million financing round led by Polychain Capital, with participation from YZi Labs (formerly Binance Labs) and VanEck. Founded in 2023 by Nic Roberts-Huntley and Dillon Liang, Blueprint Finance is committed to simplifying the process for cryptocurrency holders to participate in DeFi (decentralized finance) lending. The company has currently launched two products, Concrete and Glow, covering the Ethereum and Solana ecosystems respectively, to help investors borrow and manage digital assets more conveniently. The new funds will be used for team expansion, technology research and development, and market promotion.

DeFi Infrastructure Company Yield.xyz Raises $5 Million in Strategic Funding from Multicoin Capital

DeFi infrastructure company Yield.xyz has received $5 million in strategic financing from Multicoin Capital. The company was formerly known as Omni, a multi-chain wallet established in 2021. After being acquired by Paxful's parent company Echo Base this year, it transformed into a yield aggregation platform. Yield.xyz integrates more than 200 Solana ecosystem revenue sources through a unified API, providing plug-and-play DeFi revenue functions for wallets and crypto applications such as Ledger. In the future, it plans to expand to traditional fintech companies such as new banks and develop automated revenue strategy functions.

Private Equity Tokenization Platform Jarsy Completes $5 Million Pre-Seed Round of Financing

Jarsy, a private equity tokenization platform, has officially launched and completed a $5 million Pre-Seed round of financing led by Breyer Capital, with participation from Karman Ventures and several angel investors. The platform will use the financing funds to develop new products and strengthen compliance. The platform provides retail investors with the opportunity to invest in quasi-listed companies such as Stripe and Anthropic by issuing tokens anchored 1:1 to private company equity, with a minimum investment threshold of $10.

Institutional-level DeFi execution engine Makina completes $3 million strategic round of financing

Institutional-level DeFi execution engine Makina announced the completion of a $3 million strategic round of financing, with participation from Bodhi Ventures, Cyber Fund, Interop Ventures, Steakhouse Financial, Hypernative Labs, Kiln, base DAO, Cozomo de' Medici, Aleksander Larsen, ivangbi and Trevor McFedries. It is reported that Makina Finance is a DeFi execution engine that enables various users such as AI agents and asset managers to deploy institutional-level, risk-adjusted return strategies on the chain.

On-chain commodity derivatives exchange Sphinx completes $2 million pre-seed round of financing

Sphinx, an institutional-level on-chain commodity derivatives exchange, announced the completion of a $2 million Pre-seed round of financing, led by Eckhardt Capital, with participation from Big Brain Holdings, Blockchain Founders Fund, Blizzard, TRIVE Ventures, Cosmos Hub, London Real Ventures, GS Futures, and Andrew Durgee, Stefan Rust, Zachary Keats, etc. According to reports, Sphinx is an institutional-level commodity derivatives exchange based on its own permissioned Layer1 blockchain. It provides 24/7 direct access to futures, options, and perpetual contracts for oil, natural gas, and other energy commodities.

Byzanlink, a developer of RWA (real world asset) tokenization infrastructure in Dubai, has completed a $1 million private placement financing from investors including Outlier Ventures, NTDP Saudi, Smart IT Frame, Sensei Capital, and several individual investors, such as Smart IT Frame CEO Murali Kulala, Salla co-founder Salman Butt, and fintech investor Christopher. The new funds will accelerate product development and deepen cooperation with traditional finance and DeFi. The company is registered in the Dubai Multi Commodities Center (DMCC) and is committed to providing institutional-grade tokenization solutions for traditional assets such as private equity, credit and real estate through blockchain technology.

Web3 Games

Game developer Endless Clouds announced that it has received $6.25 million in financing from Animoca Brands and other institutions

Game developer Endless Clouds announced that it has received $6.25 million in financing from Animoca Brands, IdeoCo Labs and other institutions, and launched a new token END as a high-level pass for its ecosystem. The first project to integrate END is the open world MMORPG "Treeverse", and more games will be included in the future.

Game developer Spekter Games Inc. has completed $5 million in pre-seed financing, with participation from a16z speedrun, London Venture Partners, BRV Capital, Chamaeleon, Accelerator Ventures, Impact46, Versus Ventures, and Alumni Ventures. Its first Web3 game, Spekter Agency, is now live. The financing will enable Spekter Games to expand Spekter Agency's business to more platforms, including other chat-based super apps and traditional mobile app stores such as the App Store and Google Play. In addition, the funds will also support the publisher's ongoing development of its second game.

DePIN

DePIN and the enterprise-level cloud platform dKloud have completed $3.15 million in financing to date, with participation from Animoca Brands, Avalaunch, Blizzard, Brinc, Genesis Block Ventures Capital (GBV), Maven Capital, Pulsar, SMO Capital, Telos, and Baboon VC. According to reports, dKloud is a decentralized cloud infrastructure platform that connects DePIN with enterprise-level information technology (IT). It enables enterprises to deploy applications using cryptocurrencies and fiat currencies without the operational burden of managing multiple systems. The platform also features a marketplace where developers can contribute reusable tools and earn DKT tokens.

Infrastructure & Tools

Digital Asset, the developer of the privacy blockchain Canton Network, announced the completion of a $135 million strategic financing round led by DRW Venture Capital and Tradeweb Markets, with participation from BNP Paribas, Circle Ventures, Citadel Securities, DTCC, Virtu Financial, Paxos and other well-known companies in traditional finance and encryption.

With configurable privacy at its core, Canton Network has attracted many companies including Goldman Sachs and Bank of New York Mellon to test RWAs on its platform. This financing will help Canton Network further expand the coverage of RWAs, which currently includes asset classes such as bonds, money market funds, alternative funds, commodities, repurchase agreements, mortgages, life insurance and annuities.

Zama, a privacy-focused confidential blockchain protocol, announced the completion of a $57 million Series B financing round, with a valuation of over $1 billion, led by Pantera Capital and Blockchange. The protocol will launch a testnet on July 1. Zama provides developers with a cross-chain privacy solution through fully homomorphic encryption (FHE) technology, supporting the deployment of "confidential smart contracts" on existing blockchains. The protocol currently supports 20 transactions per second, and plans to increase it to more than 10,000 transactions per second on a single chain through dedicated hardware accelerators. The project also uses multi-party computing (MPC) and zero-knowledge proof (ZKP) technologies, initially compatible with the Ethereum virtual machine, and will be expanded to the Solana ecosystem in the future.

Cryptographic trust infrastructure Inference Labs completes $6.3 million strategic financing

Crypto trust infrastructure Inference Labs has completed a strategic financing of US$6.3 million, with participation from DACM and Delphi Ventures, and new investors such as Arche Capital and Lvna Capital, including a US$1 million community round led by Native Capital. The financing will be used to optimize circuit design and expand support for multiple proof systems, covering scenarios such as healthcare, finance, and DeFi that require trusted AI decisions. The "Proof of Inference" zero-knowledge proof protocol developed by the company can provide a decentralized verification layer for AI models, ensuring the verifiability of output results while protecting model privacy. The protocol test network has been launched, and the main network is planned to be launched at the end of the third quarter. It has currently reached strategic cooperation with decentralized AI protocols such as EigenLayer and Bittensor.

other

Consumption:

Prediction market Kalshi announced that it has completed $185 million in financing, with a valuation of $2 billion, led by crypto venture capital Paradigm. The platform allows users to predict and bet on future events such as sports events and entertainment scores. Kalshi was founded in 2018 by MIT graduates and participated in the Y Combinator incubation program in 2019. Previous investors include Sequoia Capital and others. As a federally regulated platform in the United States, its competitor Polymarket is prohibited from using it by US users because it is not registered with the CFTC. Recently, both platforms have announced cooperation with social media X, but Kalshi subsequently withdrew the relevant statement.

(This financing is not included in the statistics of this issue's weekly financing report)

YZi Labs announces investment in decentralized entertainment platform MEET48

YZi Labs announced that it has invested in the decentralized entertainment platform MEET48 through the BNB Chain MVB Accelerator, supporting it to increase fan engagement with the $IDOL token mechanism. MEET48 integrates virtual performances, idol management games and offline activities, aiming to reach more than 30 million fans in Asia, and plans to hold a large-scale Web3 idol performance festival in Hong Kong on August 2.

Crypto asset reserves: ( not included in this period's financing weekly statistics )

Anthony Pompliano tweeted that his private company ProCap BTC, LLC will merge with Nasdaq-listed SPAC Columbus Circle Capital Corp I ($CCCM) to form a new company ProCap Financial, valued at $1 billion. Pompliano also announced that it has completed $750 million in financing, becoming the largest first round of financing for a Bitcoin vault listed company in history. ProCap Financial will focus on purchasing Bitcoin and developing profitable financial products based on its holdings.

Nano Labs announces $500 million convertible note private placement for BNB strategic reserve

Nano Labs Ltd (NASDAQ: NA) announced that it has signed a convertible note subscription agreement with multiple investors to issue convertible notes totaling $500 million. The term of this note is 360 days, and the principal does not accrue interest before maturity. The holder can choose to convert the note into the company's Class A common stock within the term, with an initial conversion price of $20 per share. Nano Labs plans to initially acquire $1 billion worth of BNB through this financing and private placement, and aims to hold 5% to 10% of the total circulating supply of BNB for a long time.

Bluebird Mining receives £2 million in zero-interest funding to launch Bitcoin strategy

Bluebird Mining Ventures Ltd., a British public gold mining company, announced that it has signed a strategic financing and governance agreement to obtain a zero-interest loan of 2 million pounds, and the first 1 million pounds will be used to launch the Bitcoin treasury strategy. In addition, the company will appoint Sath Ganesarajah, a veteran in the digital asset field, as non-executive chairman on June 30, 2025, and plans to appoint a new CEO by the end of July 2025 to promote the "physical gold + digital gold" investment strategy.

Centralized Finance

Bitcoin financial platform Castle completes $1 million Pre-Seed round of financing

Bitcoin financial platform Castle has completed a $1 million Pre-Seed round of financing, led by Boost VC, with participation from Winklevoss Capital, Park Rangers Capital, Epoch VC and some angel investors. The financing will be used for product development and market expansion. The platform provides an automated Bitcoin configuration solution for small and medium-sized enterprises, which can automatically convert corporate sales revenue into Bitcoin according to a set ratio. The platform has been integrated with payment tools such as QuickBooks and PayPal, and its customers cover industries such as catering, e-commerce, and real estate.

Venture Capital

Sentinel Global, a venture capital firm headquartered in San Francisco, USA, announced that its first fund has completed fundraising of US$213.5 million. The fund's main investment areas include privacy security, financial Internet, open finance and open social related technologies, blockchain and decentralized networks, etc.

It is reported that Sentinel Global has currently invested in about 10 companies, including encryption chip company Ingonyama, identity issuance protocol Kudo Money, decentralized data and identity protection platform Via Science, etc. The new fund will focus on start-ups in the A to C rounds.

Galaxy Completes First External Fund Raising $175 Million

Crypto giant Galaxy announced the completion of its first venture capital fund raising, with a total of $175 million, exceeding the original $150 million target. This fund is the first time Galaxy has introduced external capital, focusing on investments in areas where traditional finance and blockchain meet, such as stablecoins and decentralized finance. Galaxy has deployed about $50 million in projects such as Monad and Ethena.

New crypto venture capital fund Frachtis closes $20 million

The former Chorus One executive team has established a new crypto venture capital fund, Frachtis, which focuses on the intersection of blockchain and artificial intelligence and has raised $20 million. Frachtis will invest in decentralized infrastructure, middleware and consumer applications, and has currently deployed eight projects including Hyve, Turtle.Club and Bless network. The fund's limited partners include Chorus One, cyber•Fund, RockawayX and Theta Blockchain Ventures.