Kadena Organization, the operating company behind the Kadena blockchain, announced its shutdown on October 21st in a formal, calm, yet painfully concise announcement.

The company expressed its gratitude to the community, cited “market conditions” as the reason for the outage, and confirmed that it would immediately cease all business activities and blockchain maintenance.

In a final notification on the X platform (formerly Twitter), the team reminded users that the blockchain will technically survive, as miners will continue to secure the network and the code will remain open source.

However, beneath this technical "survival" lies a crueler reality: Kadena's economic vitality and community foundation no longer exist.

Kadena’s outage is not an isolated failure, but part of a deeper structural adjustment in the cryptocurrency industry.

In this process, those infrastructure layers that have never achieved "product-market fit" (PMF), never formed a professional positioning, and never developed attractive supporting applications will gradually exit the market.

The road to despair

Kadena's starting point combines "industry background" and "grand vision".

Founded by former JPMorgan Chase engineers Stuart Popejoy and William Martino, the project launched in 2018 with the promise of offering features then unavailable on ethereum, such as high-throughput proof-of-work (PoW) smart contracts through a system called “Braided Chains.”

Its proprietary programming language, Pact, focuses on "human-readable code" and "formal verification," aiming to position Kadena as a blockchain network that is "both secure and scalable."

But "innovation without user adoption is ultimately just an unfinished story."

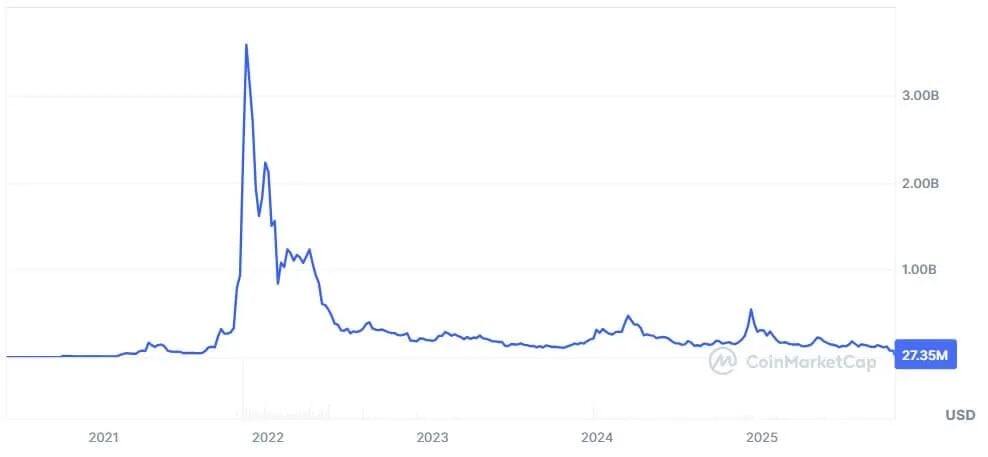

Kadena launched its mainnet in 2019 and built a limited developer ecosystem. According to CoinMarketCap data, its valuation was close to $4 billion in 2021, but has since plummeted by more than 99% from its peak.

During this period, only a few mainstream decentralized applications such as Babena emerged in the Kadena ecosystem, and Babena's peak total locked value (TVL) was only US$8 million.

At the same time, liquidity continues to flow to ecosystems with greater user appeal, first Ethereum and Solana, and then second-layer networks such as Base built directly on Ethereum.

Cryptocurrency researcher Noveleader pointed out that over the years, Kadena has failed to shake the dominance of the Ethereum Virtual Machine, and the price trend of its token KDA and the development of projects within the ecosystem have also been difficult.

This phenomenon reveals the core contradiction behind Kadena's outage: there is a serious mismatch between supply and demand in the current cryptocurrency economy.

Since 2021, venture capital has injected billions of dollars into the fields of "modular first-layer networks", "second-layer networks" and "Rollups", all of which promise to solve the problems of "scalability", "decentralization" or "transaction costs".

However, the actual user market size has barely grown.

According to data from L2Beat and DeFiLlama, there are currently more than 100 rolling upgrade projects and more than 200 independent chains running in various ecosystems (from Ethereum fork chains to Cosmos-based application chains).

But the vast majority of them have less than 2,000 daily active users (DAU).

The reason is simple: they are all competing for the same participants, including traders, yield farmers, and liquidity providers, without providing any new value.

Greg Tomaselli, a startup developer, summed up the situation well: “Blockchain networks without a clear value proposition and broad use cases are doomed to fail.”

The illusion of differentiation

Kadena’s collapse reveals a truth that the industry is reluctant to face: technological novelty does not equal “product-market fit.”

Almost every new blockchain claims to solve the problems of "scalability", "latency" or "gas fee efficiency".

But few projects can clearly explain: when most users are already deeply integrated into the Ethereum, Solana or Binance ecosystem, who needs a new chain?

Like many aspiring layer-one networks, Kadena seeks to differentiate itself through performance metrics, with its chain architecture offering high throughput while maintaining the security of proof-of-work.

But in the cryptocurrency industry, "performance" has long been a "homogeneous commodity."

Once the network can process thousands of transactions per second, the focus of "differentiation" will shift from "speed of operation" to "purpose of operation."

Ethereum's success does not come from its "fastest speed", but because it has become the "default ecosystem" for tokens, decentralized autonomous organizations (DAOs) and decentralized finance (DeFi) protocols; Solana's rise is due to its cultivation of high-frequency trading and social application scenarios.

Kadena, like other projects like EOS, has never clearly defined its core positioning other than being “better than existing chains.”

This logic of "building the chain first, then waiting for the market" is the core of the infrastructure bubble. Every new chain is chasing "imaginary demand", while users are constantly concentrating on the ecosystem "with liquidity and community culture".

The end result is that hundreds of "technically viable but economically irrelevant" networks rely on inertia to maintain operations and gradually die out.

The era of specialization

In addition, the rise of the second-layer network in the Ethereum ecosystem and the consolidation of its dominant position have completely rewritten the "rules of the game" for infrastructure design.

AminCad, a core participant in the Ethereum ecosystem, pointed out that almost all "mainstream alternative first-layer networks with considerable market capitalization" were launched before Ethereum's "Dencun Upgrade."

This upgrade significantly improves Ethereum’s scalability and reduces transaction costs for second-layer solutions.

He believes that this upgrade completely invalidates the "so-called first-layer premium" of these alternative chains, "basically becoming a legacy product of the 'pre-Ethereum second-layer scalability era'."

AminCad stated: “Today, there is no reason to choose ‘launching as an alternative layer 1 network’ over ‘layer 2 network with Ethereum as the settlement layer’ from a ‘scalability’ perspective. Therefore, there is no evidence that newly launched chains can gain any premium by being ‘single-layer architecture’.”

He also mentioned that second-layer blockchains using Ethereum as a long-term settlement layer have operating costs that are approximately 99% lower than "independent alternative first-layer networks."

At the same time, the market is "rewarding specialization rather than generalization."

Successful blockchains no longer position themselves as “universal platforms” but rather as “digital economies focused on specific verticals.”

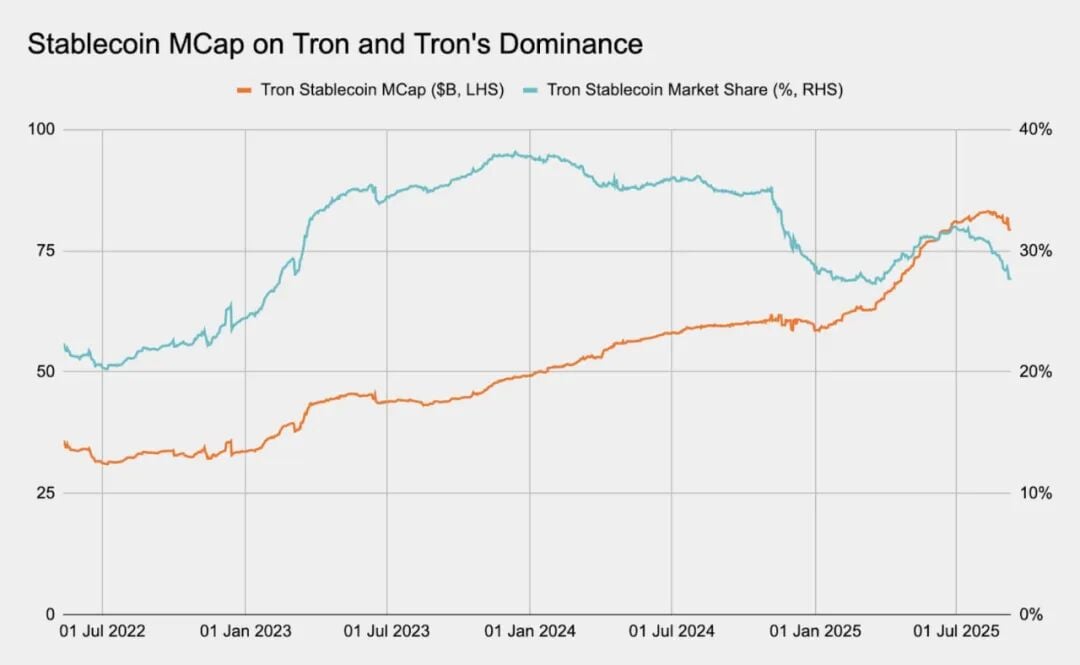

For example, first-layer networks such as Plasma and TRON focus on "global stablecoin payments", providing instant transfers, extremely low fees, and full EVM compatibility.

The competitive advantage of these chains is not "general throughput" but "occupying a niche track."

Its core differentiation lies in "practicality and narrative" rather than simple "architecture". In contrast, Kadena has neither.

This shift marks the industry entering a "more mature stage": from "technological vanity" to "economic gravity."

Therefore, chains that can survive the "coming wave of integration" must have the following characteristics: "continuous demand" to attract real users, stable transaction volume, and a value cycle that "can prove the value of its own block space."

Upcoming Integration

Kadena's failure foreshadows the future of cryptocurrency's "overbuilt infrastructure layer." The market cannot sustain the current situation of "hundreds of chains competing for the same liquidity and developer resources."

In previous cycles, "frenzied capital" masked industry inefficiencies, with venture funds incubating dozens of first-layer network projects, assuming that each project could find a niche track.

But "liquidity is not infinite", and users always prefer "more convenient" options.

In the coming years, “integration” will replace “expansion”: some networks will merge or interoperate through “shared sorters” or “modular frameworks”; others will quietly fade into obscurity, leaving only traces in GitHub archives.

Only those networks with "clear vertical positioning" (such as games, social networking, real-world assets (RWA), and institutional finance) can survive as "independent ecosystems."

This logic is similar to that of the early Internet: there were dozens of protocols competing for dominance, but in the end only a few protocols such as HTTP and DNS became "universal standards", and the rest were quietly eliminated.

Today, the cryptocurrency industry is entering its own "elimination phase."

For developers, this means that there will be fewer “vanity chains” and more “composable infrastructure” will be built on “proven ecosystems”.

For investors, this is a reminder that "laying out the first layer of the network" is no longer a "broad-spectrum bet on innovation" but a "selective bet on 'network gravity'". The core lies in the ability to "attract and retain capital" rather than simply "computing power".