Author: Todd

First of all, congratulations on Ethereum's 10th anniversary!

It's been exactly 8 years since I registered my first Ethereum wallet.

There used to be a saying that humans undergo a major cell replacement every 7 years on average.

Indeed, from a cellular perspective, I'm no longer myself.

Ethereum, however, remains Ethereum.

My original Ethereum wallet is still alive, and even the little change I left in it back then has increased tenfold.

At that moment, I was at home writing and discussing Ethereum;

At this moment, it's hard to imagine that I'm still sitting here, discussing Ethereum.

First, let me talk about myself.

As everyone knows, I'm a staunch Bitcoin supporter, but I'm not a BTC maxi (which translates to a single-minded fan of a star. I'm not a single-minded fan). I also like Ethereum, BNB, and Solana, and enjoy researching them.

My first Ethereum wallet wasn't actually MetaMask, but an ancient one called My Ether Wallet. It was too primitive, as every time I logged in, I had to upload a file called a keystore and then enter a password to unlock it before I could use it.

I wanted to register an Ethereum wallet because I wanted to buy a CryptoKitties.

Back then, two cats could have babies. Some cats were rare, and each cat had a different birth rate, allowing for an endless supply of offspring, which could then be hyped up.

My first time using MetaMask dates back to 2020. It was to speculate on AMPL, the forerunner of algorithmic stablecoins. Its characteristic is that if the price rises above $1, it prints money for everyone. If it falls below $1, it deducts money from everyone's balance, achieving the effect of a stablecoin by adjusting supply and demand.

These two wallets actually represent two eras. In fact, I roughly divide Ethereum into four eras:

- Era 0 (2015-2016): The Birth of Ethereum

- Era 1 (2017-2019): The ICO Era

- Era 2 (2020-2022): The DeFi Era

- Era 3 (2023-2025): The LST Era

- Era 4 (2025-Present): The Asset Era

Era 1: The ICO Era

In 2015-2016, Ethereum had only one trick: smart contracts. At the time, this was a novelty, as other altcoins like Ripple and Litecoin didn't have it.

Of course, people's understanding of smart contract development was very rudimentary. Until 2017, they were generally used solely for issuing coins.

After all, I was still using an inhumane wallet like My Ether Wallet. How could I possibly develop a DApp?

But simply being able to issue coins was enough. In the past, issuing a coin required modifying the code (for example, changing "Bitcoin" to "Litecoin"), finding miners to support it, and constantly monitoring network stability—it was incredibly cumbersome.

At least 80% of people simply wanted a coin to speculate on, and didn't care much about its underlying mechanisms (even the narrative is becoming less and less important now. I regret not fully understanding this back then).

Ethereum perfectly met this need, and thus became an absolute supernova of its time.

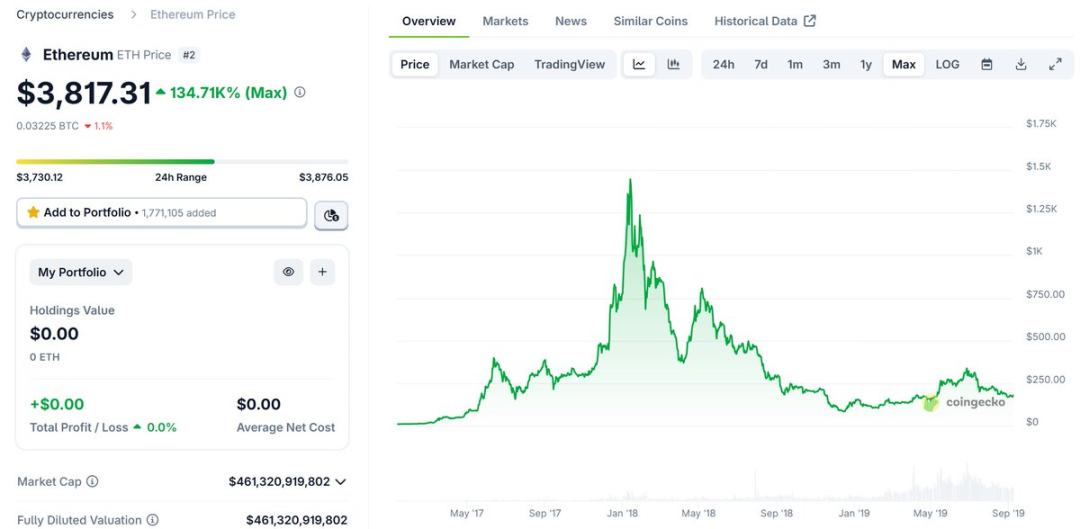

I remember vividly that when China issued the crypto ban in 1994, the price of Ethereum was 1,400 RMB. Six months later, it reached 1,400 USD!

Ethereum's recent high price is essentially due to FOMO (Fear of Monetization) driven by supply and demand.

Imagine participating in 1-3 public ICOs in your group chat every day. Each one requires Ethereum, which you deposit into a smart contract and earn 3-100x your money. How could you not hoard some Ethereum?

Of course, that Ethereum settlement was equally unexpected.

I often share with my friends the story of SpaceChain and HeroChain's price drops. SpaceChain launched blockchain nodes into space, while HeroChain was a gambling blockchain launched by a supposed Southeast Asian casino owner.

Back then, these two projects were considered the kings of the ICO era. However, in early 2018, both of them fell below their IPO prices, marking the beginning of a wave of price drops.

When everyone noticed that projects previously funded with Ethereum were cashing out, and that everyone who participated in an ICO with Ethereum was losing money, they naturally began to slowly sell off Ethereum.

Thus, Ethereum plummeted to $80 per coin in 2019, a true trough of despair.

I'm no exception. I'm not one of those true Ethereum warriors who maintains faith even when prices continue to fall.

Continuous writing is indeed a good habit, and it helps provide tools for self-reflection. I looked back at an article I published in March 2018, when Ethereum was around $400, during its low point. I also questioned the value of Ethereum—if it could only be used for ICOs, then once the ICOs were closed, what else could Ethereum do?

The comment section at the time did have some experts. One person named LionStar offered a pointed rebuttal:

"2018 is just the beginning of Ethereum's development. People in the Ethereum community themselves know that Ethereum currently has no scalability or performance, and it's still early days. Ethereum's grand vision will only take its first steps in 2018. Proof of Stake, sharding, plasma, truebit, state channels, swarm, zero-knowledge proofs, and a whole host of other things haven't been implemented yet. We'll see how Ethereum develops in five years. Furthermore, the vast majority of cryptocurrency traders base their views solely on price. They believe that if the price goes up, they're in luck, and if it goes down, they're out. This mindset is both terrifying and meaningless. Technology and development prospects determine true value, and price will ultimately converge to true value."

The dark humor is that, with the exception of Proof of Stake and zero-knowledge proofs, all of the above have failed.

Of course, this is also Ethereum's most admirable aspect: it's an open framework, allowing diverse teams to experiment with a wide range of ideas, such as those mentioned above—sharding, plasma, truebit, state channels, and swarm. Most of these initiatives originate from the community, where everyone expresses their own opinions and works diligently on them. This embodies the spirit of the internet and open source software.

It's through constant, free trial and error that Ethereum has become what it is today.

The entire Ethereum community is essentially driven by two main themes.

One is technology, improving Ethereum's performance;

The other is applications, developing applications around Ethereum.

Each flower blooms in two directions, each with its own unique charm. After Ethereum's downturn, DeFi unexpectedly began to take off.

Era 2: The DeFi Era

It all started in 2020 when Compound announced it would begin subsidizing depositors and borrowers. People were surprised to discover that Ethereum could actually create meaningful applications, beyond boring, visually appealing games like CryptoKitties.

Furthermore, these truly meaningful applications were surprisingly superior to traditional ones. They offered cheaper borrowing costs and higher deposit interest rates. There was even a point where the "subsidy > borrowing interest" ratio caused electricity meters to reverse.

People take it for granted now, but back then, people were shocked.

Remember, other popular coins at the time were all just for the sake of innovation, like distributed storage, solar-powered hemp coins, and game chains. Ethereum, however, had something that transcended traditional applications. It was truly impressive, like the village's first university student.

ICOs weren't entirely a bubble; they brought some new things. EthLend, the predecessor of AAVE, which we use every day, also originated from the ancient ICO era.

Thus, Ethereum broke down and then re-emerged, and the DeFi era officially began.

DeFi also caused shifts in supply and demand. Both Uniswap and Sushiswap required large amounts of Ethereum as limited liquidity providers, dramatically increasing demand for Ethereum.

With Ethereum, you can mine anything, bear a little bit of volatility, and earn an annualized return of over 100%. Who wouldn't be tempted by such an interest rate?

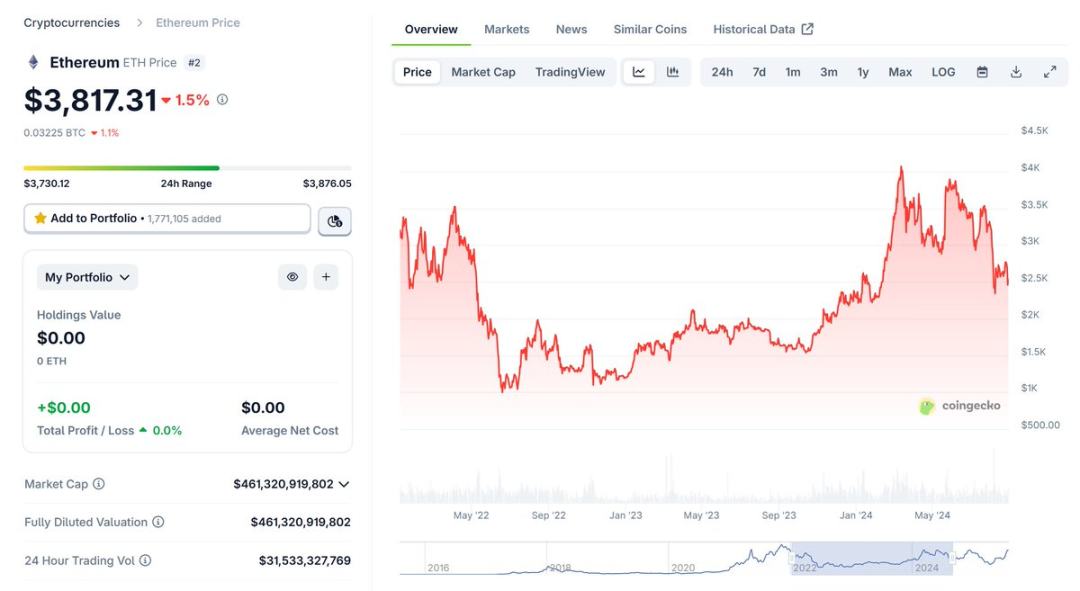

With DeFi's intensifying demand for Ethereum, Ethereum first climbed to 4100 and then reached an all-time high of 4800 in 2021. This reflects people's (my own) fantasy that Ethereum could take over traditional finance.

However, unlike the ICO era, Ethereum in 2021 faced a host of wolves. DeFi was born on Ethereum, but the good news quickly spread to competing chains. Ethereum's competitors offered cheaper fees and faster performance. In the ICO era, the difference in gas fees was not significant, but in the DeFi era, the term "noble chain" is definitely the worst advertisement for Ethereum, not a compliment.

Fast forward to 2022, and Luna—it's hard to call it DeFi, because it was a Ponzi scheme from the start. Its sudden collapse brought down the market, taking with it FTX and 3AC, and also the DeFi craze in which these institutions were deeply involved. It was like a slap in the face that strangled the DeFi summer.

Similar to the ICOs of the past, due to the reversed supply and demand relationship, people stopped participating in liquidity mining, and Ethereum began a long downward trend. The falling exchange rate with BTC, in particular, shattered the dreams of countless people.

When DeFi thrives, Ethereum thrives; when DeFi declines, Ethereum will naturally struggle, especially when other chains are focusing on transaction fees below 1 cent.

Why has Ethereum been vigorously promoting a Layer 2 strategy over a Layer 1 expansion strategy in recent years?

I think you probably understand by now.

This is truly a critical moment for its survival! Ethereum must immediately stop and slow the decline of DeFi, even if it means sacrificing its mainnet status. Thus, a large number of Layer 2 (L2) projects emerged at this time.

There were groundbreaking projects like Arb OP ZK, institutionally led projects like Base Mantle OPBNB, mother chains like Metis, novel ideas like Taiko, and application-driven projects like Uni.

Ethereum didn't need a long-term solution, but rather a very fast, simple, and immediate, in-place scaling solution that wouldn't hesitate to resort to drastic measures. After much deliberation, the obvious choice was Layer 2.

L2 projects have proven effective, solidifying the EVM's reputation and preventing a significant number of DeFi developers from leaving the ecosystem due to fee inflation.

Those funds and users who left the ETH mainnet at least:

didn't go to competitors;

They didn't spawn more competitors.

Imagine, if there weren't an L2 strategy, Coinbase would have launched its own chain; that's human nature. But with L2, at least nominally, Coinbase and others still respect Ethereum as the "common master."

As long as the EVM survives, Ethereum won't lose.

Era 3: The LST Era

Next comes Ethereum's third chapter, and it's also the worst.

Following the ICO and DeFi eras, Ethereum has entered the LST era.

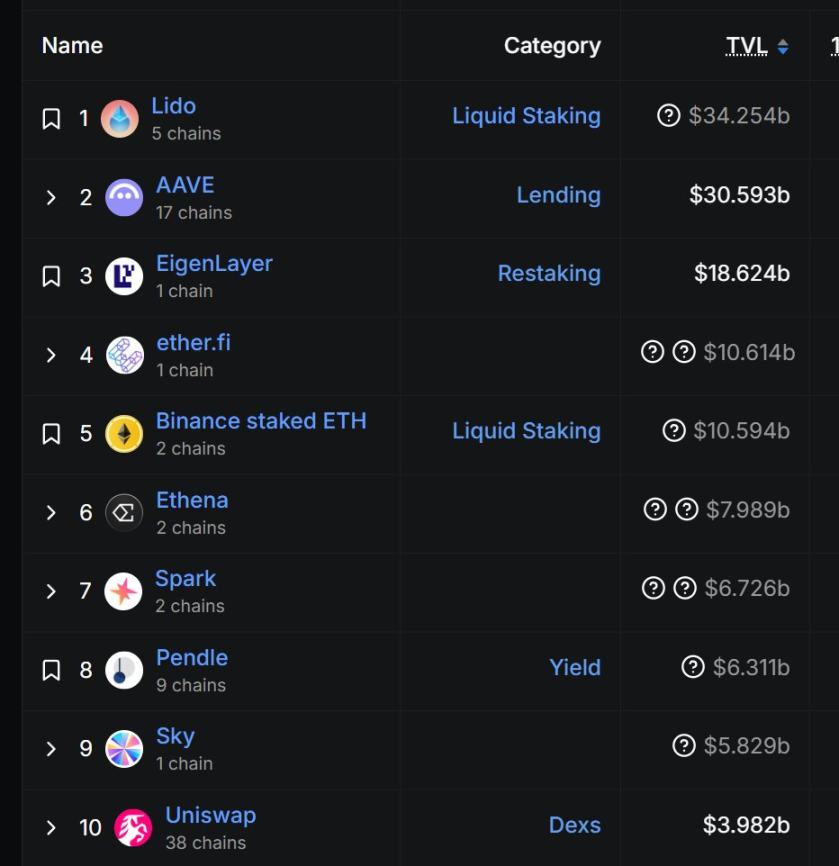

With the Shanghai upgrade, Ethereum's transition to PoS has been a complete success. From a TVL perspective, Lido and EtherFi have risen, and countless ETH LSTs have sprung up like mushrooms after rain.

Every new era bears the heavy imprint of the previous one. Just look at DeFillama; the top DeFi projects on Ethereum today are mostly LSTs or LST-affiliated units.

Source: DeFillama

What are LST's subsidiary units?

For example, revolving loans. EtherFi's revolving loans can easily achieve yields of over 10% on Ethereum (DM me if interested). However, loans require a place to borrow money. Therefore, a large amount of TVL for AAVE and Morpho actually comes from the demand for revolving loans. So, although they are DeFi, I liken them to LST's subsidiary units.

DeFi fueled the birth of LST, which has become DeFi's largest client.

A side note: Our company, Ebunker, was also founded around this time, on September 15, 2022, the day Ethereum's PoS merge was successfully completed.

To this day, over 400,000 Ethereum are running on our nodes in a non-custodial manner, a decision I'm incredibly pleased with.

After all, every Ebunker wants to contribute their own actions to safeguard Ethereum's security (I do this by running a node).

Back to the point. If you've been paying attention, you'll have noticed that I've been emphasizing that "dramatic fluctuations in supply and demand affect Ethereum's price."

However, LST (including non-custodial staking) has not brought about an improvement in supply and demand. Lido's ETH interest rate has long remained at 3%, and EtherFi's has slightly higher, reaching 3.5%, but this is already the limit.

Neither EigenLayer nor other subsequent re-staking methods have changed the nature of this base rate.

But just as everyone hopes for a US interest rate cut every day, this 3% base rate has even magically suppressed virtual economic activity within Ethereum, a virtual nation.

Ethereum's gas fees have begun to decline (of course, this is also due to the efforts of Layer 1 expansion and Layer 2 strategies), but economic activity remains sluggish.

This mirrors two previous historical instances of supply and demand imbalance.

Thus, LST did not become a summer, but instead fell along with Ethereum.

Because a 3% interest rate isn't a reason for large investors to buy Ethereum, at most it can delay their sale. However, we should still thank LST, as many large investors have deposited their Ethereum for staking, which at least prevented a similar $80 gold mine as in 2019.

The Fourth Era: The Asset Era

Fortunately, following Bitcoin, Ethereum also successfully listed on a US spot ETF, which gave Ethereum a brief moment of hype. In fact, this marked the beginning of Ethereum's fourth major chapter—the asset era.

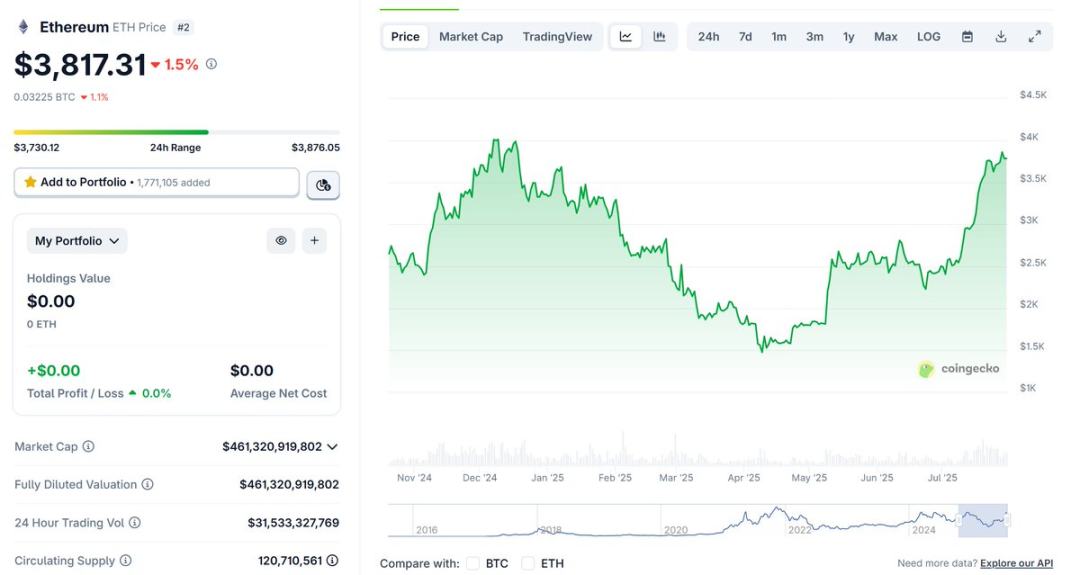

The journey from alternative assets to mainstream assets is a long one. As everyone watched, the ETH/BTC exchange rate gradually fell below 0.02, and Ethereum faced its third major "question."

In fact, everyone should thank that man, Saylor, for inventing the great microstrategy game.

Companies first buy Bitcoin/Ethereum, then use these assets to issue additional shares and debt, then buy more Bitcoin/Ethereum, continue to issue more shares and lend more bonds, and then buy more Bitcoin/Ethereum.

Microstrategy's success with Bitcoin inspired the Ethereum community.

Sharplink, led by ConsenSys and a group of insider investors, and Bitmine, represented by traditional funds backed by Wood Sister, began vying for the top spot in Ethereum microstrategies.

These companies, along with a host of imitators, successfully ignited the current US stock-cryptocurrency resonant synergy.

Yes, that's right. This time, the supply and demand relationship for Ethereum has changed again.

Institutions are buying large amounts of Ethereum at the true market price. As before, the LST era also laid the foundation. Massive staking activity has locked up a significant amount of liquidity in Ethereum's floating shares, naturally contributing to the current FOMO (Fear of Momentum) associated with the cryptocurrency-stock market.

Of course, this is also inseparable from the long-standing positive impression Ethereum has left on the industry and traditional investors.

V God hasn't shown off luxury cars and villas, nor has he endorsed copycat scams. Instead, he continues to ponder how technology, such as ZKVM, privacy, and L1 simplification, will impact the future of Ethereum.

I've never even mentioned sbet or bitmine on Twitter.

Ethereum's market selection and its arrival in this fourth era are a result of the goodwill and reputation built up over the years by both Ethereum and Vitalik Buterin.

It can be said that Vitalik Buterin is a crucial part of my identification with Ethereum's values.

Finally

As Binji mentioned, the Ethereum network has been running smoothly for 10 years, 3,650 days and nights, without any outages or maintenance windows.

During this time:

- Facebook was down for 14 hours;

- AWS Kinesis was frozen for 17 hours;

- Cloudflare shut down 19 data centers.

Yes, Ethereum's robustness is fascinating.

I hope, and I certainly believe, that I'll still be analyzing everything about Ethereum on Twitter in 10 years.

Happy 10th birthday, Ethereum!