The cryptocurrency market continued to rebound slightly on Monday, with Bitcoin hitting an intraday high of $107,068 before retreating to around $102,105. According to CoinMarketCap, as of press time, Bitcoin is trading at $105,850, with a 24-hour fluctuation of less than 1%, and a 24-hour trading volume of 40% to $64.63 billion.

"Ten Thousand Yuan Step-by-Step Rise" Model

Some market observers have noted that Bitcoin has exhibited an interesting “staircase” pattern in its recent rise.

Analyst Trader Tardigrade found that BTC price rises in phases, with each rising band of about $10,000, and a brief pause after each rise. He mentioned the movement from $75,000 to $85,000, then to $95,000, and most recently to $105,000. After each jump, there are usually seven to ten days of relatively calm sideways consolidation.

For traders, this pattern provides predictable opportunities to take profits or enter new positions. These consolidations can serve as new support levels, indicating buyers’ willingness to enter the market again. If this pattern continues, the next logical target could be $115,000, which is about 11% higher than the current price.

Tardigrade believes that the value of the $100,000 mark is self-evident. This integer is not only an important psychological defense, but also a strong technical support. It is worth noting that after a sharp increase of 11% in early May, Bitcoin still maintained a slight increase of 0.5% last week. This "slow bull" feature is healthier and more sustainable than violent fluctuations.

Target price: $160,000

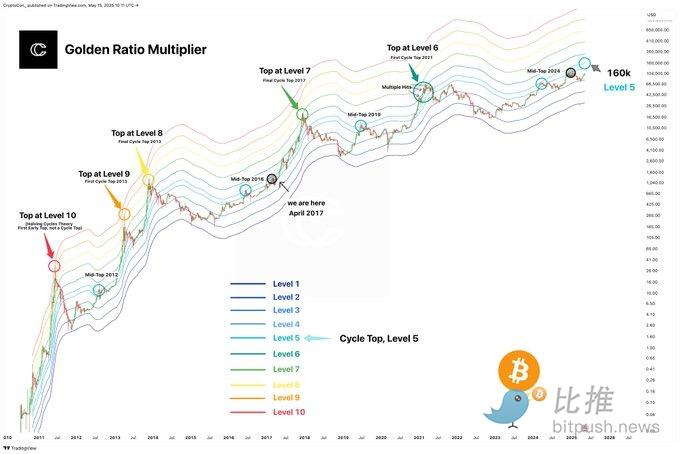

Looking further ahead, chart analyst CryptoCon offers a more optimistic outlook through the “Golden Ratio Multiplier” model.

CryptoCon said the Golden Ratio Multiplier Model was one of the few technical indicators that accurately predicted the top of the Bitcoin cycle in April 2021.

According to the model analysis, in March 2024, the market has reached the middle top of this cycle, which means that the market is likely to test the top again. The current model shows that the fifth-level target is $160,000 and continues to rise. This trend is quite similar to the bull market cycle from 2015 to 2017 - the current stage is equivalent to the position in April 2017, which is the eve of the main bull market. Historical experience shows that this slow accumulation stage often indicates that there may be an accelerated rise in the subsequent market.

It is worth noting that although this technical analysis has a certain reference value, the target of $160,000 is based on the calculation results of a specific model, and the actual trend may be affected by many factors. For ordinary investors, understanding this cyclical feature helps to grasp the market rhythm, but more importantly, it is necessary to do a good job of risk management.

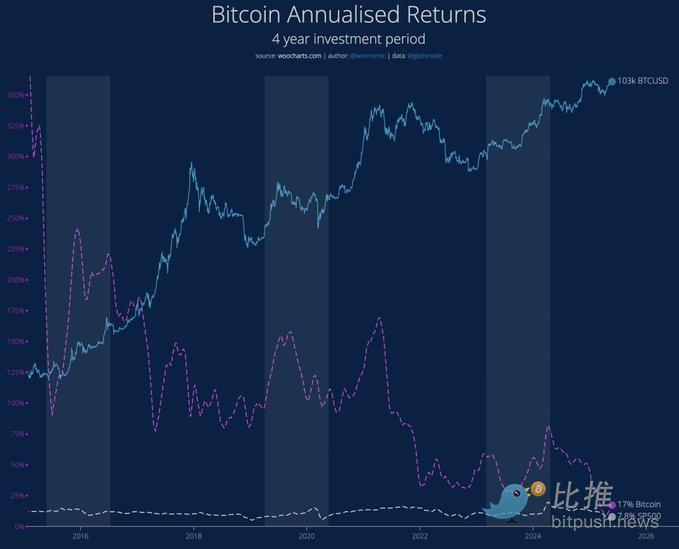

Willy Woo: BTC compound annual growth rate will stabilize at 8%

Analyst Willy Woo offers another perspective. He believes that Bitcoin has evolved from a volatile, explosively growing asset to a more mature financial instrument. Although many still view Bitcoin as a soaring "magical unicorn," Woo points out that the era of annual growth rates of more than 100% in 2017 is largely over. He marks 2020 as a key turning point, when Bitcoin achieved "institutionalization" as companies and sovereign entities began to accumulate it.

As more institutional capital enters, Bitcoin's compound annual growth rate (CAGR) naturally drops from triple digits to around 30%-40% and continues to moderate. Woo attributes this to Bitcoin's increasing maturity and its growing role as a store of capital. He emphasized Bitcoin's status as a global financial asset, noting that it "will continue to absorb capital until it reaches its equilibrium point."

Looking further into the future, Woo predicts that Bitcoin’s CAGR will eventually stabilize in line with broader economic trends, perhaps around 8% per year (combining 5% long-term monetary expansion and 3% GDP growth). While this growth rate may seem paltry compared to its early days, he remains confident in its long-term performance, concluding: “Until then (and perhaps another 15-20 years), enjoy the ride, as few publicly investable products can match Bitcoin’s performance over the long term, even if Bitcoin’s CAGR continues to decline.”