By Deng Tong, Golden Finance

On September 25, 2025, the Plasma mainnet Beta version of the Bitfinex-supported Layer 1 stablecoin payment project was launched, integrating more than 100 DeFi protocols including Aave, Ethena, Fluid and Euler.

Plasma created an airdrop myth where investors could grab $8,390 with $0.1. What is the future prospect of Plasma?

1. Grab $8390 worth of XPL airdrop with $0.1

On Thursday, the stablecoin blockchain Plasma launched its mainnet beta version, and its native token XPL was also launched simultaneously.

The news that everyone who participated in the Plasma pre-ICO program received $8,390 worth of XPL—even if they didn’t actually purchase tokens through the ICO—was met with a lot of applause.

Plasma announced that within three hours of its mainnet beta launch, half of all ICO participants had claimed their tokens. Plasma allocated a total of 25 million tokens for all pre-depositors, which will be distributed evenly across all depositors, meaning that regardless of whether they deposited $1 or $10,000, they will receive the same bonus.

The Plasma token's genesis supply is 10 billion, of which 18% (or 1.8 billion) are currently in circulation. Within Plasma's XPL token economics, 10% of the token supply was allocated for the July public sale, which was oversubscribed by over $300 million. The team also reserved 40% of the token supply for ecosystem development, with 8% unlocked at launch and the remaining 25% allocated to the team and investors over a multi-year vesting period. A portion of the circulating XPL belongs to US investors, who, due to regulatory considerations, will not receive their XPL until July 28, 2026, meaning fewer than 1.8 billion XPL tokens have actually been traded.

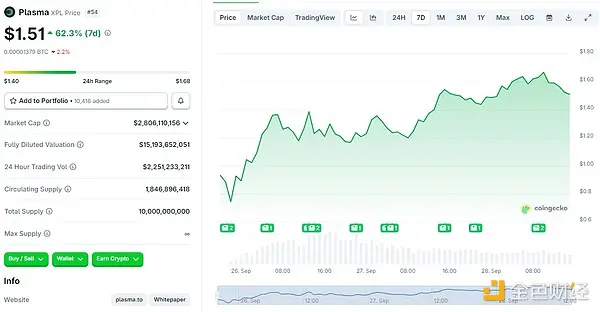

Since XPL was listed on mainstream exchanges on September 25, its price trend has been relatively stable, reaching a high of over $1.6 and was reported at $1.51 as of press time.

XPL has been a popular asset for whales since its launch. According to on-chain analyst @ai_9684xtpa, a mysterious whale holding 24.29 million XPL yesterday transferred the tokens to address 0x57d...02dd1 at 10:30 PM last night. The tokens were subsequently transferred to the Plasma mainnet via the Hyperliquid cross-chain bridge. The recipient address has not yet transferred or sold the tokens, representing a value of $39.6 million.

2. Plasma’s Development Prospects

1. Plasma may be a long-tail way to access Tether

Some industry insiders believe that Plasma's valuation may still be high relative to its adoption rate. Delphi Digital analyst @simononchain once noted that while Plasma hasn't yet achieved true adoption, the market is generally focused on larger opportunities like stablecoins. "The market may view Plasma as a long-tail way to gain exposure to Tether, which is rapidly becoming one of the most valuable companies in the world."

Plasma is a Layer 1 blockchain dedicated to stablecoins, backed by Tether. Tether's sister company, Bitfinex, participated in its investment, and Tether CEO Paolo Ardoino personally participated in Plasma's financing. Currently, Tether continues to experience rapid growth. Tether CEO Paolo Ardoino has noted that USDT is experiencing rapid global growth. The number of USDT on-chain transactions in the first half of 2025 increased by 120% compared to the full year of 2024, with 66% of this increase occurring in West Asia, the Middle East, and Africa.

Due to the special relationship between Plasma and Tether, investing in Plasma is equivalent to investing in Tether in disguise. As Tether continues to grow bigger and stronger, investors will also be full of confidence in Plasma.

2. The competitive landscape Plasma will face

Plasma has an ambitious mission: to change how money flows globally. Back in February of this year, Plasma raised $24 million to develop a new blockchain for Tether's USDT. However, Plasma is currently facing competition from multiple rivals.

First of all, Ethereum still holds the top spot in terms of stablecoin liquidity, and Tron, Solana, etc. are also strong competitors.

Secondly, the stablecoin blockchain market is on the rise, and competition is intensifying. On August 12th, Circle announced the launch of Arc, an open Layer 1 blockchain designed specifically for stablecoin financial scenarios. On August 11th, fintech giant Stripe partnered with crypto venture capital firm Paradigm to develop a high-performance, payment-focused Layer 1 blockchain called Tempo. Noble, a native asset issuance chain built on the Cosmos SDK, is also on the rise. Even Google recently announced the Google Cloud Universal Ledger (GCUL), a Layer 1 blockchain focused on providing digital payments and tokenization for financial institutions.

Therefore, Plasma’s competitors include not only the established public chains in the crypto industry, but also the new generation of stablecoin chains and giants from traditional industries.

3. The Future of Plasma

Plasma has now launched its mainnet and native XPL token, introduced zero-fee USDT transfers through a custom consensus called PlasmaBFT, and boasted over 100 DeFi integrations. Within 24 hours of its launch, Plasma attracted over $4 billion in cryptocurrency, ranking it eighth among DeFi blockchains by deposit value. This is primarily due to users earning XPL, the network's native token, by locking assets in the Plasma lending vault and partner DeFi protocols. This morning, Plasma announced that the stablecoin supply on the Plasma chain has exceeded $7 billion in just two days.

Due to its speed and zero fees, exchanges, financial firms, banks, and others will be able to use Plasma as a settlement layer for large transfers. Banks or corporate consortiums can also run private overlays on Plasma to settle large interbank transfers with the finality backed by Bitcoin. For a corporate treasury, transferring $50 million between subsidiaries could take only seconds, rather than days like with traditional SWIFT.

In addition to launching the mainnet to facilitate settlement, Plasma will also launch a new banking product - Plasma One.

On September 22nd, Plasma announced the launch of Plasma One, the first new bank powered by a native stablecoin. Targeting users in emerging markets with strong demand for US dollars, the launch offers features such as a stablecoin-backed bank card, fee-free USDT transfers, and quick onboarding.

Plasma One has the following features: Earn while you spend: Pay directly from the user's stablecoin balance while earning more than 10% in returns; Real Rewards: Get up to 4% cash back when using PlasmaOne's physical or virtual cards; Borderless Coverage: Use the card at 150 million merchants in over 150 countries; Zero-Fee USDT Transfers: Send digital dollars instantly and free to individuals and businesses through the app; Fast Registration: Sign up, complete the onboarding process, and get a virtual spending card in minutes (not days).

Plasma One will fully integrate the entire Plasma ecosystem into a single application, such as integrating the DeFi ecosystem, exchange integrations, and payment partners, providing pricing and liquidity, as well as a consistent user experience.

Summarize

The popularity of the Plasma project was evident as early as June of this year: on June 9th, the Plasma public token sale surpassed its $500 million subscription quota within minutes. Over 1,100 wallets participated for the first time, with an average deposit of approximately $35,000. On June 12th, Plasma announced the lifting of the deposit cap by another $500 million, bringing the total cap to $1 billion.

Plasma CEO Paul Faecks once pointed out: “The US dollar is a product that most people in the world desire to obtain. Stablecoins provide a basic, permissionless way to hold and transfer US dollars anywhere…”

Plasma has rocked the industry with its XPL airdrop, and through its partnership with Tether, it has garnered widespread investor attention as a strong competitor poised to reshape the competitive landscape of stablecoin chains. No one can predict the exciting possibilities Plasma will unlock in its efforts to disrupt traditional financial payments.