In 2011, Marc Andreessen, founder of a16z, published an article titled "Software Is Eating the World" in the Wall Street Journal. The core argument is that software is changing the world at an unprecedented speed and scale.

Over the past 10 years, we have witnessed the rapid development of the Internet, and a large number of companies with a market value of over 100 billion yuan have been born. Even now, this statement is still valid, because AI has begun to change the world in new ways. Some people have also proposed that AI is swallowing up software, but everything seems to have started in 2011. After all, the Weibo and WeChat that we often use exploded in that year.

Now, more than a decade after the birth of blockchain technology, we have finally ushered in the beginning of "blockchain swallowing the world", and this beginning is the implementation of the tokenization of U.S. stocks.

Although the tokenization of U.S. stocks is nothing new, and has even been partially realized in the bankrupt FTX, the players entering the market now are no longer pure crypto companies, but well-known Internet companies like Robinhood.

Last week, Robinhood announced the launch of a stock token trading service based on the Arbitrum network in Europe, and tokenized the equity of some private companies, including OpenAI and SpaceX. The news caused a sensation in the financial circle and helped push Robinhood's stock price to a record high.

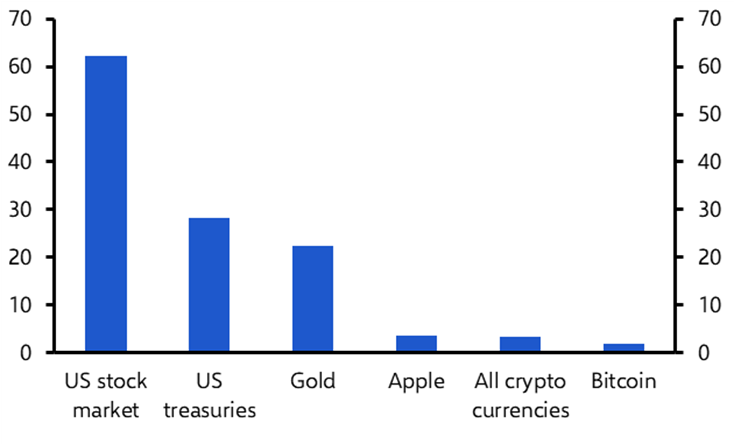

Currently, the total market value of the entire crypto market is approximately US$3.4 trillion, while the total market value of the global stock market is approximately US$135 trillion, a difference of nearly 40 times.

On the other hand, the ultimate ceiling market for stock tokenization is 135 trillion, and as long as the market value continues to grow, the ceiling will be opened.

However, its current market share may be less than 0.1%. Only when it can break through 3% can the industry usher in real explosive growth.

This is the future that these emerging trading companies are aiming for, and it is also the real growth point of blockchain.

If this logic holds true and is realized, the impact of blockchain and cryptocurrency will be no less than the impact of "software eating the world."

It can be predicted that the next 1-2 years will be a period of wild growth in this field. More companies will enter the market, which will force some traditional stock service companies (TradFi) to transform. The door to this trend has been opened.

But is stock tokenization the end of blockchain? I think it is just an important step.

At the end of last year, MicroStrategy CEO Michael Saylor released a proposal titled "U.S. Digital Asset Framework, Principles and Opportunities". Regarding development prospects, Saylor predicted that the global digital capital market is expected to grow from US$2 trillion to US$280 trillion, and the digital asset market (excluding Bitcoin) may grow from US$1 trillion to US$590 trillion.

There are three important turning points before us: the first is the global craze for stablecoins, both in the West and the East; the second is the continued growth in the scale of government bonds and money market funds on the chain, which is widely referred to as RWA; and the third is the beginning of stock tokenization.

The final scale mentioned by Michael Saylor is the market after all these assets are put on the chain, and the real "everything on the chain" that may come - after all, this term has been mentioned for several years, from the lively STO in 2018 to the current RWA and stock tokenization, we have finally reached the critical point. Although the road is still long and full of challenges, it is already on the way.

Although these data seem a bit far-fetched now, it is just as dramatic and absurd as saying 10 years ago that Bitcoin would reach 100,000 US dollars. Now it has reached 110,000 US dollars and is constantly breaking historical highs.

In the foreseeable future, we can see that blockchain is reshaping the way assets are presented and value is transmitted. Whether it will reshape the way information is transmitted remains to be seen. AI is reshaping the way information is captured and bringing about productivity changes. Now the technology tree is on the eve of an explosion.

Coincidentally, the technical backgrounds of both have been lurking for more than 10 years, from being ignored to being full of bubbles, and then to the reshaping of value. Perhaps it is time to release the "monster".

So, who will be the next big player in stock tokenization? We will have to wait and see.