Highlights of this issue

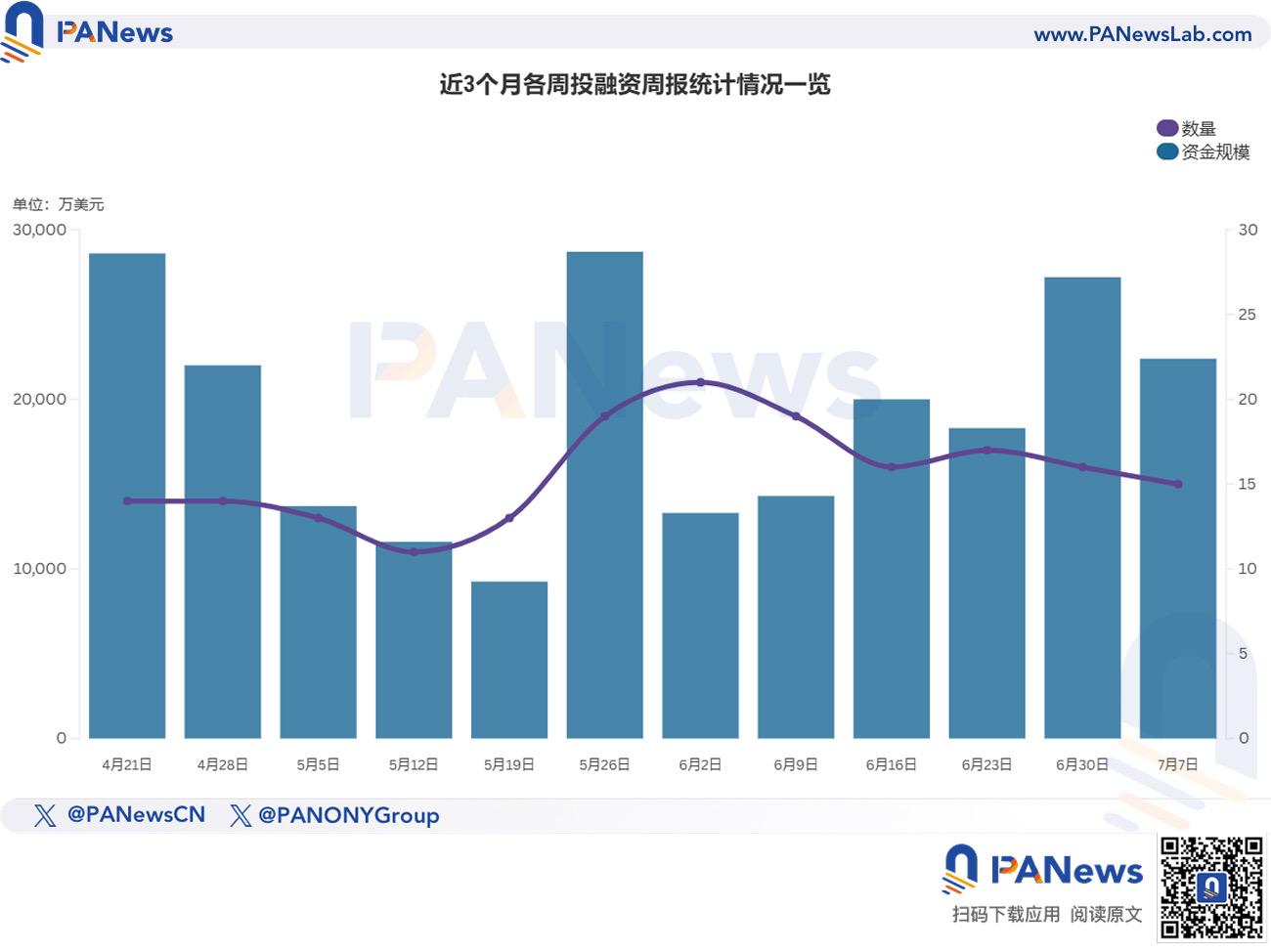

According to incomplete statistics from PANews, there were 15 investment and financing events in the global blockchain last week (June 30-July 6); the total scale of funds exceeded US$224 million; in addition, the total amount of financing for listed companies' crypto asset reserves exceeded US$140 million. The overview is as follows:

- DeFi announced two investment and financing events, among which the Islamic DeFi project inshAllah Finance completed a seed round of financing of US$2.1 million, led by Alliance DAO;

- The Web3 gaming track announced two investment and financing events, among which the game studio Distinct Possibility Studios completed a $30.5 million financing, led by Bitkraft Ventures and Brevan Howard Digital;

- The AI+Web3 track announced three investment and financing events, among which Zypher Network completed a US$7 million financing, led by UOB Venture and Signum Capital;

- The Infrastructure & Tools sector announced three investment and financing events, among which the data sovereignty Web3 cloud platform Impossible Cloud Network (ICN) completed 28.8 million euros (about 33.91 million US dollars) in financing;

- In other applications, three investment and financing events were announced, among which the Base chain prediction market platform Limitless.exchange completed a strategic financing of US$4 million;

- The centralized financial sector announced two investment and financing events, among which Japanese crypto exchange operator BACKSEAT has completed a total of approximately US$9.69 million in financing

DeFi

Islamic DeFi project inshAllah completes $2.1 million seed round of financing, led by Alliance DAO

The Islamic DeFi project inshAllah Finance announced the completion of a $2.1 million seed round of financing, led by Alliance DAO, with participation from Blockchain Builders Fund, Polymorphic Capital, Sancus Ventures and other institutions and angel investors. inshAllah Finance aims to combine Islamic finance with decentralized finance (DeFi) through the Solana network to provide Islamic-compliant financial services to the world's 2 billion Muslims. Its latest products include the Islamic-compliant yield-generating stablecoin iAUSD and the zero-interest, low-liquidation penalty lending protocol iABorrow.

Decentralized stablecoin infrastructure project Perena announced the completion of a new round of financing, which attracted more than 350 backers. This round of financing included participation from institutions such as Susquehanna, Native CryptoX and Hermeneutic Investments.

Web3 Games

Distinct Possibility Studios, a game studio founded by EverQuest co-creator John Smedley, has completed a $30.5 million financing round, led by Bitkraft Ventures and Brevan Howard Digital, with participation from Tezos Foundation, Hashed, Delphi Ventures, Shima Capital, North Island Ventures and Decasonic. The funds will be used to develop and release the AAA shooting game "Reaper Actual", which is planned to be launched on Steam and Epic Games Store. Distinct Possibility Studios also stated that it has chosen Etherlink, an EVM-compatible Layer 2 network built on Tezos, as the blockchain for building "Reaper Actual".

Swedish game studio Cold River Games announced that it has completed a $2 million financing, which will be used to develop its free ARPG game "Crystalfall". This round was led by Beam Investments, and Partnerinvest Norr, CoinFund, Avalanche Foundation, A100X, MH Ventures and others participated in the investment. "Crystalfall" is expected to land on Steam in 2025. It adopts a steampunk style, focusing on item growth and skill theory construction, and may introduce Web3 elements to improve equipment circulation and player economic security.

AI

Zypher Network Completes US$7 Million Funding, Led by UOB Venture and Signum Capital

Zypher Network, a provider of decentralized trust infrastructure for autonomous AI agents, has raised $7 million in funding to accelerate the development of its zero-knowledge (ZK) protocol stack and AI-specific Rollup infrastructure. UOB Venture and Signum Capital jointly led the round, with participation from HashKey Capital, Hong Leong Group, Cogitent Ventures, Catcher VC, Hydrogenesis Labs, DWF Venture and other strategic investors.

AI-driven superstructure network Datagram has completed a $4 million Pre-Seed round of financing, led by Blizzard the Avalanche Fund, with participation from Animoca Brands, Cointelegraph, Amber Group, Aquanow, Arche Fund, DePIN X Capital, ISKRA, JDI Ventures, Yellow Capital, etc. This round of funds will be used to build a sovereign Layer1 blockchain on Avalanche and accelerate node network deployment. The Datagram network builds decentralized infrastructure by integrating idle computing resources, and currently serves 200 companies and 1 million users worldwide. Its CEO said the technology is expected to become the "foundational layer of the decentralized Internet."

AI and Web3 startup verification platform Idea-L completes $1 million Pre-Seed round of financing

Idea-L, a Dubai-based AI and Web3 startup verification platform, announced the completion of a $1 million Pre-Seed round of financing, with the participation of multiple angel investors. The new funds are intended to support the launch of its DAO-managed venture capital fund deVC Fund and plans to launch a governance token, which will support the construction of a large artificial intelligence language model dominated by reasoning in multi-model and multi-modal environments to verify entrepreneurial ideas.

Infrastructure & Tools

Impossible Cloud Network (ICN), a data sovereignty Web3 cloud platform headquartered in Zug, Switzerland, has completed a financing of 28.8 million euros (about 33.91 million US dollars), bringing its post-investment valuation to more than 398 million euros. This oversubscribed financing combines new capital and previously undisclosed investments, including early investments from 1kx, Protocol Labs, No Limit Holdings and HV Capital. The latest round of strategic financing was led by NGP Capital. ICN's native token $ICNT is also officially launched. Earlier news , Binance Alpha and Binance Futures will list Impossible Cloud Network (ICNT).

The Open Platform Completes $28.5 Million Series A Funding, Led by Ribbit Capital

Telegram ecosystem development platform The Open Platform announced the completion of a $28.5 million Series A financing, with a post-investment valuation of $1 billion. This round was led by financial technology investment institution Ribbit Capital, and crypto venture capital Pantera Capital participated. This financing transferred about 5% of the equity, and did not include cryptocurrency shares. The Open Platform has raised more than $70 million in total.

TOP is the core developer of Telegram's official blockchain, The Open Network (TON). Its "Telegram Wallet" has been opened to users in Russia, Asia and other regions. The company's CEO said that the new funds will be used to expand the European and American compliance markets and incubate blockchain games and AI applications based on TON.

AllScale Completes $1.5 Million Financing, Amber Group and Others Participate

AllScale, a fintech company, announced that it has completed a $1.5 million financing round. Investors include DraperDragon, Amber Group, Y2Z Capital, KuCoin Ventures, etc. The funds will be used to develop stablecoin invoices, social e-commerce and payroll solutions. AllScale is committed to providing small and medium-sized enterprises with a one-stop stablecoin payment tool, lowering the threshold for use and solving compliance and complex process issues. The founding team comes from well-known companies such as Kraken and Block, and its products support global fast payments, sales and payroll management.

other

Consumer applications:

Basechain prediction market platform Limitless.exchange completes $4 million in strategic financing

Limitless.exchange, a prediction market platform on the Base chain, announced the completion of a $4 million strategic financing. Arthur Hayes joined the company as an advisor, and his family office Maelstrom also participated in the investment. After this round of financing, the total financing amount of the project reached $7 million. Investors include Coinbase Ventures, 1confirmation, Maelstrom, Collider, Node Capital, Paper Ventures, Public Works, Punk DAO and WAGMI Ventures, as well as individual investors through the Base Ecosystem Fund group on Echo. Limitless is the largest prediction market on Base, with more than $250 million in bets on unique contracts, allowing users to bet on the performance of their favorite assets in the next few minutes, an hour or a day.

Japanese content tokenization platform Questry announced that it has raised 260 million yen (about 1.8 million U.S. dollars) in the first half of the Pre-A round of financing, with participation from Brand New Retail Initiative Fund, Blizzard the Avalanche Fund, and TIS. The funds will be used to strengthen content business and digital financial business, including exploring the application of blockchain technology in cross-border investment. According to reports, the company's goal is to "establish a direct financing platform specializing in entertainment", and the company is also considering introducing a system that uses blockchain technology to achieve global market investment.

Venture capital studio Thesis has acquired Bitcoin rebate platform Lolli

Bitcoin venture capital studio Thesis announced the acquisition of Bitcoin rebate platform Lolli, the details of the transaction were not disclosed. Lolli was founded in 2018 and allows users to earn Bitcoin rewards by shopping at 50,000 retailers or playing thousands of mobile games. The acquisition will integrate Lolli into the Thesis ecosystem, forming synergies with its Bitcoin financial platform Mezo and cross-chain protocol tBTC.

Lolli founder Alex Adelman said the merger will allow users to not only earn BTC, but also realize practical applications through products such as Mezo. The company also announced the spin-off of its enterprise-level rewards platform Mirado, which has provided white label rewards services to 85 million cardholders. Industry data shows that Lolli completed an $8 million Series B financing led by Bitkraft Ventures in 2023, with a total financing amount of $28.3 million.

( Not included in this issue's financing weekly statistics )

Coinbase has acquired token management platform Liquifi

Crypto exchange Coinbase announced the acquisition of token management platform Liquifi, which is its fourth acquisition completed in 2025. Aklil Ibssa, head of corporate development at Coinbase, declined to disclose the specific terms of the deal. Liquifi has received $5 million in seed funding led by Dragonfly. Its clients include well-known projects such as the Uniswap Foundation and OP Labs. It mainly provides services such as token attribution and tax management. Aklil Ibssa, head of corporate development at Coinbase, said that this acquisition will improve its full-cycle service capabilities from token creation to listing.

( Not included in this issue's financing weekly statistics )

Crypto Mining:

British cloud mining platform TWL Miner completes $95 million Series B financing

British cloud mining platform TWL Miner successfully completed its Series B financing, raising $95 million, which will be used to support the integration of artificial intelligence technology and cloud mining business. The company said that this round of financing attracted a number of professional investment institutions in the fields of blockchain and sustainable technology, but did not disclose the specific participating institutions. The new funds will be used to strengthen the construction of a global renewable energy data center network and develop an artificial intelligence mining system to dynamically manage computing resources, predict the best mining time, reduce energy consumption, and improve the success rate of block verification and operational stability.

According to reports, TWL Miner currently operates more than 60 data centers powered by wind and solar energy in many countries, in line with its sustainable mining strategy. The platform has served more than 7 million users in 180 countries and regions around the world.

Crypto asset reserves: ( not included in this period's financing weekly statistics )

DeFi Development Corp discloses $112.5 million private placement to fund SOL purchases

Solana Ecosystem listed company DeFi Development Corp (stock code DFDV) disclosed details of a $112.5 million private placement, which will be used primarily to increase holdings of SOL tokens. The transaction includes a "prepaid forward" stock purchase agreement, which allows investors to hedge risks by establishing short positions.

According to the announcement, the convertible notes issued by the company have an annual interest rate of 5.5%, mature in 2023, and a conversion premium of 10%. Of this, $75.6 million will be used for the aforementioned hedging transactions, and the remaining funds will be used for corporate operations and SOL acquisitions. The company's holdings at the end of May showed that it held 621,313 SOLs (approximately $107 million), and it also obtained a $5 billion credit line in June.

Amber International raises $25.5 million to bolster its cryptocurrency reserve program

Amber Group subsidiary Amber International Holding (AMBR) said it has raised $25.5 million in a private placement. The proceeds from the private placement will be strategically used to enhance Amber International's $100 million cryptocurrency reserve program, which is designed to support long-term ecosystem integration and product innovation. Since the announcement of the strategy earlier this year, the reserve has been allocated to major digital assets such as Bitcoin (BTC), Ethereum (ETH) and Solana (SOL), and is continuing to allocate to Binance Coin (BNB), Ripple (XRP) and Sui (SUI).

The offering price was $10.45 per share, a 5% discount to the company's three-day volume-weighted average trading price, and attracted investors such as Pantera Capital, CMAG Funds, and Kingkey Financial International to participate. The private placement issued 12,200,915 Class A common shares, equivalent to 2,440,183 American Depositary Receipts (ADS).

Coinsilium completes £2.7875 million financing for strategic development in the digital asset field

Coinsilium Group Limited, a UK-listed company, announced the successful completion of an accelerated placement financing round, raising £2,787,500. This round of financing issued 15,486,111 new ordinary shares to institutional investors through Peterhouse Capital, SI Capital and Oak Securities, with an issue price of £0.18 per share, a 10% discount to the closing price on July 2. The new shares are expected to officially start trading on July 8. The proceeds from this financing will be used to support the company's strategic development in the field of digital assets.

Norwegian Block Exchange (NBX), a Norwegian listed digital asset trading platform, announced the completion of a financing of 5.4 million Norwegian kroner. It is reported that the funds will be used exclusively for the purchase of Bitcoin. The company has previously purchased 6 Bitcoins (approximately US$633,700) and plans to explore the use of Bitcoin as collateral.

Centralized Finance

Japanese crypto exchange operator BACKSEAT has raised approximately US$9.69 million in financing

Japanese crypto exchange operator BACKSEAT announced that it has completed its seed round of financing, with a total financing amount of approximately 1.4 billion yen (approximately 9.69 million US dollars) in just one year since its establishment. This round of financing was jointly led by Spiral Capital and Headline Asia, with East Ventures participating. The funds raised will be used for product development, talent recruitment and strengthening the organizational structure. According to reports, BACKSEAT acquired all the shares of the Japanese crypto exchange "coinbook" in February 2025 and established a wholly-owned subsidiary "BACKSEAT Exchange (BSE)". The company plans to upgrade existing services and launch new crypto asset trading services within the year.

Australian crypto exchange Coinstash completes $3.08 million Series A funding

Australian crypto exchange Coinstash announced the completion of A$4.7 million (about $3.08 million) in Series A financing, bringing its total capital raised to more than A$8 million. This round of financing was led by a family office in Brisbane and will provide funds for Coinstash's continued platform development, team expansion and user acquisition, with the goal of attracting 100,000 Australian investors. According to reports, Coinstash was founded in 2017 and currently serves more than 50,000 users, providing Bitcoin, Ethereum and more than 1,000 cryptocurrency trading services.