Editor’s Note:

From the dramatic shift in the Trump administration’s tariff policy to the recession risk hidden in soft U.S. economic data, global markets have been fluctuating driven by liquidity and sentiment. At the same time, Bitcoin seems to be brewing a new high, and the entire market seems to be able to smell the breath of “altcoin season”.

So, what is the current situation of the entire market? Is Bitcoin's dominance rate likely to reach its peak? Is the "altcoin season" really coming? This article will give you a glimpse of the situation from the perspective of data indicators.

We have been watching key support areas for Bitcoin (BTC) with plans to either exit the market (anticipating further declines) or redeploy capital into riskier assets as cash flow permits, in anticipation of a possible “alt season” or market climax later this year.

Next, we discuss how we are managing risk in the context of tariffs and improving market sentiment.

01\Macroeconomics

tariff

We initially thought the Trump administration would take a tough stance on China while negotiating with other countries. This view seemed correct when Trump raised tariffs to 145%. Of course, this actually created unsustainable trade barriers between the world's two largest economies.

Now, we are seeing tariffs on China capped at 30% with a 90-day suspension. The market has reacted enthusiastically to this news. But it is important to understand that the global effective tariff rate is still 17.8%, compared to 2.5% when Trump took office.

Looking ahead

We can’t predict the short-term trajectory of tariffs, and it’s a futile exercise to try. But suffice it to say that traders who bought when Trump said “buy” and sold when he said “sell” likely made a lot of money over the past few months.

Long-term readers know that this is not our investment style. We look forward to returning to long-term thinking. At the same time, in the late stages of the cycle, a short-term view also has its necessity.

From a long-term perspective, we try to focus on the big picture:

The tariff rate will not return to 2.5%.

The tariffs are primarily about rebalancing trade with China (power struggle) while appealing to Trump's populist base (bring manufacturing back to the US). Killing two birds with one stone.

Economic Recession

Ahead of 90-day suspension of tariffs on China, soft data (surveys) suggest rising recession risks:

The ISM manufacturing index fell to 48.7 (business cycle contraction) in April, although the services index rose to 51.7 (expansion).

The University of Michigan's consumer sentiment index was 52.2 in April, well below the long-term average of 85 (71 during the peak of the COVID-19 pandemic).

One-year inflation expectations rose to 6.5% in April (University of Michigan survey).

Challenger reported in March that layoffs hit their highest level since the Great Recession, and they fell back in April, but are still 63% higher than last year.

Data from the Port of Los Angeles showed a 30% drop in cargo volume from China, which is expected to affect retail sales in May/June.

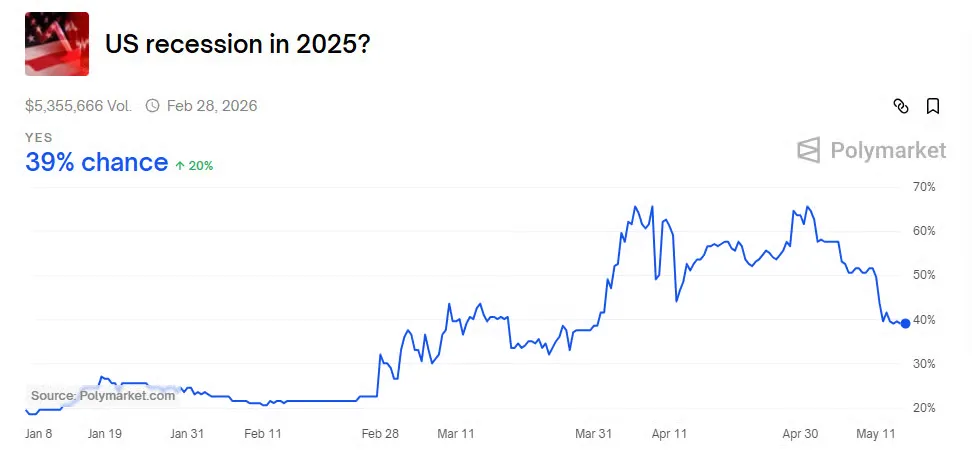

To put things in context, Polymarket put the probability of a recession at 66% on May 1 (now 40%).

Data source: Polymarket

We believe that soft data will eventually be reflected in the hard (real) data - which currently still shows a strong economy.

Now, with a 90-day tariff pause, we believe short-term recession concerns have eased.

The question is how long this “wall of worry” can be climbed before another wave of negative news weighs on expectations.

This could happen tomorrow, no one knows, which makes it more of a trader's market right now.

Nonetheless, it seems likely that there could be a near-term window of increased risk appetite where capital allocators may need to chase the market.

02\Crypto Market

Rising risk appetite is most evident in crypto markets, the asset class most sensitive to liquidity conditions.

The crypto market seems to be sensing the following trends:

U.S. government fiscal spending has not declined and still exceeds 7% of GDP.

Government and corporate debt will face a refinancing wave of $3.5-4 trillion in the third and fourth quarters.

Tax cuts, regulatory relief and adjustments to the supplementary leverage ratio (SLR) (which could increase banking sector leverage/liquidity) are likely later this year.

Inflation is falling (this week's CPI and PPI reports showed a slowdown in inflation), which could give the Fed a green light to cut interest rates.

Overall, liquidity conditions are favorable as the Fed may need to purchase some of the upcoming refunding and new debt issuance.

These factors increase the likelihood of a “coltet season” even if the Fed remains on hold for now.

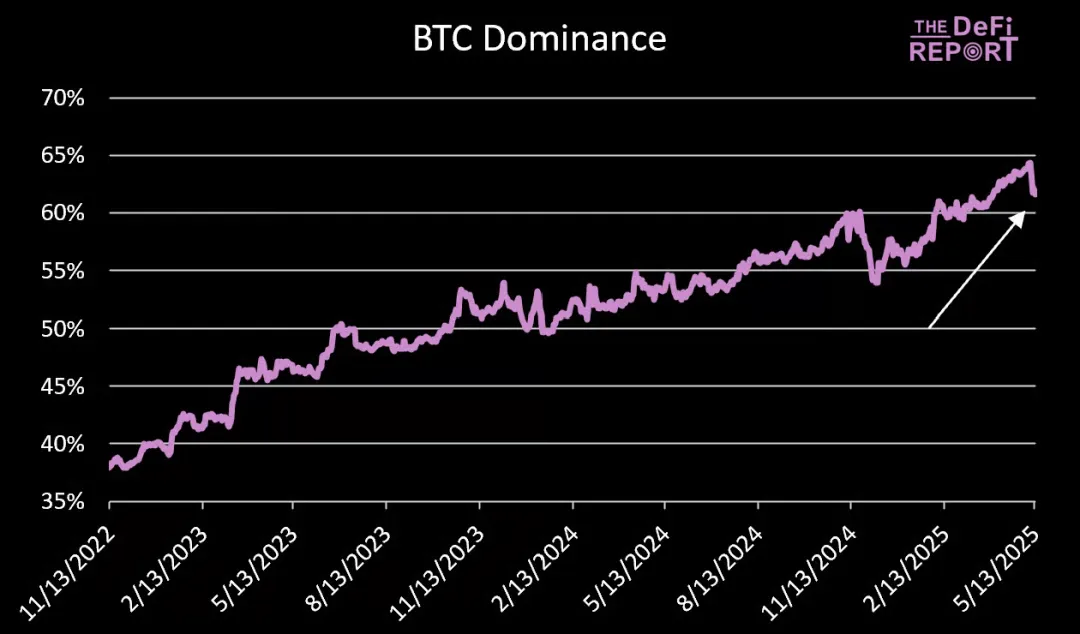

For the first time since Q4 of last year, we observe a sustained rise in altcoins and meme coins. Meanwhile, Bitcoin dominance rate appears to have peaked:

Data source: Glassnode, The DeFi Report

Cottage Season

If we are indeed entering an “ alt season”, the Bitcoin dominance rate in the above chart still has a long way to go. This means that (some) altcoins will outperform.

But how do we identify the “ copycat season”? Here are the key factors:

The last year of the cycle.

Bitcoin dominance was 65-70% at the beginning.

From quantitative tightening (QT) to quantitative easing (QE).

ETH/BTC ratio is rising.

Retail investor interest and the “meme” resurgence.

We are currently early in this process. ETH/BTC is still at 0.024, and ETH/USD is 46% below its all-time high. The Fed is still implementing QT.

Nonetheless, ETH’s 35% gain last week is reminiscent of its 68% gain from January 1 to January 7, 2021 (from $729 to $1,224).

At that time, the ETH/BTC ratio rose from 0.03 to 0.07 four months later, and ETH/USD rose 370%.

This triggered a craze for altcoins, NFTs, “metaverse” tokens, and alternative Layer 1s. There was almost no pullback from January to May 2021. The market then plummeted in mid-July (ETH fell from $4,000 to $1,800) before hitting an all-time high in November.

Some altcoins, like Terra Luna, continued to rise after BTC and ETH peaked until the entire market crashed.

This was the situation in the previous cycle.

So, how do we respond to the current situation?

03\Portfolio Management

We were satisfied with locking in profits on our long-term positions in December/January last year. Since then, we have been monitoring the market for signs that it is either collapsing into a bear market or rebounding to form another climax.

We are currently leaning towards the latter.

But that doesn't mean we're going all out.

As many readers know, our style is to wait for "fat balls" (high certainty opportunities). We do not think the current situation is a "fat ball", but we also think there is upside risk.

Here is our strategy:

We are not interested in BTC at current prices.

Instead, we reallocate small amounts of profits into riskier assets.

Historically, assets that do well in late cycles are early outperformers + emerging/shiny things. Tokens with strong communities/narratives and low float are likely to rise the most.

DeFi projects with strong fundamentals are also likely to perform well, and we also expect the top “blue chip” meme coins to outperform.

04\Risk

Let me be clear, we are not going all in right now. We are just looking to capture some of the upside if the market rebounds strongly.

Risks to consider include:

Bitcoin needs to break out above its all-time highs. If that doesn’t happen, our view may be irrelevant.

Summer is usually a period of volatility/consolidation. Sentiment is a bit extreme right now and further declines similar to last year are possible.

Bond markets. We think long-term yields will eventually rise. Stock markets (and cryptocurrencies) may rise during these periods, but valuations are ultimately determined by DCF calculations, and if that happens, stocks (and cryptocurrencies) will eventually correct.

Stablecoin legislation failed to pass the Senate last week (Democrats are still blocking cryptocurrencies). This is significant, and the crypto market may be underestimating its impact. If this legislation fails to pass, larger crypto bills may also be blocked, becoming a headwind for the asset class.

05\Summary

“ Alt Season” refers to when more than 50% of new inflows into the crypto market go to non-BTC assets. This does not mean that all altcoins will outperform.

Asset selection and timing are critical.

Please understand that in addition to market risk, there are many other risks. Yesterday we learned that Coinbase user data was recently exploited. As prices rise, hacks, hidden leverage, and social engineering scams bring additional risks to crypto investors.

We believe there will be opportunities to buy BTC and other blue chip assets at a discount in the near future. But we also want to have fun and try to capture any upside that may be left in the current cycle.