Key Highlights:

- Event focus: The Jackson Hole economic policy symposium will be held from August 21 to 23, 2025, and Federal Reserve Chairman Jerome Powell will speak at 14:00 GMT on Friday.

- Rate cut expectations: The market expects an 83% chance of a 25 basis point rate cut on September 17, down from 94% last week.

- Dollar impact: Lower interest rates tend to weaken the dollar and boost risky assets like stocks and cryptocurrencies.

- Powell's tone matters: a dovish Powell could drive a breakout in EUR/USD; a hawkish tone could trigger profit-taking.

- EUR/USD Setup: The EUR/USD pair has rallied 13% year to date and is trading near 1.168, just below the key resistance level of 1.182.

- Neutral technicals: Flat MACD and RSI at 50 reflect market indecision ahead of Powell’s speech.

Macro Background

The Jackson Hole Symposium, hosted annually by the Federal Reserve Bank of Kansas City, Wyoming, has become one of the most anticipated macroeconomic events of the year. While a gathering of global central bankers, economists, and academics gathers, this year's market focus is on one figure: Federal Reserve Chairman Jerome Powell, who will deliver a speech at 2:00 PM GMT on Friday. The stakes are high. The Fed will announce its next interest rate decision on September 17th, and investors are eager for forward guidance. US interest rates are currently at 4.5%, and the market is pricing in an 83% chance of a cut to 4.25%. Just a week ago, that probability was as high as 94%, highlighting the heightened uncertainty. Why is this important for traders? Lower interest rates reduce the appeal of US dollar savings and US Treasury yields. This typically leads to capital flows into riskier assets such as technology stocks, cryptocurrencies, and non-US currencies like the euro, yen, and franc. Conversely, higher interest rates can boost the US dollar and put pressure on stocks and commodities. Beyond interest rates, the Jackson Hole symposium is likely to address broader macro themes:

- Trade policy: Continued tariff uncertainty involving Europe, Japan, and China

- Geopolitics: US, Russia hold peace talks on Ukraine

- Labor market: The employment situation is weak, with the latest non-farm payroll data showing a slowdown in hiring and an increase in the unemployment rate.

Over the past few years, the market has reacted strongly to Powell's comments:

- On August 26, 2022, Powell delivered a hawkish speech, hinting at a rate hike. The US dollar surged, and the S&P 500 index sold off.

Source: TradingView

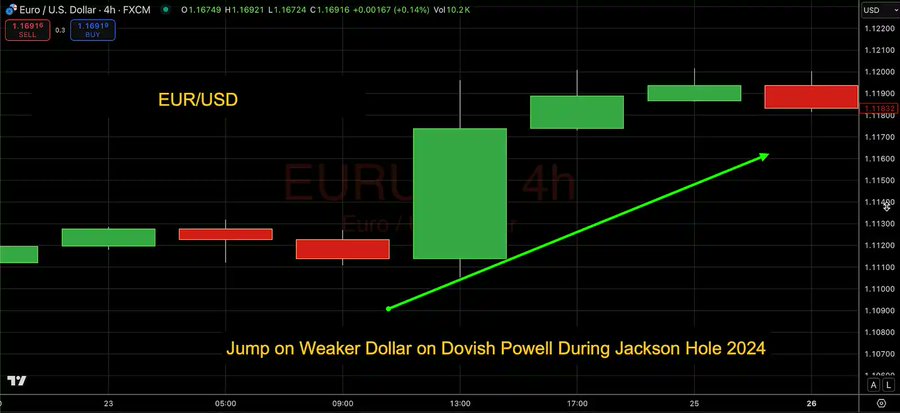

On August 23, 2024, Powell delivered dovish remarks, triggering a rise in stock markets and a general decline in the US dollar.

Source: TradingView

Given the current level of uncertainty, another outsized move could occur this Friday.

Technical analysis: EUR/USD

- The EUR/USD pair is a key barometer of sentiment toward the US dollar. When the dollar weakens, the EUR/USD ratio tends to rise, and vice versa. So far in 2025, EUR/USD has risen 13%, supported by expectations of easing US monetary policy and a more proactive fiscal stance in the Eurozone. Increased military investment across the EU, coupled with tariff-driven supply chain shifts, has also supported the euro. Currently, the pair is trading around 1.168, having peaked at 1.182 on July 1st. The short-term outlook depends largely on Powell's tone: a dovish scenario: a break above 1.182 could quickly target the psychological 1.2 level.

- If 1.2 is broken, the next targets include the May 2021 high of 1.227 and the January 2021 peak of 1.235.

- Hawkish scenario: The dollar could strengthen if Powell signals no immediate rate cut.

- A break below 1.16 could see a drop towards 1.14, which was a key support level earlier this year.

The momentum indicator currently has no clear bias:

- An RSI of 50 indicates a neutral stance, often the “calm before the storm.”

- The MACD is flat with no crossover or momentum divergence, confirming indecision.

For the RSI to reach overbought or oversold levels, EUR/USD would need a strong move, as the RSI indicator is neutral at 50. On the daily chart, resistance lies precisely at 70. Therefore, to reclaim this level, EUR/USD would likely need to break through the resistance level of 1.182 from July 1st. On the daily chart, EUR/USD's move down to RSI 30 was even more powerful, well below 1.14. From a technical perspective, a decline to 1.10 is possible. This technical picture aligns with fundamental uncertainty, as traders remain on the sidelines awaiting signals. Traders should also note the following:

- Volatility Setup: The probability of a sharp breakout increases due to narrow technical range and known macro catalysts.

- Leverage sensitivity: EUR/USD trading often comes with leverage, and even small fluctuations can result in high profits (or high risks), depending on the position size.

- Profit-taking risk: A surprising hawkish move could trigger broad-based buying of the dollar and liquidate EUR/USD longs that profited earlier this year.

Source: TradingView

Jackson Hole compared to previous years

This year is unique in the divergence between data and market sentiment. Inflation is softening and the job market is cooling, which typically suggests more accommodative policy. However, geopolitical risks and trade frictions are fueling inflationary pressures, and the Fed may be reluctant to cut rates too quickly. This is why Powell's policy guidance on Friday is crucial. Even subtle hints from the Fed regarding its views on tariffs, unemployment, and/or global economic growth could influence interest rate expectations for the rest of the year. The market is currently divided among the following possibilities:

- Two rate cuts before the end of the year brought the Fed's interest rate down to 4.0%.

- Three rate cuts will bring the interest rate to 3.75% by 2025

- Only cut rates once if inflation and/or geopolitics worsen

The more dovish Powell's comments are, the more likely the dollar will weaken. But if he emphasizes risk and patience, traders may flock back to the dollar.

in conclusion

The Jackson Hole Symposium is always important, but this year it could be decisive for the US dollar and global markets. Traders should note:

- Powell's speech at 14:00 GMT on Friday

- EUR/USD breaks through 1.182 or falls below 1.16

- Changes in the probability of a September rate cut

- Cross-asset reaction, particularly cryptocurrencies, stocks, and gold

Positioning remains underweight as momentum indicators are neutral. However, volatility could surge once Powell speaks. Traders should be prepared for range breaks, dollar volatility, and headline-driven price action, which could set the tone for the remainder of 2025.